One reason Americans are mad at rich people right now could be that the system seems rigged so that rich people never fail.

bloomberg.com/opinion/articl…

Who is his modern equivalent?

time.com/3207128/stock-…

Today it would take a truly global catastrophe to bring down the super-rich.

Most fall out of the 1%, or off of the Forbes 400 list, at some point.

But going from super-rich to just-rich doesn't seem like THAT big of a risk.

money.cnn.com/2016/01/07/new…

Basically, you have to commit some huge crime like a Ponzi scheme or corporate fraud in order to truly be brought low.

(And remember, prosecutions for the financial crisis were basically nonexistent!)

Medical bankruptcy.

Unemployment.

Getting fired for smoking weed to cope with the stress.

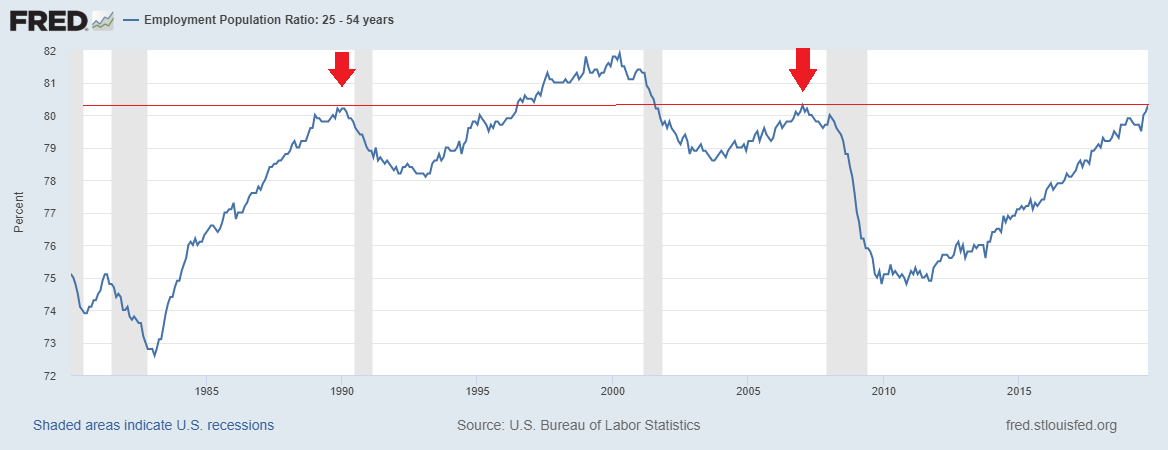

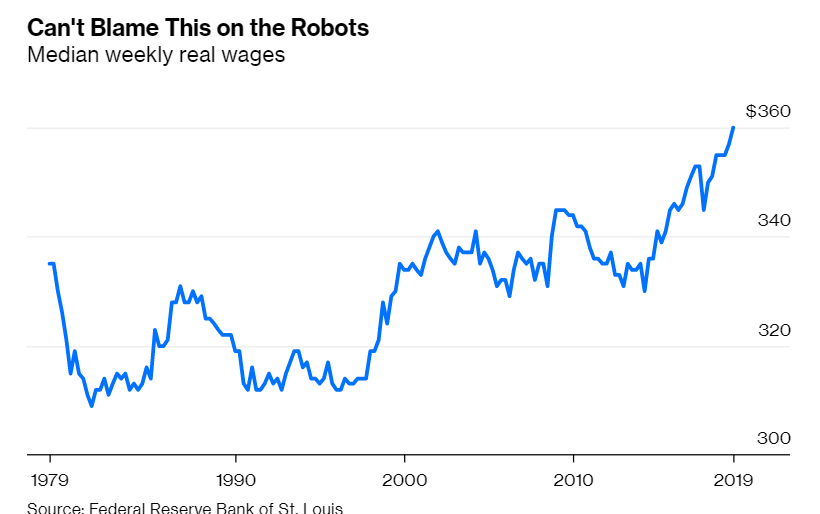

The asymmetry of risk between the wealthy and the middle-class is pretty glaring.

We can reduce rich people's wealth with taxes, but that doesn't address the asymmetry of risk.

And allowing macro volatility to return to our economy doesn't sound like a good option either.

So how do we address "risk inequality"?

Implement national health insurance so no one has medical bankruptcies.

Promote full employment so unemployment isn't a big danger.

If the system will always be rigged in favor of the rich, rig it in favor of the middle class too.

(end)

bloomberg.com/opinion/articl…