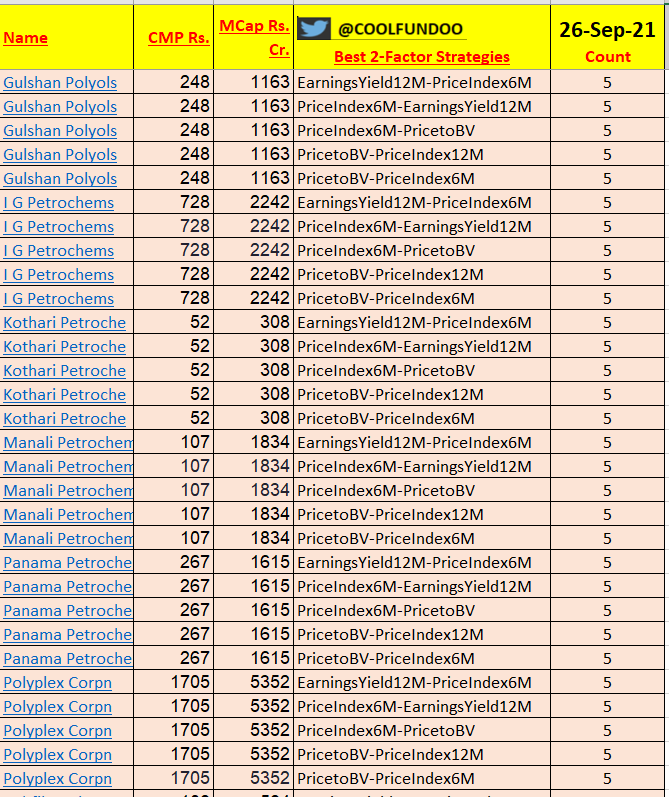

BEST 2-FACTOR STRATEGIES !

2nd Upd-18Oct20

QUANTITATIVE Value Investing in Europe:What works for achieving!

GIST ->

📌#CheapestValue in #HighestPrice #Momentum Stocks

OR

📌#HighestPrice #Momentum in #CheapestValue Stocks

💞#Thread of #Threads !

@gvkreddi

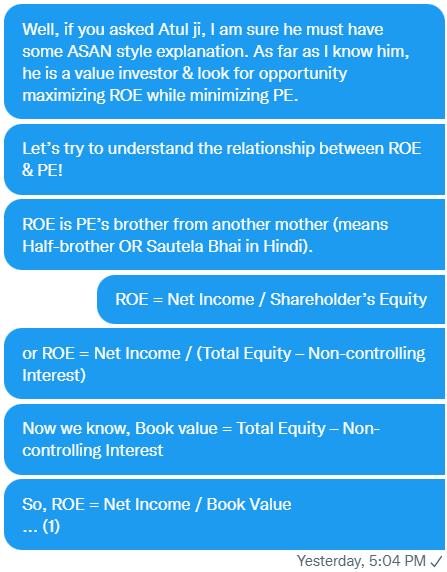

@Atulsingh_asan

1

2nd Upd-18Oct20

QUANTITATIVE Value Investing in Europe:What works for achieving!

GIST ->

📌#CheapestValue in #HighestPrice #Momentum Stocks

OR

📌#HighestPrice #Momentum in #CheapestValue Stocks

💞#Thread of #Threads !

