-You create tail events simply by regulating the process - it’s an unnatural constraint

-It’s misconstrued that lowering variability actually lowers risk

-McDonalds exists as an insurance policy

-Everything non-linear is necessarily convex/concave

-Have optionality on the convexity of random events

-PTSD vs Post traumatic stress growth. One is talked about because it makes $$$

-Floor your losses

-Zero intelligence trading works when you have convexity bias

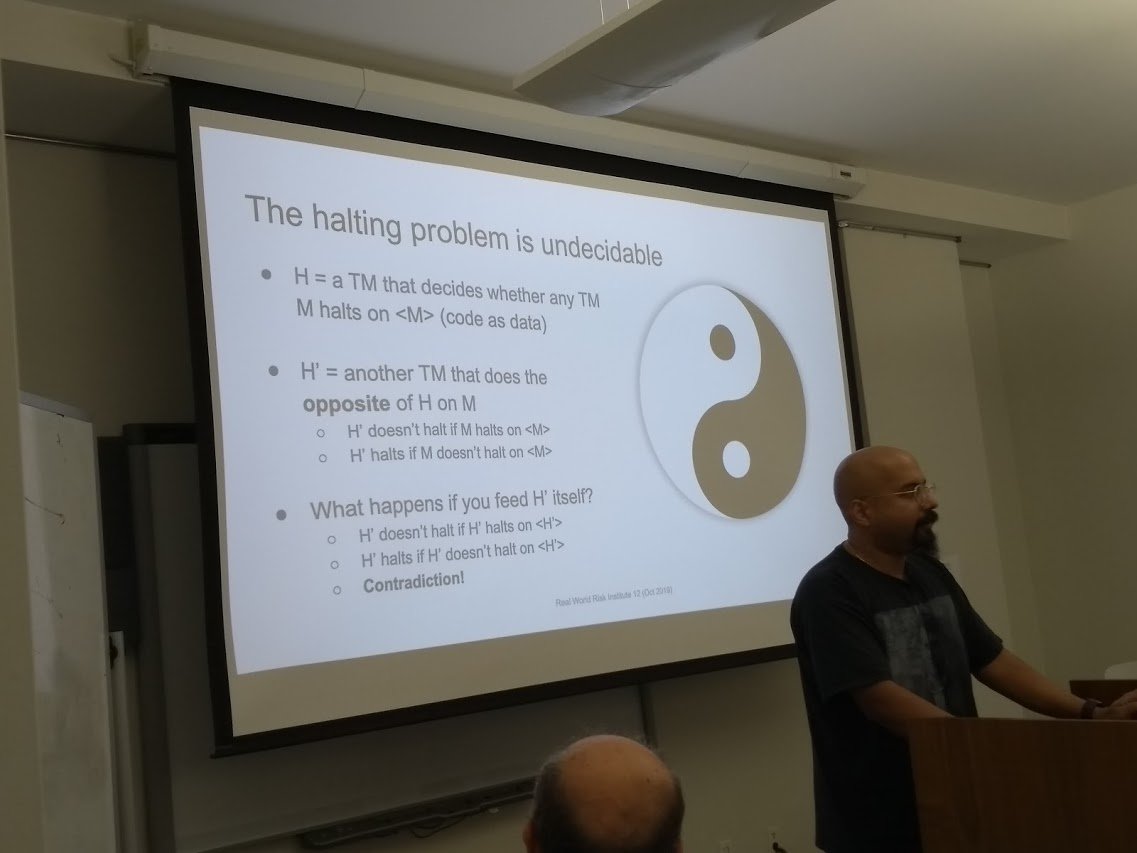

-Prediction in complex systems is fundamentally beyond our reach

-Think in bounds and limits, not precision

-We use continuity for assumptions in math, not descriptions of life

-Discrete displays things continuous does not

-Don’t fuck with the tail

-Cut pollution in half and you see non-linear benefits

-The more uncertainty makes the argument stronger for the precautionary principle #antifragile

-Scale invariance means adding a 0 does not change the proportion

-A non-linear domain, aka extremistan, has exponential function

-If you cant afford insurance, don’t buy the portfolio

-There is a point where the risk is so immense that it’s beyond worth insuring - were all dead anyway

-% gains vs % losses are asymmetric

Drawdowns memoryless

-Outlier vs extreme: does it lie outside the range of variation of the distribution

-Extreme value theory says the world is not getting safer. War could be >

Ex. 2 people die by Ebola

2000 die by lawn mowers

Shadow mean in Ebola could be 2 or 2 million. Insufficiency of the sample is the problem.

-There is no way to prove me right, only a way to prove me wrong

-When stress testing, plot the acceleration to determine what domain were in

-Endogenous factors far outweigh exogenous ones in bubbles

-Evolution uses extreme value theory for dealing with tail events

Great meeting the attendees @coordinatedsync @brenorb @WorkinnDaniel and many more