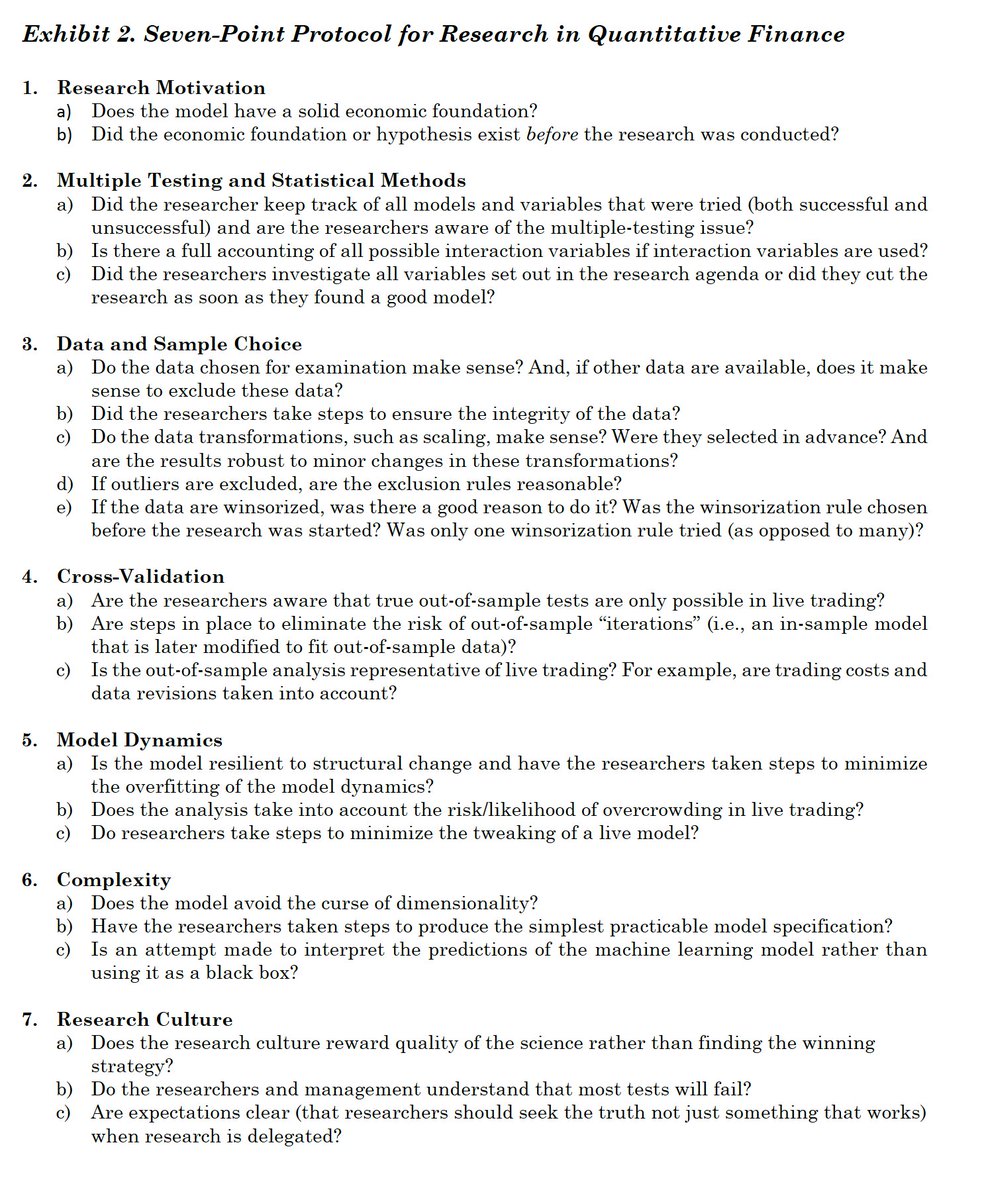

A financial paper with excellent thoughts about the cautions that should be taken in quantitative methods. My comments below: 👇👇👇

Including a Nobel prize!

And the motivation for the protocol is excellent...

