Leeds United’s 2019/20 accounts cover a season when they won the Championship under Marcelo Bielsa, thus securing promotion to the Premier league after a 16-year absence, despite unprecedented challenges posed by the COVID-19 pandemic. Some thoughts in the following thread #LUFC

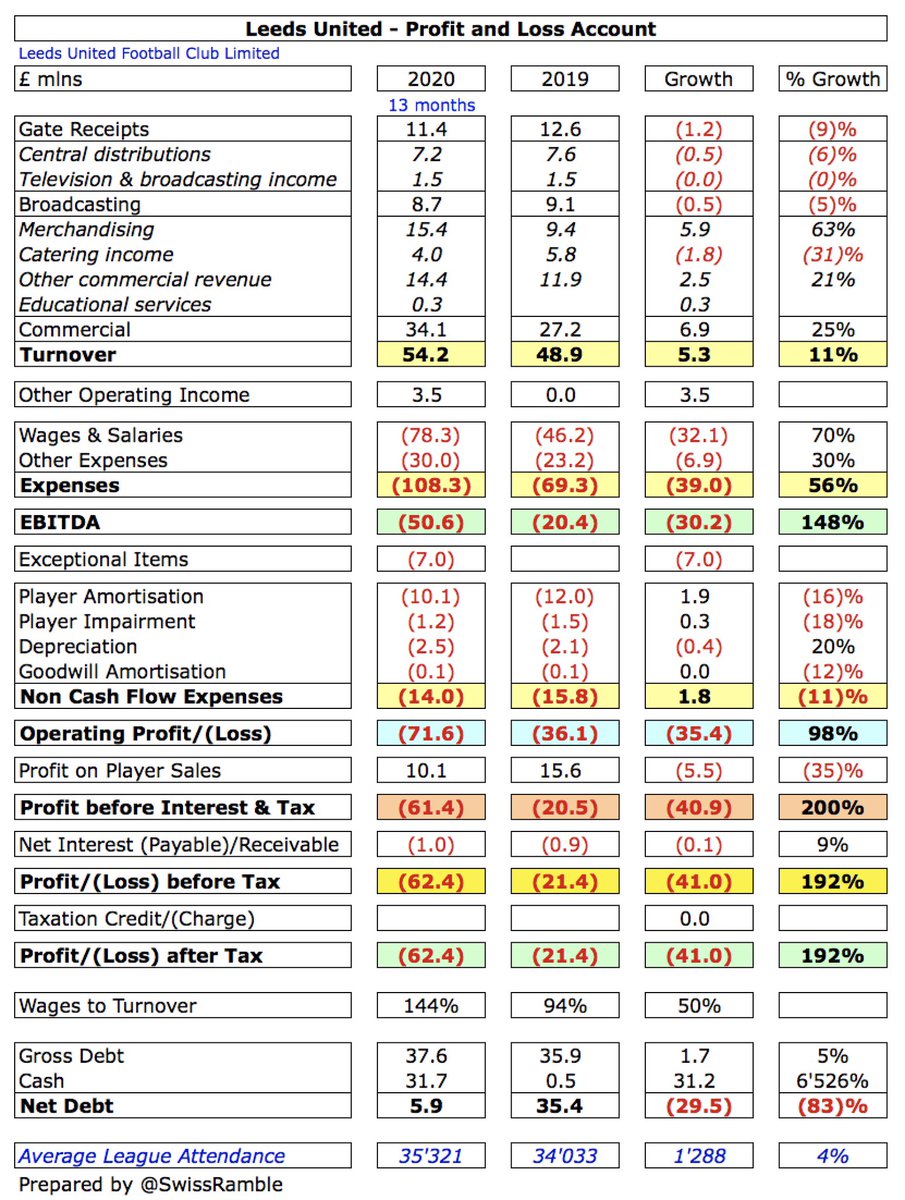

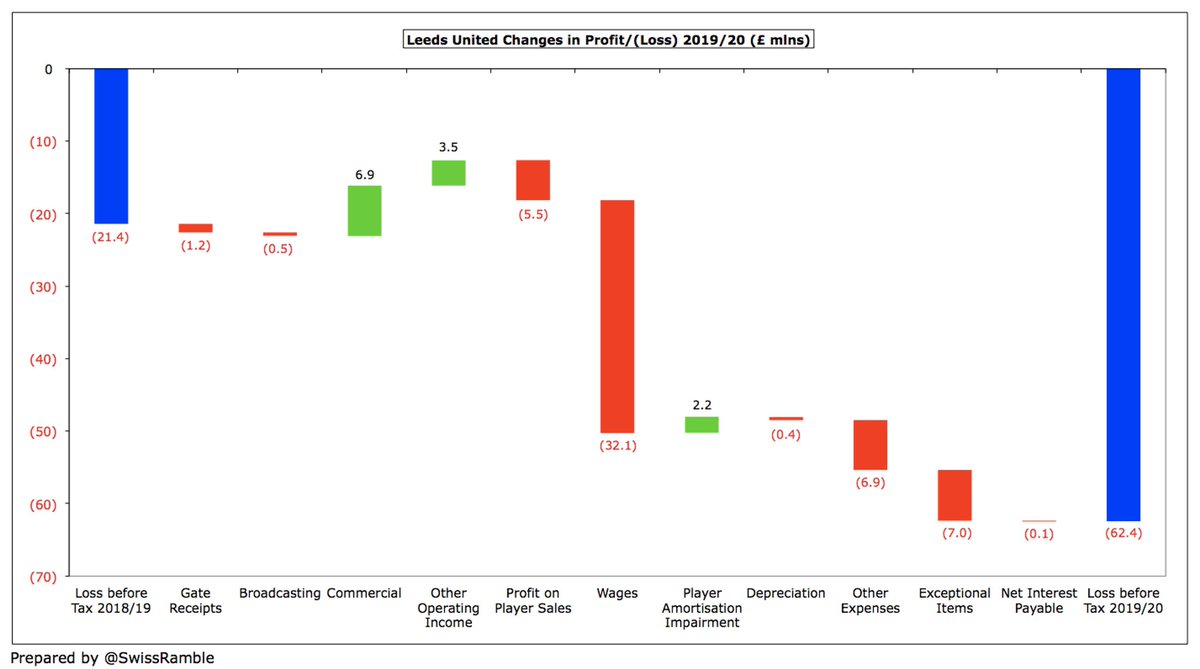

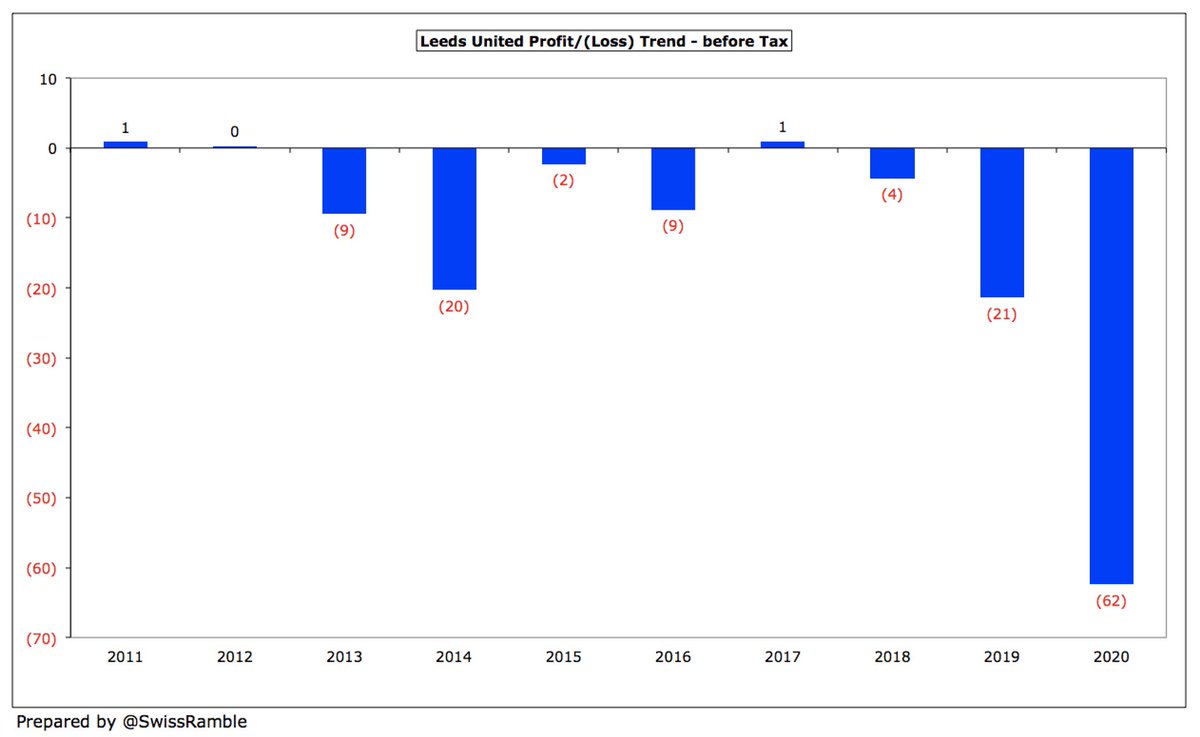

#LUFC paid a price for success, as their pre-tax loss widened from £21m to £62m, despite revenue rising £5m (11%) from £49m to £54m, as significant investment led to expenses increasing £44m (52%), including £20m promotion bonuses and £7m TV rebate to broadcasters.

