The Tower of Basel dropped the 'Quarterly Review: International banking & financial market developments' so I loaded up on espresso & blueberries & dove in2 this trove of soothing CB lingo mixed with some Sufi wisdom & colourful illlus: bis.org/publ/qtrpdf/r_… Some takeaways 1/5

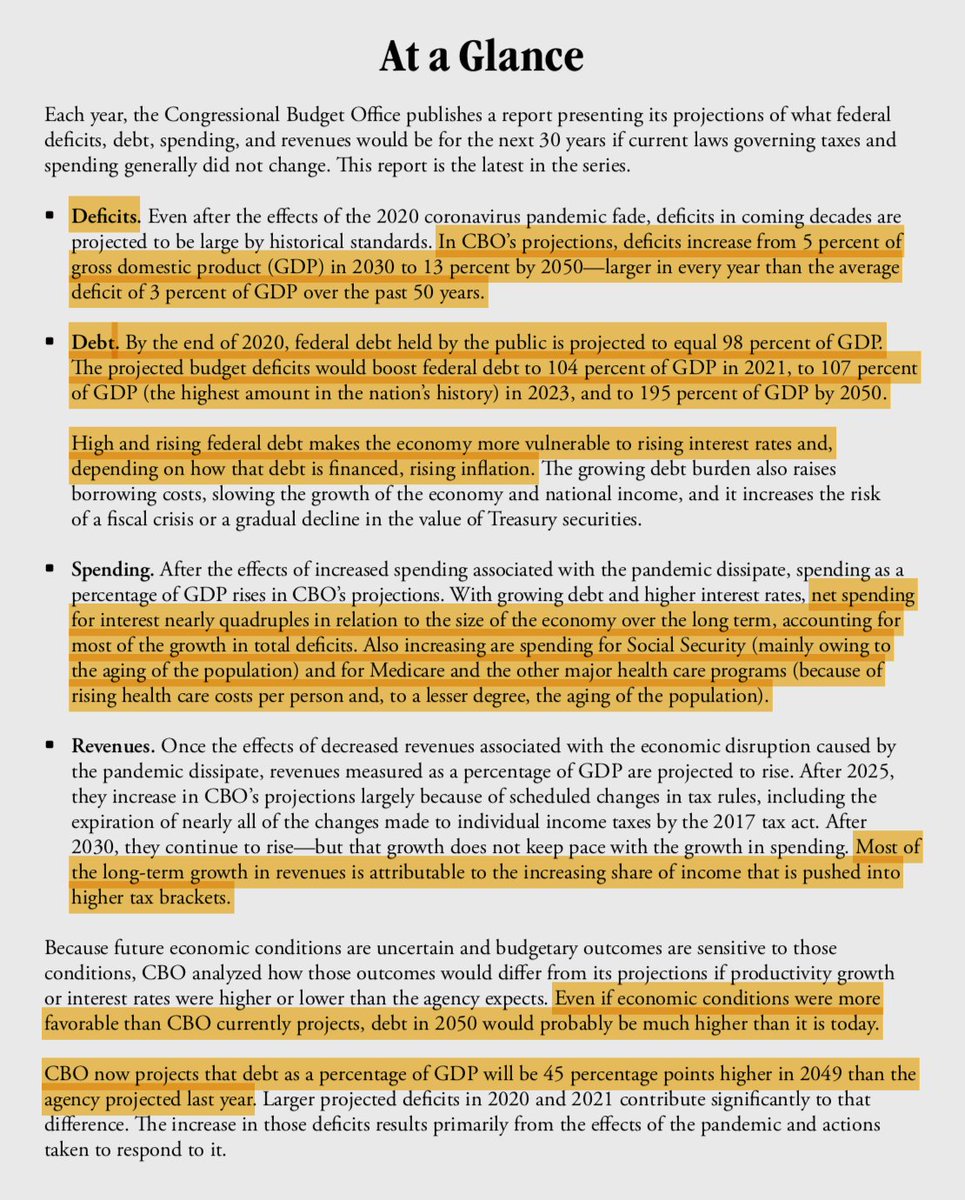

2/5 Riddle me this; "Stock markets rebound unevenly amid downgraded earnings expectations." & "Corp #credit spreads tighten despite indications of persistently high credit #risk" & "funding costs for #EM sovs drop despite weak pf inflows."

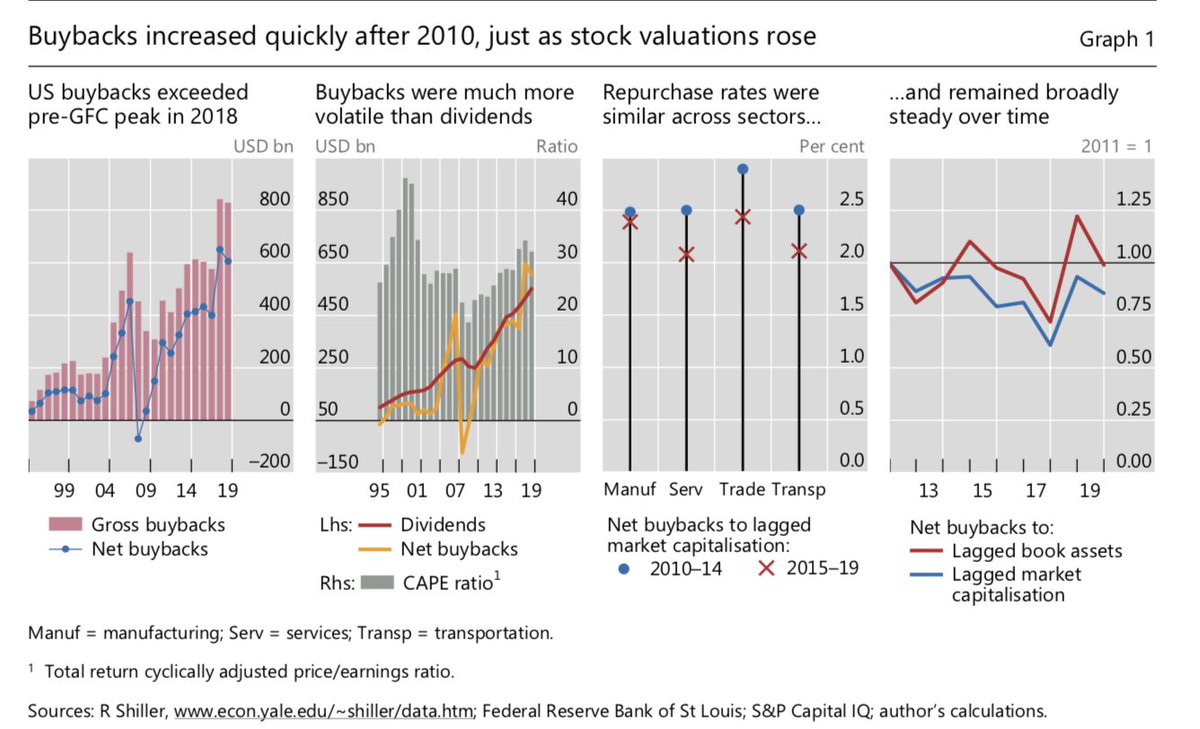

3/5 Heads up: "Firms desired leverage can be excessive if companies do not account for all financial distress costs..." "Share buybacks rose just as valuations began to rise..." & "#Credit #risk rose with leverage but it only revealed itself during market stress..."