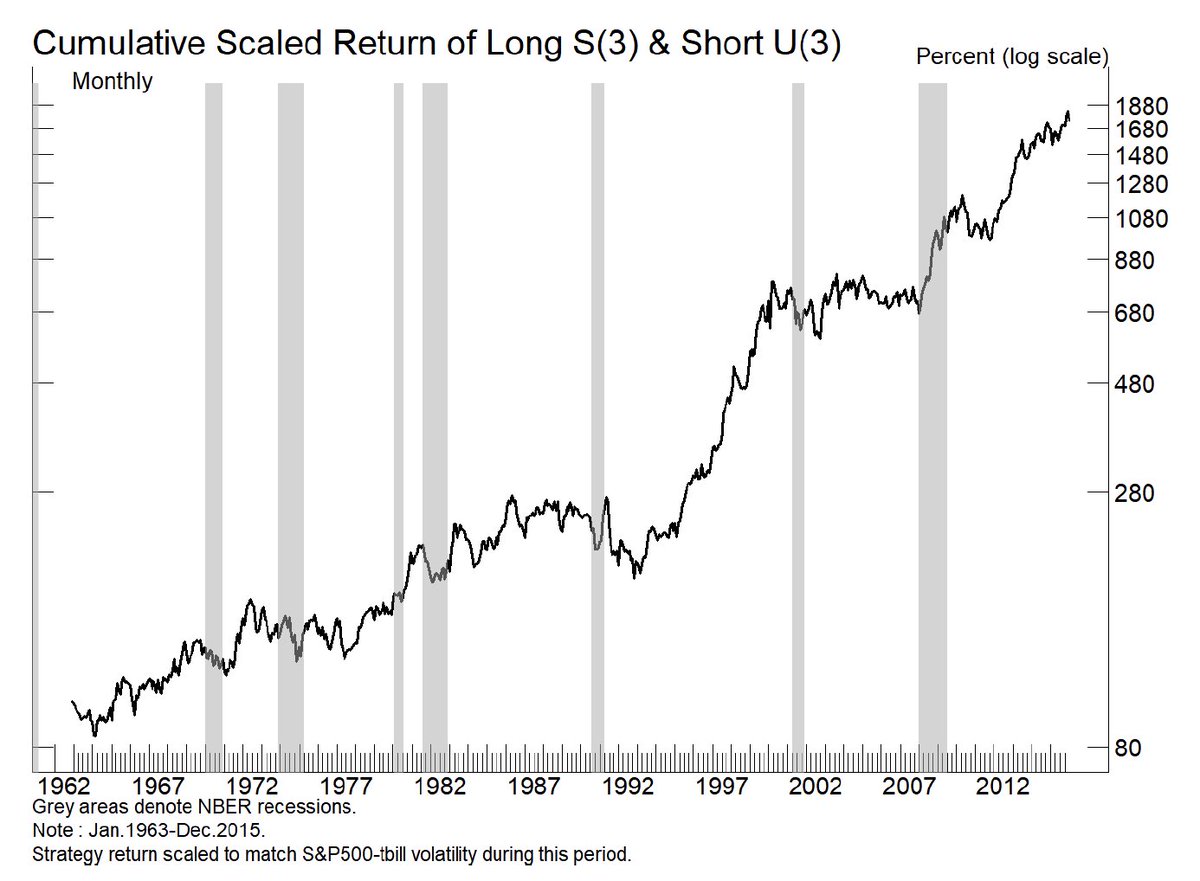

But would you invest in such a (non-sense) strategy?

And with so many models tested and retested, it's not difficult to find false positives (discoveries). And once published, these promising models rarely work as well as in the backtest...

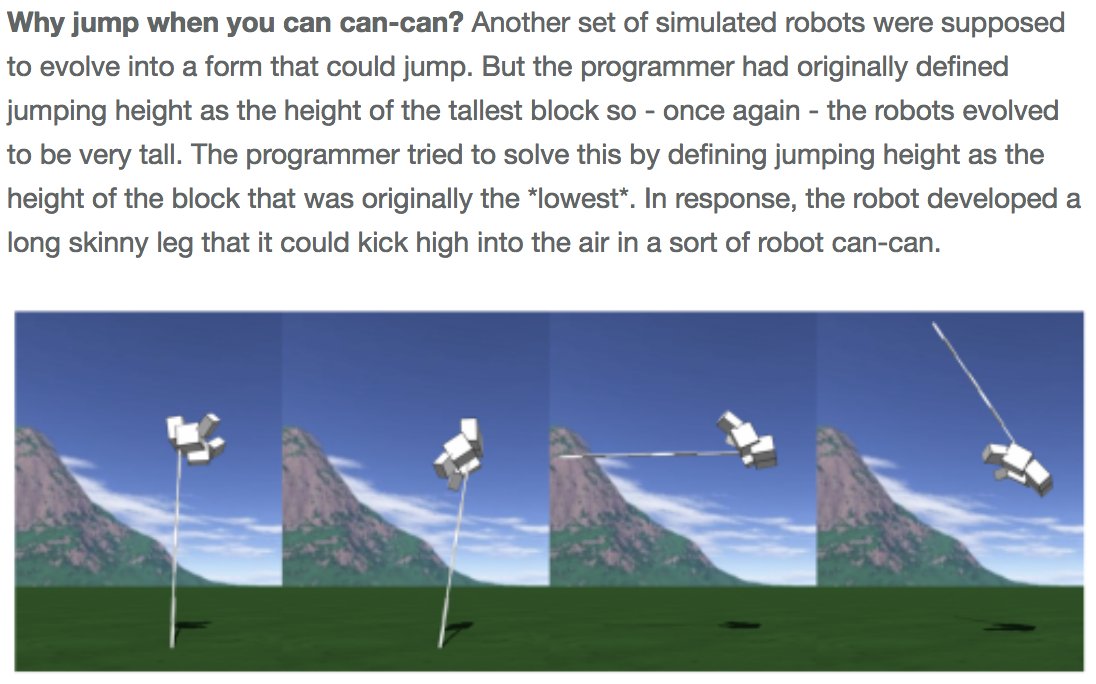

![Why walk when you can flop? In one example, a simulated robot was supposed to evolve to travel as quickly as possible. But rather than evolve legs, it simply assembled itself into a tall tower, then fell over. Some of these robots even learned to turn their falling motion into a somersault, adding extra distance.<br />

<br />

<br />

[Image: Robot is simply a tower that falls over.]](https://pbs.twimg.com/media/Daq-7wBU8AUlmLK.jpg)