@gvkreddi

@Atulsingh_asan

1

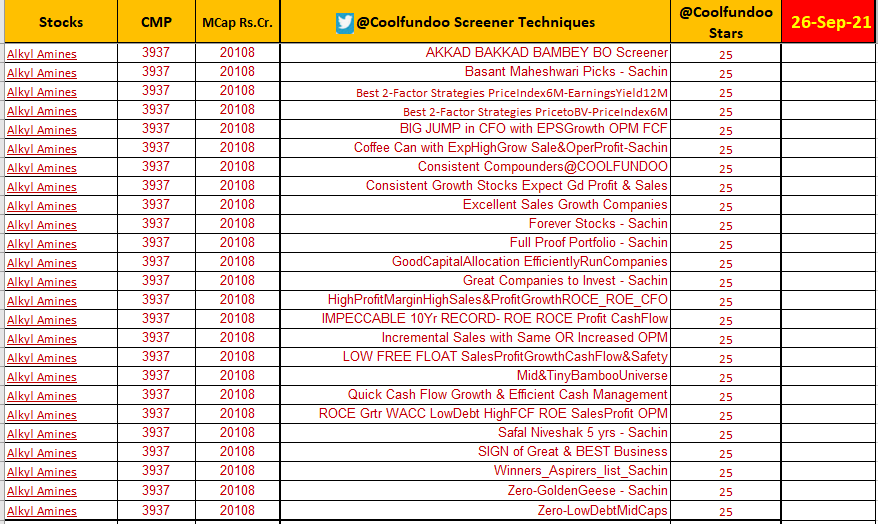

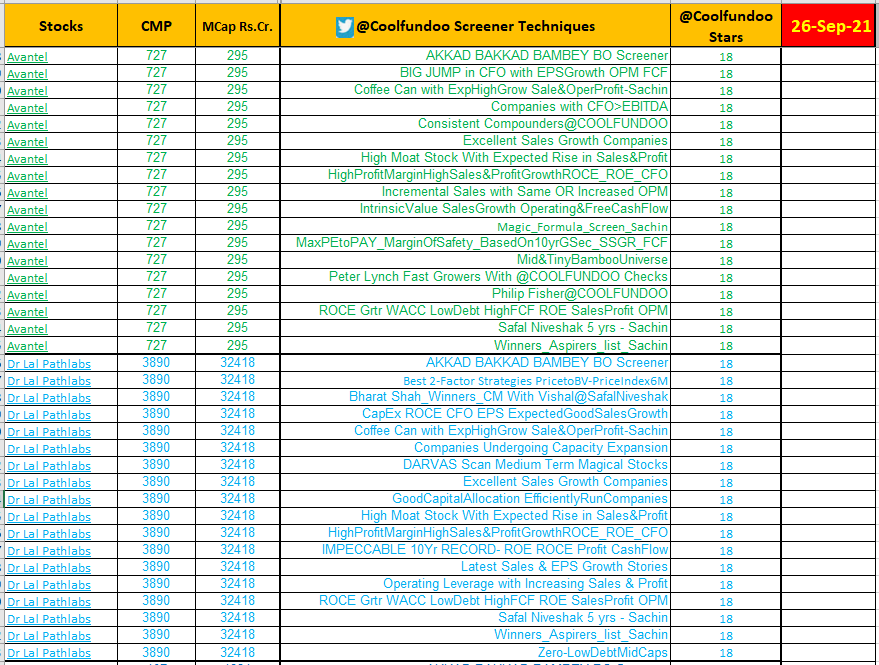

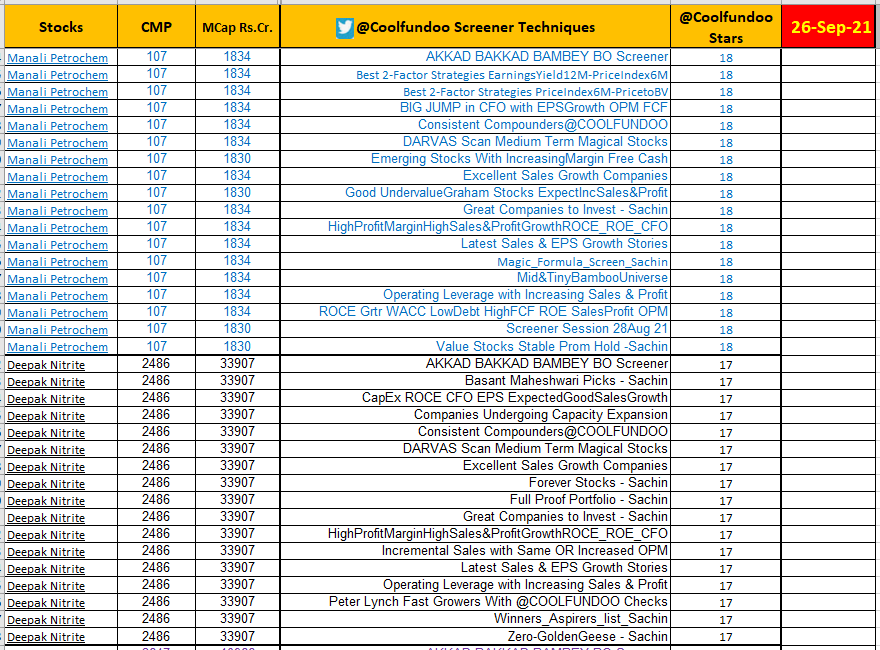

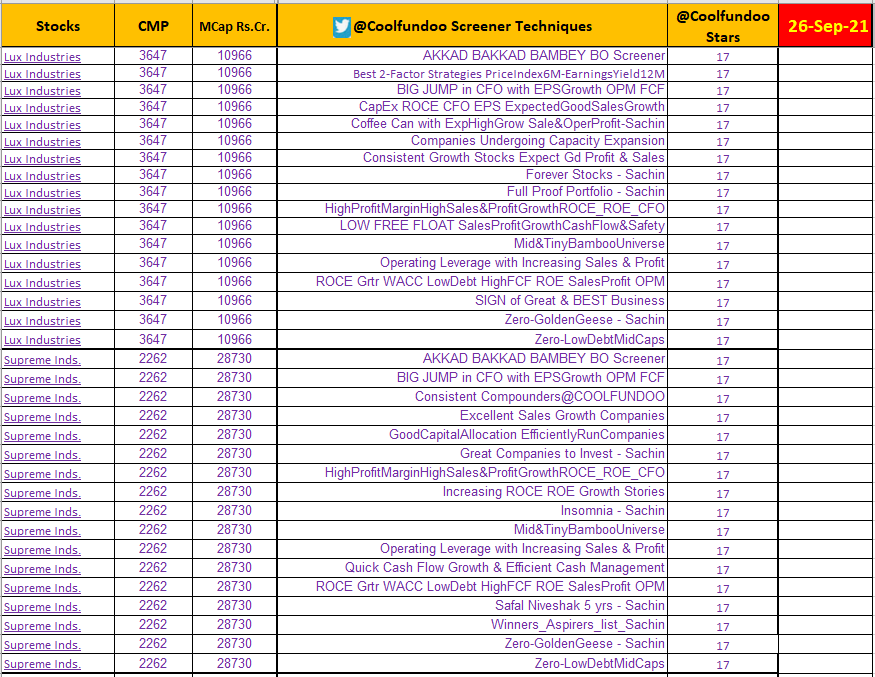

STRATEGY No. 1

📌PriceIndex6M & PricetoBV

2

📌PriceIndex6M & PricetoBV

https://twitter.com/Coolfundoo/status/1286820339469688832?s=20

2

STRATEGY No. 2

📌PricetoBV & PriceIndex6M

3

📌PricetoBV & PriceIndex6M

https://twitter.com/Coolfundoo/status/1287206820424146944?s=20

3

STRATEGY No. 3

