Head Macro Economist @Swissblock | Business Cycles | TED Speaker | Forbes Economics Columnist | Author of "The Monetary House of Cards" |

46 subscribers

How to get URL link on X (Twitter) App

Let's first focus on why we don't have a Recession at this point. This one is the easy part.

Let's first focus on why we don't have a Recession at this point. This one is the easy part.

First argument is based on our Business Cycle Model developed with Swissblock and @Negentropic_

First argument is based on our Business Cycle Model developed with Swissblock and @Negentropic_

Major events still to be seen (apart from rest which will be repeated and become much worse than before!): 1) Pension fund crisis 2) Run from paper money 3) War (hope not!) 4) Debt resolution (Monetary Reset?). We are NO where near end of this major crisis, which ends K's Winter

Major events still to be seen (apart from rest which will be repeated and become much worse than before!): 1) Pension fund crisis 2) Run from paper money 3) War (hope not!) 4) Debt resolution (Monetary Reset?). We are NO where near end of this major crisis, which ends K's Winter

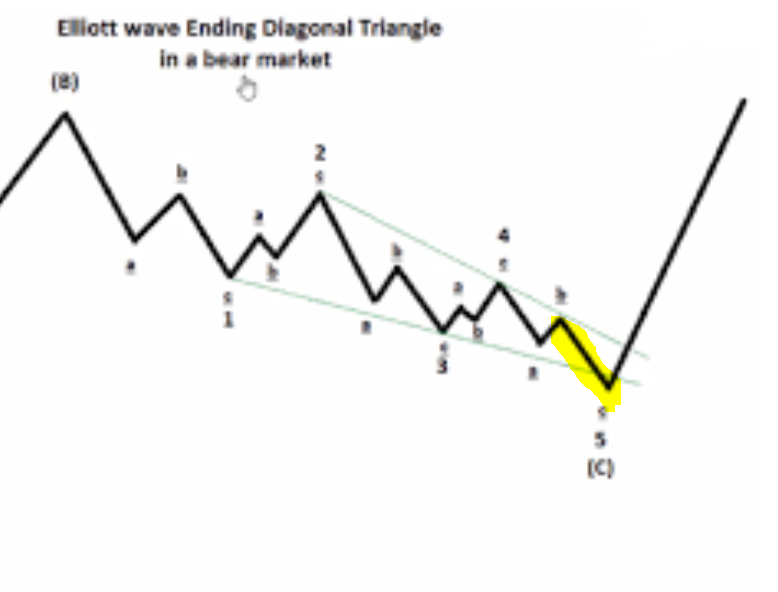

And we have this for US 10 yr. Bullish C wave coming!

And we have this for US 10 yr. Bullish C wave coming!

It will take place in HAMBURG at my friend @KlitgaardEgon's hotel in Hamburg. egonhotel.com/en/ Of course we need to get to other side of #coronavirus. Hence, I cannot be specific about the dates yet. But - we will do 3-4 sessions, or more if needed.

It will take place in HAMBURG at my friend @KlitgaardEgon's hotel in Hamburg. egonhotel.com/en/ Of course we need to get to other side of #coronavirus. Hence, I cannot be specific about the dates yet. But - we will do 3-4 sessions, or more if needed.

