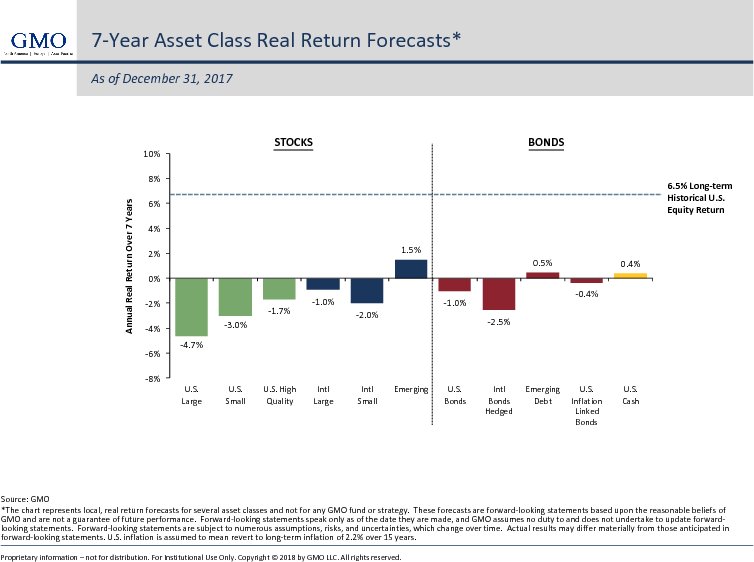

Pensions account for their future liabilities by discounting them at an est. return.

Most are projecting +7%/yr, but if you drop to 4%, CA's liability, for instance, goes up by $200bn

As the risk premia falls, pension funds need to take on *even more* risk to get paid

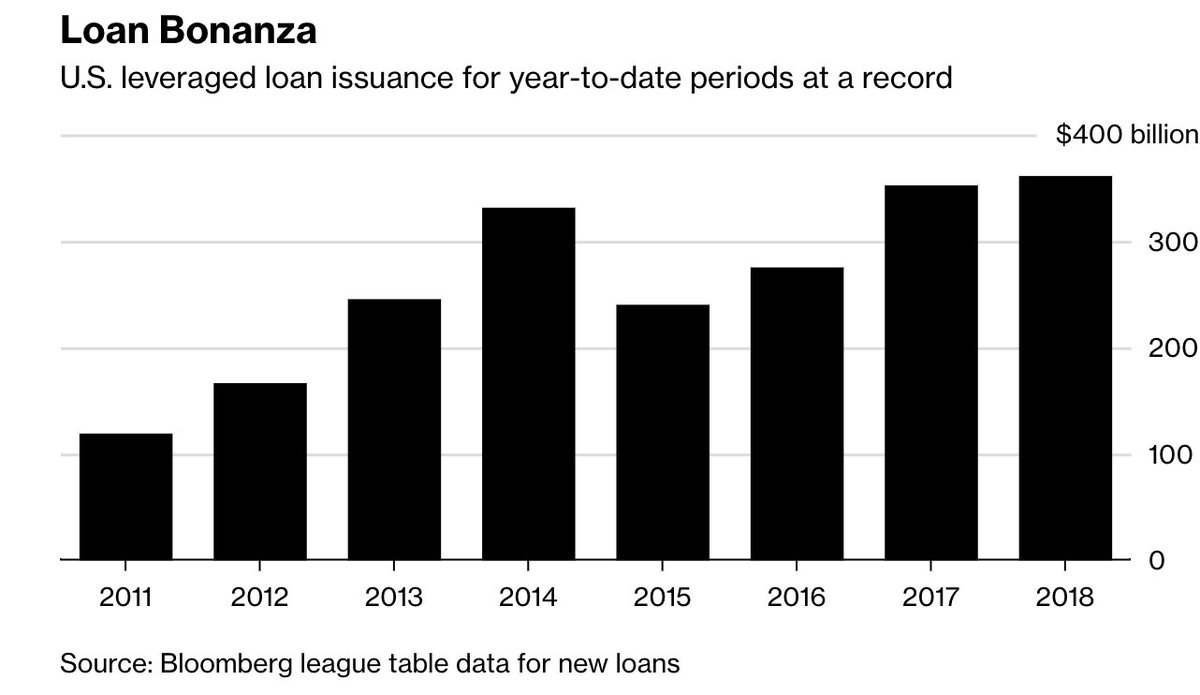

And with debt from the unreasonably low rates, they buy back stock, because it's almost always accretive at rock bottom rates and their execs are compensated based on EPS

(1) It's no longer accretive to buy back stock at higher rates. Company's are forced to actually invest for growth. Wages increase. Zombie co's exposed.

(2) Debt service increases, reducing profitability and EPS growth

(4) Yields increase further as demand for levered loans fall. Company's can no longer refi debt. Bankruptcies. Bad news bears.

As @EricRWeinstein frequently says, there are ponzi / pyramid schemes embedded in many of our revered institutions

Pension fund viability was predicated on the largest bull market of all time...which could be coming to an end

A stock market that isn't increasing 6%/yr will expose the vulnerabilities and tail risk we've created