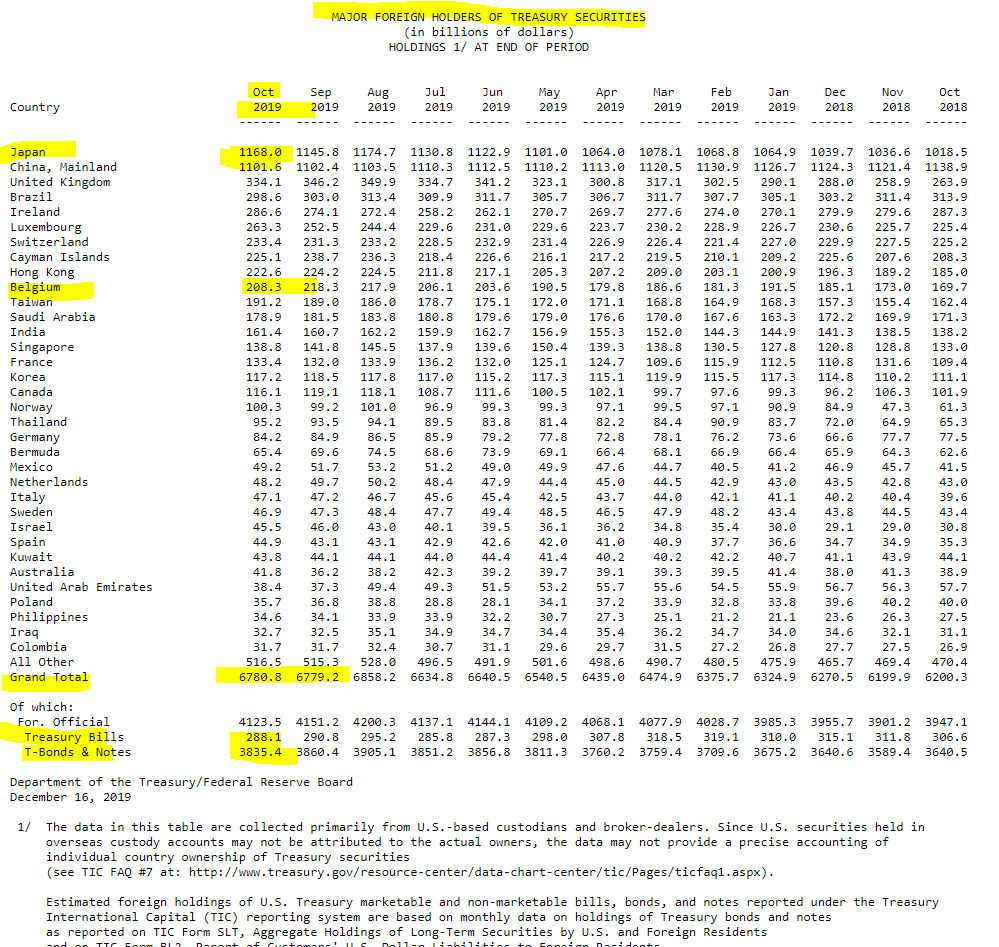

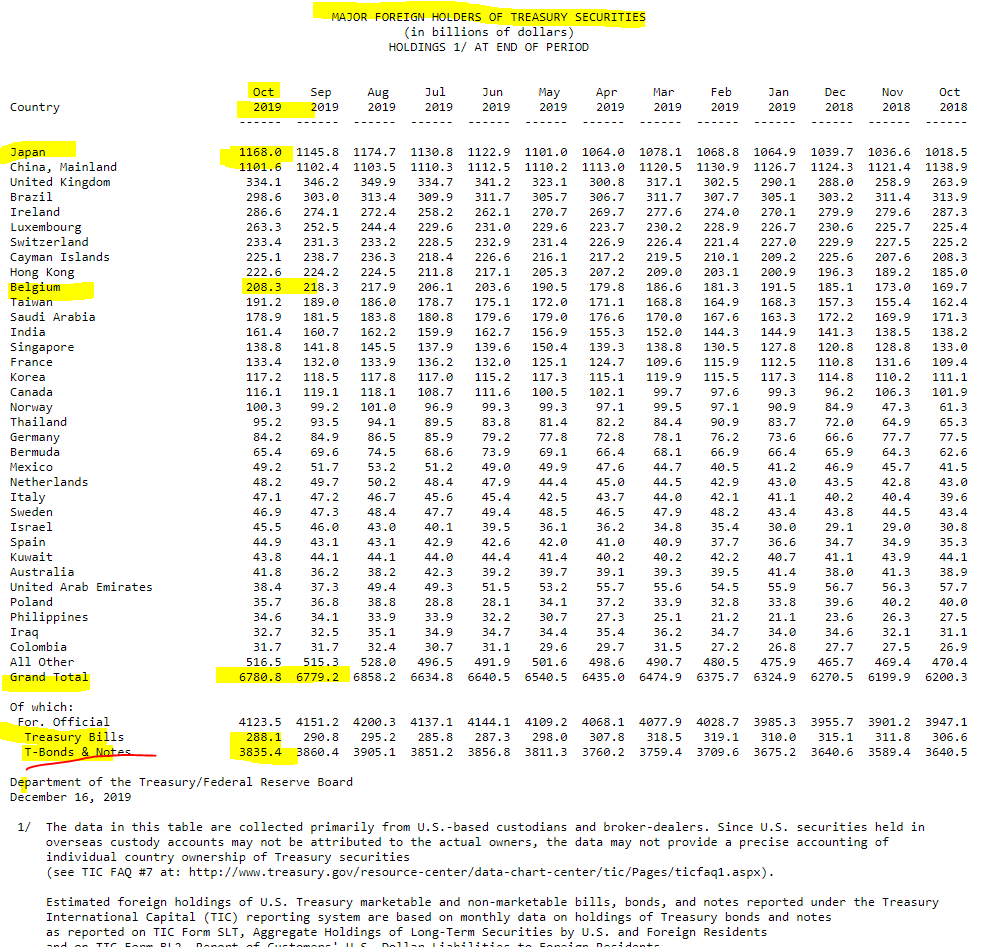

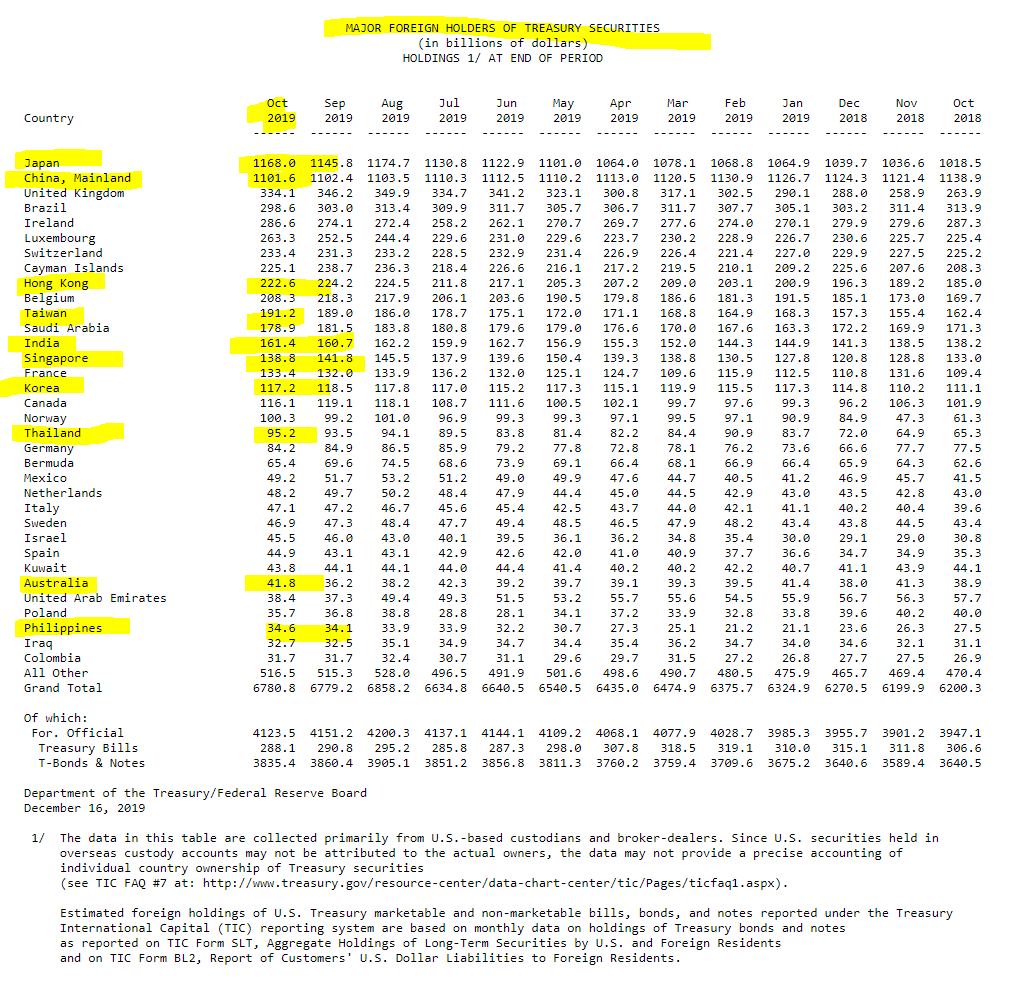

China holdings flat at 1,101.6

Investors sold long-end👇🏻

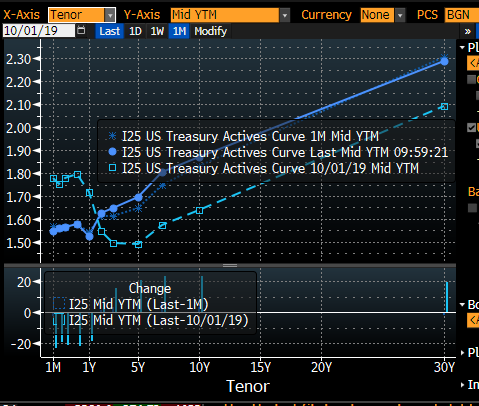

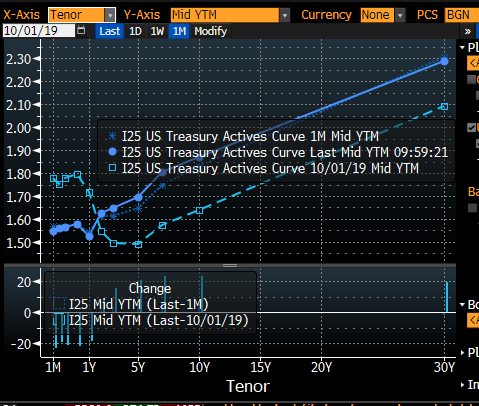

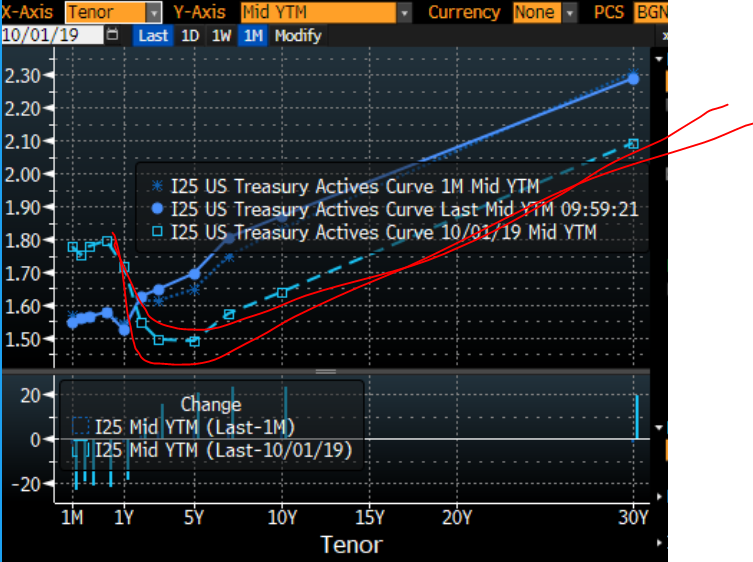

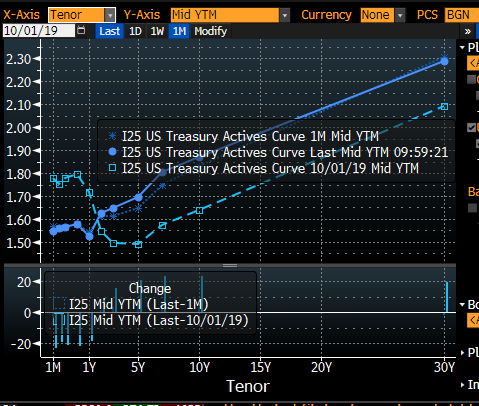

Yield curve since 1 October👇🏻 & short end moved downward (Fed rate cuts) & long-end shifted up

Bills = US govies issued less than 1yr

Notes = 2, 3, 5, 10 yrs

Bonds = 30 yrs

People tend to just use the word bonds to describe fixed income but those are the terms, most foreigners own than 1yr & they sold those in Oct (less fear of recession)

Why? The MOST LIQUID ASSET in the world. What is liquidity? Ability to sell & buy!

If GLOBAL investors fear, they buy @USTreasury 👈🏻

👇🏻👇🏻👇🏻

*There won't be a recession or there will be just because of the inversion/not

*It just shows investors' expectations of the future & sometimes they are right & sometimes they are wrong

*Markets do REPRICE 👈🏻👈🏻