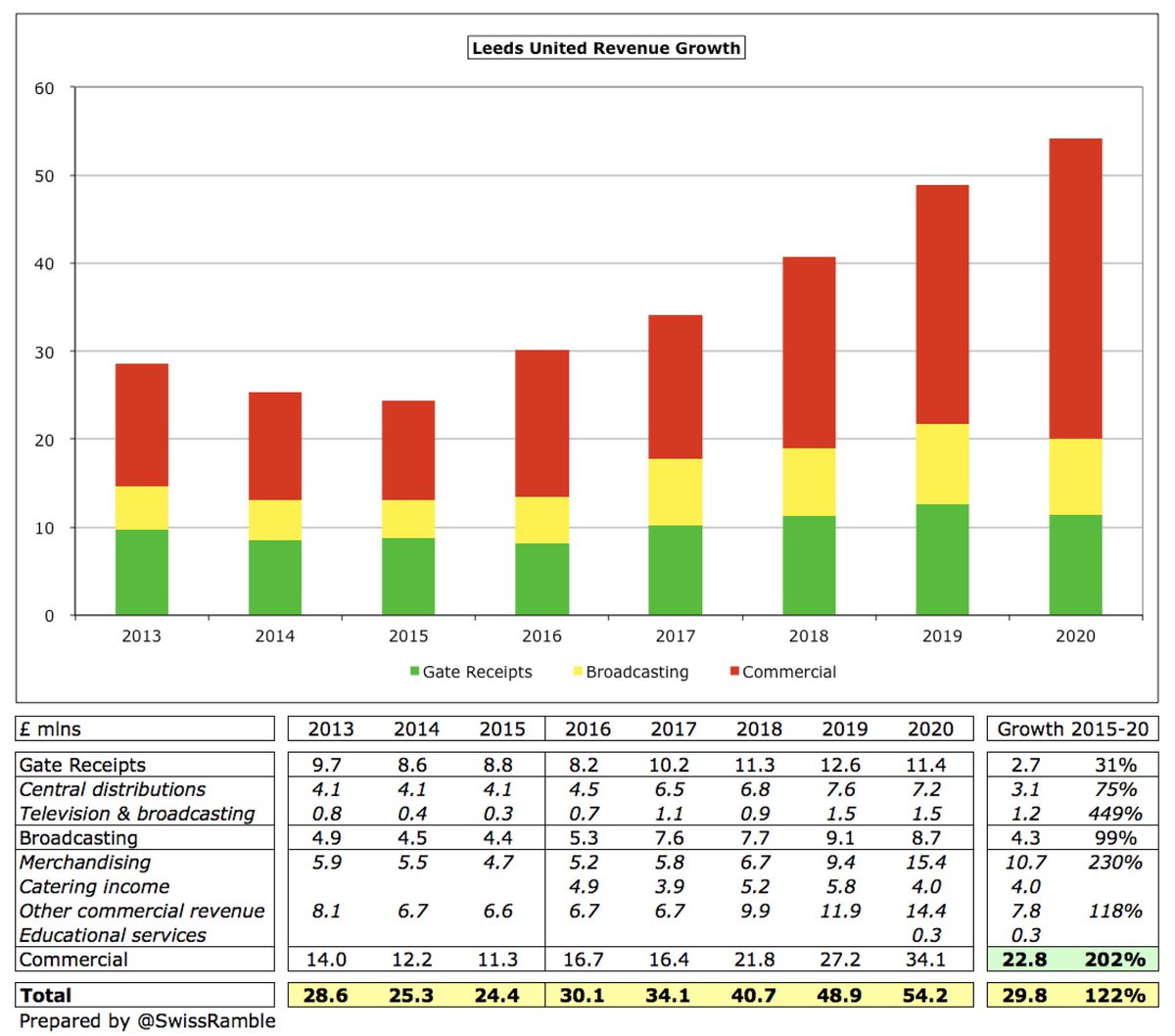

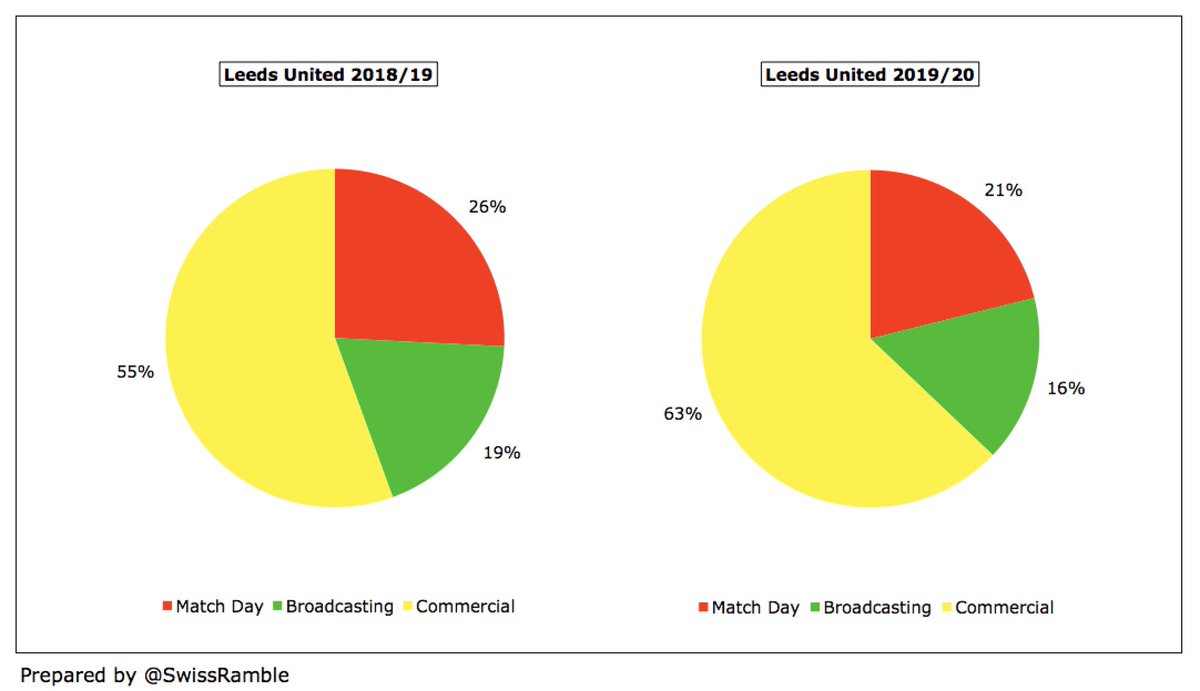

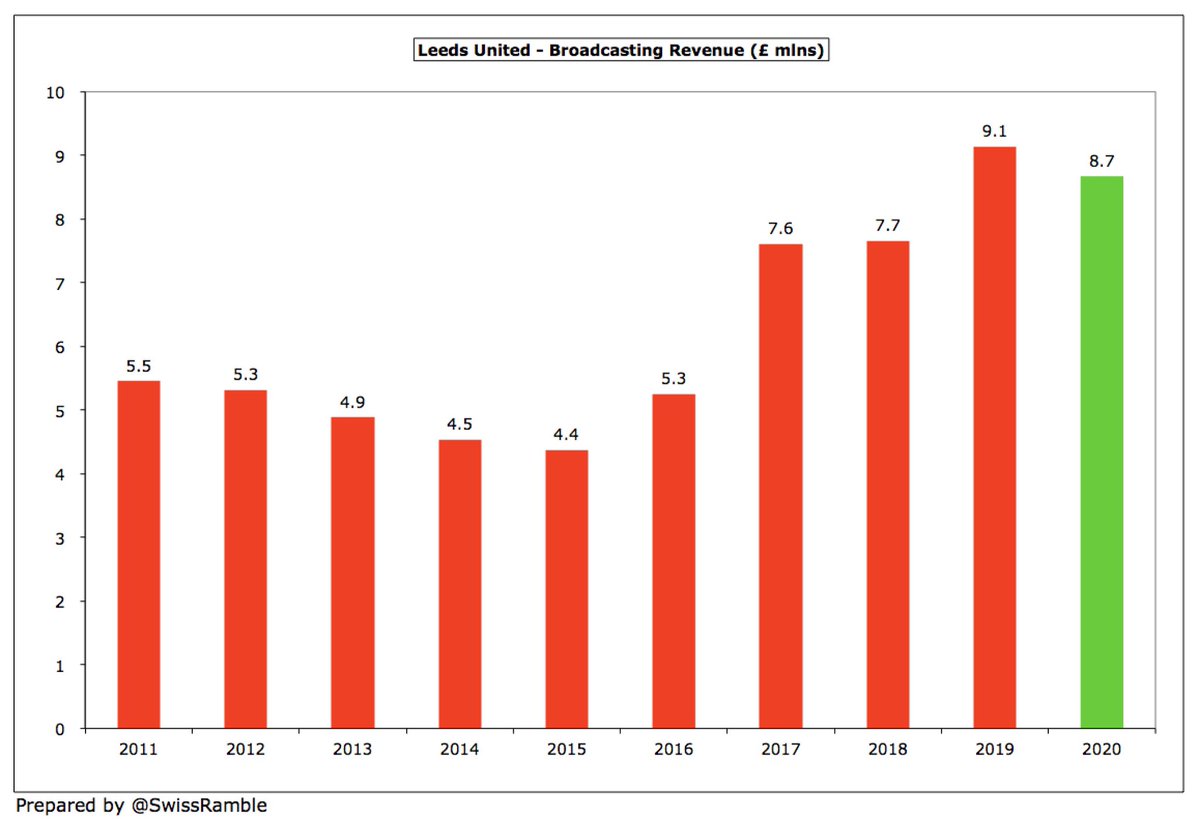

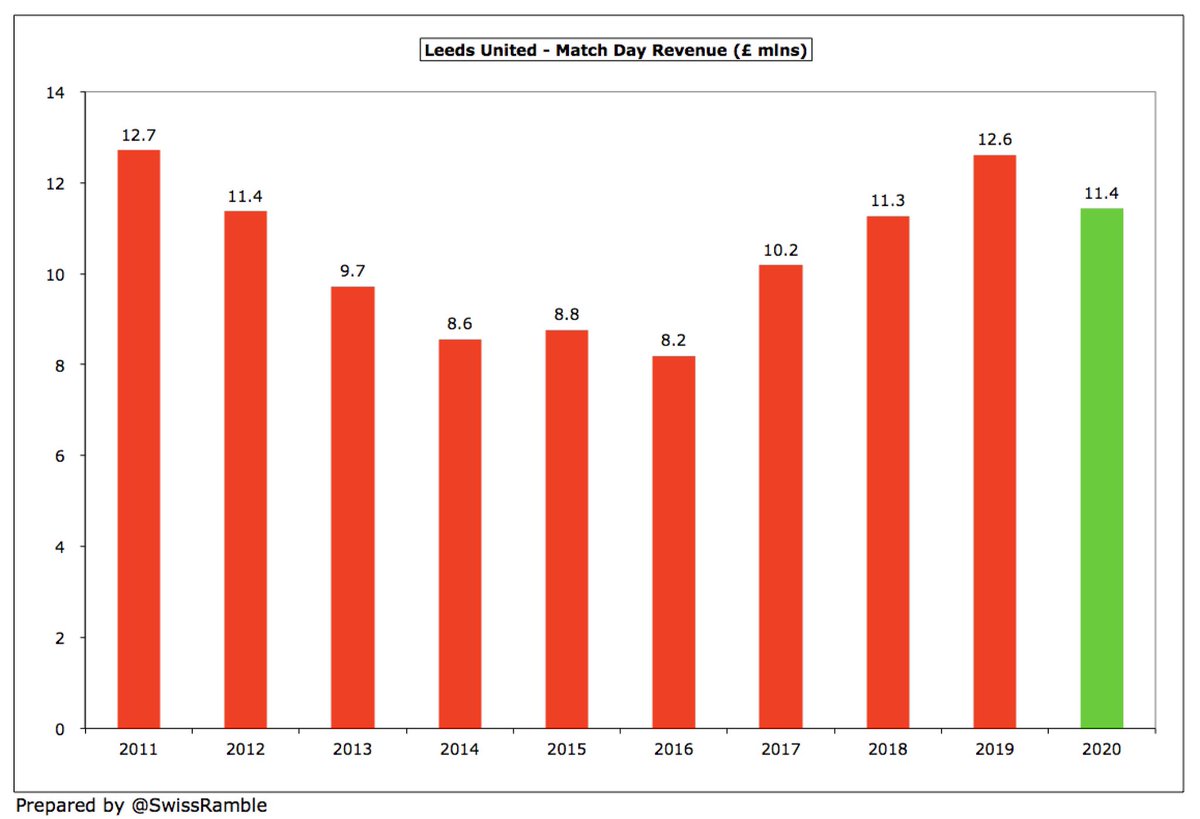

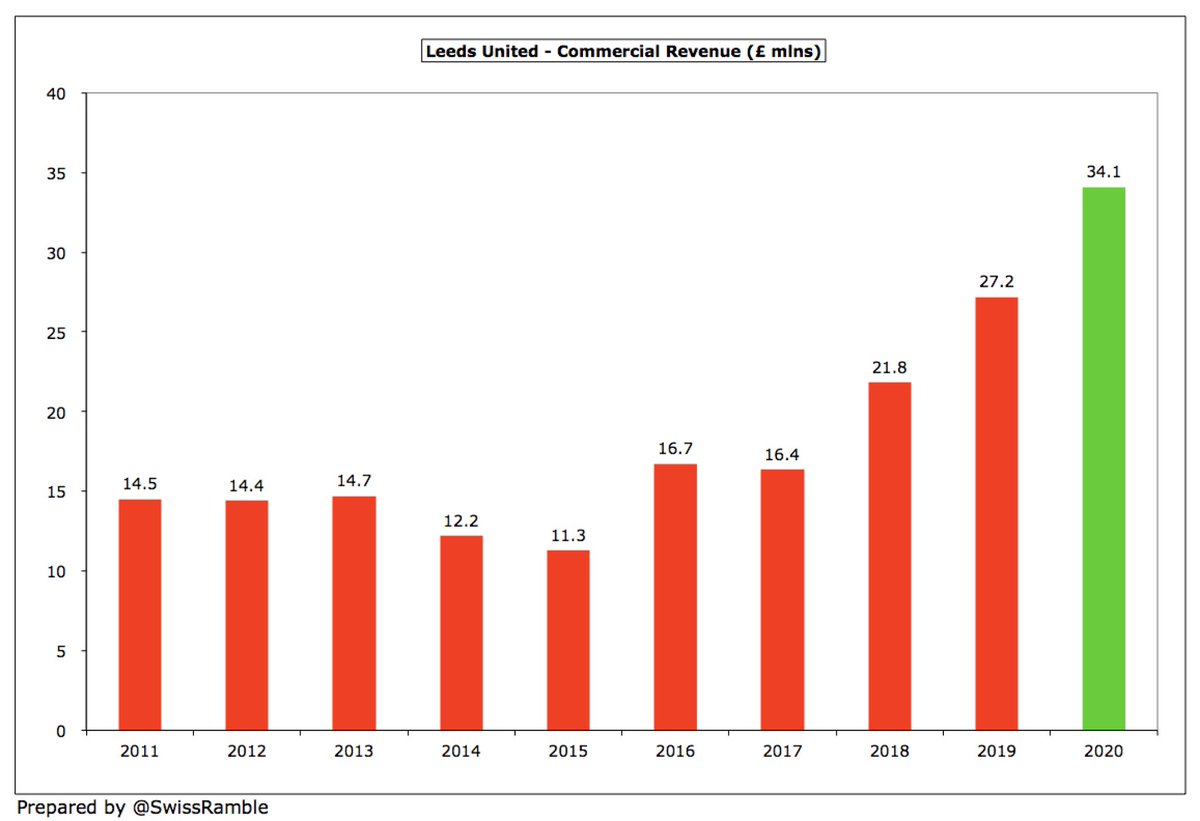

The main reason for #LUFC £5m revenue growth