FYI, RBNZ 🇳🇿just signaled room for ✂

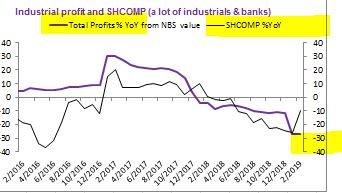

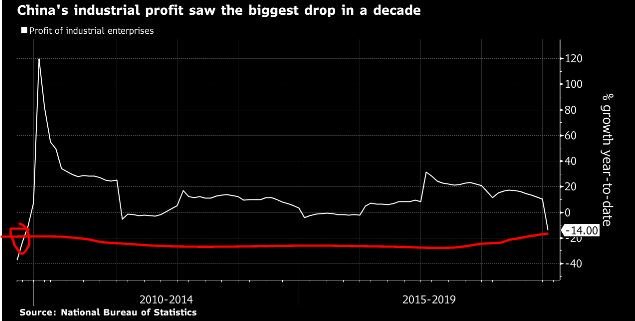

a) Contraction Chinese industrial profits spills over to consumers via 📉income 📉consumption;

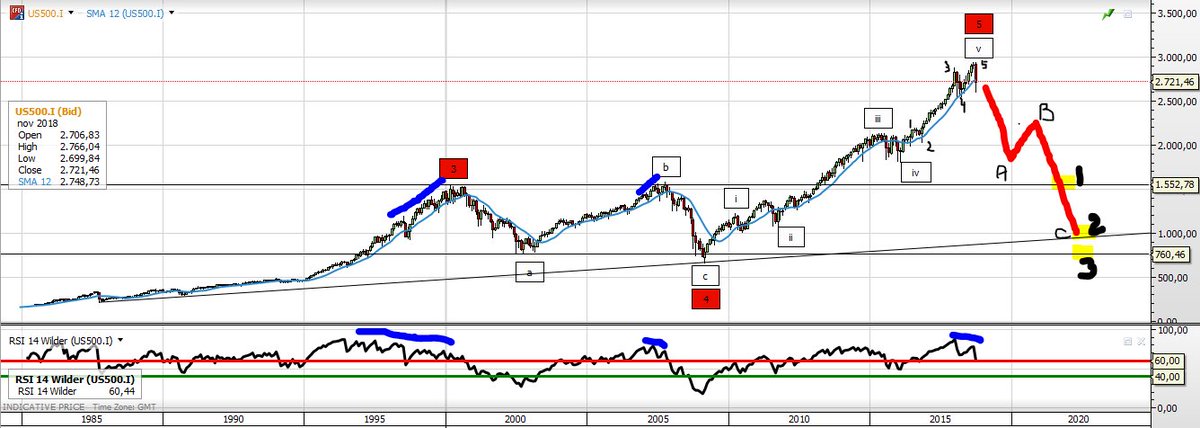

b) 🇺🇸 firms that sell goods to Chinese consumers (Apple & Caterpillar) 📉

c) US consumers' sentiment📉

d) US eco slows

@Trinhnomics , Senior Economist, @natixis says Asian central banks are setting the stage for rate cuts ahead & also discusses what investors should be aware of ahead of upcoming elections in various Asian nations.

📉econ data =✂

bloomberg.com/news/audio/201…

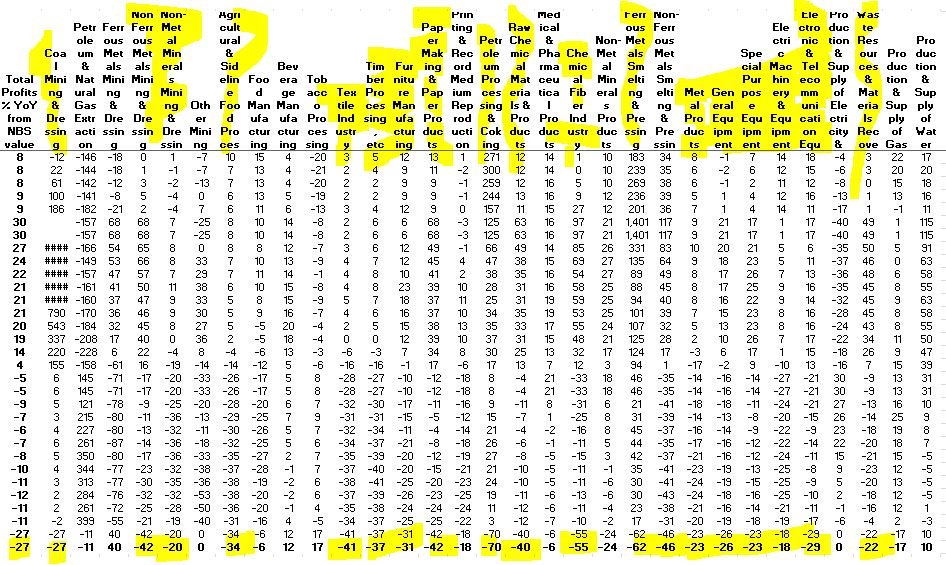

Answer: We are here 👇🏻, as in back to 2009 level & hasn't been that bad since 🤢

Say China firm debt/GDP ratio is 163, meaning if u think of it as 1 firm then income is 100 then debt is 163.

In 2019, income dropped -14%, income = 86, meanwhile debt is multiplied at roughly 5%;

In 2019, debt at 171 vs 86 income.

So wut to do?🤔