This past week, Barry Ritholtz (@ritholtz) hosted an excellent podcast with Bill Gurley (@bgurley) on the @MastersinB Podcast.

Thanks @bgurley for sharing your insights!

Here are 10 highlights from the podcast:

bloomberg.com/news/audio/202…

Thanks @bgurley for sharing your insights!

Here are 10 highlights from the podcast:

bloomberg.com/news/audio/202…

1) Bill Gurley is a legendary venture capitalist and has been a Partner at Benchmark Capital since 1999. He frequently shares his thoughts on his blog, which can be found at this link: abovethecrowd.com

2) Prior to joining Benchmark, Gurley worked as a:

- Design engineer at Compaq

- Research analyst on Wall Street

- Lead research analyst for the Amazon IPO

- Partner at Hummer Winblad Venture Partners

- Design engineer at Compaq

- Research analyst on Wall Street

- Lead research analyst for the Amazon IPO

- Partner at Hummer Winblad Venture Partners

3) Bill Campbell was a legendary coach to several high-profile and high-performing Silicon Valley CEOs, founders, technologists, and business leaders.

4) Gurley discussed direct listings, traditional IPOs, the IPO underpricing issue, and the incentive structure of investment banks in the IPO process.

Professor Jay Ritter publishes lots of IPO data, which can be found at this link: site.warrington.ufl.edu/ritter/ipo-dat…

Professor Jay Ritter publishes lots of IPO data, which can be found at this link: site.warrington.ufl.edu/ritter/ipo-dat…

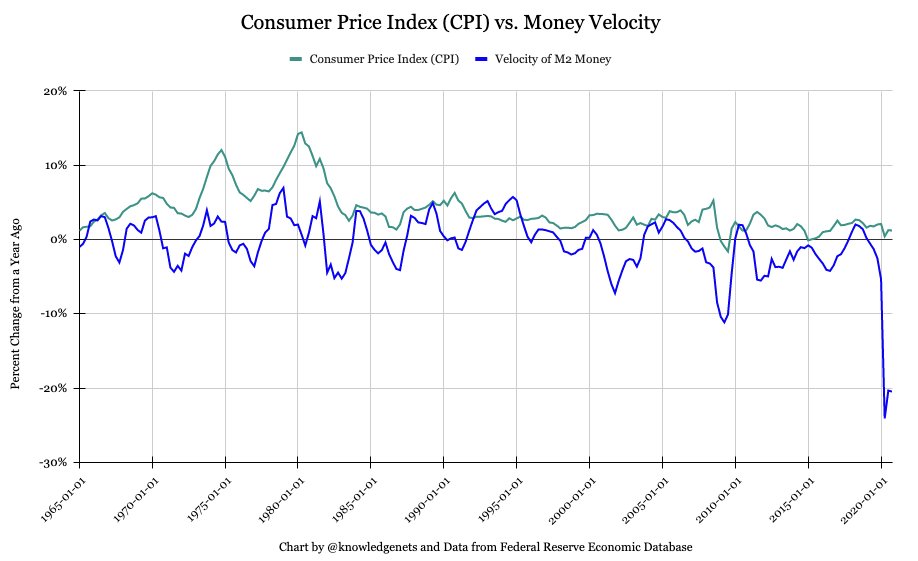

5) Speculation increases as interest rates decrease. Currently, we are in a low interest rate environment.

The "TINA Effect" (There Is No Alternative) in investing exists in a low interest rate world, and many investors are searching for positive inflation-adjusted returns.

The "TINA Effect" (There Is No Alternative) in investing exists in a low interest rate world, and many investors are searching for positive inflation-adjusted returns.

6) In a zero-interest rate environment, growth matters more than profitability.

Companies and investors, particularly in private markets and the startup community, can use “capital as a weapon” to promote growth initiatives.

Companies and investors, particularly in private markets and the startup community, can use “capital as a weapon” to promote growth initiatives.

7) Gurley is excited about the future of fintech, particularly in consumer finance and consumer banking.

8) Gurley believes that regulatory capture has created massive problems in the American healthcare industry. Gurley believes that regulations often favor the incumbents.

9) Gurley’s favorite book is titled “Complexity: The Emerging Science at the Edge of Order and Chaos” by Mitchell Waldrop.

10) Career advice: Learn from great mentors and exceptional individuals.

Gurley credits a lot of his learnings about investing, business, and entrepreneurship to Michael Mauboussin (@mjmauboussin), Al Jackson, Charlie Wolf, Jeff Bezos, Frank Quattrone, Bill Campbell, and others.

Gurley credits a lot of his learnings about investing, business, and entrepreneurship to Michael Mauboussin (@mjmauboussin), Al Jackson, Charlie Wolf, Jeff Bezos, Frank Quattrone, Bill Campbell, and others.

If you’re curious on seeing more content from Bill Gurley (@bgurley), I recommend starting with this presentation and his blog:

Hope you enjoyed this thread of thoughts!

Special thanks to @bgurley for sharing several ideas, insights, and anecdotes on the podcast with @ritholtz on Bloomberg's Masters in Business Podcast.

Special thanks to @bgurley for sharing several ideas, insights, and anecdotes on the podcast with @ritholtz on Bloomberg's Masters in Business Podcast.

• • •

Missing some Tweet in this thread? You can try to

force a refresh