was £7m (25%) increase in commercial income from £27m to £34m (largely merchandising), as gate receipts fell £1.2m (9%) to £11.4m and broadcasting was down £0.5m (5%) to £8.7m. Profit on player sales dropped £6m to £10m.

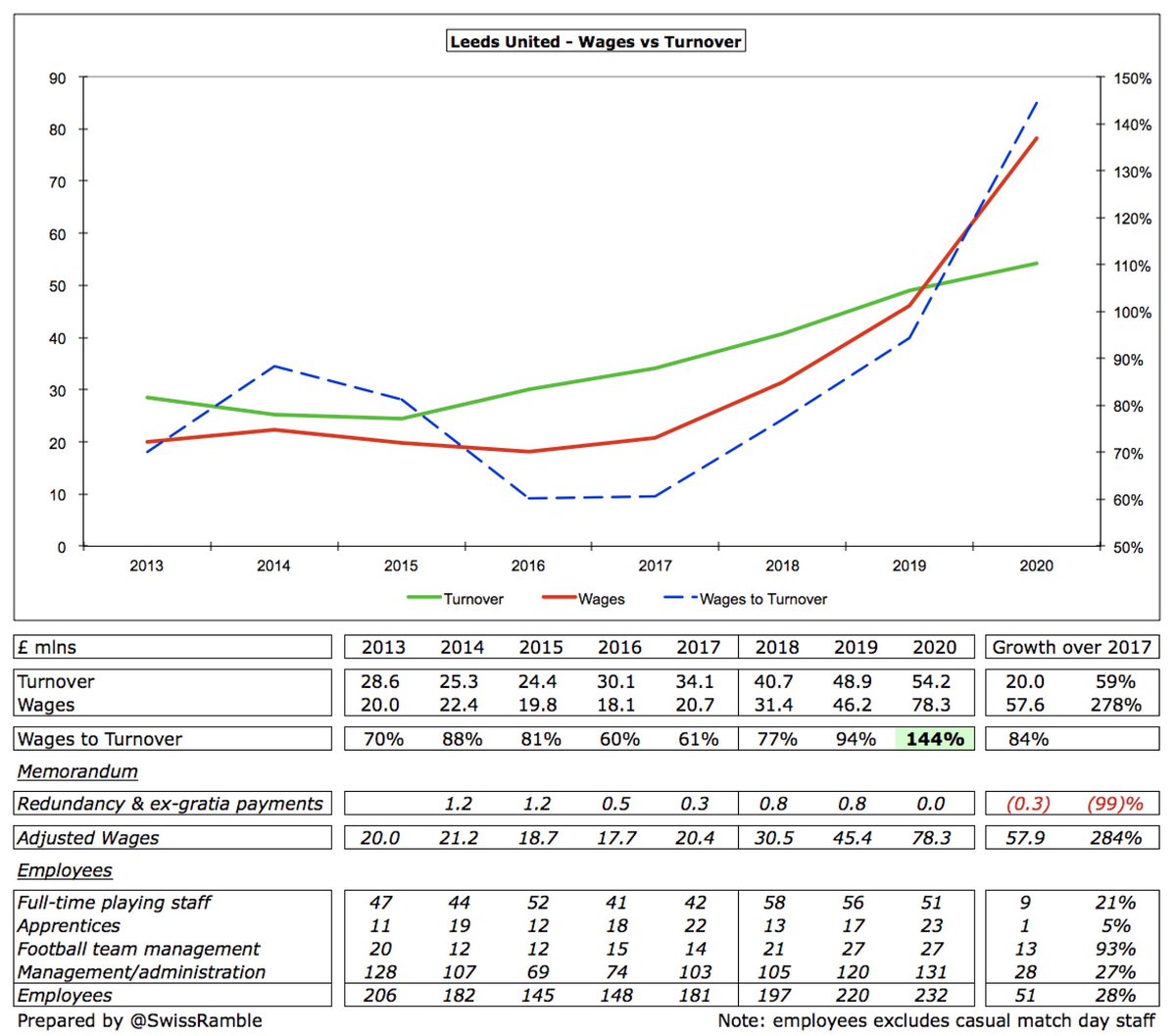

However, #LUFC saw significant cost growth, as wages shot up £32m (70%) from £46m to £78m (including £20m promotion bonus) and other expenses rose £7m (30%) to £30m. On the other hand, player amortisation fell £2m (16%) from £12m to £10m.

