Short thread on my column today: bloomberg.com/opinion/articl…

Portugal had neglected it through centuries of colonization.

Indonesia's occupation had killed around 100,000 people.

And Australia, which had been its defender in the 1999 crisis, was about to betray it.

abc.net.au/4corners/secre…

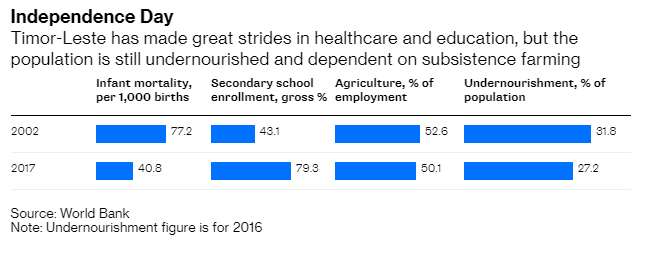

Infant mortality has been cut in half and secondary school enrollment doubled since 2002. Unlike more recently-independent states like Montenegro and South Sudan, it's also a functioning democracy.

Corruption scores around the same levels as Brazil and Colombia. Pretty good in the circumstances.

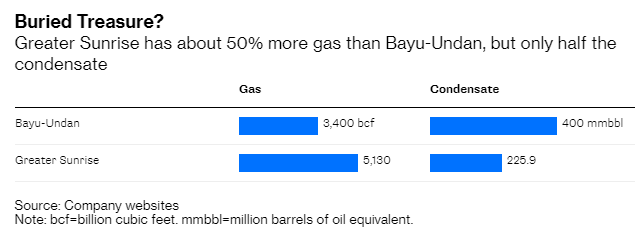

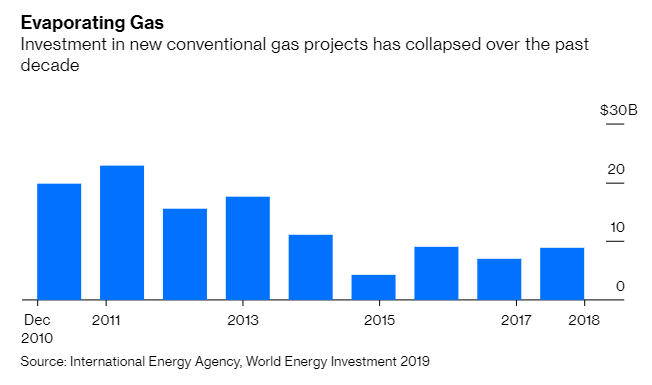

The engineering and political-risk challenges of putting the downstream infrastructure in Timor-Leste may be the last straw.

So it sees building an onshore processing plant as a nation-building project.

Chinese state-owned companies are already sucking up hundreds of millions building white-elephant projects across Timor-Leste, as this great @JasonVScott report shows: bloomberg.com/news/features/…

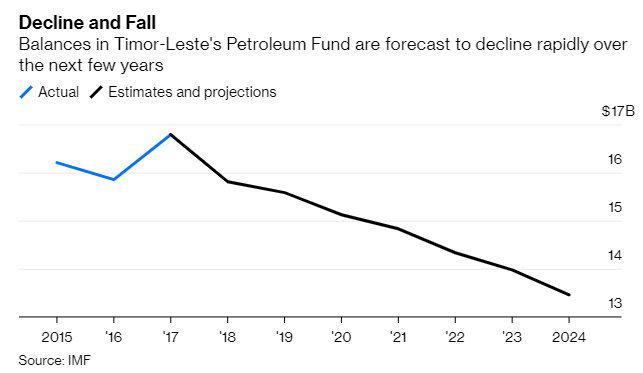

But it risks drifting towards another abusive relationship with China, with a future of budget and current account crises.

Timor-Leste will get 80% of upstream revenues. LNG plants only employ skeleton staff, anyway.

bloomberg.com/opinion/articl…

Plus fantastic @JasonVScott story here: bloomberg.com/news/features/…

And @danmurtaugh gives the detail in this Quicktake here: bloomberg.com/news/articles/…

(ends)

woodside.com.au/about-us/histo…

When Indonesia invaded Timor-Leste in 1975, Gough Whitlam offered Jakarta advice on how to make it look like the result of the popular will.