Bottom line costs: $55B up front & $16.5B over next 10 yrs

Bottom line benefits? Um, lots! Yeah, lots

Here’s why costs are actually much higher & benefits don’t come close. [thread]

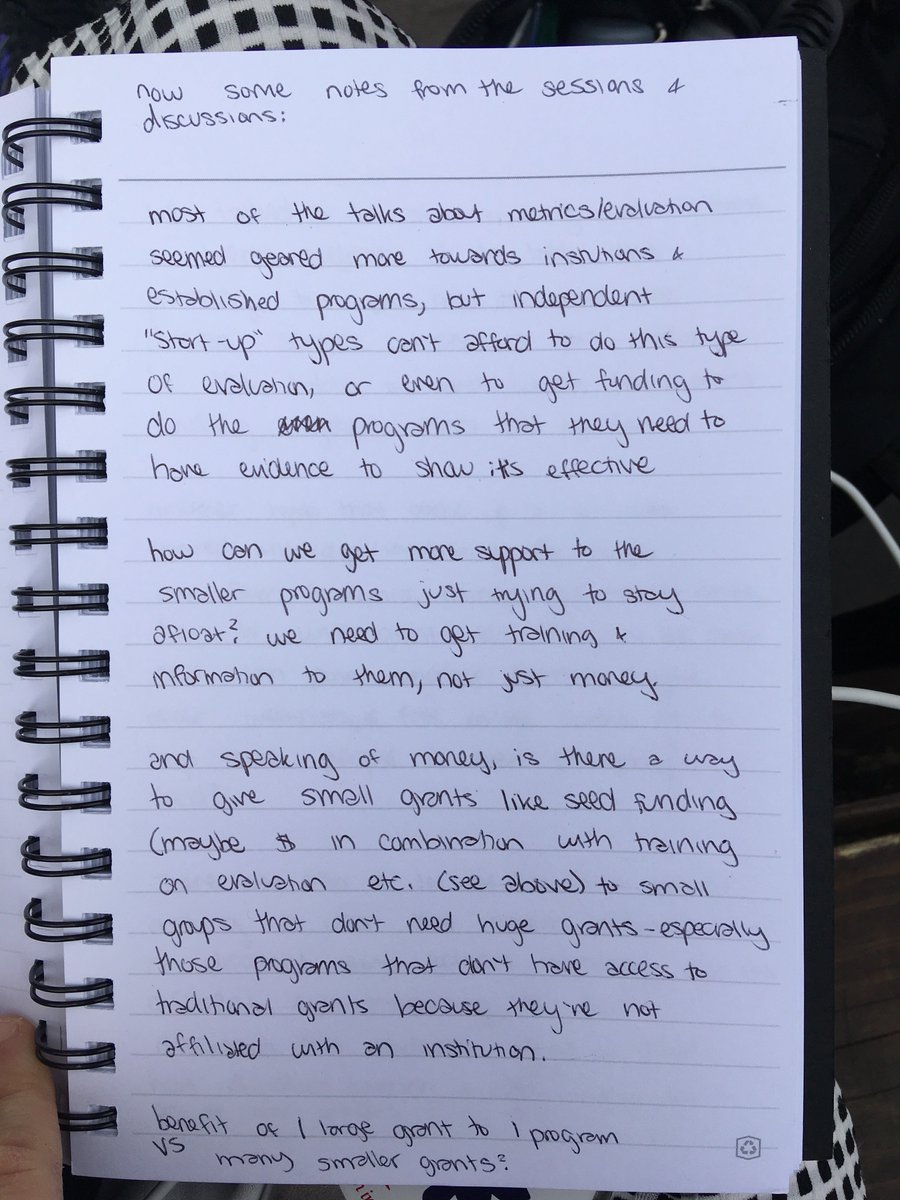

Among other things (if you can believe it) no one actually knows how many businesses CCPA will cover.

That’s… quite a margin of error.

Imagine passing a law & being *that* uncertain who it covers….

(For reference, 80% of CA firms surveyed by @privacypros believed they’d be covered)

So all of these costs are *in addition to* — not in lieu of — the costs companies already incur to comply with privacy rules.

The reality is likely higher given IAPP’s conservative calculations.

And none of this counts non-US firms, of course.

But it’s debatable whether CCPA actually confers benefits...

(See @laweconcenter’s lengthy analysis of privacy regs bit.ly/2oFKv6g & @alecstapp’s takedown of CCPA bit.ly/2oFKX4s)

- $4.6B in GSP

- 14,000 jobs

- $9.3B in output/investment/income

CA is a big state, so these are small as a %, but tell that to the people affected.

I wonder how much privacy protection someone would give up not to be fired...?

