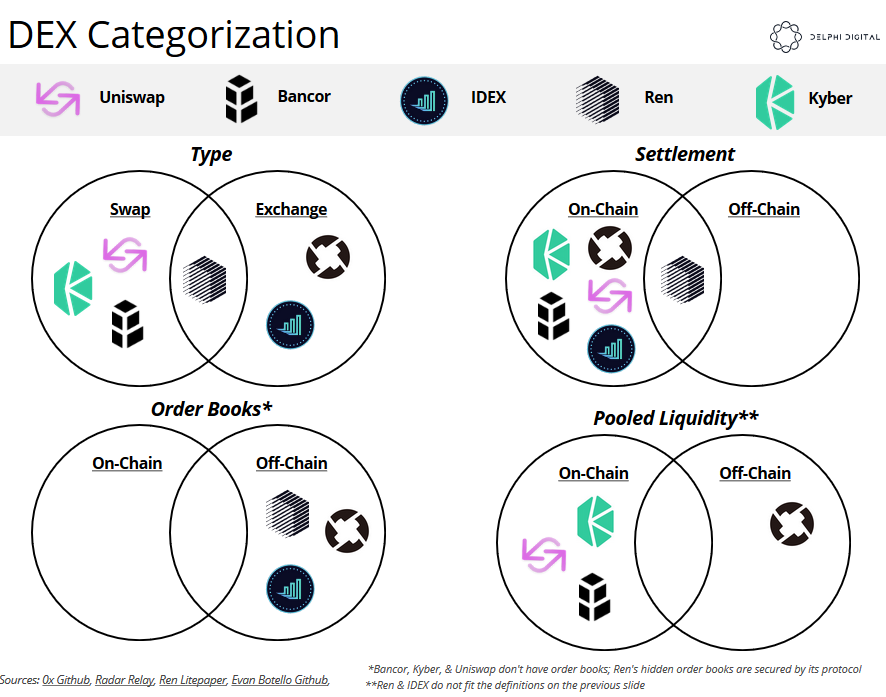

tokens on the Ethereum blockchain. It prioritizes decentralization and security and has eliminated rent extraction and censorship, enabling faster and more efficient exchange.

matches between buyers and sellers, but Uniswap doesn't. The protocol is composed of an ETH-ERC20 exchange smart contract for each ERC20 token on the platform.

reserve in its exchange contract increases and the ETH reserve decreases. The mechanism shifts the reserve ratio to increase the price of the ETH relative to the token for future txns.

placeholder.vc/blog/2019/4/9/…)