#US Employment: #NFP vs #ADP

- NFP has surprised (un-revised actual vs expectation) in same direction as ADP only 51% times (14 yr data)

- Since Covid, Feb'20, NFP & ADP have surprised 67% times in opposite direction

- Median ADP & NFP Surprise ~zero with Covid fat tail

1/3

- NFP has surprised (un-revised actual vs expectation) in same direction as ADP only 51% times (14 yr data)

- Since Covid, Feb'20, NFP & ADP have surprised 67% times in opposite direction

- Median ADP & NFP Surprise ~zero with Covid fat tail

1/3

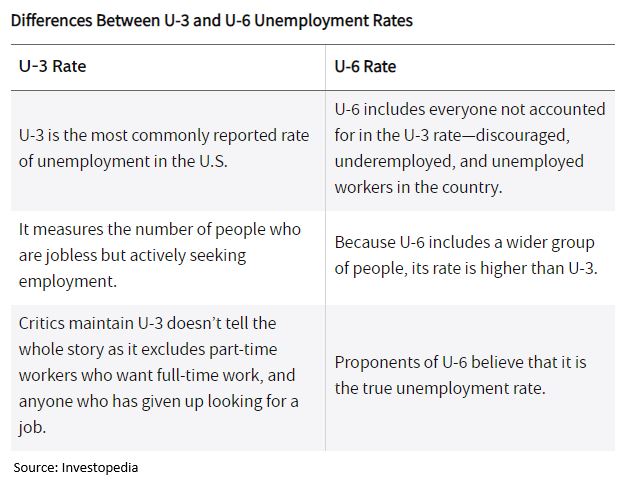

NFP

- US Bureau of Labor Statistics, BLS

- both private & govt non-farm payrolls

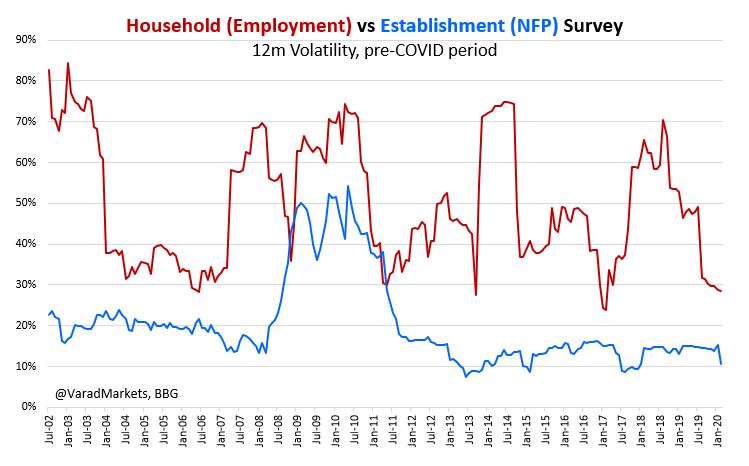

- Establishment survey (CES) & Household survey

ADP

- Automatic Data Processing (ADP), a services provider

- only private non-farm payrolls

- survey of ADP's clients: ~20% of all US employment

2/3

- US Bureau of Labor Statistics, BLS

- both private & govt non-farm payrolls

- Establishment survey (CES) & Household survey

ADP

- Automatic Data Processing (ADP), a services provider

- only private non-farm payrolls

- survey of ADP's clients: ~20% of all US employment

2/3

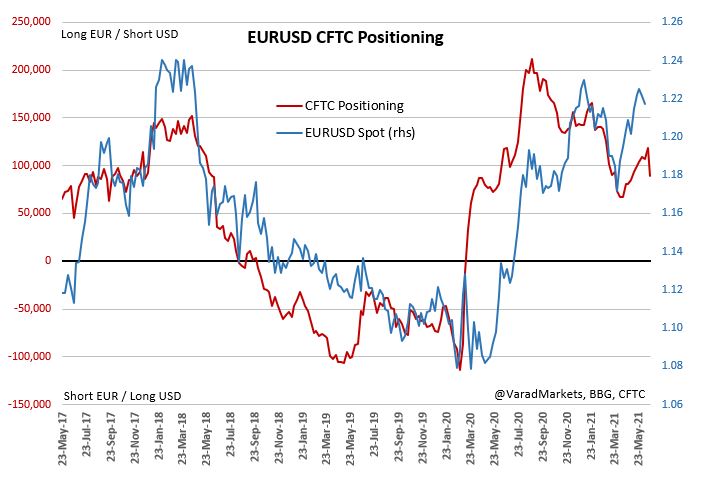

Some inherent correlation b/w ADP & NFP as NFP expectations may get adjusted by ADP's Actual release two days before

BLS CES Establishment Survey Methodology:

bls.gov/opub/hom/pdf/c…

ADP Methodology

adpemploymentreport.com/common-legacy/…

BLS CES Establishment Survey Methodology:

bls.gov/opub/hom/pdf/c…

ADP Methodology

adpemploymentreport.com/common-legacy/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh