⭐ Snippets by Peter Lynch ⭐

👇👇

⭐ Stocks in General:

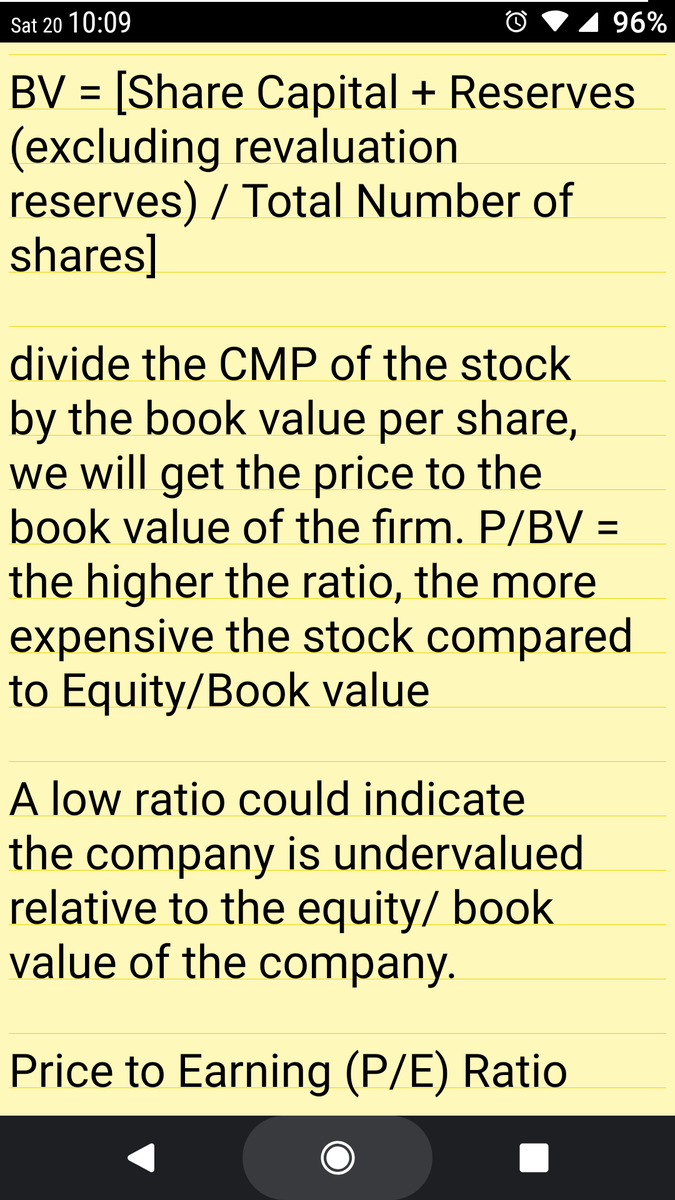

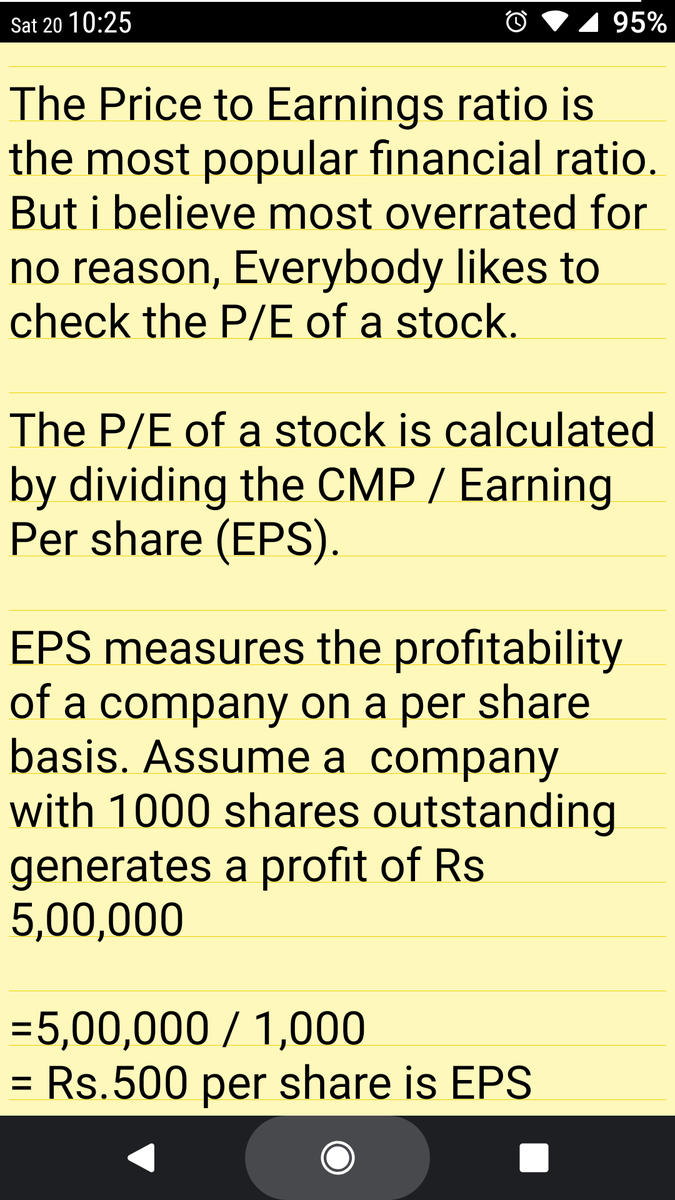

👉 The p/e ratio. Is it high or low for this particular company & for similar companies in the same industry.

👉 The percentage of Institutional ownership.The lower the better.

Both are positive signs.

👉 The record of earnings growth to date & whether the earnings are sporadic or consistent. (The only category where earnings may not be important is in the asset play.)

👉 The cash position. Net cash provides floor on the stock.

⭐ Slow Growers:

👉 Since you buy these for the Dividends (why else would you own them?)

👉 When possible find out the percentage of the earnings are being paid out as dividends. If it's a low percentage, then the company has a cushion in hard times.

⭐ Stalwarts:

👉 These are big companies that aren't likely to go out of business, the key issue is price, & the p/e ratio will tell you whether you are paying too much.

👉 Check the company's long term growth rate, & whether it has kept up the same momentum in recent years.

👉 If you plan to hold the stock forever, see how the company has fared during previous recession & market drops.

👉 Inventories.Demand-Supply relationship. New entrants into the market,which is usually a dangerous development.

👉 Anticipate a shrinking p/e multiple over time as business recovers & investors look ahead to the end of the cycle, when peak earnings are achieved.

⭐ Fast Growers:

👉 Whether the stock is selling at a p/e ratio at or near the growth rate.

👉 That the company has duplicated its successes in more than one city or town, to prove that expansion will work.

👉 That the company still has room to grow.

👉 Whether the expansion is speeding up or slowing down.

👉 That few institutions own the stock & only a handful of analysts have ever heard of it. With fast growers on the rise this is a big plus.

👉 Most important, can the company survive a raid by its creditors? how much cash does the company have? how much debt?

👉 If it's bankrupt already, then what's left for the shareholders?

👉 Is business coming back?

👉 Are costs being cut? it so, what will the effect be?

⭐ Asset Plays:

👉 What's the value of the assets? are there any hidden assets?

👉 How much debt is there to detract from these assets? (Creditors are first in line.)

👉 Is there a raider in the wings to help shareholders reap the benefits of the assets?

🙂⭐ End 🙂⭐