A question:

Is there a framework to understand why so many constant function market makers (CFMMs) work IRL?

Yes! Thread 👇🏾

arxiv.org/abs/2003.10001

IMO: CFMMs exist to automate ETF underwriting (e.g. @blackrock's ETF division):

- 'create' basket of synth. assets

- 'redeem' same basket

CFMM curve: redistributes rev. to traders, LPs, underwriters (devs!)

1. Arbitrary decimation: Don't need to redeem integer share quantities [no ILPs, no rounding errors!]

2. Underwriter fees are transparent: @UniswapExchange's sustainability fees are 100x smaller than Blackrock for the same service

This last condition is crucial and unique to cryptocurrencies: You can use halting/reversion of code to *enforce* no-arbitrage!

In our first paper, @GuilleAngeris, @_charlienoyes, @htkao, @ChiangRei, and I show that no-arb holds if Uniswap is being arb'd as a price oracle. This paper generalizes that!

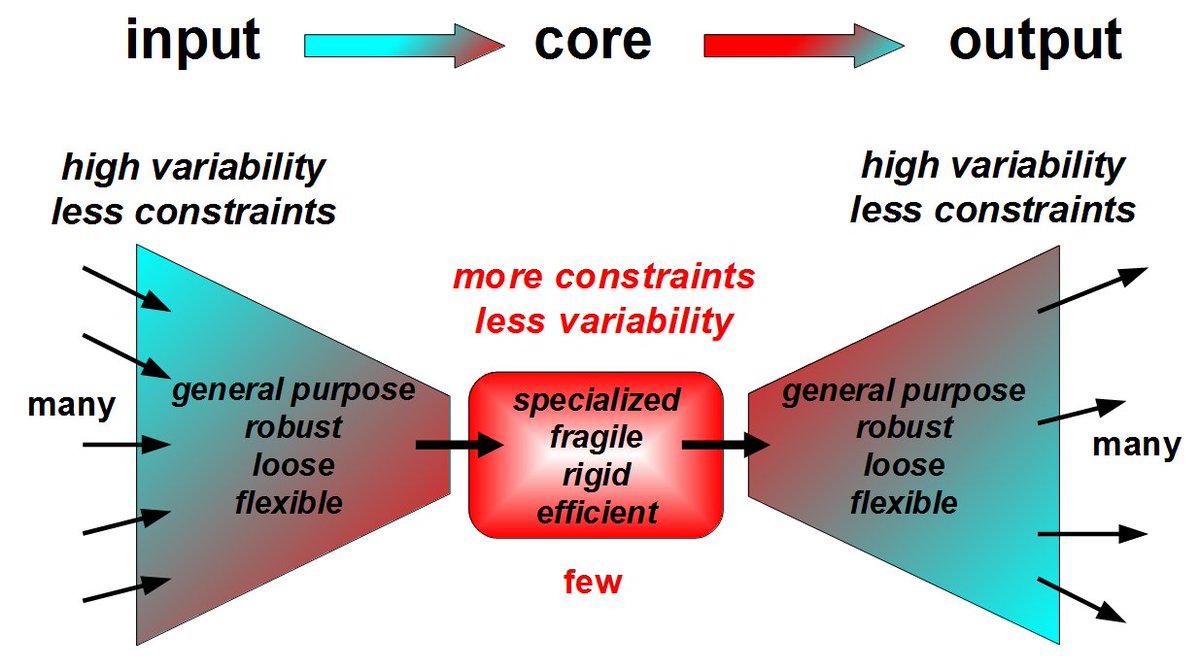

1. Multiple components: ETFs have N assets you, in theory, should be able to trade any of the pairs of assets to arb the delta between an ETF and it's NAV

2. Bonding curves adjust for volatility: e.g. @CurveFinance and @ShellProtocol

Why? As we show in the paper, this is a necessary condition for no arbitrage in the n asset to m asset generalization of Uniswap

But what else do we learn from convexity?

Convexity provides three things:

1. Easy to arbitrage

2. LP returns are computable

3. You _don't require path indep._

This is counterintuitive, FYI.

We show that being path deficient — it is more expensive to split trades — makes it *easier* for arbitrageurs to...

A cool result from this: We show that LP returns are related to the Fenchel dual function of the bonding curve!

@GuilleAngeris and I will be giving some video lectures on 'Convex Analysis and DeFi' soon 😎

[Right, @tzhen?]

homepages.wmich.edu/~zhu/papers/CD…

tl;dr: Unfortunately, you'll need to do it numerically (no closed form)