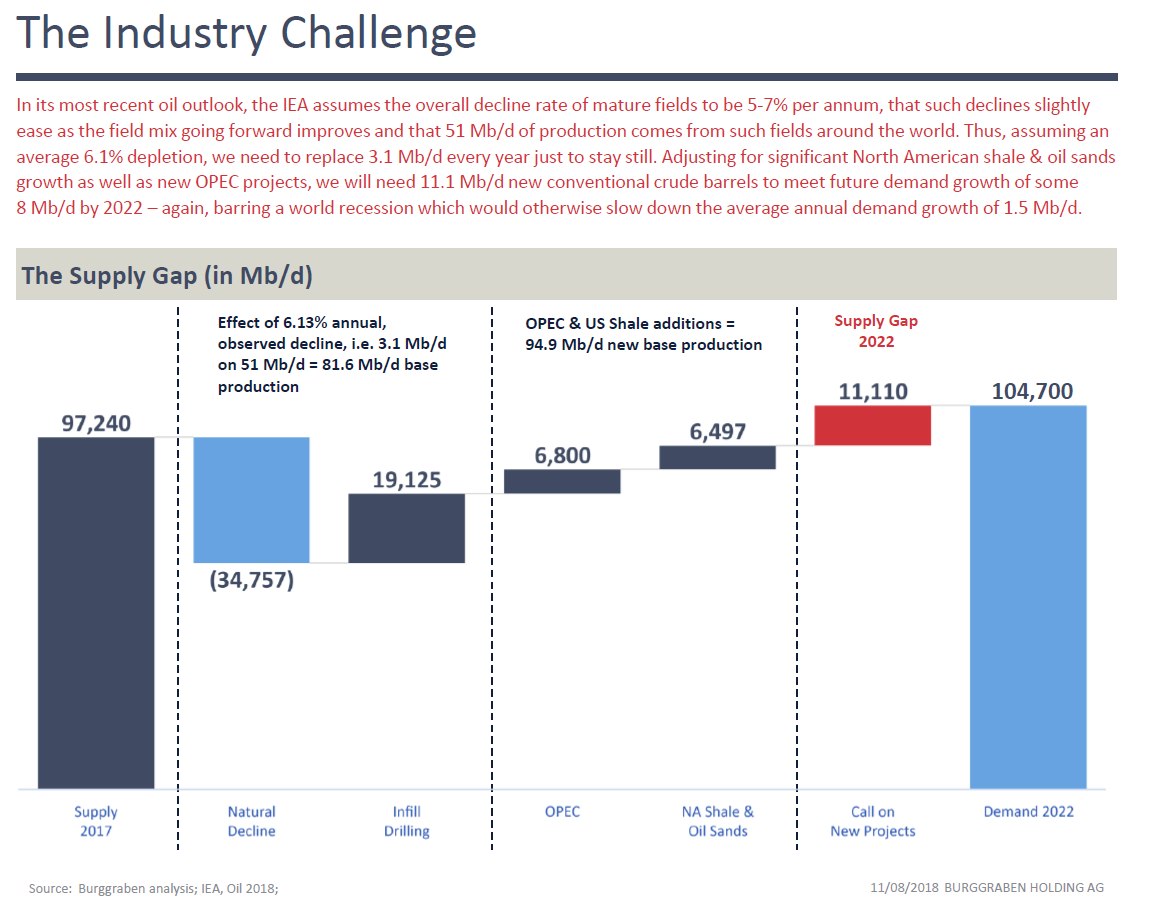

Our answer: by 2021. Which is why we see a supply gap in 2022.

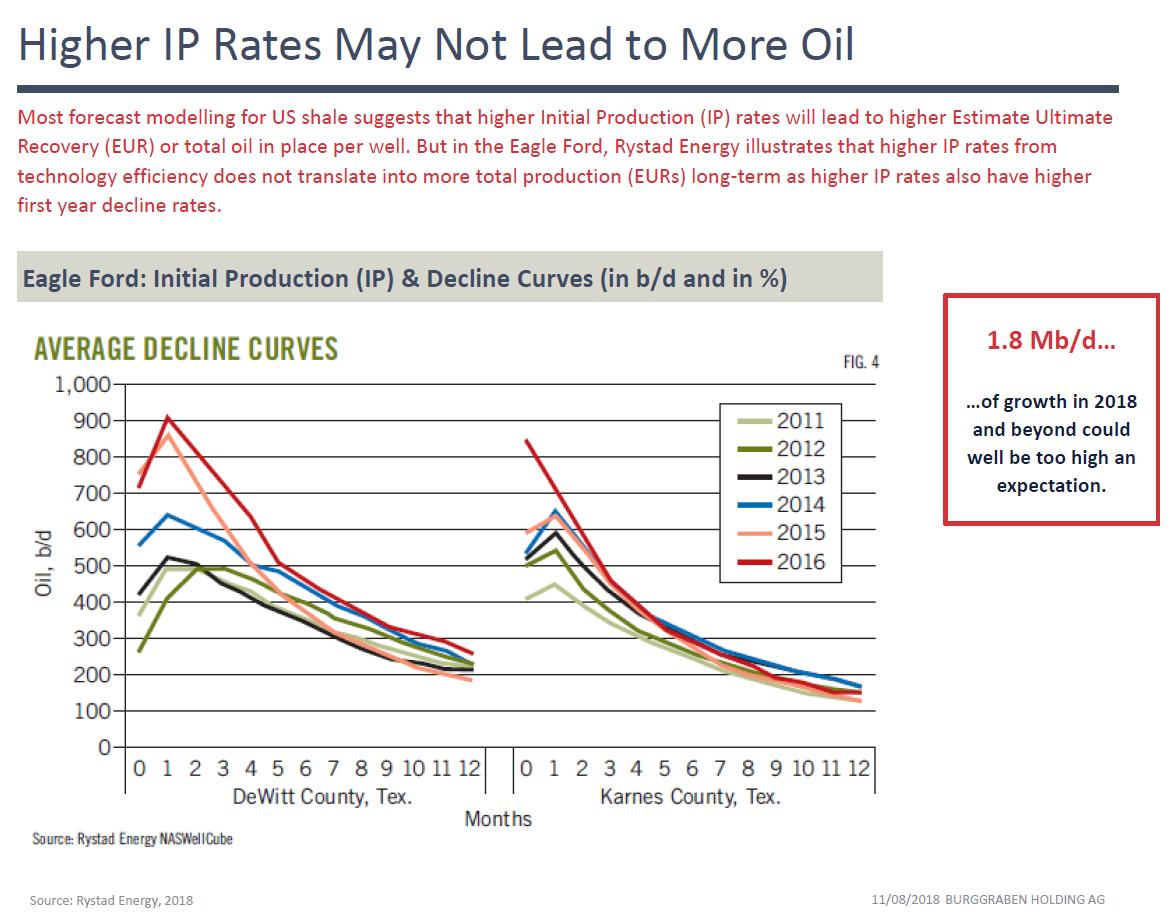

Here is why, i.e. a brief summary on the Permian from David Hughes' latest report postcarbon.org/how-long-shale…. @drillinginfo @Bob_McNally @kingofcrude

#OOTT

seekingalpha.com/article/417044…