How to break a pension system" (link). Some quotes and comments in the thread below. 1/

pensions system? We were asked this question a few weeks ago, by one of our clients. Our short answer was: Yes, it looks like the academics were

probably right to strike." 2/

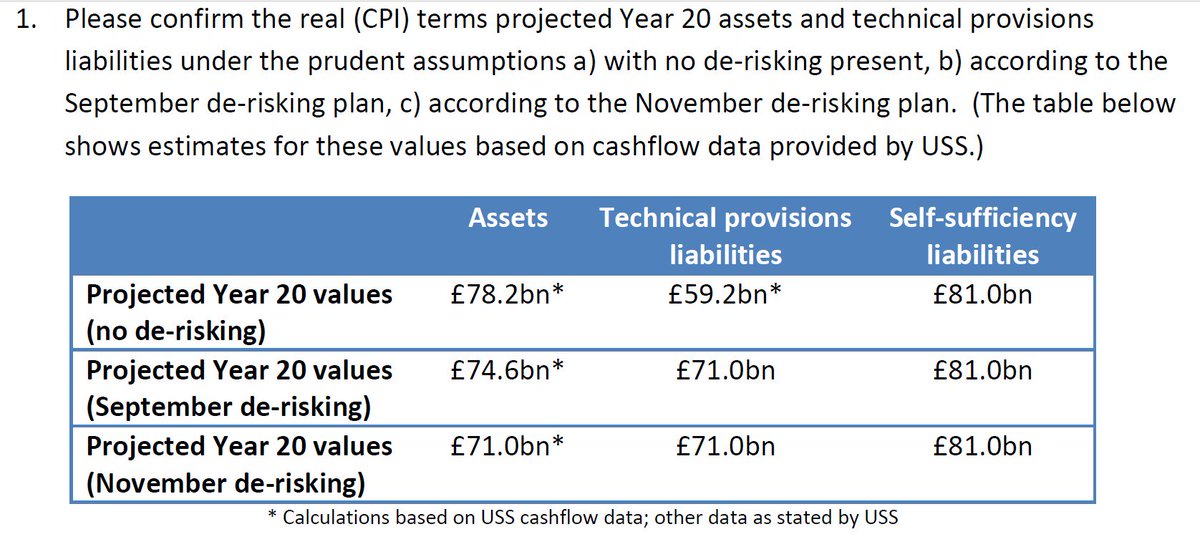

strategy by switching from equities into bonds", @FixingEconomics writes: 3/

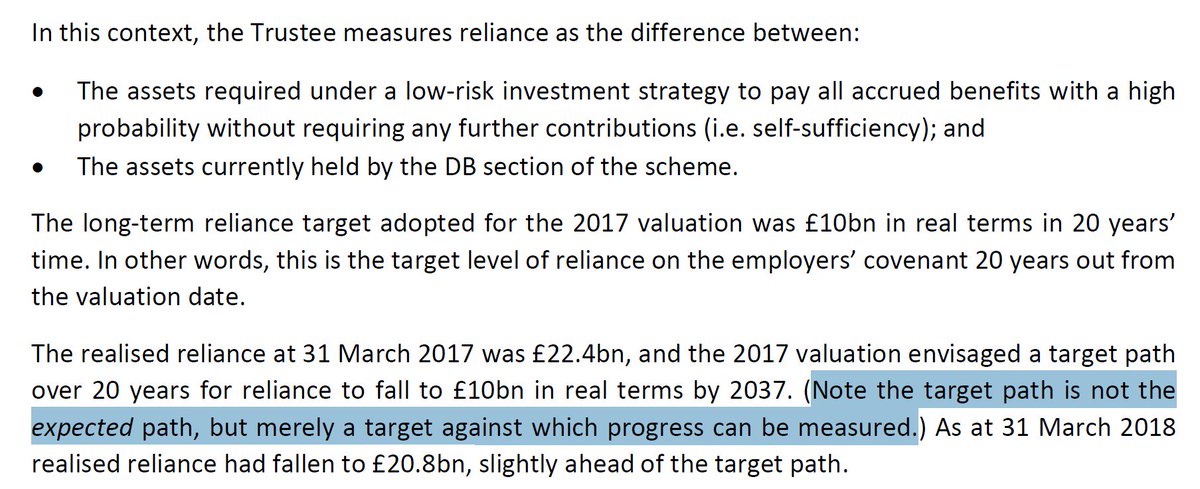

If we accept universities are a perpetual industry, then future pension contributions from university staff should be considered a perpetual income stream." 11/

