Last year, Modi govt. dropped the controversial FRDI Bill which had proposed a “bail in” clause - meaning that your bank deposits would be used to bail out any bank that is at risk of going under.

Wanna know how sneaky they are?

Thread 👇

This means that your bank deposits/FDs up to an amount of 1 lakh are protected & insured (1/10)

With massive uproar from the Congress & the Opposition, the Bill was temporarily withdrawn in 2018. (2/10)

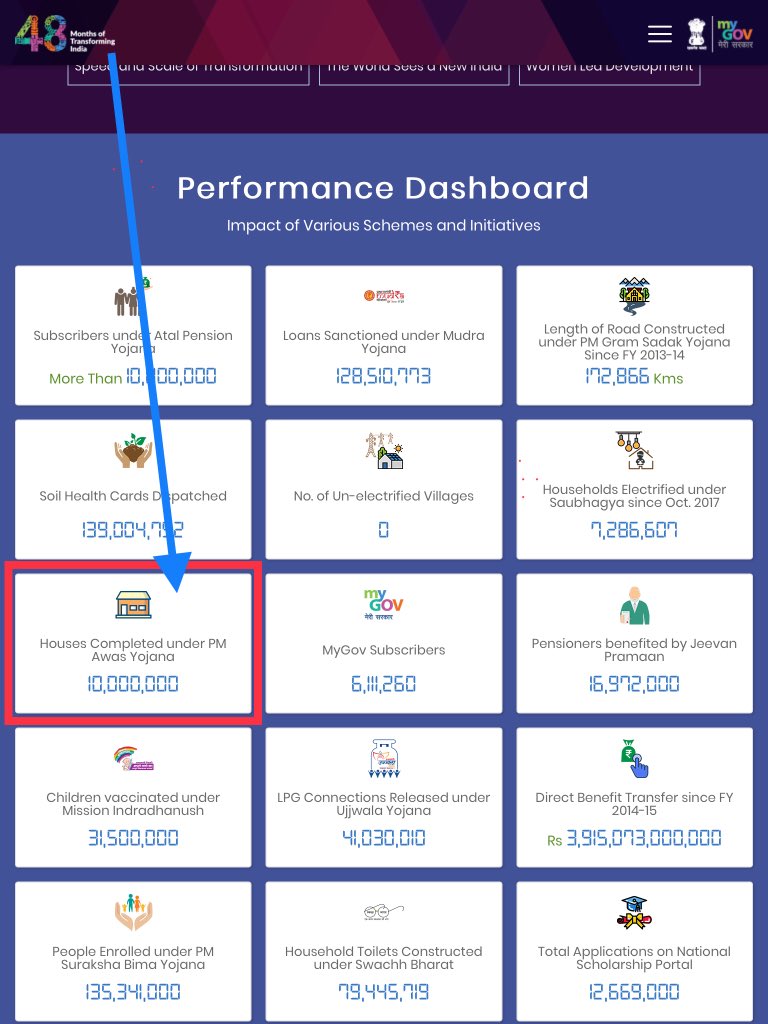

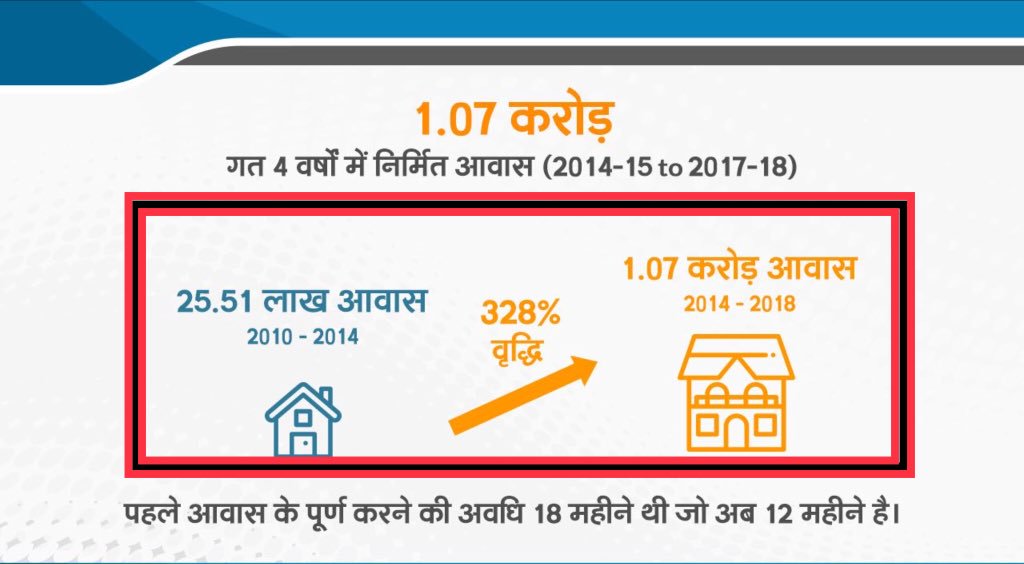

The PM Jan Dhan account scheme was also rolled out to push more people to keep their money in banks. (3/10)

That’s another reason why most banks hiked up their “minimum balance” requirements. (4/10)

Thanks to the Opposition, this was stalled in time (5/10)

But how will the RBI have money if it keeps transferring its surplus to the govt.? (6/10)

The Modi govt. has conveniently taken this money away from RBI. (7/10)

It was only a move to get you to put your money in banks which would be used to bail out the bank when it gets into trouble.

Ur deposits were to protect Ambani & Nirav Modi’s frauds. (8/10)

Remember - the protection on ur deposits is still is only up to 1 lakh. (9/10)

This is how sneaky Modi govt. is - it eyed ur deposits to pay for the sins of corporate defaulters & frauds. (10/10)