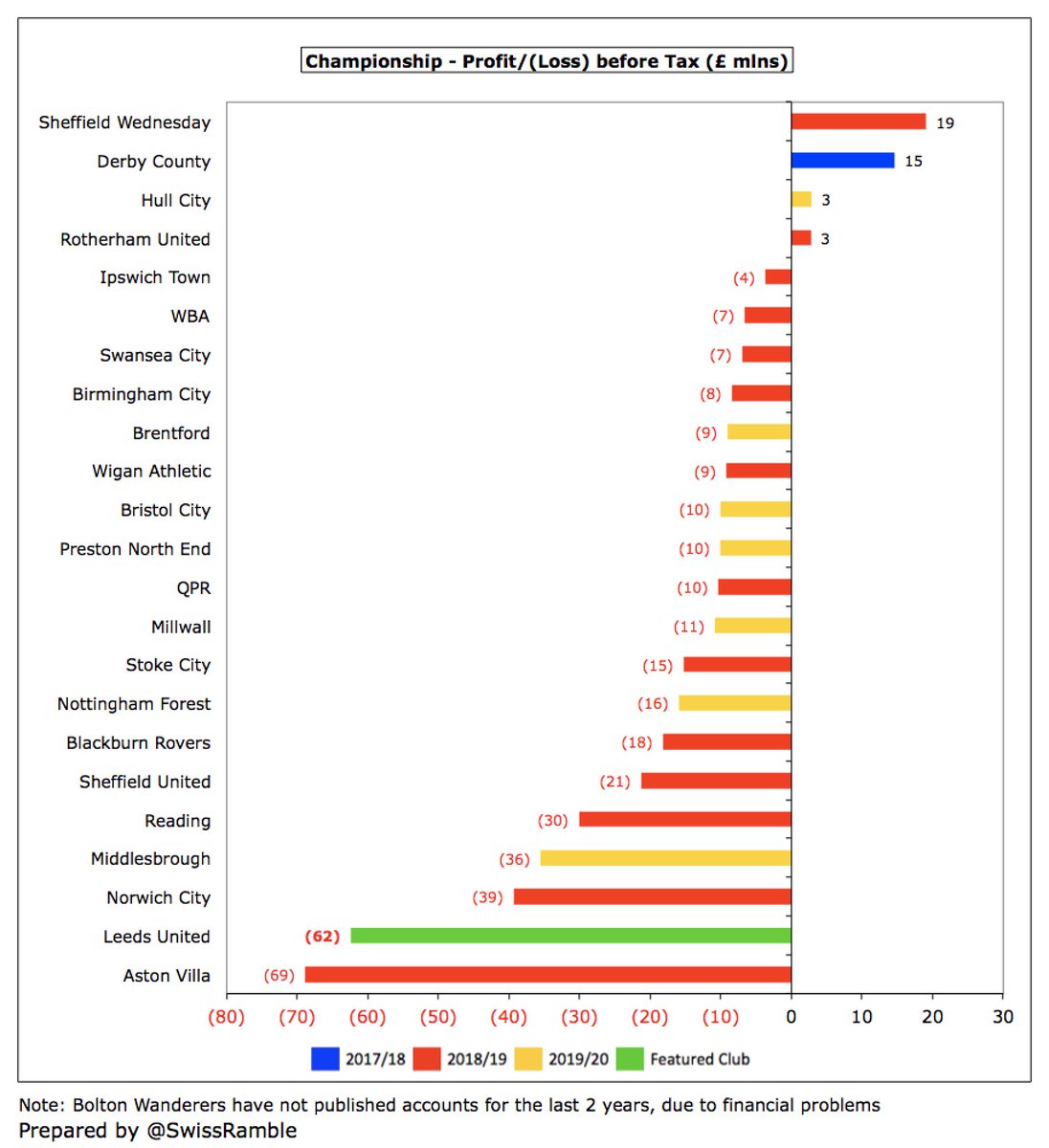

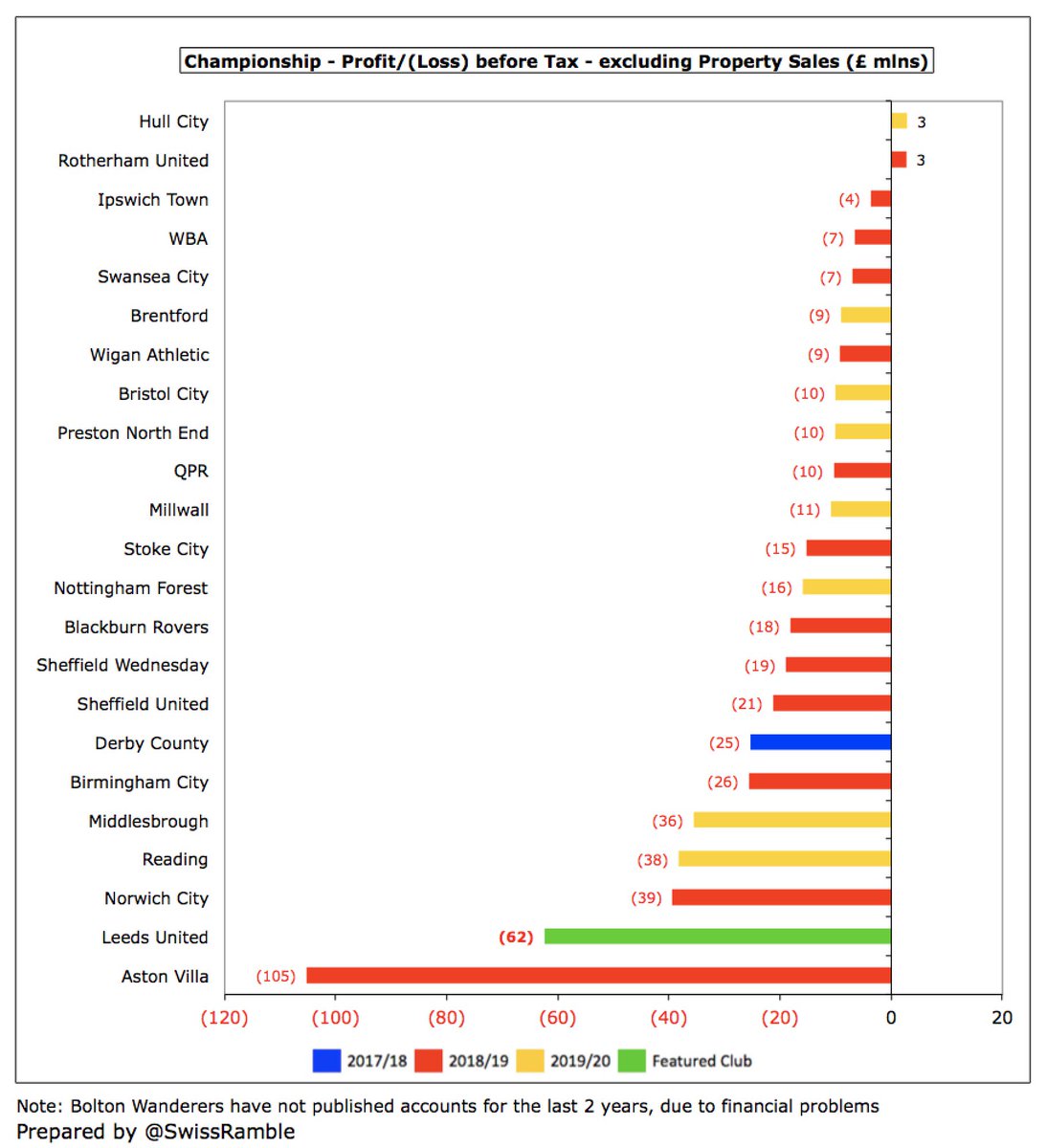

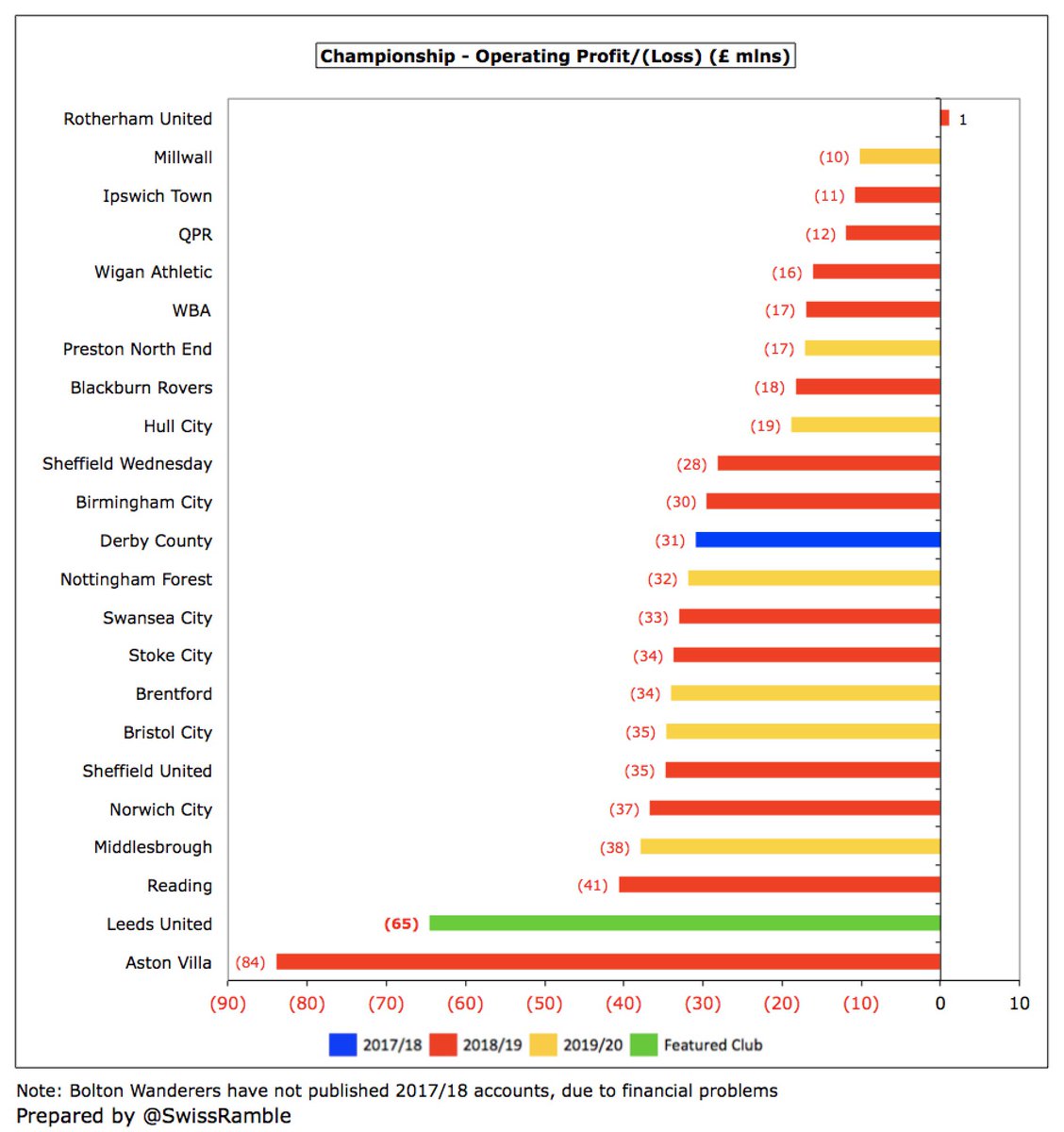

Of course, most clubs in the Championship habitually report large losses. Even before the pandemic, quite a few lost more than £20m. That said, #LUFC £62m loss is by far the worst to date in 2019/20, much more than the next highest, #Boro £36m and #NFFC £16m.

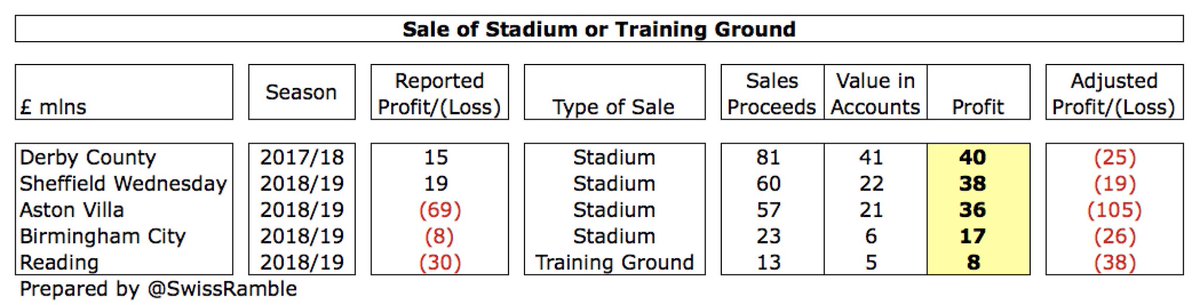

It is also worth noting that some clubs’ figures were boosted by the sale of stadiums, training grounds and land, especially #DCFC £40m, #SWFC £38m and #AVFC £36m, so their underlying profitability was even worse than reported.

Excluding property sales, just two Championship clubs are profitable (only #HCAFC in 2019/20). The sad reality is that almost all clubs in this division lose a lot of money, as they strive to remain competitive in pursuit of promotion to the top flight.

