I just published Maker (MKR) Valuation Fundamentals - The case for Trillion Dollar Maker

I will summarize in this thread 👇

medium.com/@Rewkang/maker…

- Dai Supply

- Dai Burn Ratio

- Expected Annual Return

The average collateralization ratio currently hovers between 250–300%. In the long run, I believe this will drop to 150% due to lower volatility of collateralized assets.

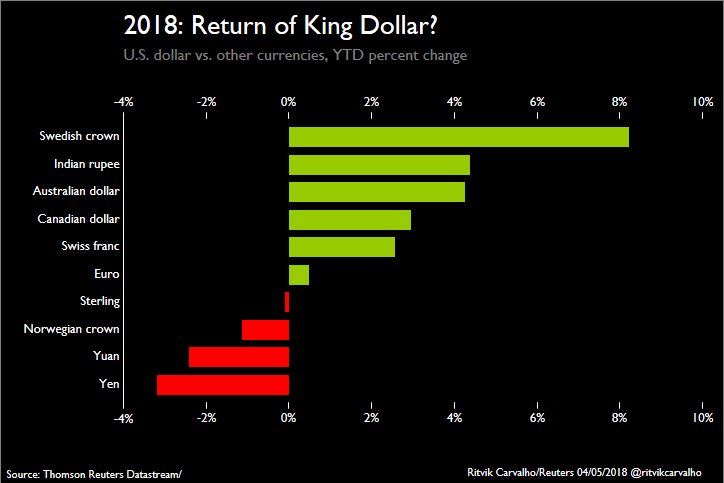

- Permissionless Cryptoassets ($50–100T)

- Tokenized Fiat ($40–100T)

- (Semi)Fungible Non-Bearer Assets (e.g. stocks, treasuries, corporate bonds, commodities) ($100T+)

Based on risk & growth factors, it is likely that the rate of return ranges between 3–6% in the long run after Maker is a proven system & model .

docs.google.com/spreadsheets/d…

cc: @RuneKek @cburniske, @alexhevans, @KyleSamani, @ricburton, @cyounessi1, @cdixon, @marcandu