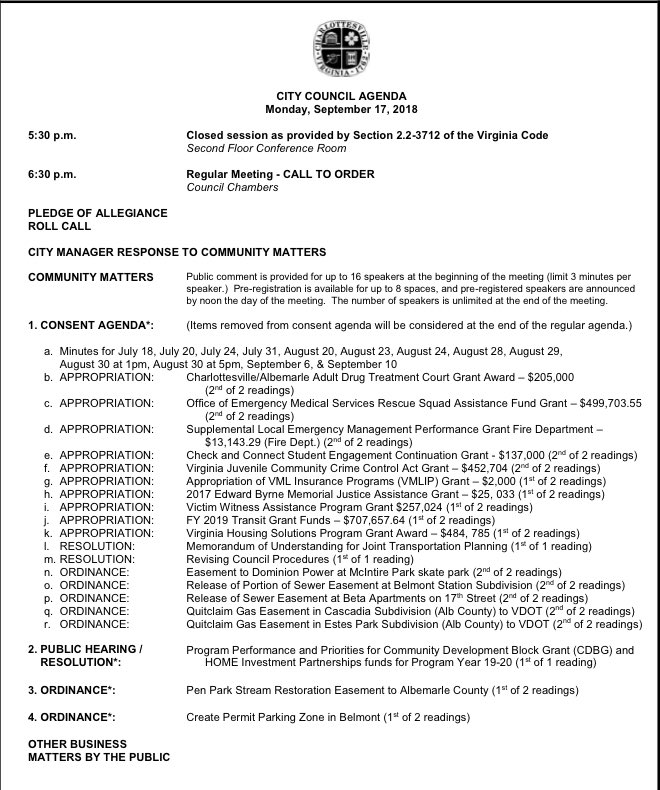

taxjustice.net/tjn19-programm…

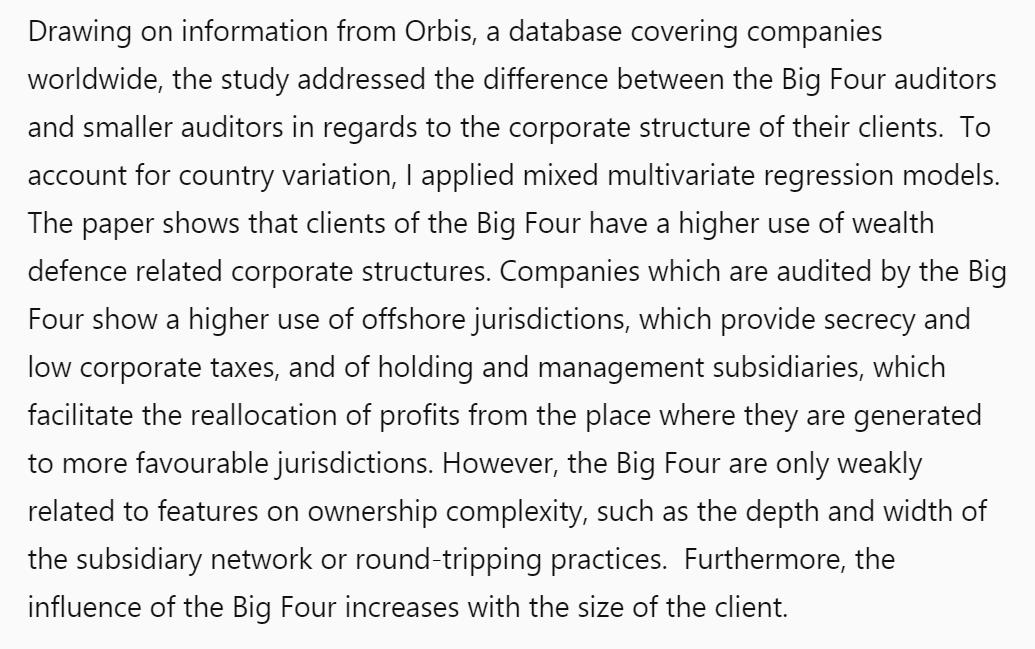

Full paper at osf.io/preprints/soca…

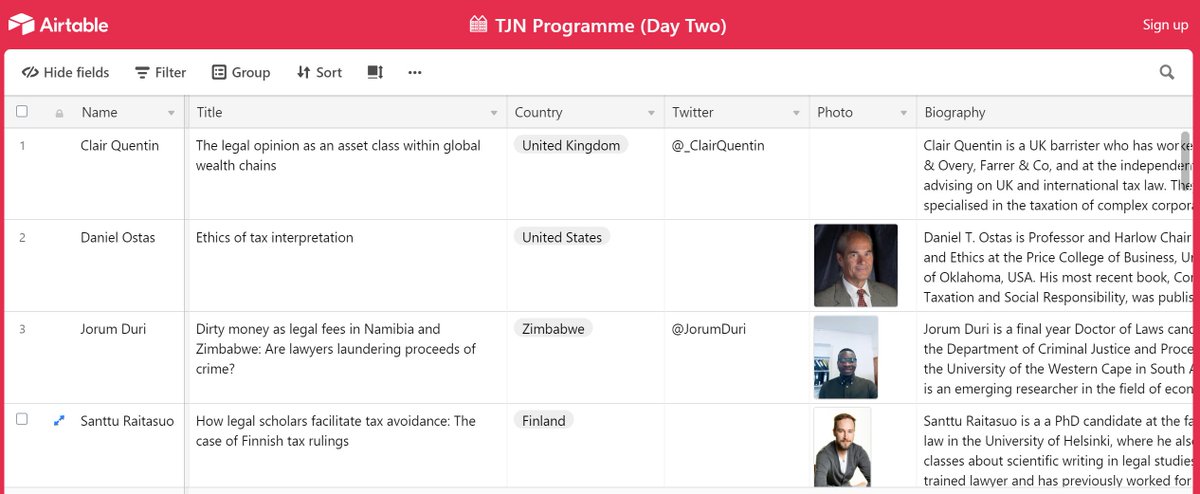

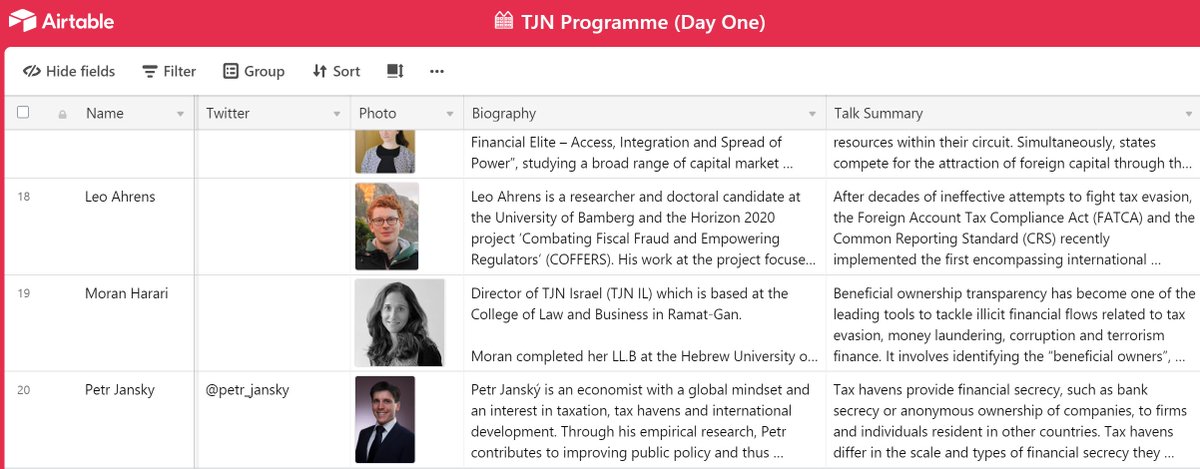

Extended summary: airtable.com/shrmOimd7cA0YO…