an inflation gauge

an inflation gauge

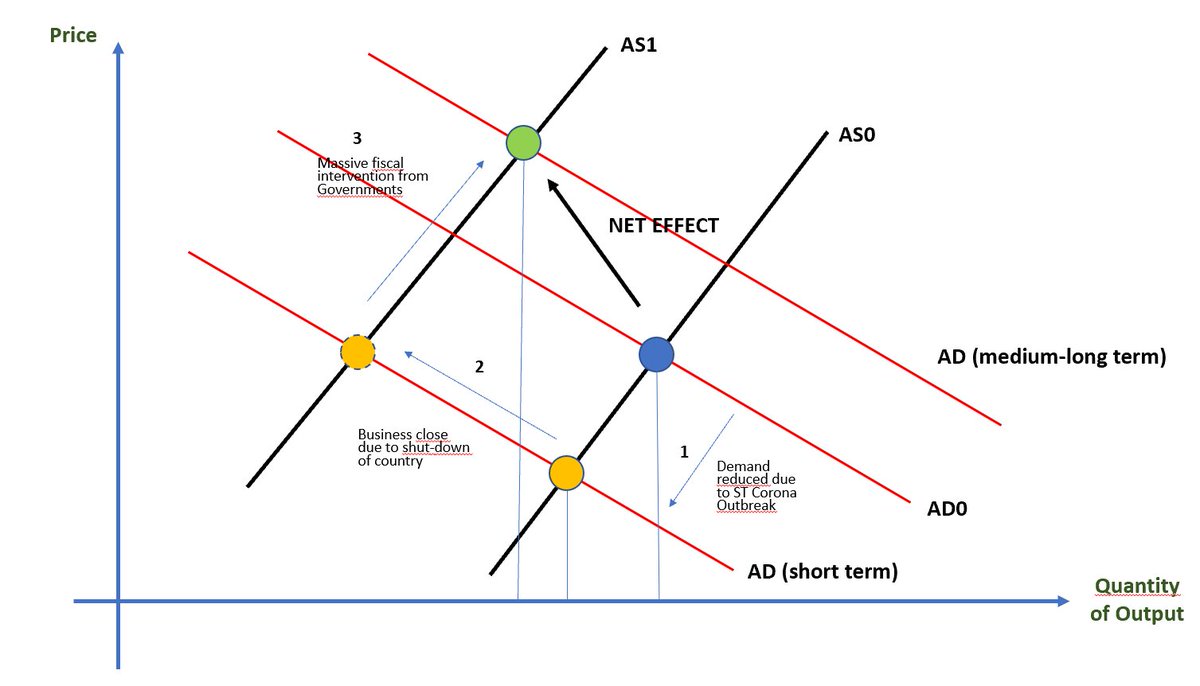

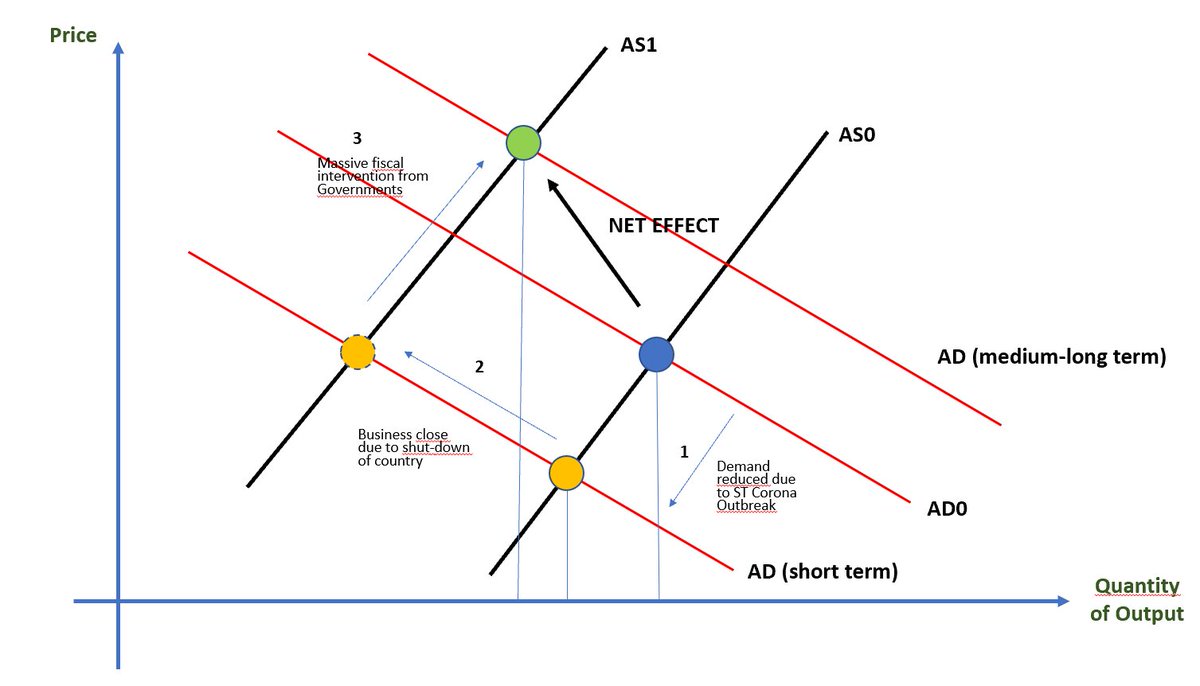

Corona makes Governments shut down countries. Deflationary! Businesses are affected and start to reduce output and close business. Supply reduced! Governments massively stimulates DEMAND side, which increases demand above equilibrium. NET EFFECT = HIGHER PRICES - LOWER OUTPUT!

Corona makes Governments shut down countries. Deflationary! Businesses are affected and start to reduce output and close business. Supply reduced! Governments massively stimulates DEMAND side, which increases demand above equilibrium. NET EFFECT = HIGHER PRICES - LOWER OUTPUT!

#Silver neg. on Day, #GDX #Miners neg. on Day, #Bitcoin neg. on Day. Massive neg. RSI divergence on #Gold. Major turn in gold is imminent!

#Silver neg. on Day, #GDX #Miners neg. on Day, #Bitcoin neg. on Day. Massive neg. RSI divergence on #Gold. Major turn in gold is imminent!