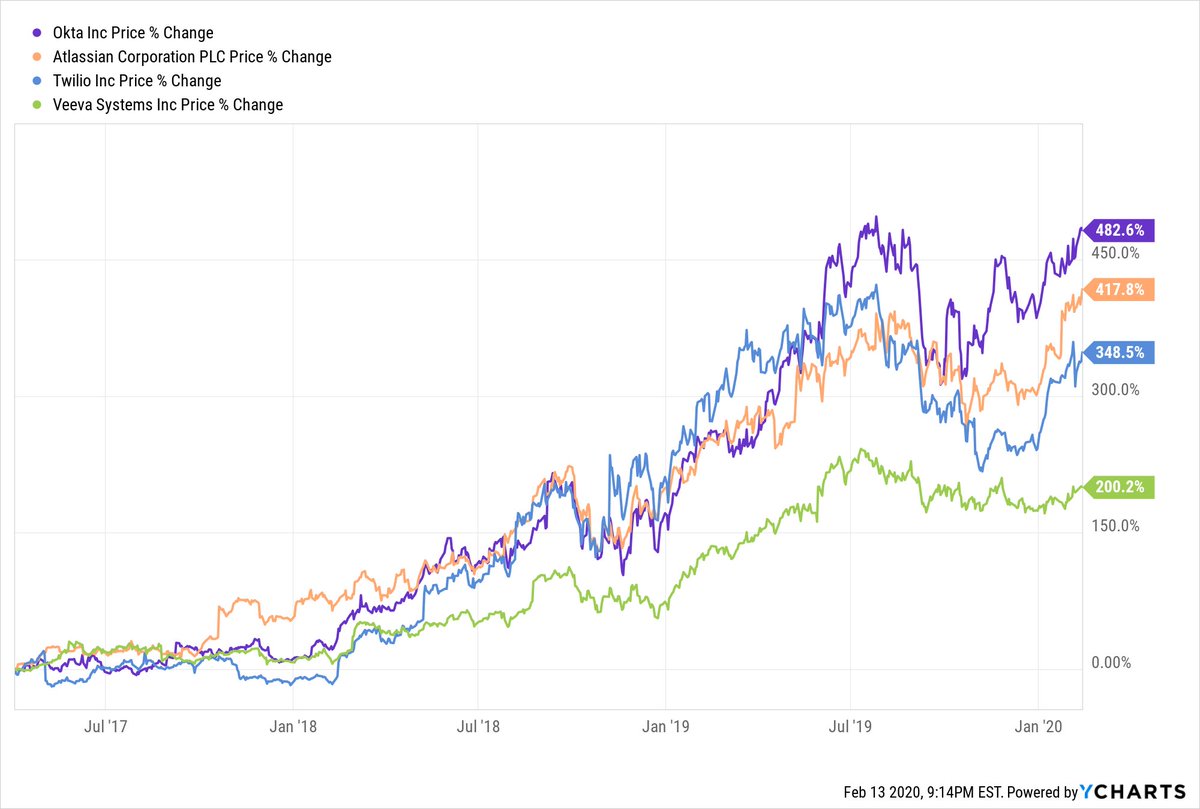

For instance, if you were going to invest $TWLO, you would need to know that its crazy revenue growth was spiking due to a key acquisition and not organic.

e.g. For these types of companies, one of things I'm most concerned with is the stickiness of their platforms (e.g. high switching costs).

Thanks for all the support!