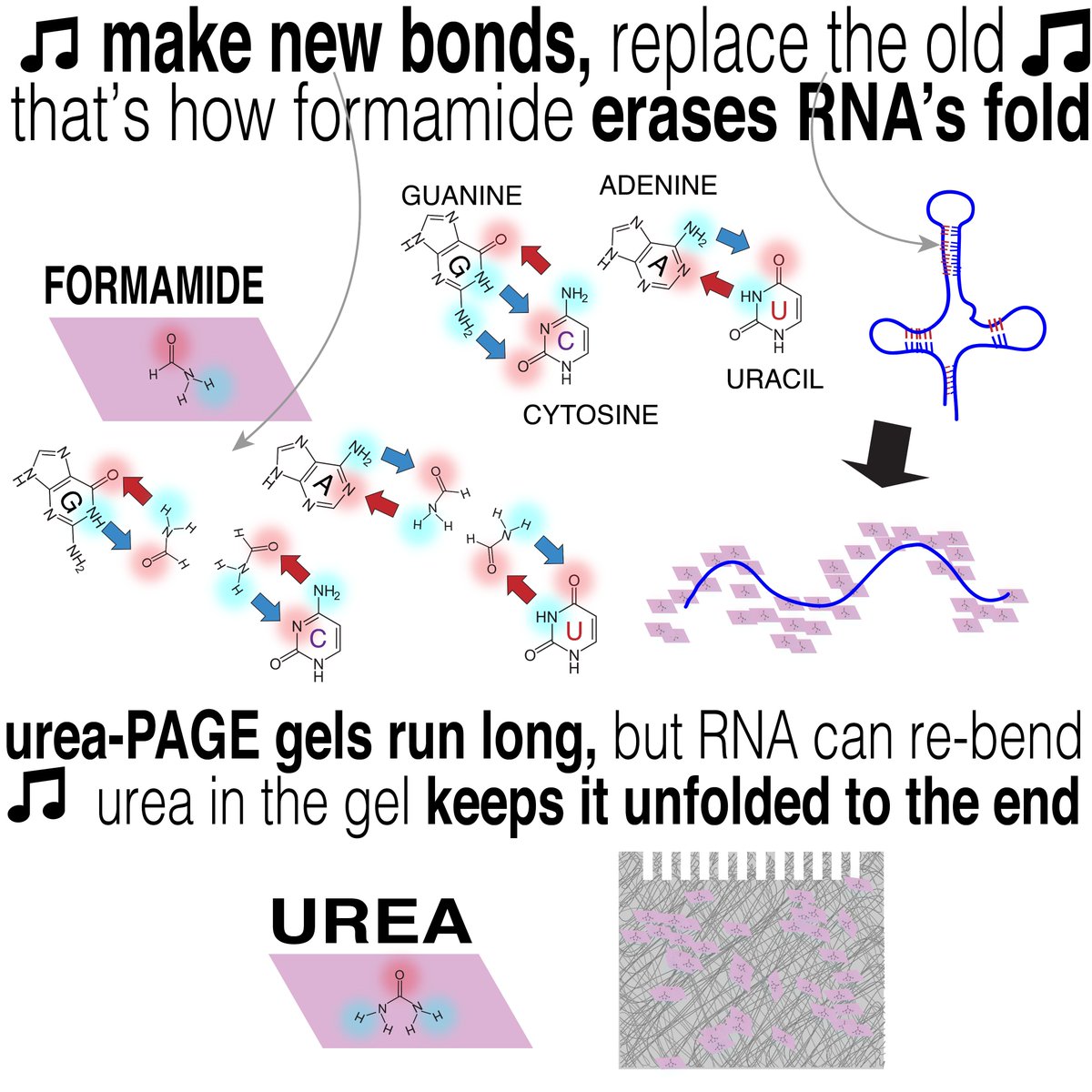

@cetucker & @avigoldfarb suggest this is into the $billions based on their research on privacy regs' impact on ad effectiveness bit.ly/2n01IH8

Great news for Google & FB, but for advertisers & consumers? Not so much.

Well, the measurement problems here are even more significant & the report acknowledges the extreme uncertainty of any estimates of the law’s benefits.

Nevertheless, it offers a couple of possible measures.

$169M (implied value of firms’ WTP for consumers’ basic info)

$9.7B (implied value of firms’ WTP for more-sensitive info)

$12B (ARPU of personal info used for advertising in CA)

Rather, they estimate the potential value to firms of the underlying data.

Some of CCPA’s costliest rules require disclosure, e.g. This doesn’t inherently preserve data value.

It might trigger add’l expense to claw data back, but it doesn’t simply *confer* its value on consumers.

So keeping it out of firms’ hands doesn’t confer that value on consumers; it *destroys* that value.

This means very real consumer *costs*:

Higher product prices, less info flow, &/or subscription fees. (See also Goldfarb & Tucker)

All of this is ignored by the report.

Copycat bills like one proposed in NJ (bit.ly/2nZWpYH) don’t even do that.

As @iab has noted, bit.ly/2nXORFZ, this is a big problem:

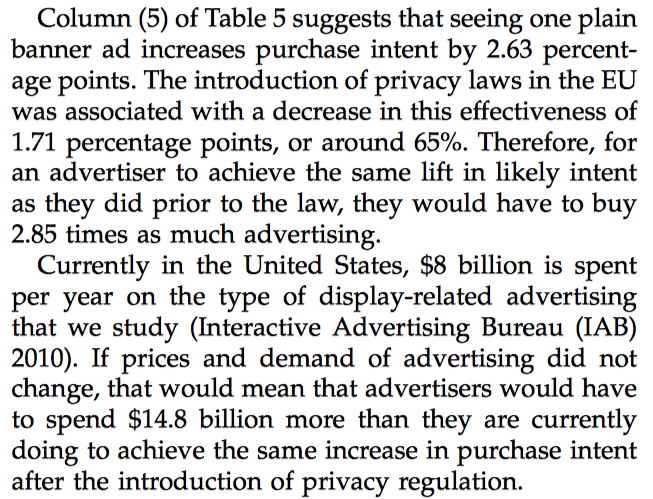

$1.6–5.4B/yr benefit at a cost of $7.2B/yr (annualized up-front & ongoing costs over 10 yrs).

Even without all the probs above, this is... not a good deal