(free access here: rdcu.be/bgJQs )

Thread

⬇️⬇️⬇️

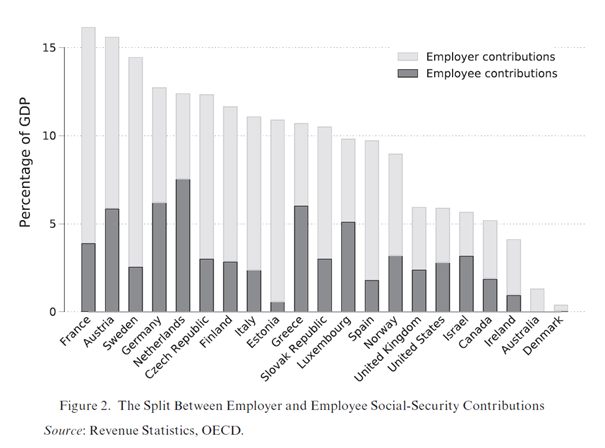

The paper maps how countries use the four levers.

It received the @lisdata Aldi Hagenaars Memorial Award as a WP.

[End]

Get real-time email alerts when new unrolls are available from this author!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!