nytimes.com/2019/04/14/bus…

For one thing, the tax cuts were pretty small for most people. ~$780 on average per @TaxPolicyCenter. And they came over the course of the year, not in a lump sum, which made them harder to see.

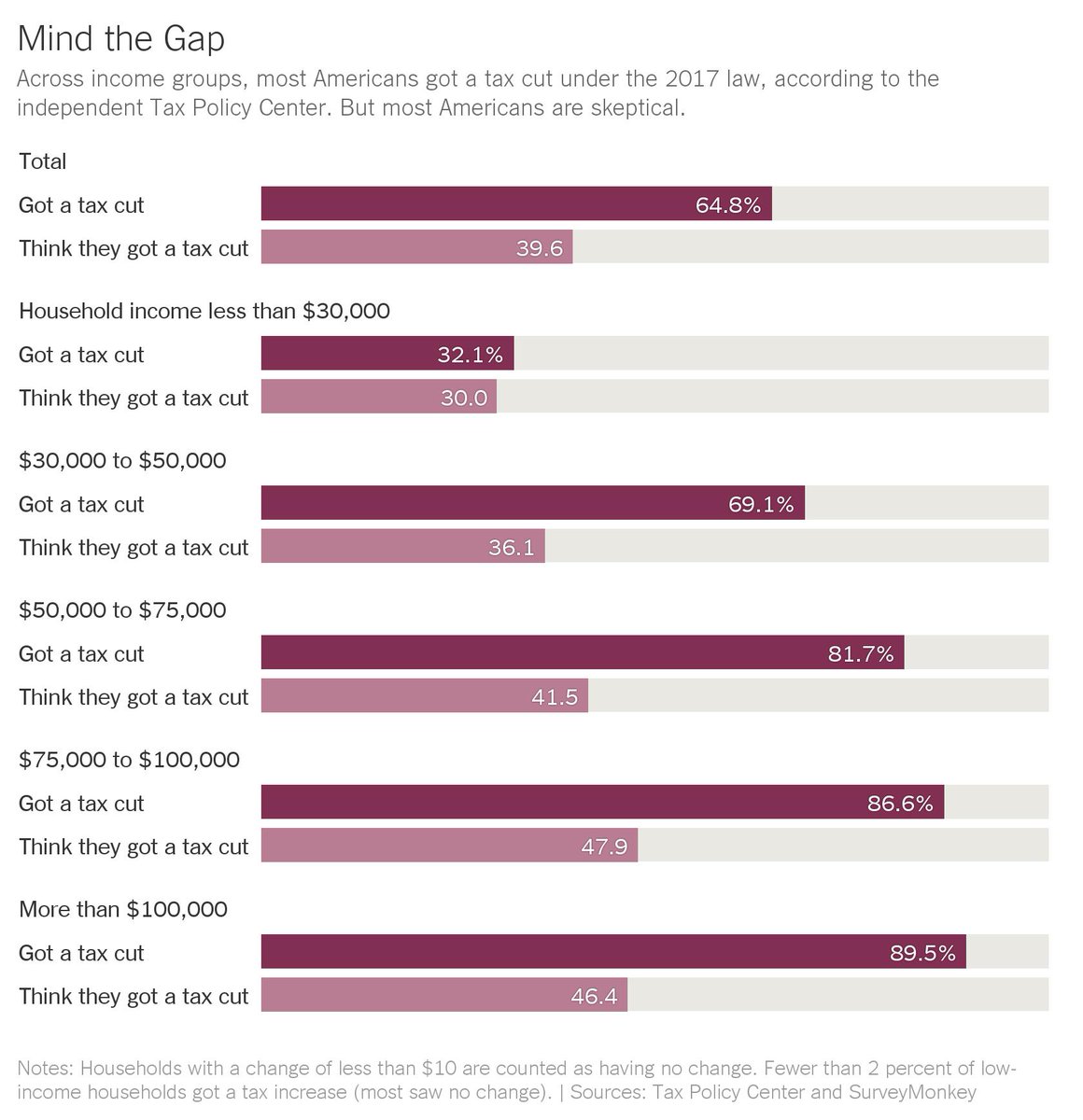

1. Most Americans got a tax cut under TCJA;

2. The cuts disproportionately benefited corporations and the wealthy.

b) Many people who think they lost out because of SALT were *never benefiting from the deduction in the first place.*

nytimes.com/2019/04/14/bus…