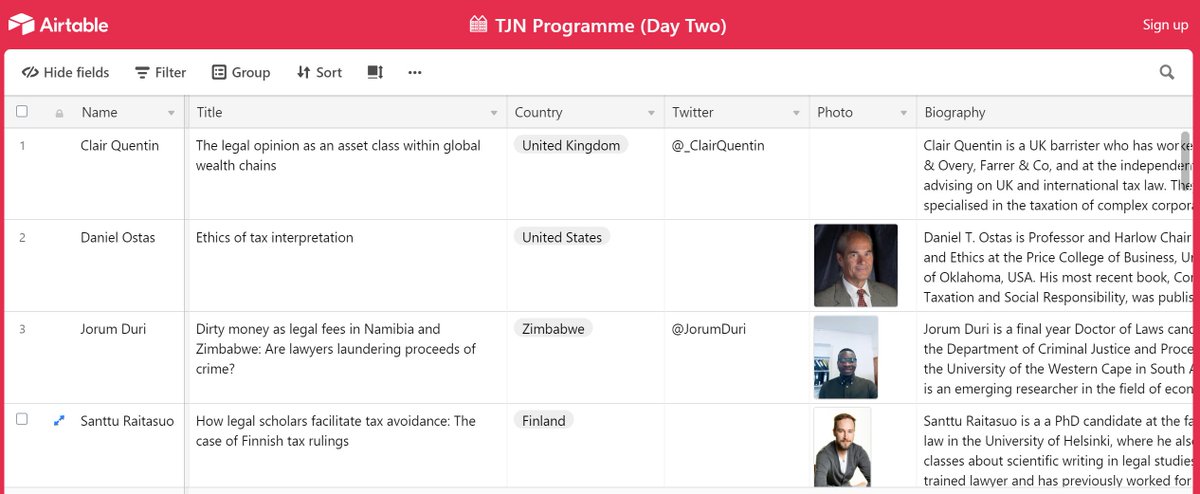

airtable.com/shrIZhVqrmAzzV…

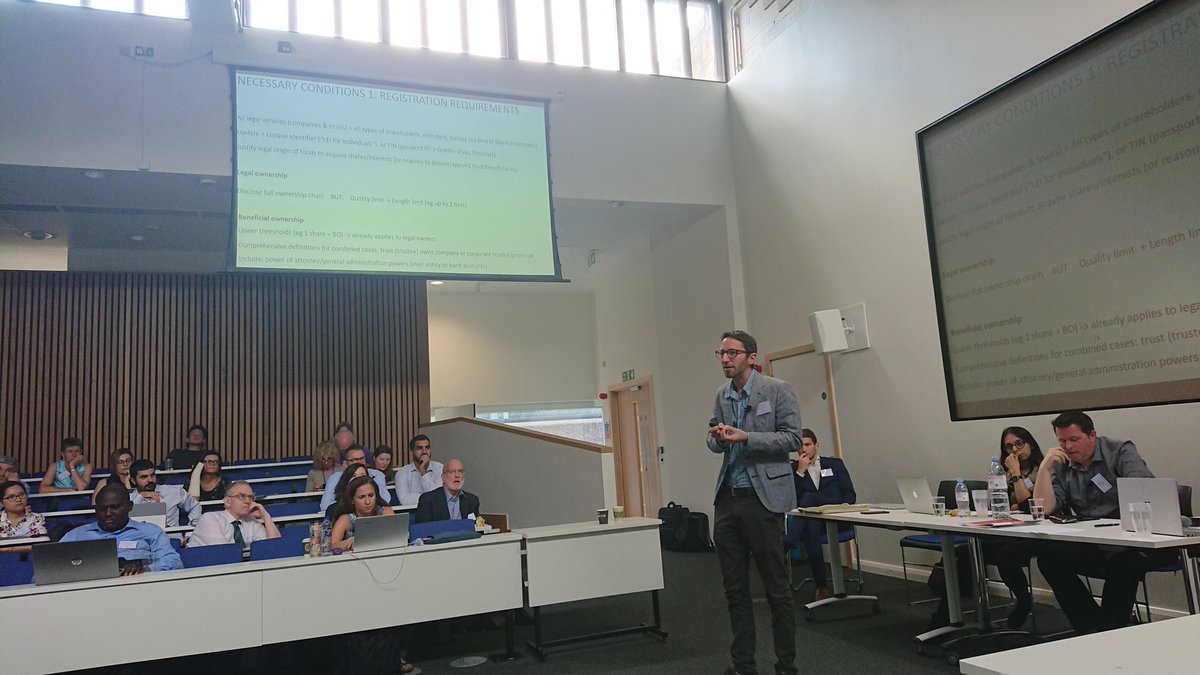

