This is about understanding when a company is sliding towards bankruptcy, regardless of the stock price.

Also, how to short it. It also helped me understand when to start selling, which has been a big issue with me.

amzn.to/34oy3ag

2. Most of the companies that fail are just plain old failures, the result of bad ideas, bad management or a combination of the two. Some of the common mistakes of management are:

b. They relied too heavily on formula for success (Not everything is a formula)

d. They fell victim to a mania

e. They failed to adapt to a tectonic shift in their industries

3. Historical Myopia is very common in commodities industries where management tend to look at what they have experienced and forget the longer, super cycles. This has led to many a failures in...

6. Another key issue is the doctrine of elite infallibility. Stanford’s dean was overseeing audit at Enron and it meant nothing in the end. Just because most of the management and analysts come from elite colleges doesn’t mean they...

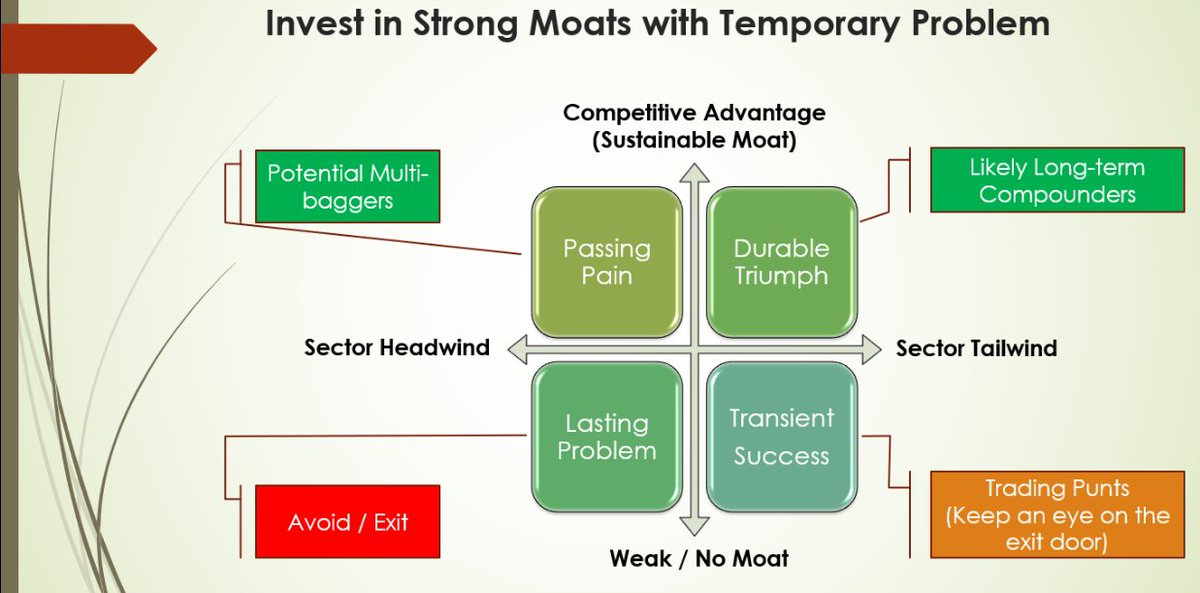

7. Most of us rely on some or other formula for stock picking. The key skill lies in when to overlook them.

A great attribute of any business is whether customer care how much they pay – For eg. Starbucks...

8. Another issue with most of the management is their eagerness to grow at hyper-speed. This almost always lands up in horrible performance and lead to fast death of companies which...

9. More often that not, stocks of companies keep trading even when businesses have failed long way back. It’s more aggression and hope than...

Yes Bank?

10. Another type of failures discussed in detail here is when the management starts believing that their customers want the same thing as them. The author did the same mistake with his ...

Understand your customer first and your friend circle is not your customer.

And that’s just not how it works.

I can think of so many of such kind of businesses, cropping up every day.

Best idea is to stay away from manias – Don’t go long or short in them. Just avoid.

Unfortunately, this attitude is exceedingly rare on Wall Street.

And Dalal street.

Blockbuster, Kodak, Nokia are big examples of these.

Be aware of managements who live in a different city, move around with different crowds than their customers.

Many examples here. Does the management overspend, travel business when the business is in dumps? Best idea is to dump the stock then.

I have experienced this first hand when I started shorting 3 years back. It requires much more effort and is generally, more rewarding.

Get the book here - amzn.to/34oy3ag