1/ Keep an open mind to the mounting tensions in the ongoing Russian-Ukrainian conflict while markets remains unprepared for it to go from minor to major.

Thread

Thread

2/ Upfront, below a brief summary on the conflict which is ongoing for 7 years now & its rapid escalation behind (most media coverage) scenes.

3/ For the past weeks, Russia has significantly increased military assets around its Ukraine borders & continues to do so. What got my attention in likely unbiased tweet below? Russia's preparation may involve Belarus too!

https://twitter.com/NikGerassimow/status/1378671855742152708?s=20

4/ Should Russia try to make this the annexation of Ukraine rather than a more intensive "local" conflict, markets remain unprepared IMHO. Pro-Memoria:

porcelaintwinz.com/vladimir-putin…

porcelaintwinz.com/vladimir-putin…

5/ More motives: Since Russia's annexation of Crimea, Ukraine cut off its water supply. W supply by other means is expensive. While this is not new, grabbing southern parts of Ukraine would address a rising issue. Unlikely enough on its own though.

https://twitter.com/Osinttechnical/status/1377432142867664899?s=20

6/ Oops: VVP & cronies robbed their country. Keeping citizens distracted is always on agenda. Unfortunately, @navalny masterfully displayed VVP crimes in preparation of his imprisonment this Feb 21. The original had 116m views on a 140m population!

7/ How to know if they move from preparation to war? Russia's leadership likes to use the Nazi playbook, i.e. accusing others of their own attentions. One thus have to look for propaganda that Russia needs to "defend itself" which seems to increasing now.

https://twitter.com/terror_alarm/status/1378486849543487494?s=20

8/ The conflict continues to draw little international media attention. But certain political analysts explain more about it...

https://twitter.com/Nigelgd1/status/1378312431584301063?s=20

9/ As the ongoing war has escalated sharply in recent days, both the Ukrainian & Russian governments however have issued official statements.

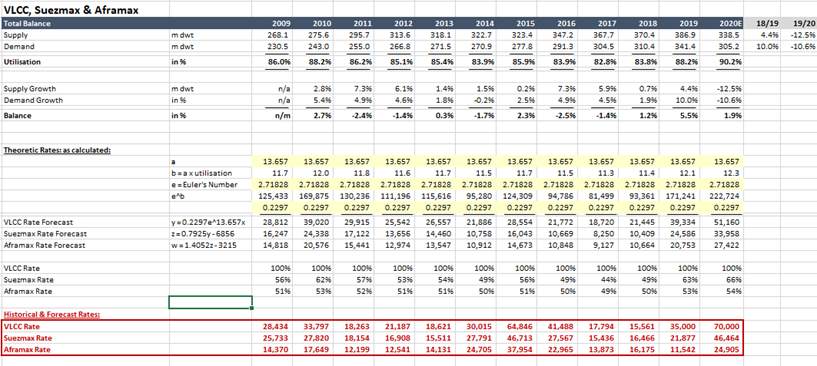

nytimes.com/2021/03/30/wor…

nytimes.com/2021/03/30/wor…

10/ Russia has also verbally prepared its full list of options. One relevant "hint" came from Lavrov when issuing the warning that an "escalation" in east Ukraine could "destroy" it. My point: this may well go from "minor to major" this time.

i24news.tv/en/news/intern…

i24news.tv/en/news/intern…

11/ There are other "dots" to connect. Here, the Kremlin as usual slams the EU for deteriorating relations. Of course, this is rubbish, but the timing of the statement suits the above agenda (i.e. "not our mistake").

bing.com/videos/search?…

bing.com/videos/search?…

12/ Of course, none of the above is news to Western leaders. They know what is brewing. For instance, @potus announced his "unwavering" support to the Ukrainian people on the weekend.

msn.com/en-us/news/wor…

msn.com/en-us/news/wor…

13/ @potus may also consider the people of Belarus as this crisis may address "other issues" of VPP & Lukashenko. At least, do not be surprise if this conflict will involve Belarus in some shape or form as Lukashenko has open invoices to pay to VVP.

theguardian.com/world/2020/sep…

theguardian.com/world/2020/sep…

14/ This is of course purely coincidental but #Russia’s Chief of Staff Gen. Gerasimov & US Chairman of the Joint Chiefs of Staff Gen. #Milley discussed issues of "mutual interest" in phone talk on 31 March 2021 - that is last Wednesday.

https://twitter.com/natomission_ru/status/1377695884864016392?s=20

15/ Today, @NATO seemingly annouced to hold joint military drills with Ukraine amid escalating tensions with Russia. I could not find such a statement on their Website. This remains to be confirmed.

thehill.com/policy/interna…

thehill.com/policy/interna…

16/ Sadly, EU responses so far remain an (unnecessary) embarrassment. My apologies, but the muppets in charge do not seem to understanding their cards & how best to play them with VVP. You knew that already. My point: it does not contain a bully.

https://twitter.com/JulianRoepcke/status/1378453938513580032

17/ Whether this becomes a "market event" will be path dependent. If @potus gets involved, this has potential to go from "minor to major" or stop quickly. It may be positive for US LNG export & related shipping rates. Not ready to speculate further.

usnews.com/news/world/art…

usnews.com/news/world/art…

18/ Below a list of knowledgeable accounts "all matters Eastern Europe / Russia". My apologies for the many more not mention. End.

@Billbrowder @mbk_center @vtchakarova @alexstubb @Kasparov63 @Halsrethink @mashagessen @DarthPutinKGB @anneapplebaum @OlgaNYC1211 @CITeam_en

@Billbrowder @mbk_center @vtchakarova @alexstubb @Kasparov63 @Halsrethink @mashagessen @DarthPutinKGB @anneapplebaum @OlgaNYC1211 @CITeam_en

Update confirming this May be major as Belarus is involved.

https://twitter.com/mhmck/status/1378085663950655493

Sad reality of EU #realpolitik summarised

https://twitter.com/kasparov63/status/1378982304194965504

An interesting assessment on VVP’s possible intentions which more or less confirm the above.

https://twitter.com/OlgaNYC1211/status/1378921208876523522

Russian military ramp up continues, seemingly from all parts of the country...

https://twitter.com/CITeam_en/status/1378667714219237376

And some news on propaganda. Remember, one has to look for news why Russia has to “defend itself”

https://twitter.com/francska1/status/1378960959646076930

Of course, @NATO membership is part of the mix and why a conflict (as with #georgia ) mustn’t stop from a Russian interest perspective as territory disputes automatically prevents membership.

#NATO

#NATO

https://twitter.com/asbmilitary/status/1378939420842283011

• • •

Missing some Tweet in this thread? You can try to

force a refresh