@skorusARK uses this to illustrate @Tesla's profits will rise.

I mostly agree but with some caveats.

ark-invest.com/research/wrigh…

In most scientific literature I've read they are called "experience curves" or "learning curves". This is what I and e.g. the @IEA, @BloombergNEF and @MLiebreich usually call them.

But there is merit in changing the term to Wright's law.

It excludes economic learning theory hotly (and mostly wrongly imho) debating why this is true

Economists are right some learning must be going on and not all learning is equal.

So I advocate (BIPV) where the PV panel *is* the roof: you avoid double installation that is not becoming cheaper.

But most of the car is Model T tech. Here the effect of Wright's law is negligable.

So I think the right way to look at it (and the way I model it) is as follows:

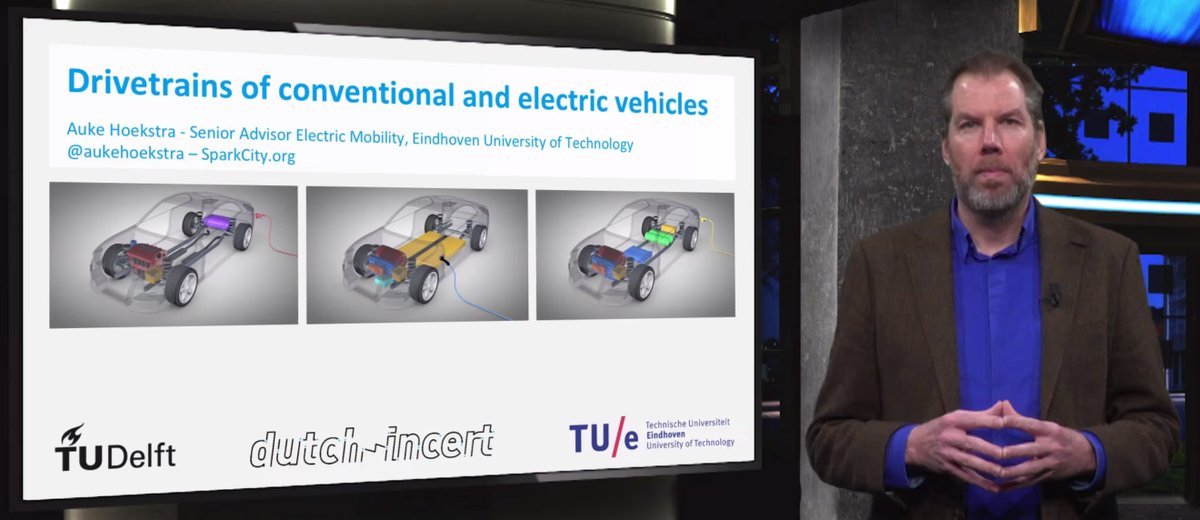

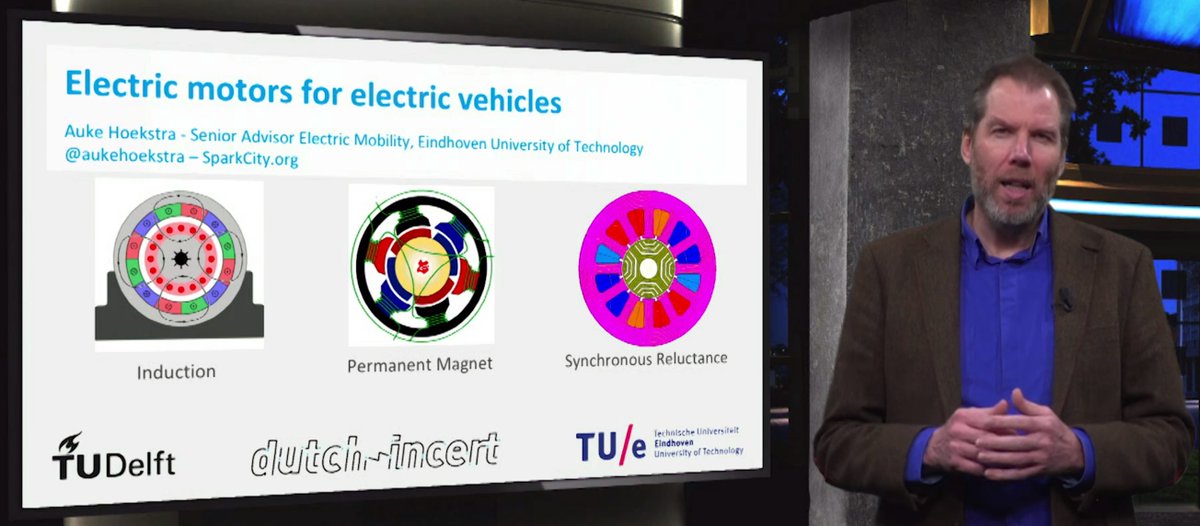

Divide the electric car in 3 large chunks: drivetrain; battery; and "other".

