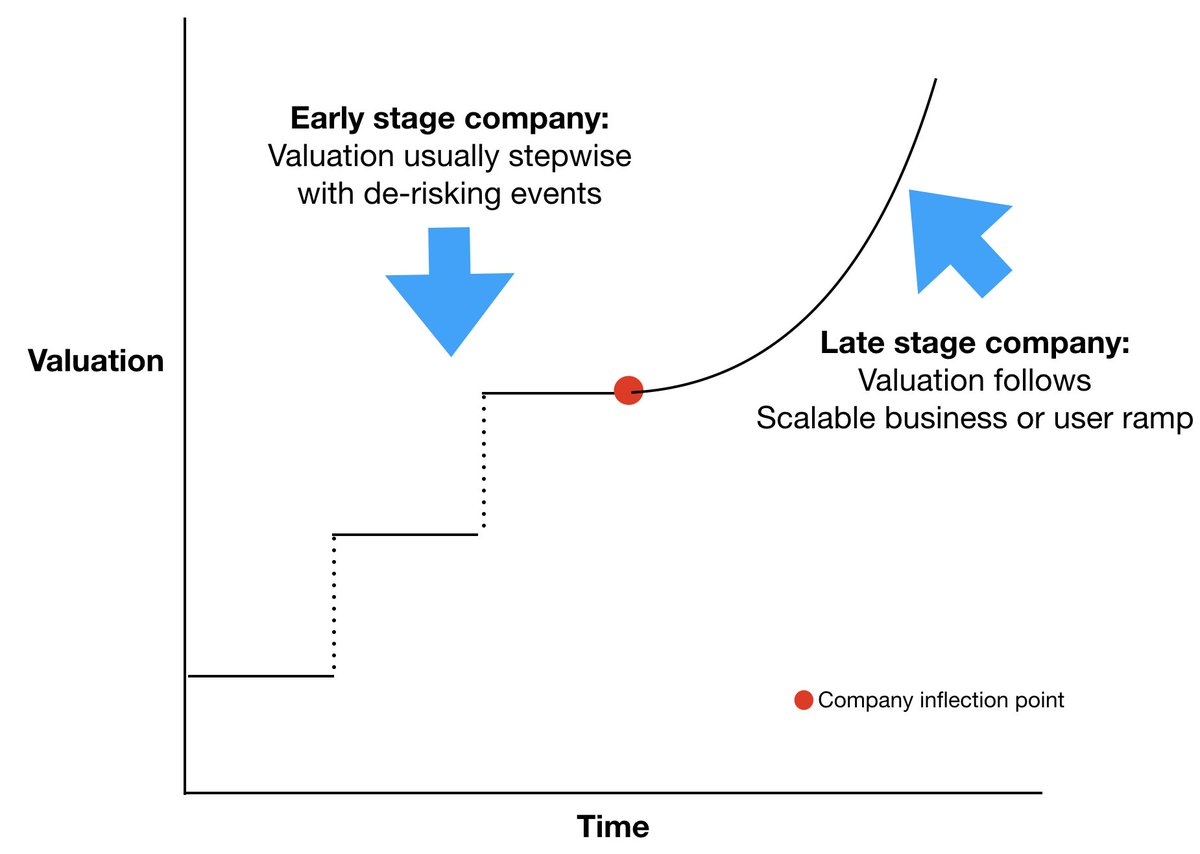

In a pre-emptive round, a VC pays up for the next round of funding before the company has hit a new milestone or new data exists to de-risk the company.

1. Funds have gotten bigger - for some VCs 1% of the fund is now $10M instead of $3M. Checks to buy an option have gotten larger.

A few will hit it big by preempting the next Uber or Airbnb or Stripe.

If you let the same firm pre-empt over & over, you also have fewer people around the table to help you build a business. This can either be good to help you focus, or bad if need diversity of thought.