bloomberg.com/opinion/articl…

bourseandbazaar.com/research-1/201…

reuters.com/article/us-ira…

When the letters were not forthcoming, @JZarif highlighted it as an early failure of U.S. commitments on sanctions relief.

financialtribune.com/articles/natio…

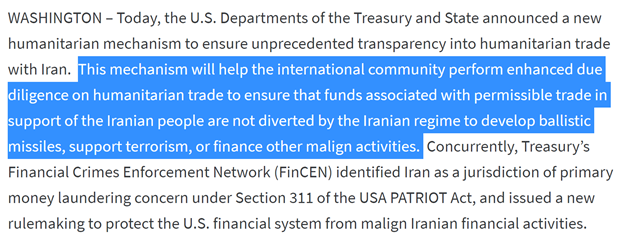

But now, they have issued such a letter.

bourseandbazaar.com/articles/2020/…

But the new use of comfort letters could change their calculations.

foreignpolicy.com/2019/09/10/aft…

US-Iran talks may be far off, but the pieces need to be put in place. Comfort letters are key.

foreignpolicy.com/2019/04/15/lif…