Determine learning for the first two.

E.g. when your calculations tell you, your battery becomes cheaper than your materials, you are doing something wrong.

On the other hand: we see e.g. less (expensive) cobalt in batteries.

The battery and drivetrain of EVs (not just Tesla) will become cheaper fast. Combined with the fact that electric cars are easier to design this results in EVs ultimately (2023-2030 depending on type) getting a lower purchase price.

My feeling is that Tesla will become a smallish but profitable premium brand with regular automakers providing the bulk of car production.

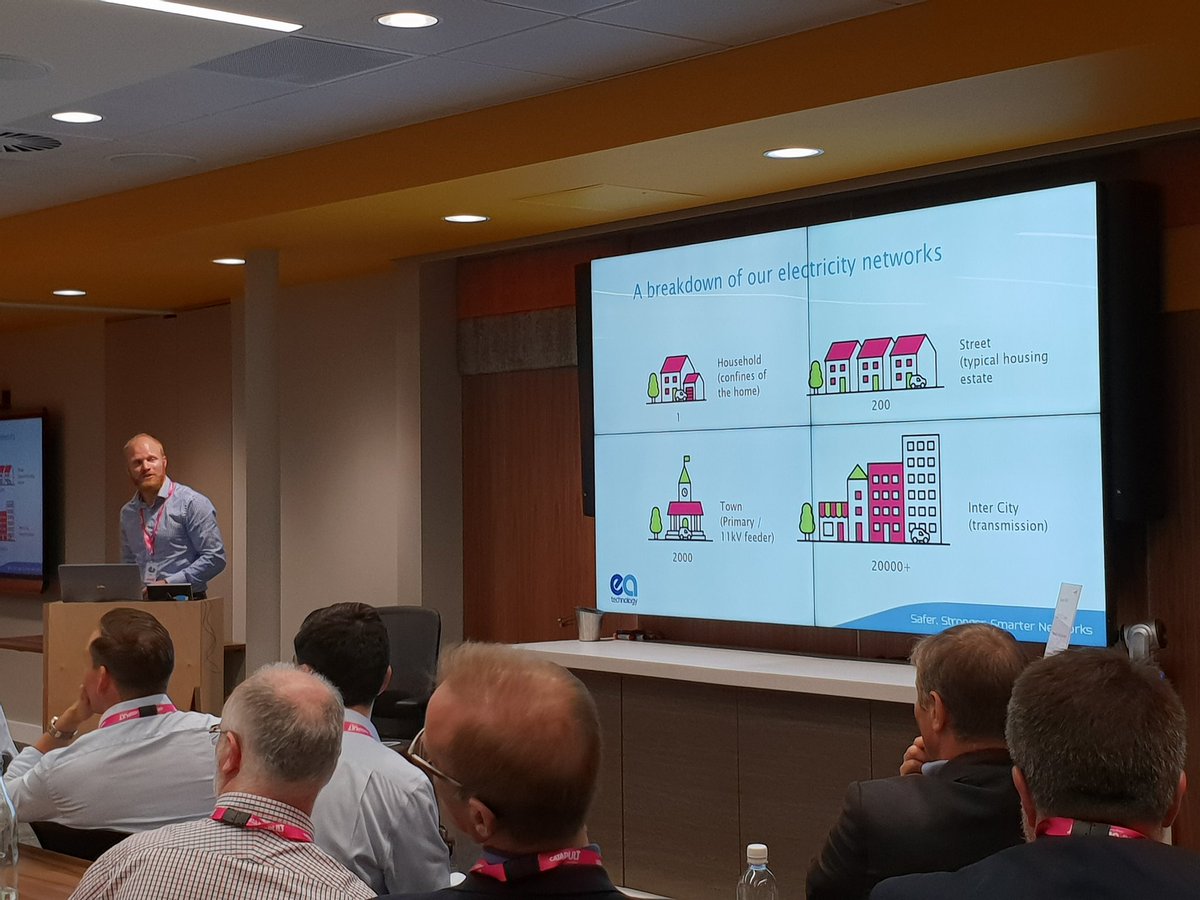

If ever household on the planet would get a car, this would be a nightmare scenario for the natural environment but also for cities.

We need to bike and share small electric vehicles for most trips.

Wrights law works: new tech gets X% cheaper for every doubling of production.

EVs (Tesla's and others) will make fossil cars and trucks economically uncompetitive.

We need to think more about sharing smaller electric vehicles.