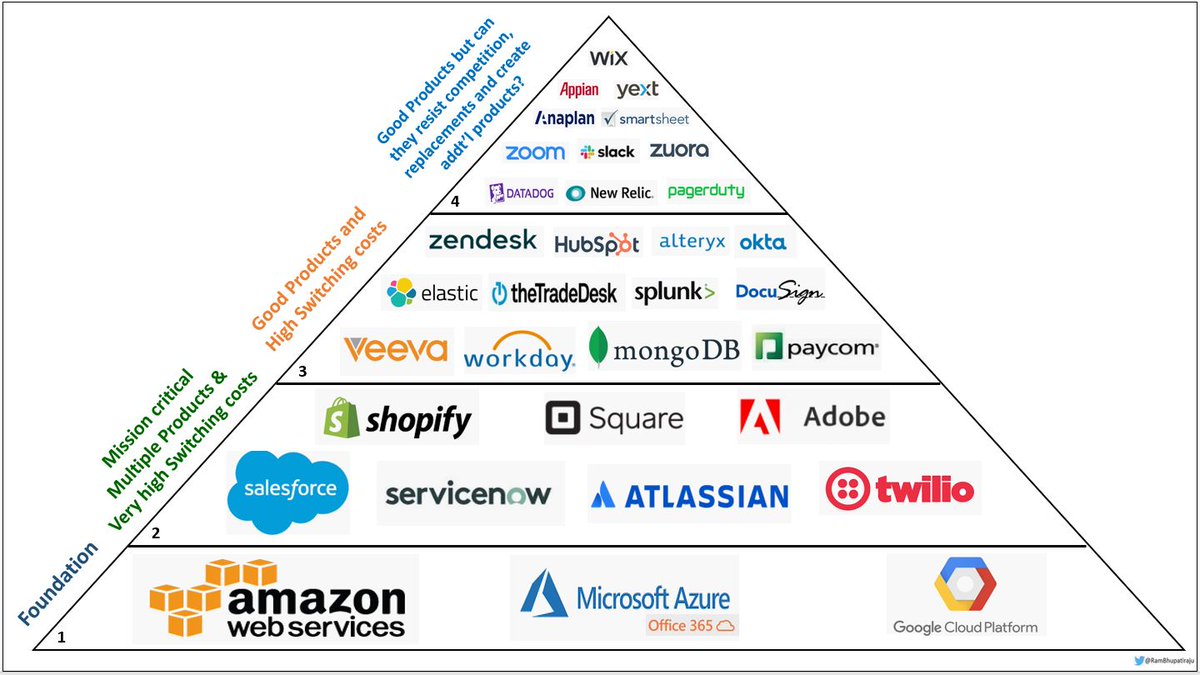

I used to find it easier in 2016-17 with fewer SaaS companies to choose from and the valuations being more reasonable.

With so many public Co's now and P/S over 20 for most, it's important to be really right about the quality/durability of the Company

Yes, the really big winners could wipe out the losers, but I believe that every investment should be made on its own merit/potential & not with a "Spray and Pray" approach that they'll be bailed out by the winners.

-the exact utility/quality of the Product/Service.

-the competitive/replacement threats to that Product from incumbents, future Co's that IPO, and from giants who have adjacent products and strong customer relationships.

Comments welcome.

@TMFJMo @TMFInnovator @TMFStoffel @BrianFeroldi @FoolMCochrane @saxena_puru @FromValue @AustinLieb @investing_city

Own : $AMZN $GOOGL $CRM $TWLO $SHOP $SQ $VEEV $PAYC $TTD $AYX $OKTA $ZS

Holiday wishlist : $NOW $ADBE $WDAY $DOCU $SPLK (if they come down a little, like last Nov/Dec🙂) and $TEAM $MDB $ESTC $ZM (once I understand them better and/or feel more confident).

END.

YMMV depending on your level of research & understanding of the space.👍