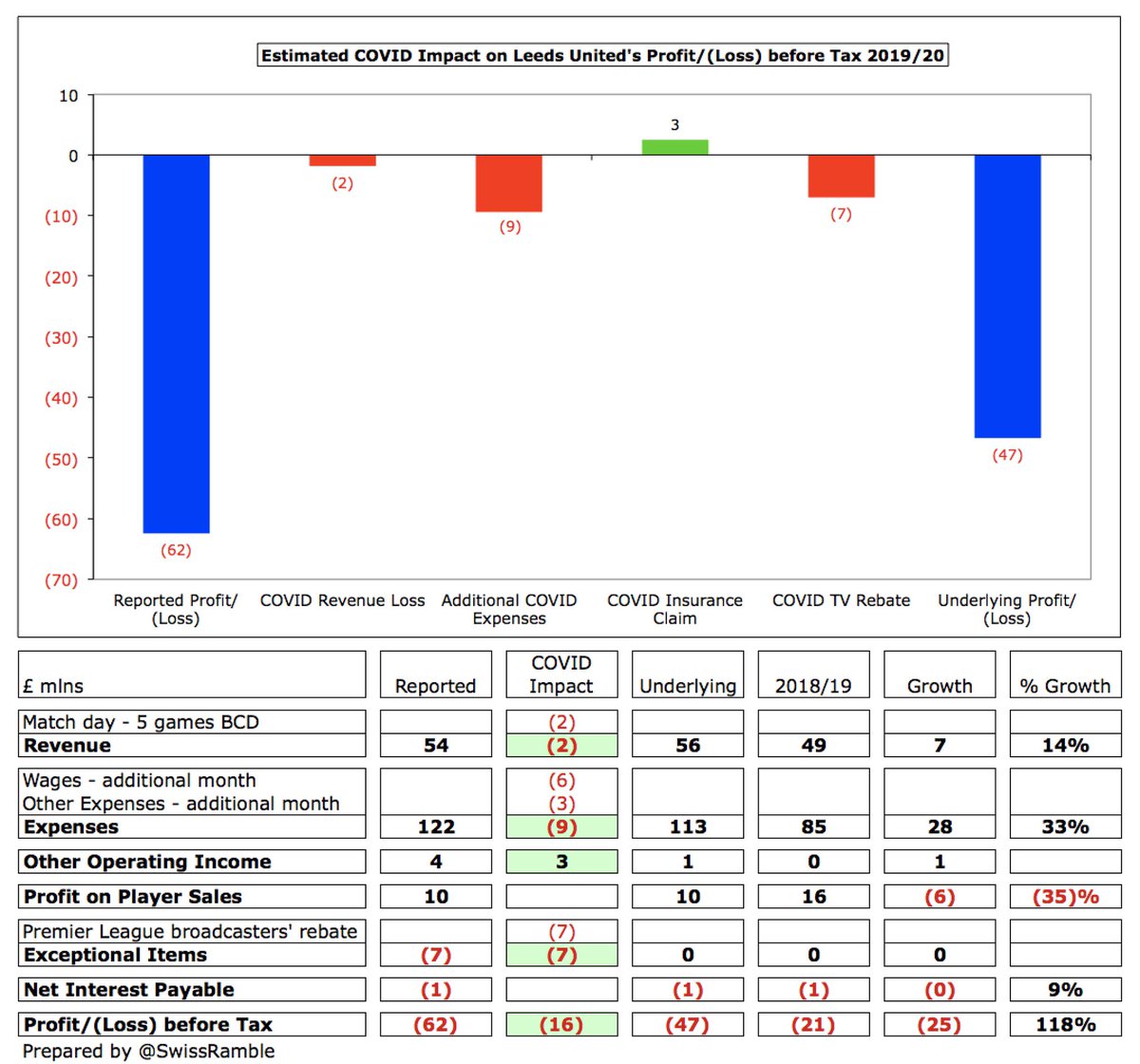

As a technical aside, #LUFC extended their financial reporting close to 31st July 2020, a period of 13 months. Although this enabled them to include revenue for games played in July, this also meant that 2019/20 accounts covered an additional month of expenses.

Without COVID #LUFC revenue was projected to be £2m higher at £56m, though this was covered by £2.5m insurance claim. However, they incurred £9m costs for additional month and had to pay £7m for Premier League TV rebate as a promoted club. Their loss would still have been £47m.

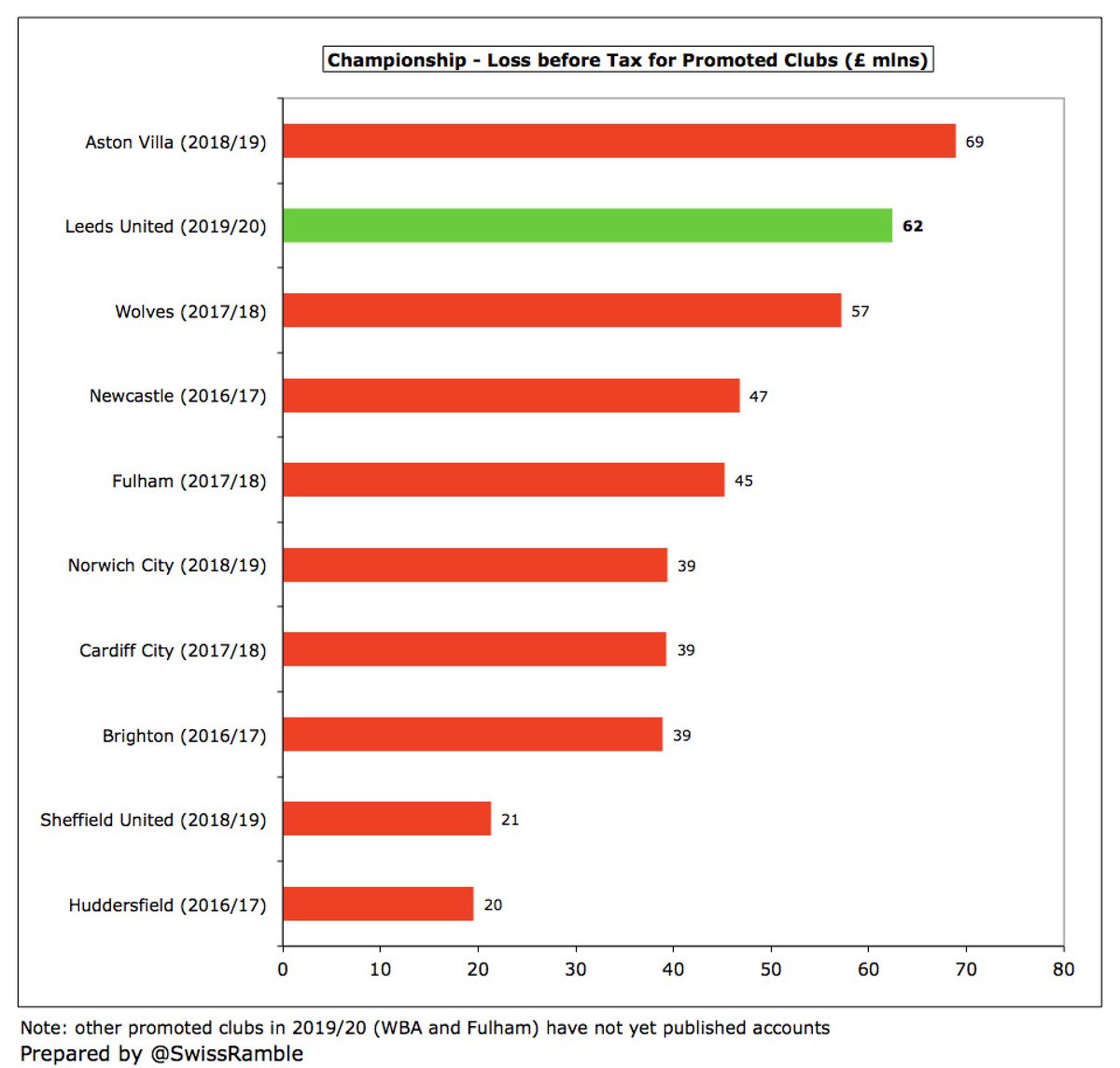

In fairness, nearly all promoted clubs have had to splash the cash to finance the investment required to get out of the Championship, leading to hefty losses (including promotion bonuses). That said, #LUFC £62m loss is only below £69m posted by #AVFC in 2018/19.