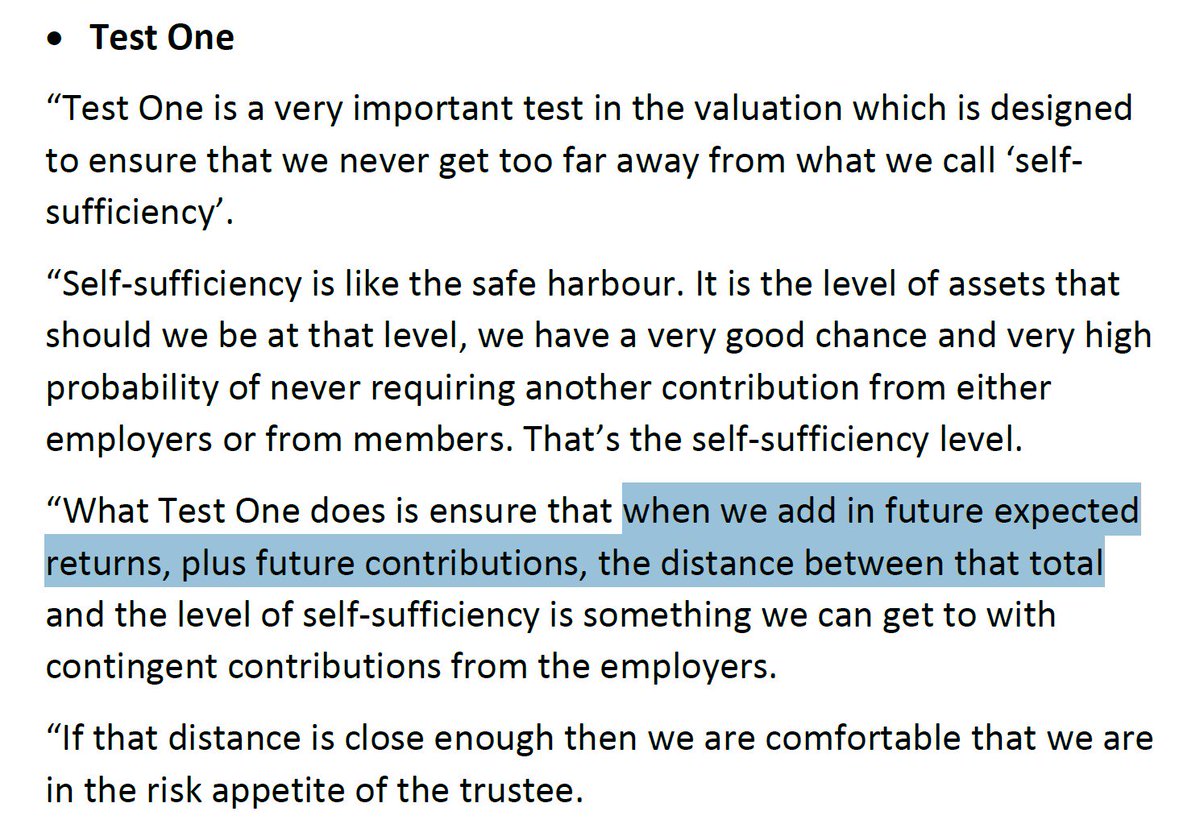

"As we see it, much of the problem lies in the rigid guarantees built into Defined Benefit Schemes...." 14/

By relaxing the guarantees pension schemes would be able to invest in more appropriate higher returning equities...." 15/