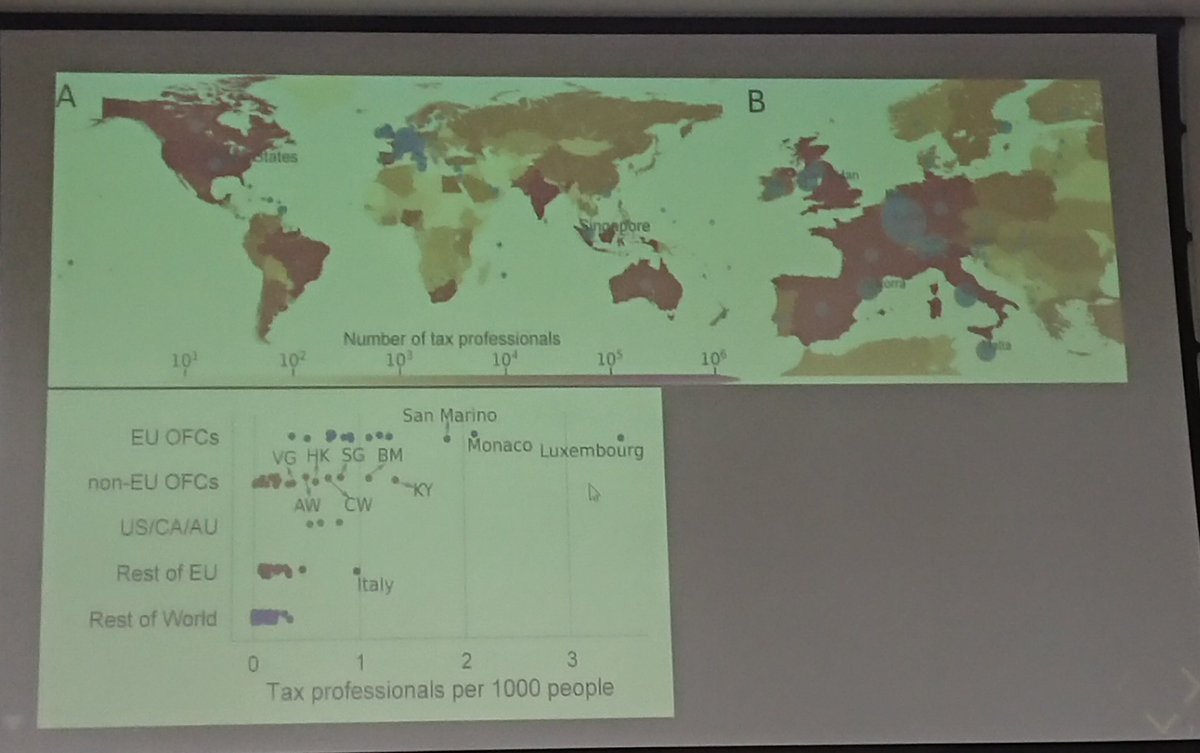

UAE

Mauritius

France

Zambia

UK

Qatar

China

Kuwait

South Africa

Saudi Arabia

#tjn19

#tjn19

Livestreaming at taxjustice.net/tjn19/

airtable.com/shrmOimd7cA0YO…

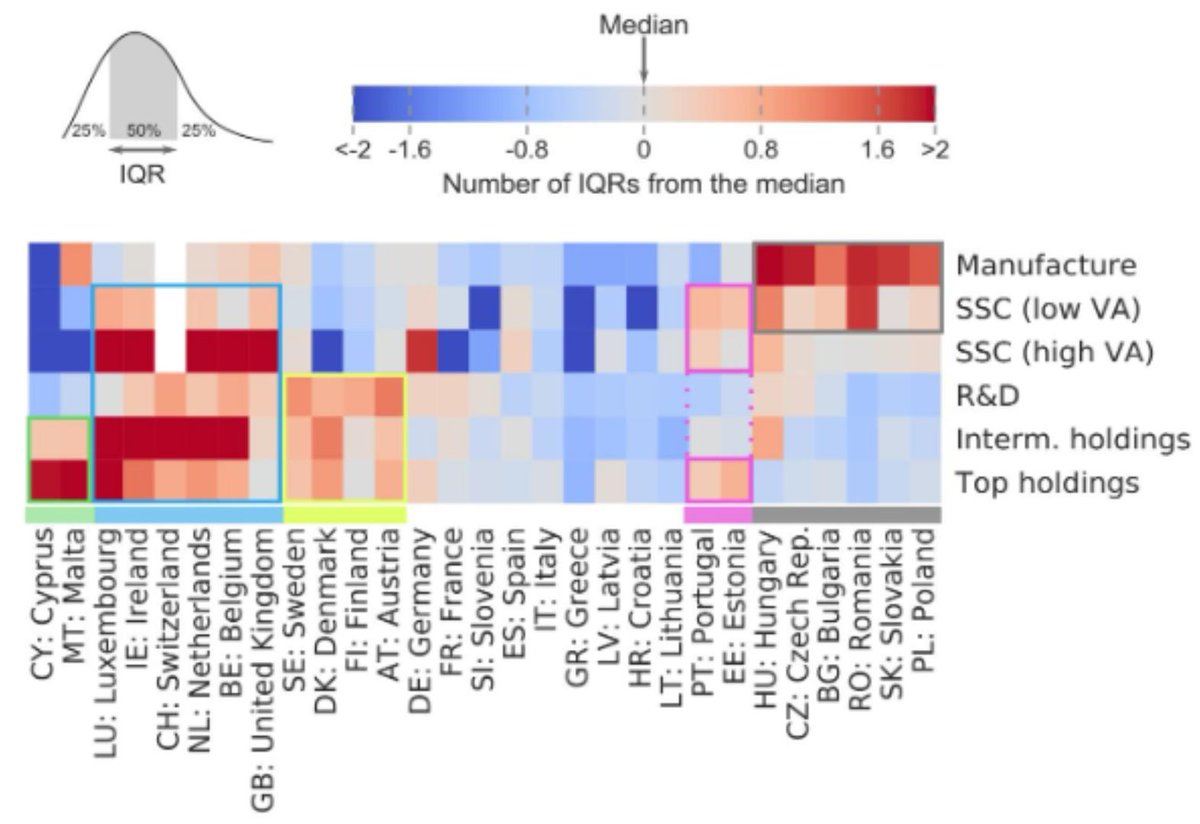

Questions focusing on regression results (@LAjdacic v robust!); and on the future of accounting (@AlexJacobs16 asks: how can we take this forward?)

airtable.com/shrmOimd7cA0YO…

First key result: the intensity of global financial secrecy has on average decreased, by 10%+ from 2011 to 2018

Questions welcome at slido.com/j928