nytimes.com/2019/04/14/bus…

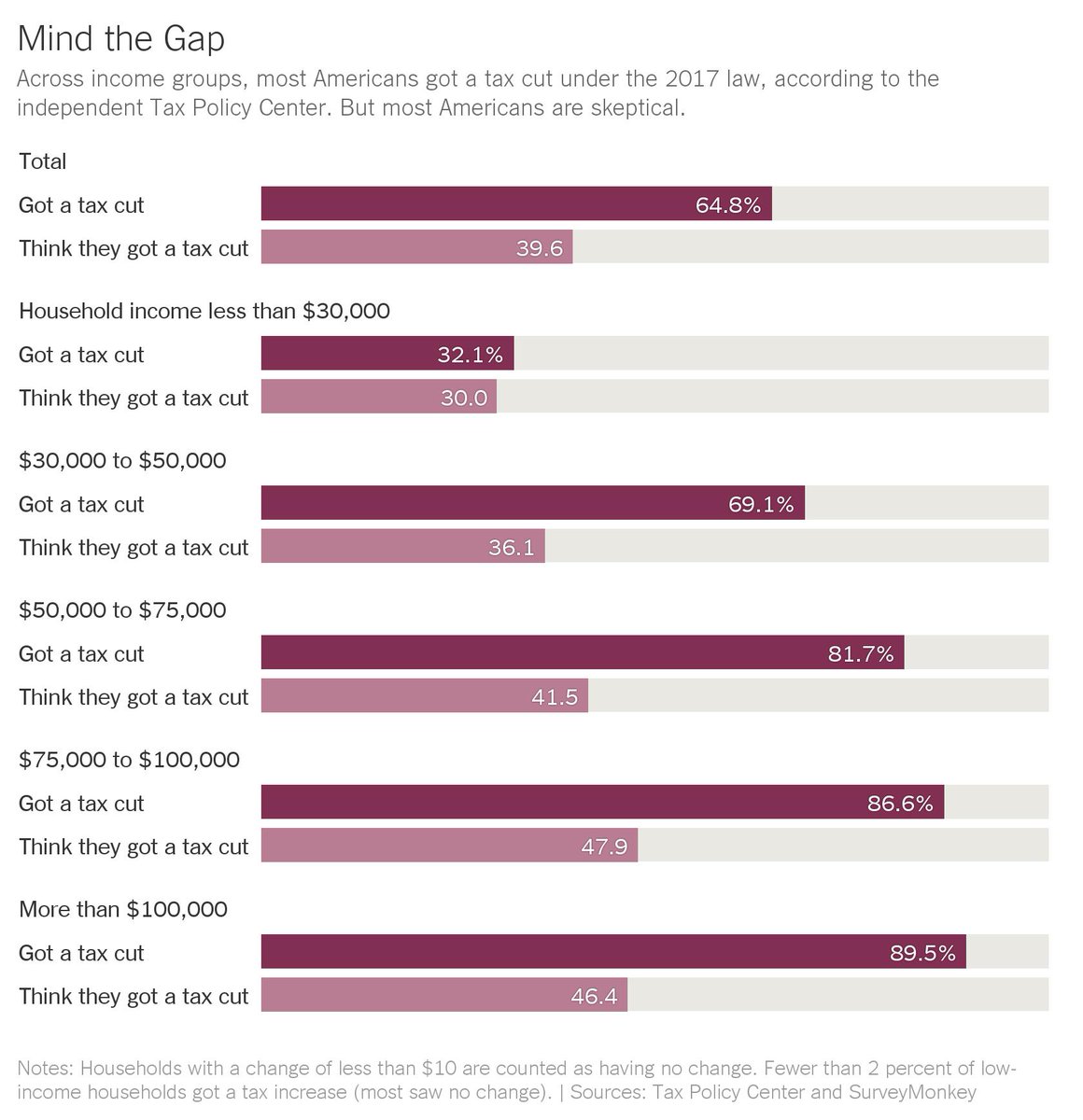

1. You morons are wrong. I totally got a tax increase!

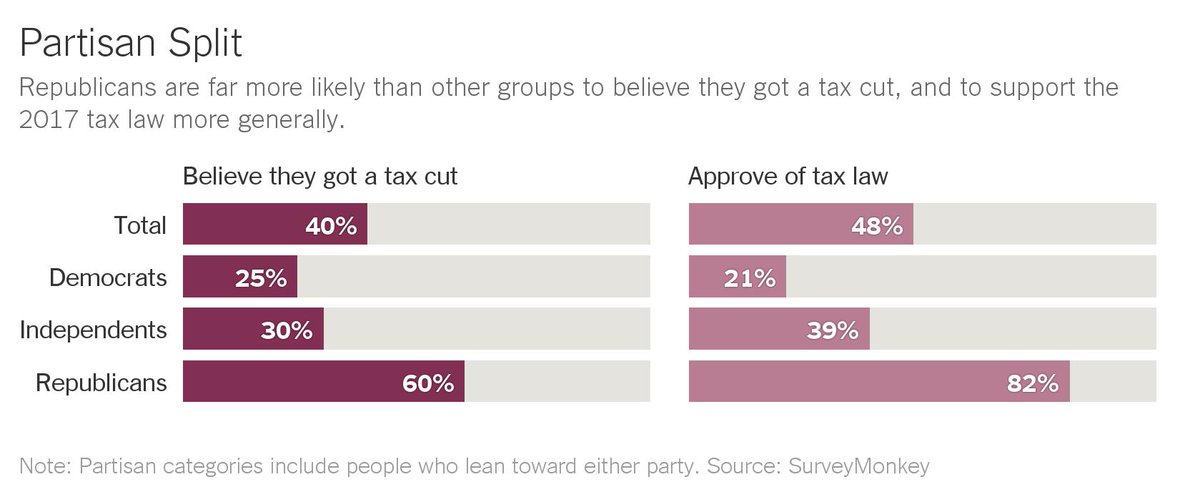

2. You liars in the media are the reason no one thinks they got a tax cut.

3. So what if I got a few bucks extra? The law was still terrible!

Going to take these in reverse order.

nytimes.com/interactive/20…

And also in my thread from yesterday:

tpc-tax-calculator.urban.org

Here's one from @taxfoundation: taxfoundation.org/tax-calculator/