(3/5)

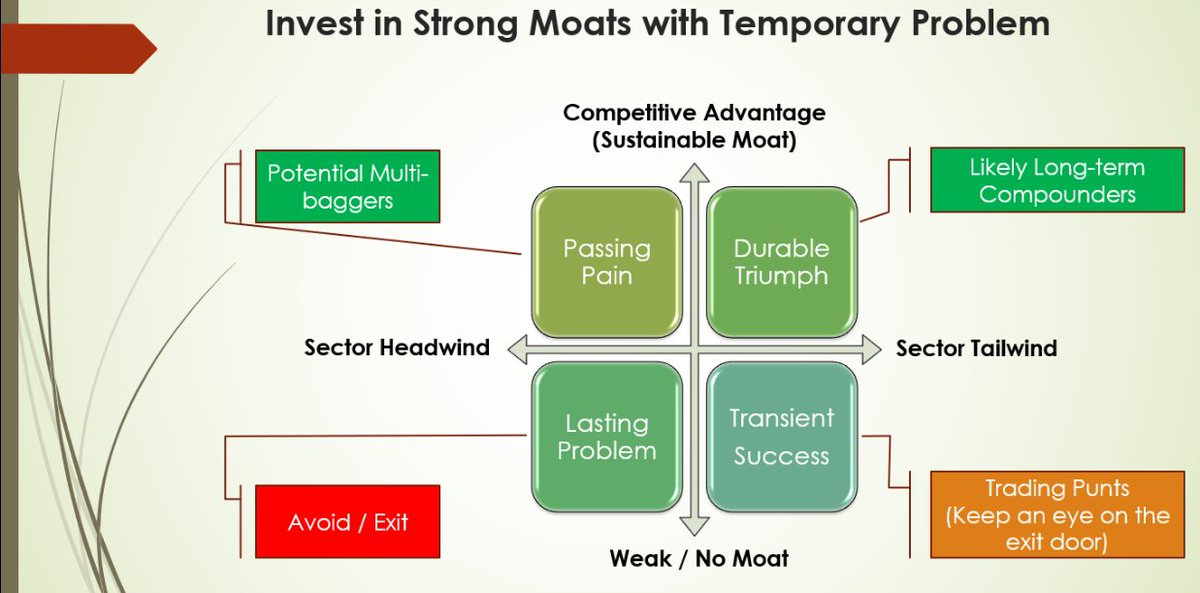

Cyclicals, Commodity Chemicals, Sugar, Metals, Paper, Building materials (#VisakaIndustries #EverestIndustries)

Caution: Don’t overstay your welcome here! If you miss an exit, the next one way be few years away 😊

(4/5)

Chemical Pharma having generic products past their ‘sell by’ dates! #PSUBanks , Gems and Jewels stocks, even Education sector stocks etc.

(5/5)