#tjn19

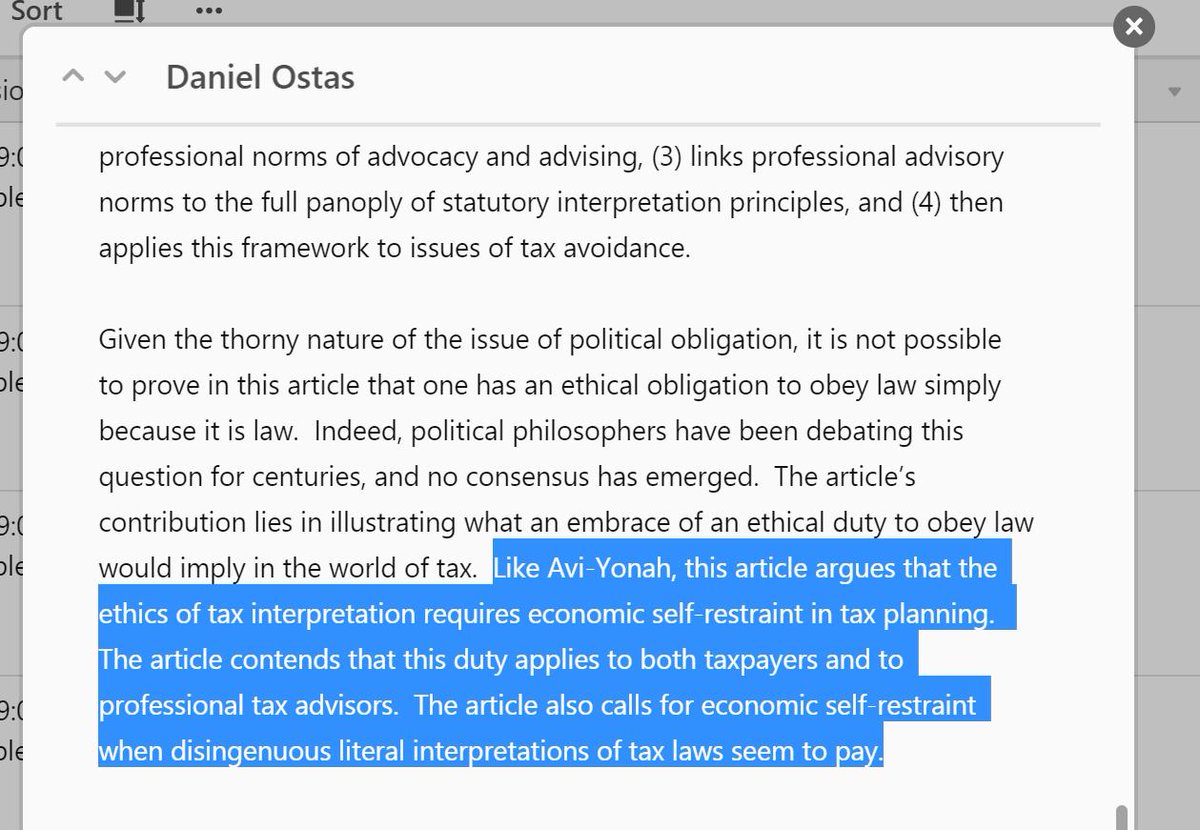

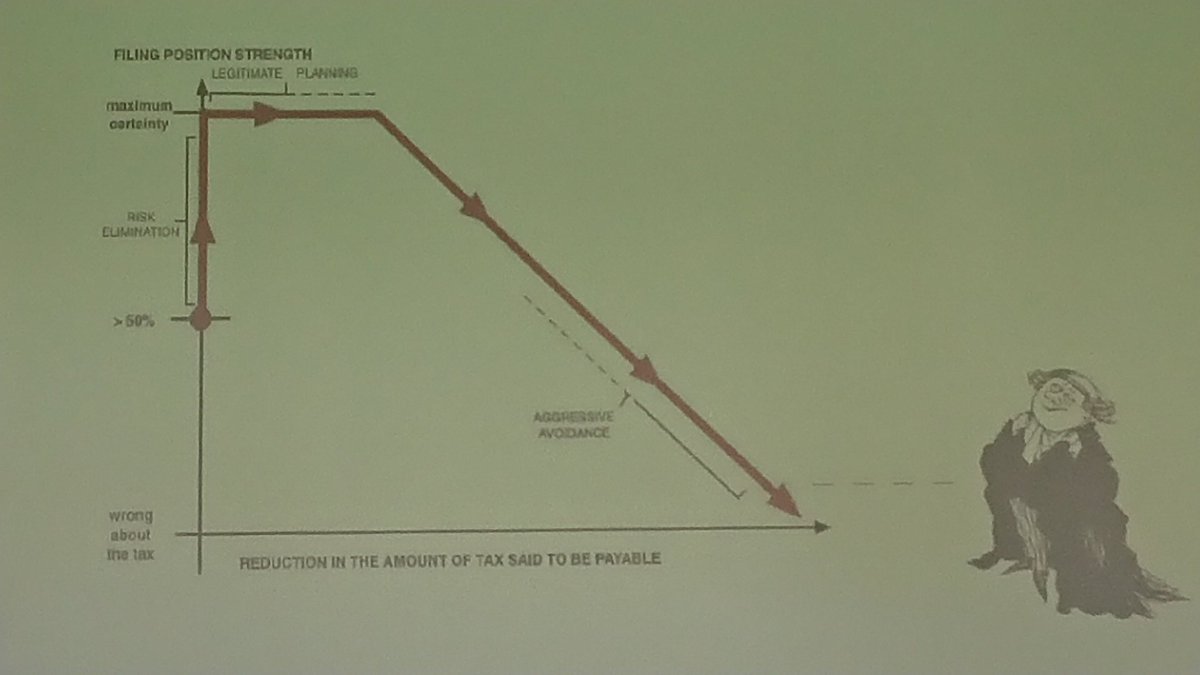

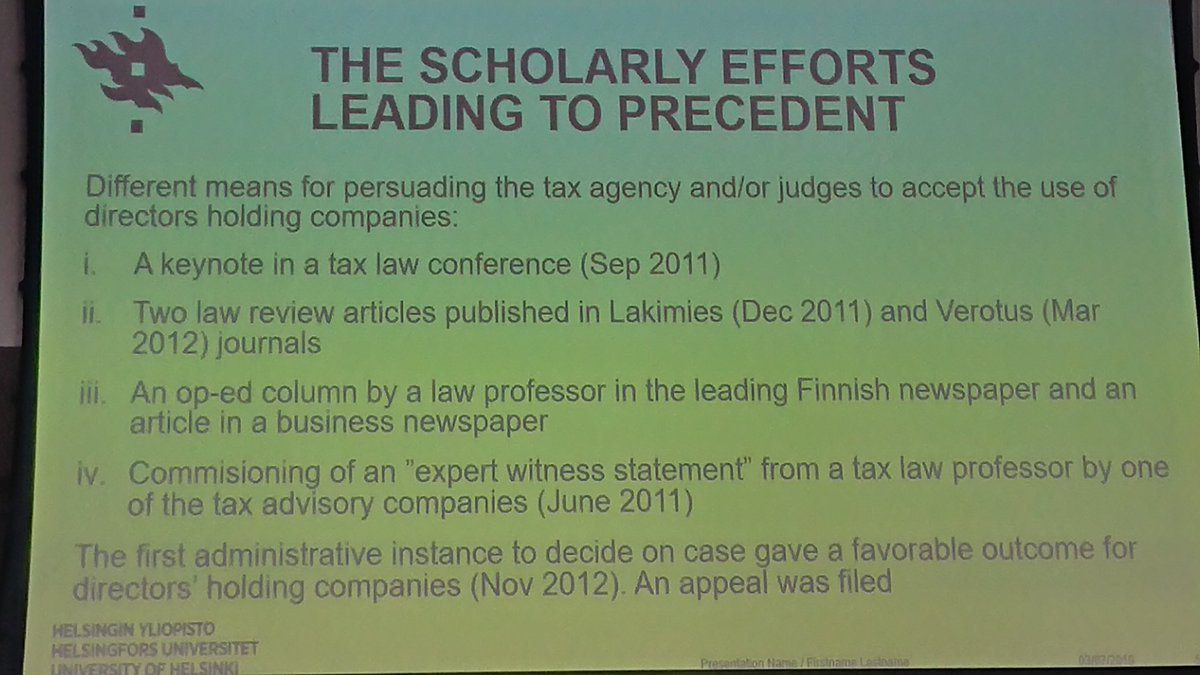

