Let's follow the money together, this time foreign direct investment (FDI) & we'll read @UNCTAD investment monitor together.

Here we go: global investment flows 👇🏻

Why? Well, credit & fund flows ebbed (portfolio equity flows down & now u see that FDI is DOWN too 🥶

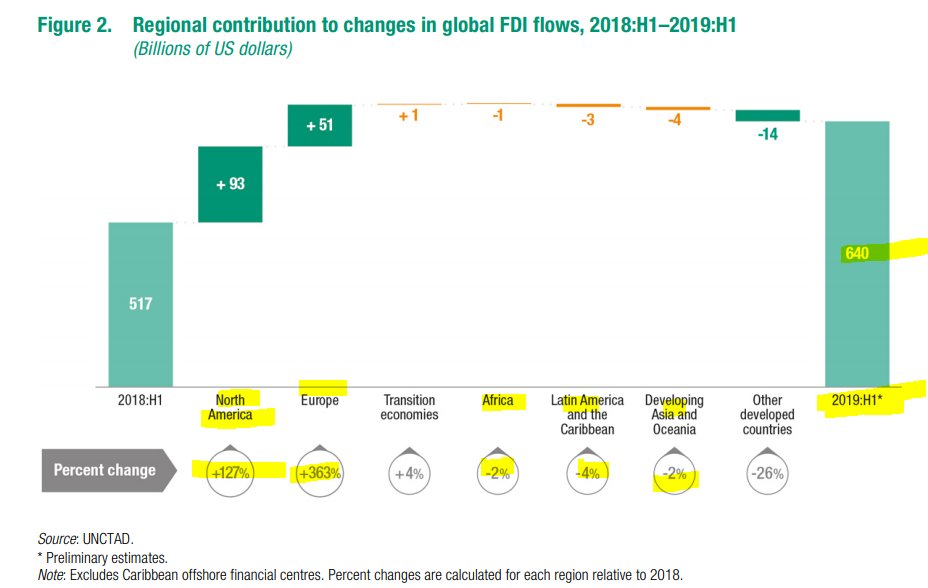

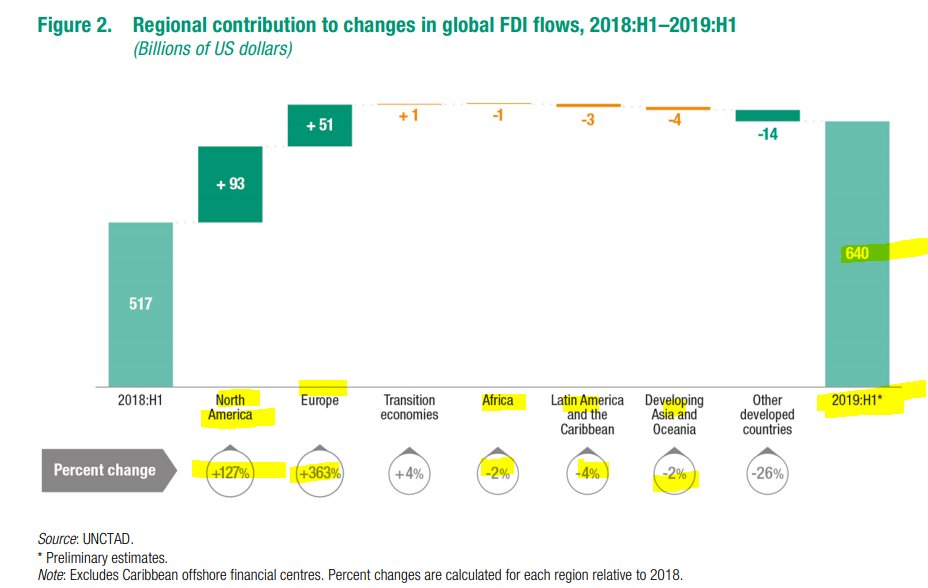

Regional contribution to H1 2019 FDI👇🏻

a) Investment recovered somewhat from abysmal H1 2018 (read pinned tweet on impact of US tax reforms on GLOBAL FDI)

b) While global FDI recovered, MOSTLY WENT TO THE USA 🇺🇸 & to a lesser extent Europe