📌PriceIndex6M & EarningsYield12M

4

📌PriceIndex6M & EarningsYield12M

https://twitter.com/Coolfundoo/status/1287040631852998661?s=20

4

STRATEGY No. 4

📌EarningsYield12M & PriceIndex6M

5

📌EarningsYield12M & PriceIndex6M

https://twitter.com/Coolfundoo/status/1287266450848256005?s=20

5

STRATEGY No. 5

📌PricetoBV & PriceIndex12M

6

📌PricetoBV & PriceIndex12M

https://twitter.com/Coolfundoo/status/1287231997312737291?s=20

6

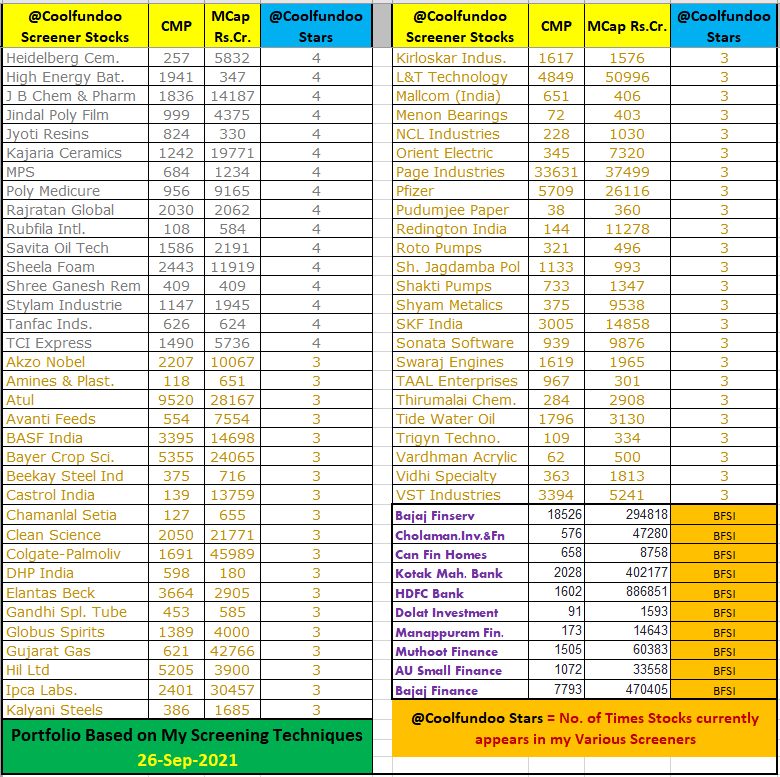

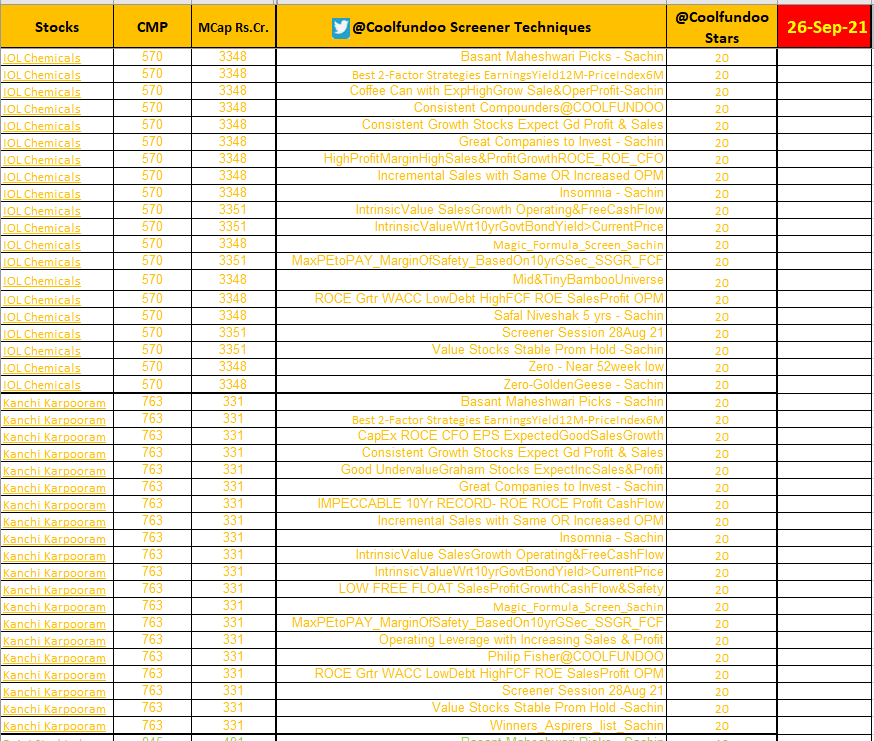

Quantitative Value Investing In Europe #Backtested on 1500 #stocks in 17 country Eurozone market for 12yr test period (13Jun99 to 13Jun11)

Book Reference (Kindle Unlimited) ->

amazon.com/Quantitative-V…

7

Book Reference (Kindle Unlimited) ->

amazon.com/Quantitative-V…

7

Previous Update Link ->

Best 2-Factor Strategies

24Jul2020

8

Best 2-Factor Strategies

24Jul2020

https://twitter.com/Coolfundoo/status/1287399011033505797?s=19

8

• • •

Missing some Tweet in this thread? You can try to

force a refresh