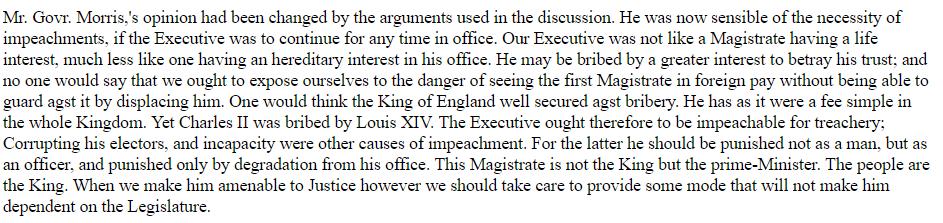

That's both broad and ambiguous, so let's break it apart. /1

That said, I don't think that's what Beto meant nor how people interpreted it. /2

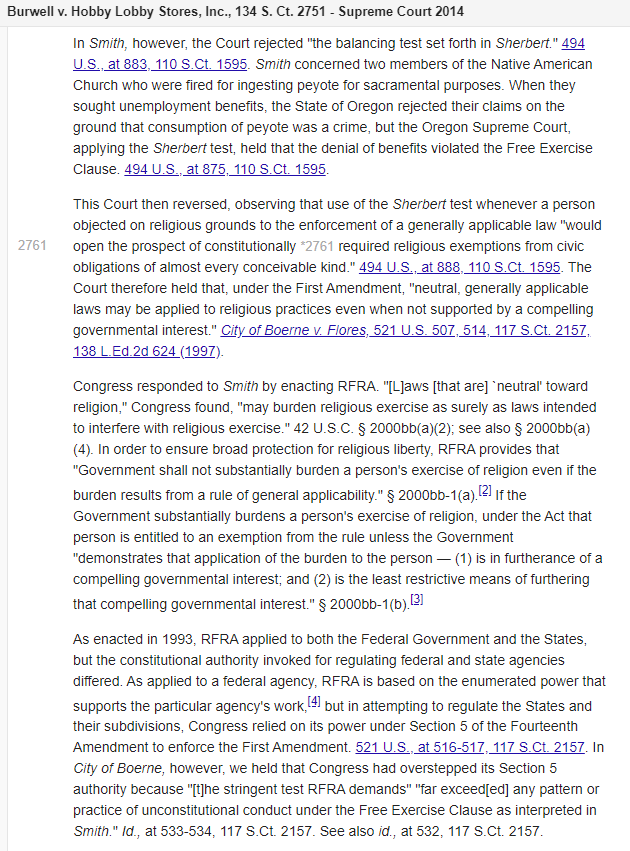

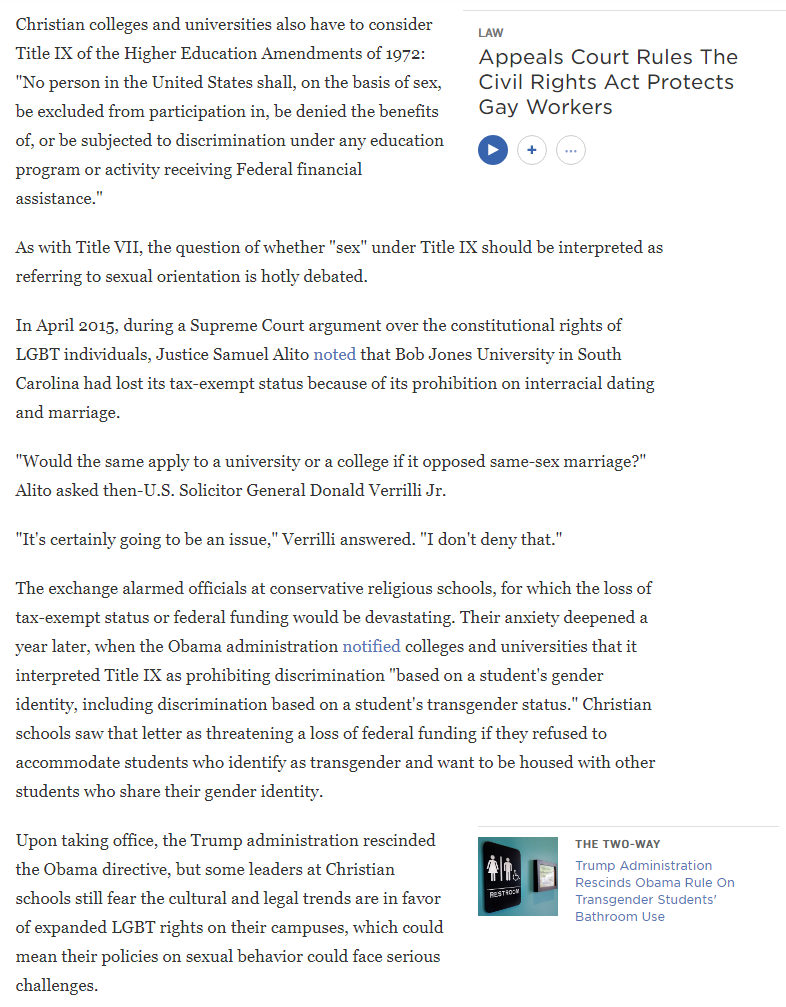

This issue has been brewing for a while: npr.org/2018/03/27/591…

/4

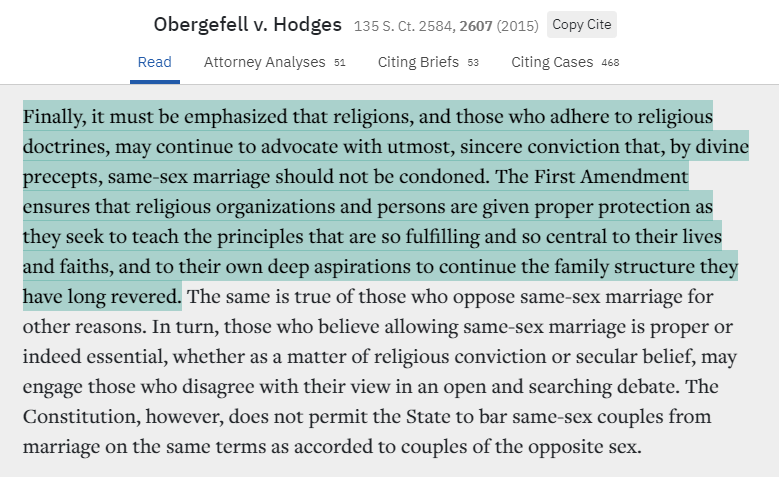

That said, what about churches that invite the public to hold weddings? It's hard to square same-sex exclusions with public accommodation laws: slu.edu/law/law-journa…

/5