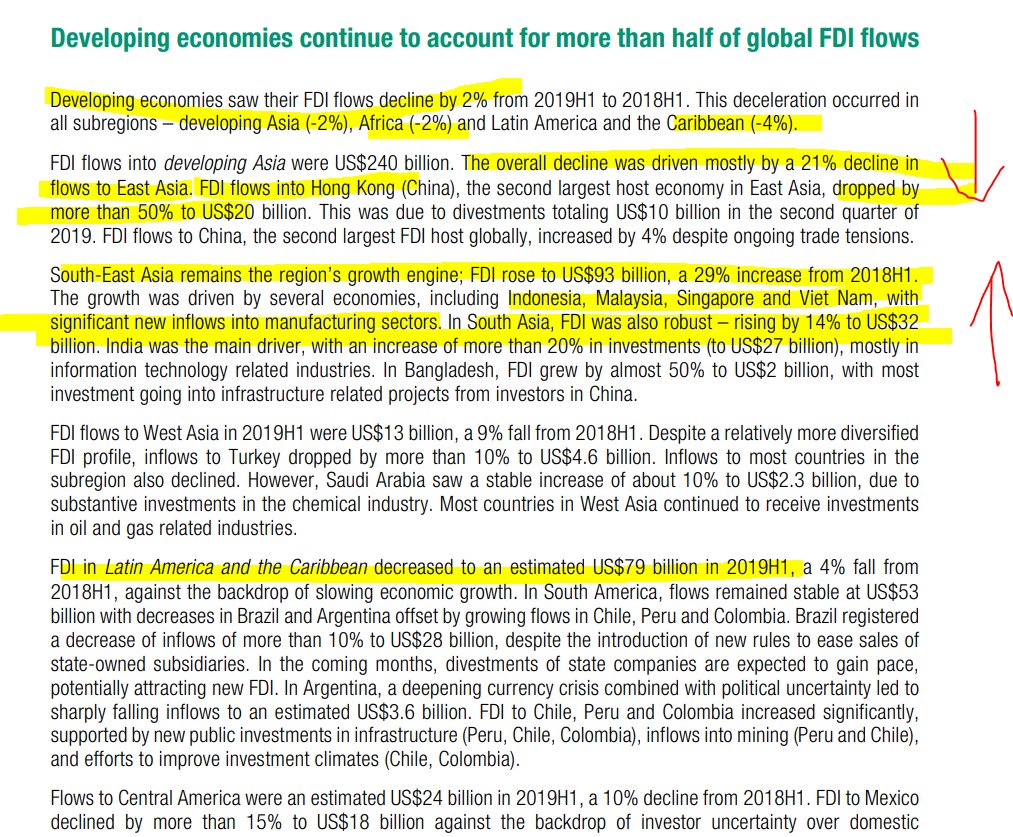

c) Sadly, the economies that need (EM) FDI are DOWN

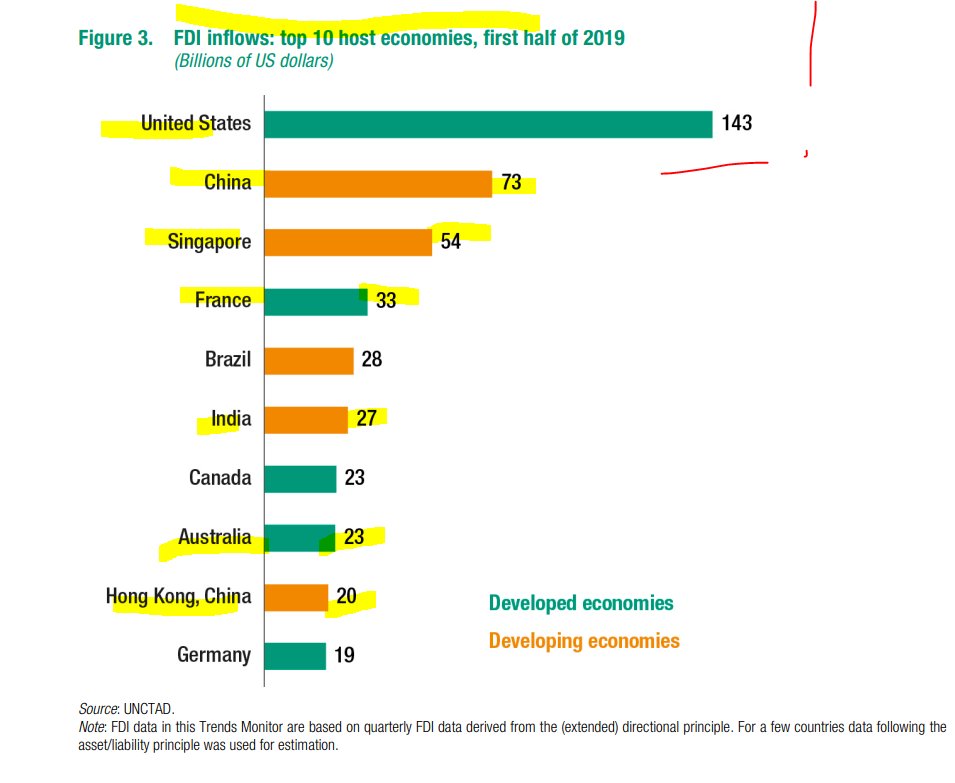

But let's 1st talk about who's HOOVERING FDI? THE USA 🇺🇸!!! Capital chases return & investors vote w/ their feet👇🏻

That said, the STAR is SOUTHEAST ASIA💥with USD93bn of flows (20bn more than China) w/ mostly to MANUFACTURING!

India 💥!!!👇🏻👇🏻👇🏻

Now India too!

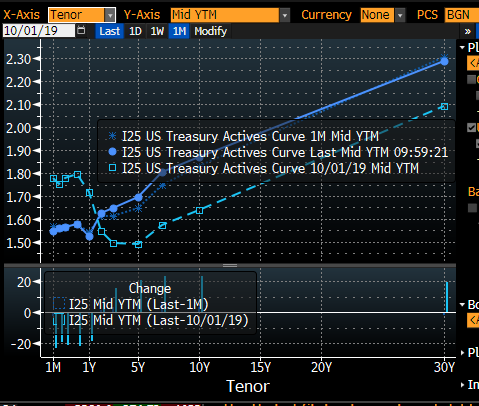

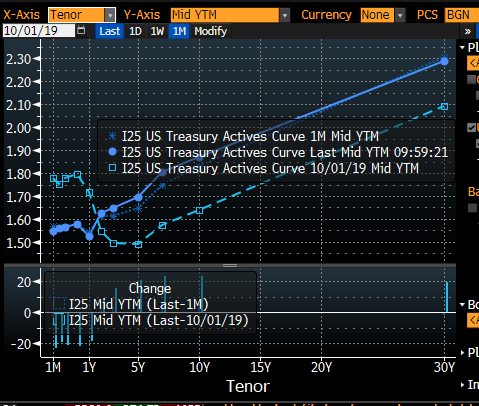

Chart below 👇🏻👇🏻