Sirius shareholders wobble ahead of crunch vote on Anglo American takeover telegraph.co.uk/business/2020/…

Already getting quite heated.

Shareholder responds: “You too Mr Fraser.”

When Chris Fraser gets on the mic he’s a lot more punchy, telling this shareholder he doesn’t really know what he’s talking about.

Palmer has held the floor for about 15 minutes now, waxing lyrical on the company’s accounts.

“What have you raised in your career?” Fraser fires back at Palmer.

Disdain dripping from every word.

Round of applause ripples around the room.

Seems a little bit late in the day for that.

Round of applause.

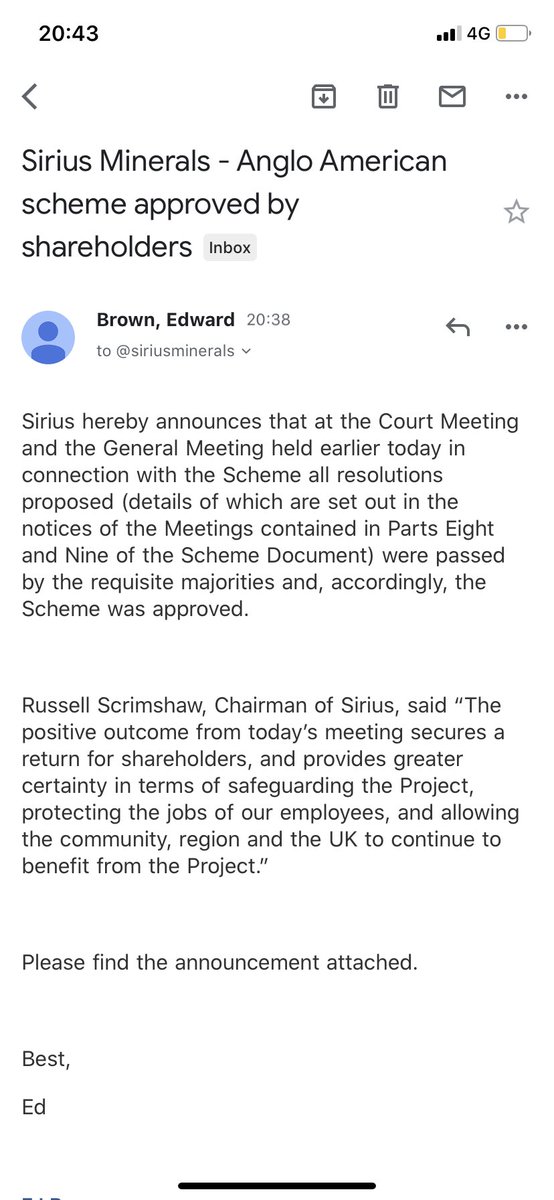

Fraser says that no higher offer is coming from Anglo American.

“We’ve failed, and we’re incredibly sorry for the outcome. But this offer is the only way forward.”

Big round of applause - but are the people who’ve come to London today for this meeting representative of the entire shareholder base?

Sirius and Anglo are betting that they aren’t, and silent majority want a deal.

“It would be even harder for us to raise money now given the coronavirus situation,” he says.

It has gone completely off the rails in the last five minutes with this particular shareholder.

Ah yes, the old frozen computer trick applied to a collapsing mining company.

A new, elderly shareholder has just discovered Anglo American is a UK-headquartered company.

“Well, that’s one complaint I don’t have about this deal anymore.”

Fraser repeating the same points over and over: This isn’t a great offer. It is the only offer. We don’t think Anglo will revise its offer if the deal fails. Why would they?

That might be the first time I’ve heard someone say they invested in a stock to “feed the world.”

This is like a breakup. I wasn’t prepared for this kind of emotional labour.

The shareholder concludes by asking if Anglo has been playing the long game, waiting for Sirius to run out of money.

He adds that not raising the money is the biggest failure of his career.

Gutted he hasn’t chosen the Telegraph for that bombshell.

*pauses*

“More than my wife does.”