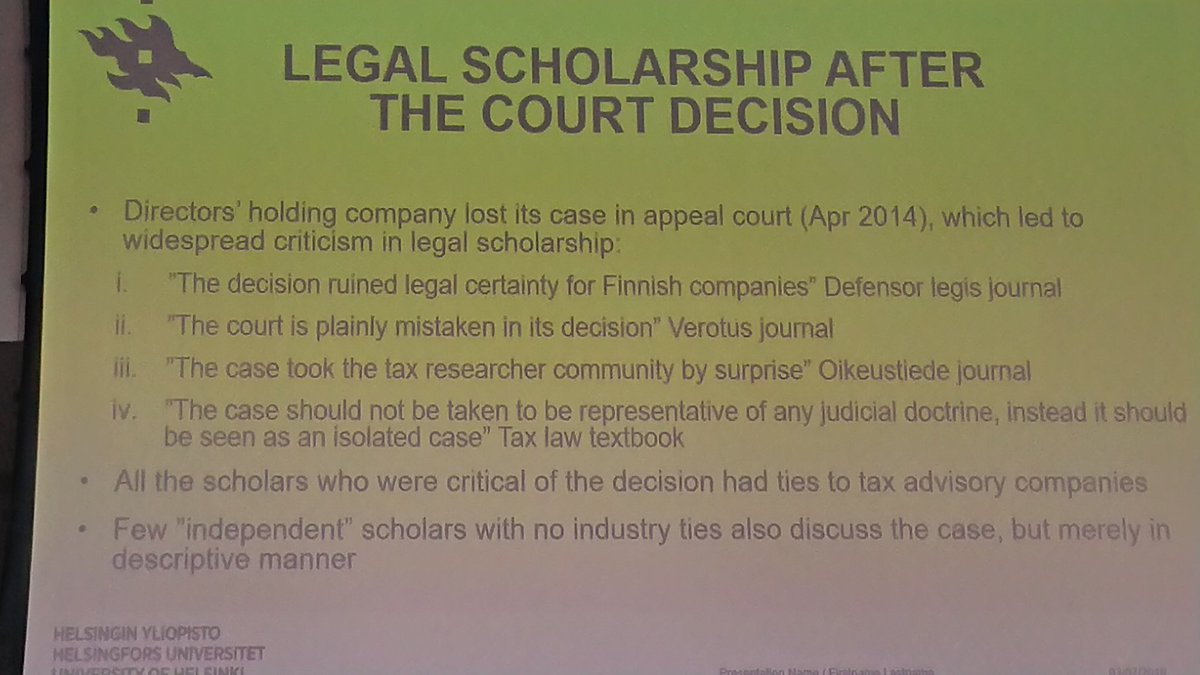

'by achieving positions of trust in academia, tax consultancy firms gain gatekeeper roles that facilitate corporate-friendly research and subdue critical arguments' #tjn19

