That is what we want!!! #secondbest

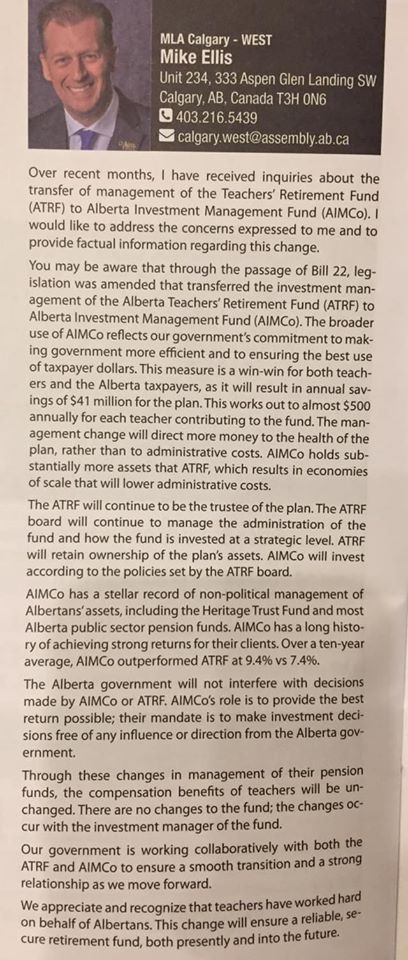

But it actually says the exact opposite. Please refer your MLA to page 10 where noted financial expert Bill Morneau opines:

In other words, if the fund is too big (>$90 billion) no economies of scale are achieved.

With the addition of $19 billion from the ATRF they will achieve dis-economies of scale. #counterintuitive #oops #ABLeg

NOT LIKELY. #notahopeinhell

This dis-economy of scale of super large investment funds is well known in the industry. #tellTravis #ABLeg