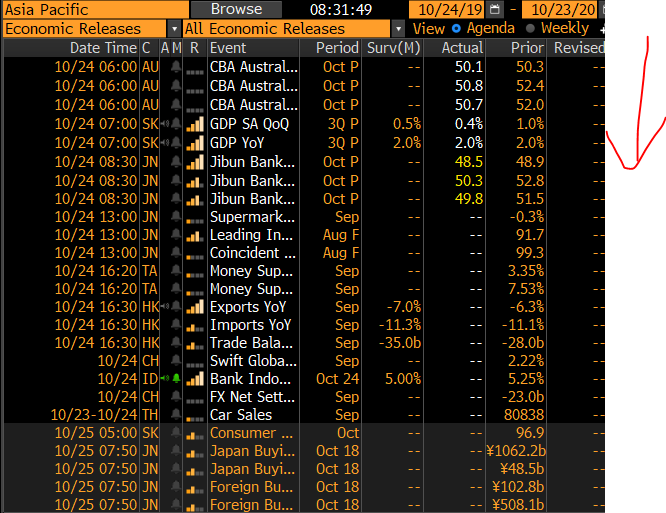

Based on trade data in October - Q4 will likely be just as bad even if there is a statistical boost from a favorable base. SKY Hynix said DRAM & NAND capacity to fall in 2020

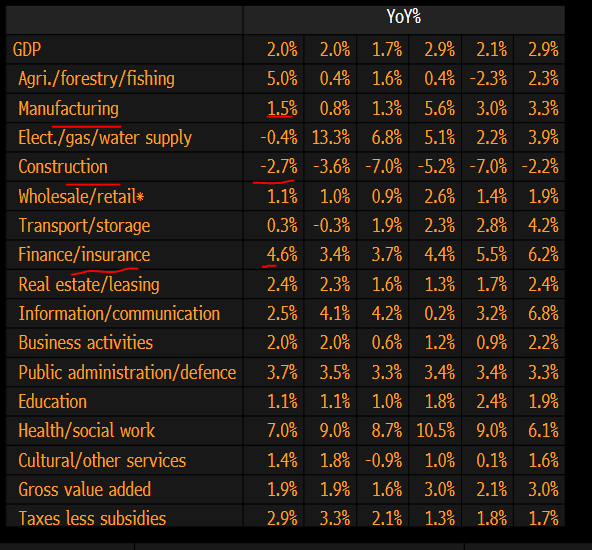

Manufacturing weak but some stabilization

Construction contracting per usual & a huge drag (we had expected this as the cycle goes down after a spike)

On the investment side, construction investment a drag but facility investment weak too😬

The good news is that we got a favorable base soon!🤗

Expectations are for some stabilization at a low level 👇🏻

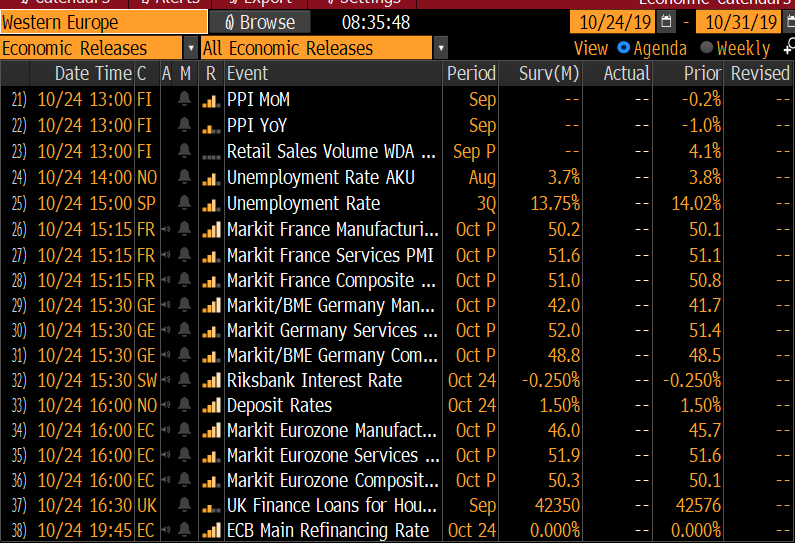

Jaws widening!!! 🦈😯👇🏻👇🏻👇🏻 (referencing Speilberg's movie obvs & sadly Hollywood hasn't made such good movies in a while)

Question: Will KOSPI recover? Too discounted?