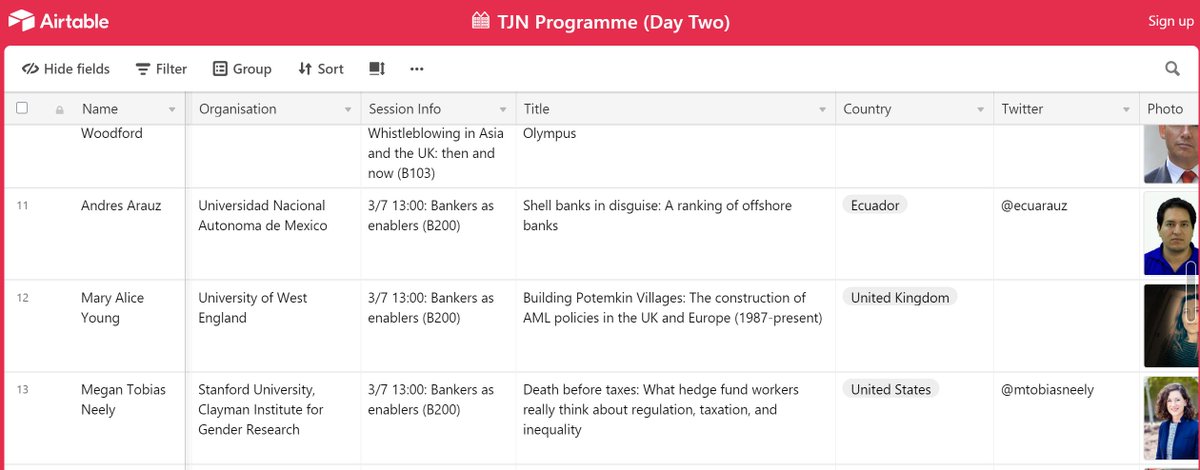

airtable.com/shrIZhVqrmAzzV…

* An extra 1000 tax inspectors reduces the probability of using an offshore tax haven by 0.2% when evaluated at the mean. [HMRC headcount fell 15,000.]

* An extra 100 media headlines that include term 'tax haven' increases(!) use by 5%.

