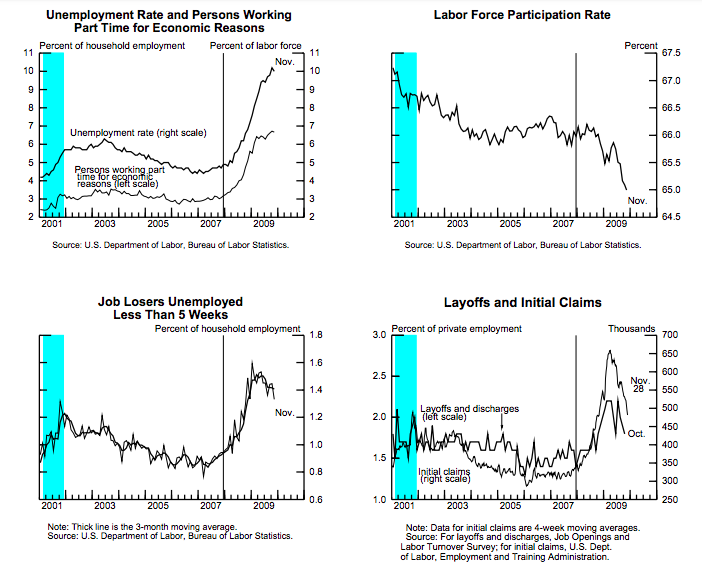

Bernanke: "In the labor market, I think it’s really important for us to keep in mind what a deep hole we’re currently in...the employment-to-population ratio has fallen from a peak of 62.7 percent to 58.5 in the most recent month"

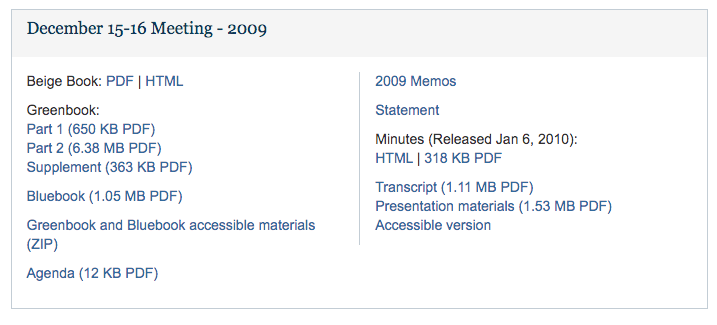

all the materials here federalreserve.gov/monetarypolicy…

/end