Founder & CEO of 42 Macro—the world’s best research and risk management partner for investors who wish to retire on time and comfortably. Not investment advice.

7 subscribers

How to get URL link on X (Twitter) App

1) The Stock Market Always Rallies Sharply Leading Up to Recessions

1) The Stock Market Always Rallies Sharply Leading Up to Recessions

1. Global Liquidity Has Been Declining Over The Past Few Months

1. Global Liquidity Has Been Declining Over The Past Few Months

1) The Market Believes The Fed Is Done Hiking. We Are Fading That View.

1) The Market Believes The Fed Is Done Hiking. We Are Fading That View.

1) Liquidity Drives Asset Markets

1) Liquidity Drives Asset Markets

1) We expect the Debt Limit Crisis to negatively impact global liquidity.

1) We expect the Debt Limit Crisis to negatively impact global liquidity.

1) Although inflation is moving in the right direction, we still have some work to do.

1) Although inflation is moving in the right direction, we still have some work to do.

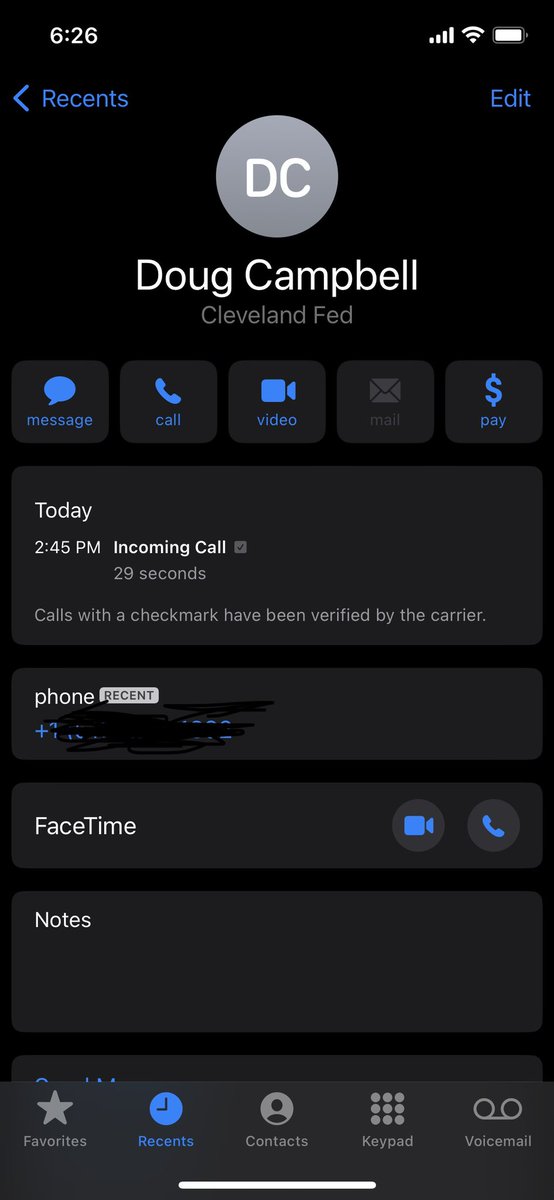

I had two officials reach out to confirm that the lack of an update was due to a “technical error”. I don’t necessarily buy it. What I think *may* be happening here is Loretta Mester was prepared to break ranks with the hawks today because of the data but Powell shut it down. 2/

I had two officials reach out to confirm that the lack of an update was due to a “technical error”. I don’t necessarily buy it. What I think *may* be happening here is Loretta Mester was prepared to break ranks with the hawks today because of the data but Powell shut it down. 2/

The answer to “What now?” has 3 components:

The answer to “What now?” has 3 components:

I know that #Bitcoin view is not especially popular, but I don’t see how they get around the fact that the only “safer” form of collateral is USD fiat — Defi’s arch nemesis.

I know that #Bitcoin view is not especially popular, but I don’t see how they get around the fact that the only “safer” form of collateral is USD fiat — Defi’s arch nemesis.

https://twitter.com/eminiTrader007/status/1590116209281810432Here is the #math on the magnitude of future returns required to get your money back after drawdowns of various magnitudes:

I spent dinner discussing the #FTX saga with my fiancé who knows as much about how global financial markets work as the average #Crypto bro. My explanation to her (and them) is as follows:

I spent dinner discussing the #FTX saga with my fiancé who knows as much about how global financial markets work as the average #Crypto bro. My explanation to her (and them) is as follows:https://twitter.com/macromindcap/status/1589301182454824960The solution is obviously thoughtful fiscal and regulatory policy that promotes effective reallocation of resources within and across our borders.

One poorly researched, popular Fin-Twit view that has chapped my ass of late is the discussion about bond market liquidity. The bond market is fine. Bond prices are going down b/c investors have altered their views on the expected path of policy rates and stickiness of inflation.

One poorly researched, popular Fin-Twit view that has chapped my ass of late is the discussion about bond market liquidity. The bond market is fine. Bond prices are going down b/c investors have altered their views on the expected path of policy rates and stickiness of inflation.

Obviously not every slide in the deck needs to be updated every day, as some only feature monthly or quarterly data. But I do go through every economic release, from every major economy, every single day, to ensure that I do not miss updating any slide that requires an update. 2/

Obviously not every slide in the deck needs to be updated every day, as some only feature monthly or quarterly data. But I do go through every economic release, from every major economy, every single day, to ensure that I do not miss updating any slide that requires an update. 2/

https://twitter.com/kajd17/status/1587106710090665985Ignoring the very obvious fact that anchoring on a NON-STATIONARY TIME SERIES like nominal credit card debt should not ever ever ever be used to form the basis of CYCLICAL (read: stationary) determinations, the reason high credit card debt it misses the mark is threefold... 2/

That said, the last time we saw such a deep downside deviation w/r/t the S&P 500’s Probable Range was on 5/12/21. At the risk of anchoring on an n-size of 1, investors can breathe a sigh of relief b/c that was not a sell signal on either a one-week or one-month forward basis.

That said, the last time we saw such a deep downside deviation w/r/t the S&P 500’s Probable Range was on 5/12/21. At the risk of anchoring on an n-size of 1, investors can breathe a sigh of relief b/c that was not a sell signal on either a one-week or one-month forward basis.