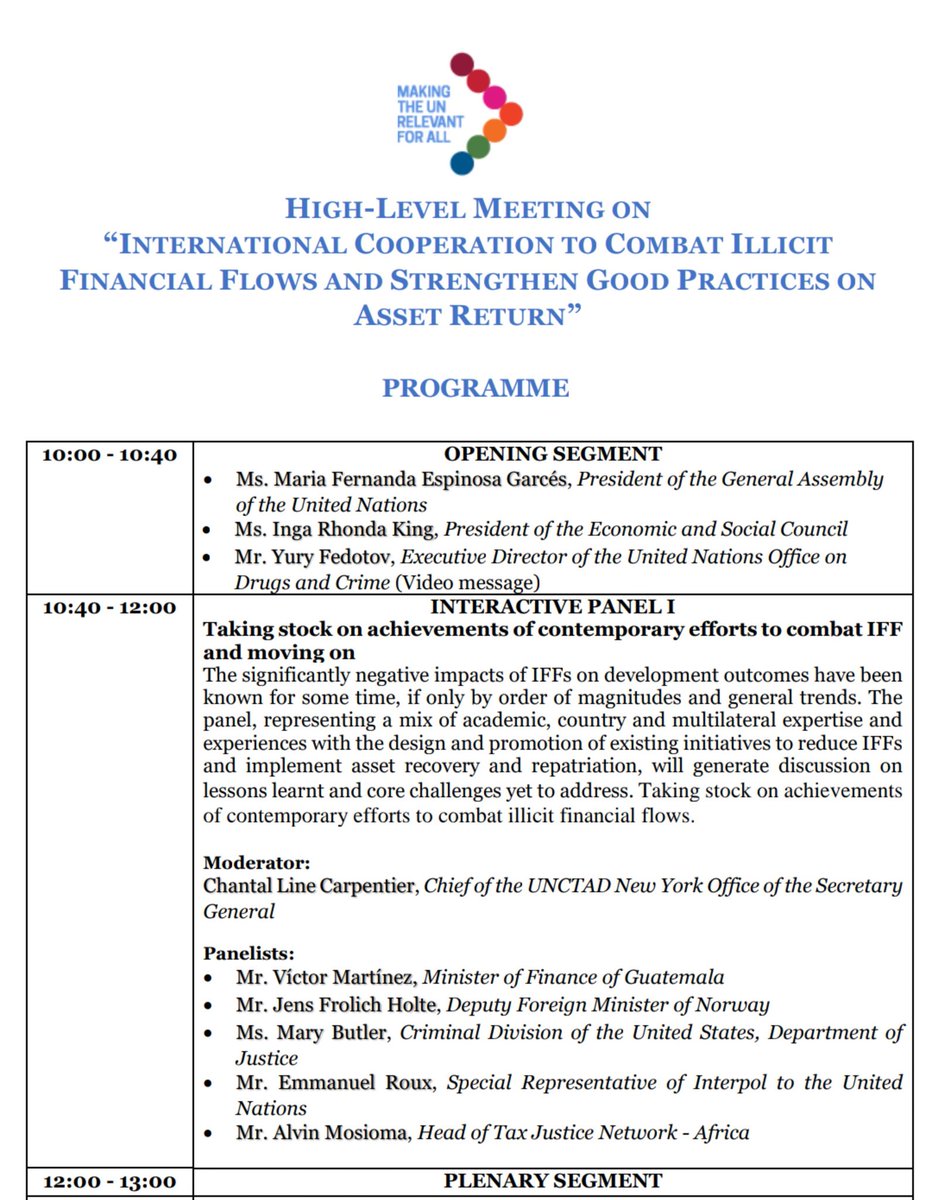

Aside: Kazakhs speak Kazakh and Russian. Astana International Financial Centre conducts business in English - and all meetings to inauguration took place in London. Is not in oecd CRS. #tjn19

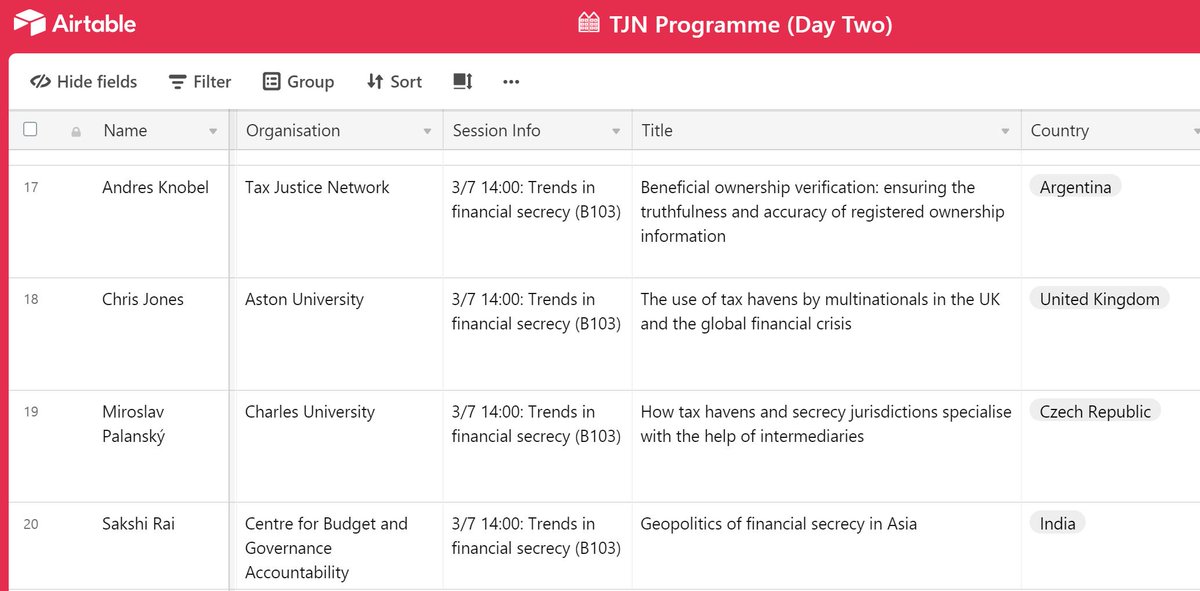

@sakshirai92 says not - the model is Dubai, or in some cases Singapore

#tjn19