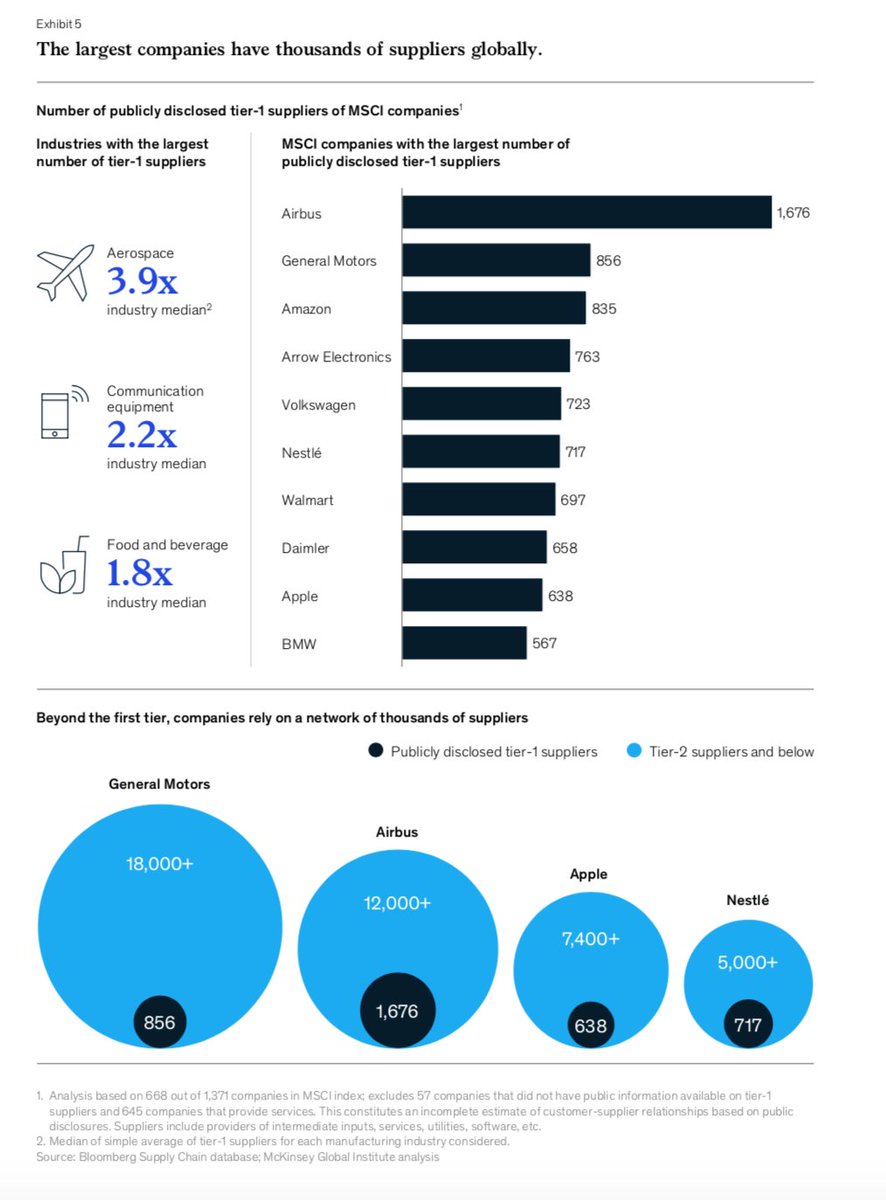

3/5 Good news: Apparently it was not the share buybacks that hurt corporates but it was the leverage endured in part to facilitate such share buybacks..#Banks are gr8, its those pesky NBFIs & their cross-border links tht is an issue..plus 4get about 1 and 2 and focus on the 'and'

4/5 Ups: Apparently the #banks somehow managed to get mixed up with the pesky NBFIs on a global scale & with "An unprecedented spike in cross-border liabilities"...#Credit #Macro #Risk

5/5 A quick drive by: #USD credit trends outside the #US...Global #consumer prices...Arg, India & Turkey👀....Global CB policy rate trends...low & flat decline except for Arg & Turkey...#Macro #Risks

• • •

Missing some Tweet in this thread? You can try to

force a refresh