I wanted to write a quick tweetstorm contrasting the two.

(Full disclosure: I manage tactical portfolios.)

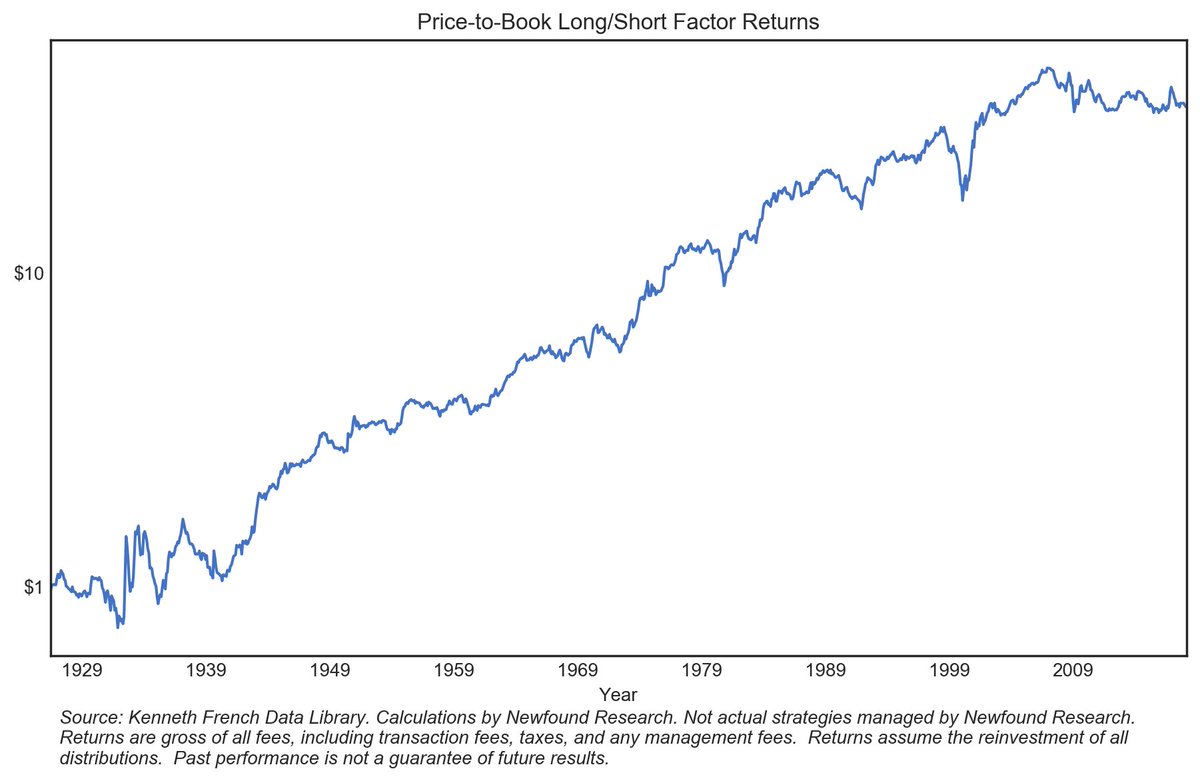

I, personally, lean heavily towards signals derived from the pantheon of quantitative style premia: value, momentum, carry, defensive, and trend.

This is typically achieved by going long one set of investments and short another, often eliminating a significant proportion of systematic risk.

But then again, many people consider TAA to be market timing.

In contrast, tactical strategies will likely have time-varying correlations to different systematic risk factors.

But we can really think of this as a 50/50 equity/cash portfolio plus 50% exposure to a long/short equity strategy.

From a diversification perspective, however, the structural equity exposure remains.

The problem is that they are often opaque. Combined with negative realized tracking error and we have a behavioral nightmare.

If we believe in alternatives, we should use them up to our tracking error comfort level.

Beyond that point, if we have not diversified away sufficient systematic risk, we can consider tactical strategies.