Q&A 63 #Thread

Chemicals , Manufacturing, Niche Technology & Overall Discussion on Quality Long term Businesses !

Q->

1

Chemicals , Manufacturing, Niche Technology & Overall Discussion on Quality Long term Businesses !

Q->

1

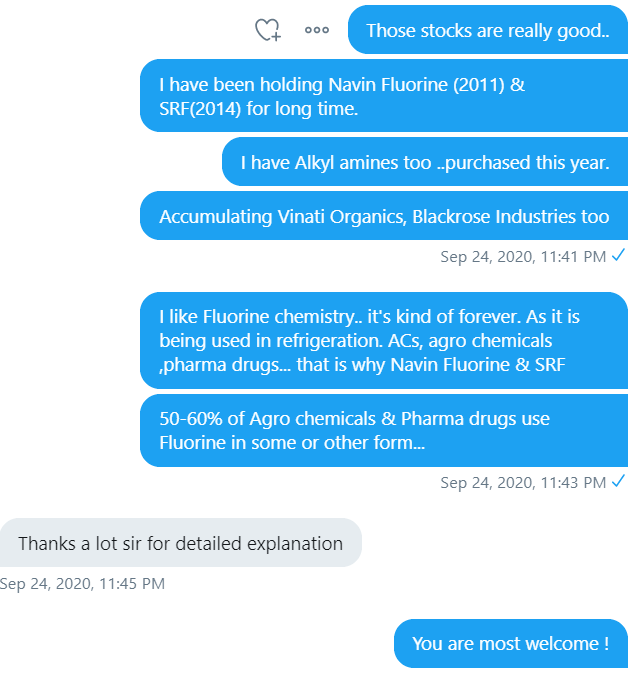

Honeywell, GMM, Havells !

Me->Honeywell you will find in my most screeners, Portfolio, low float screener... lot of places..

3

Me->Honeywell you will find in my most screeners, Portfolio, low float screener... lot of places..

3

Me->If you stay course and keep investing all surplus for 10-15 years. It will generate your 2nd salary. Whether your current job takes care of you or not but this will.

5

5

• • •

Missing some Tweet in this thread? You can try to

force a refresh