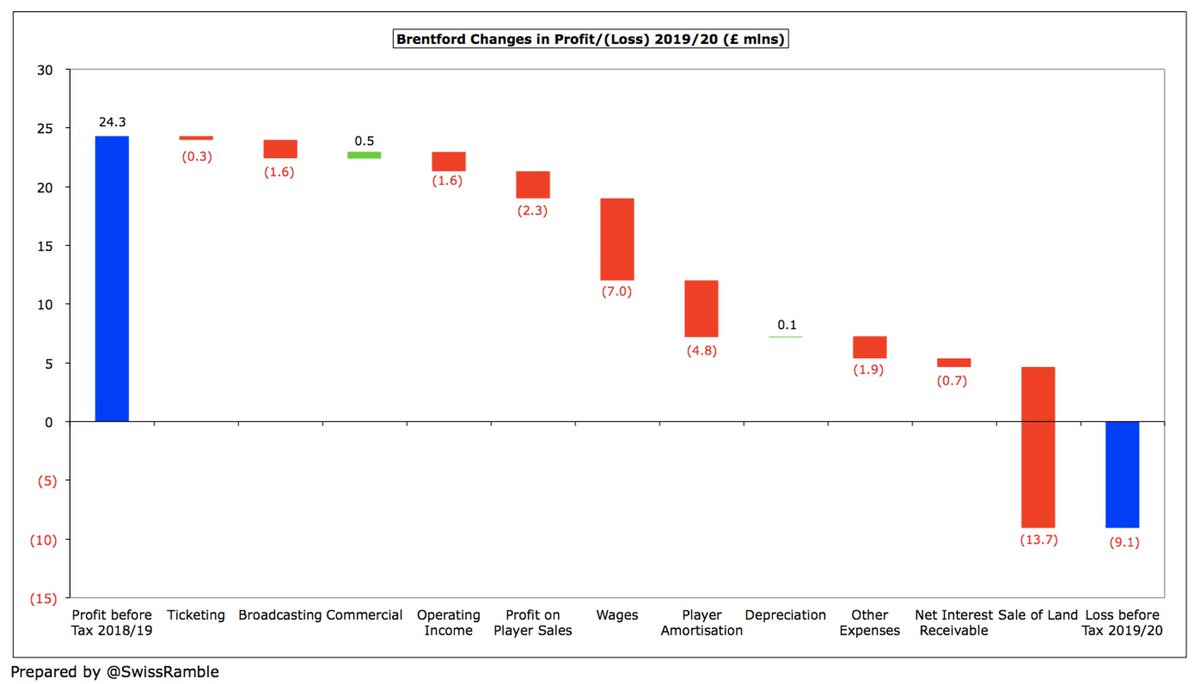

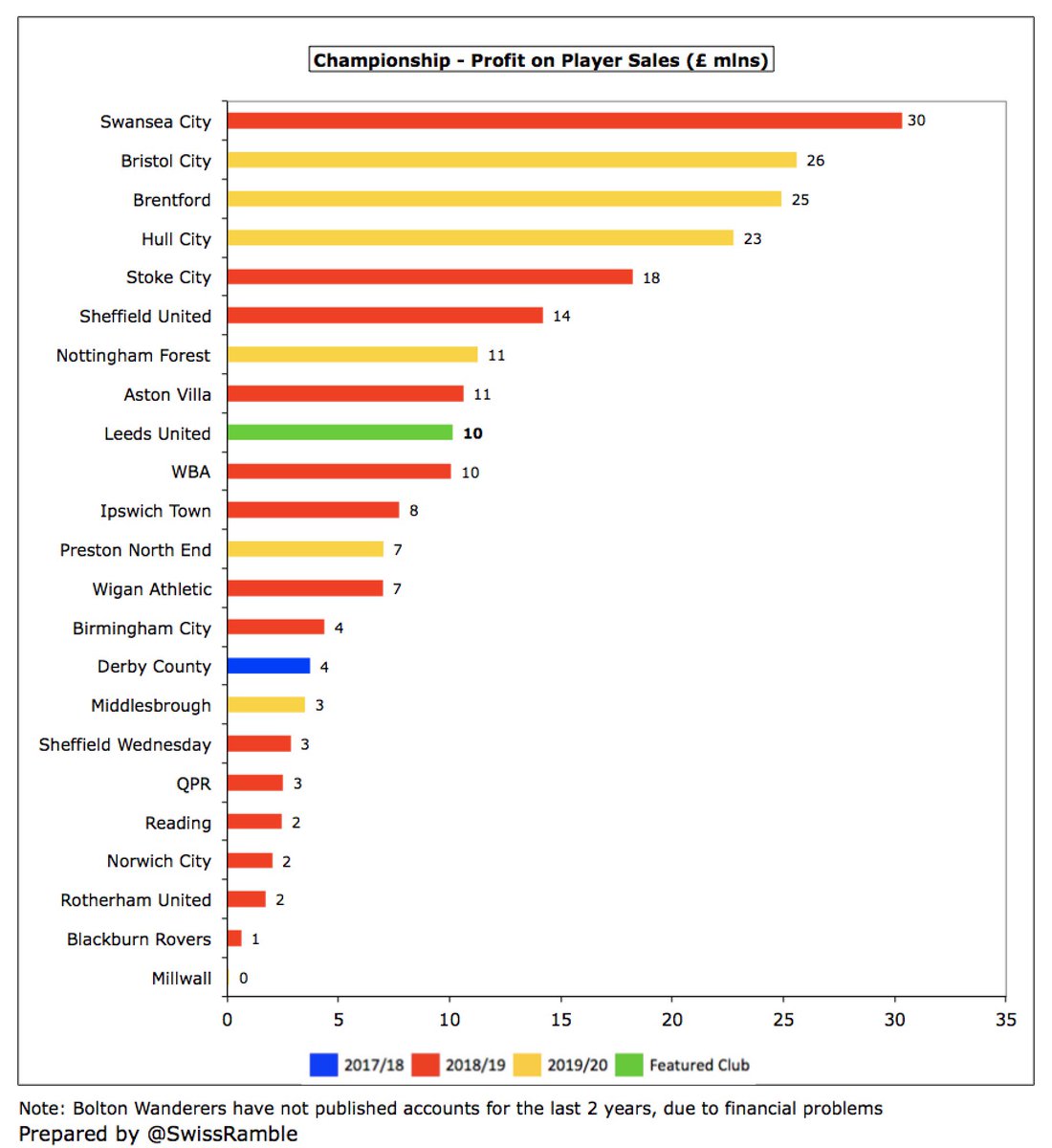

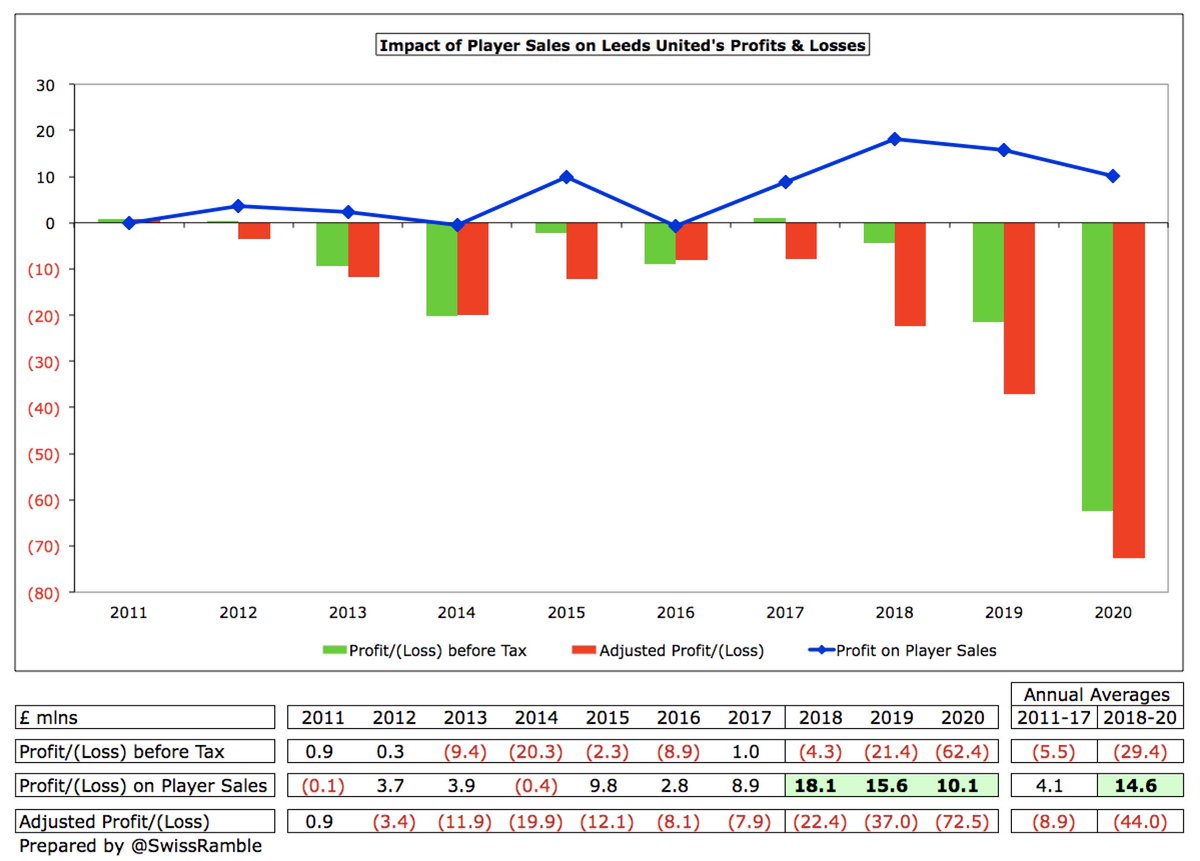

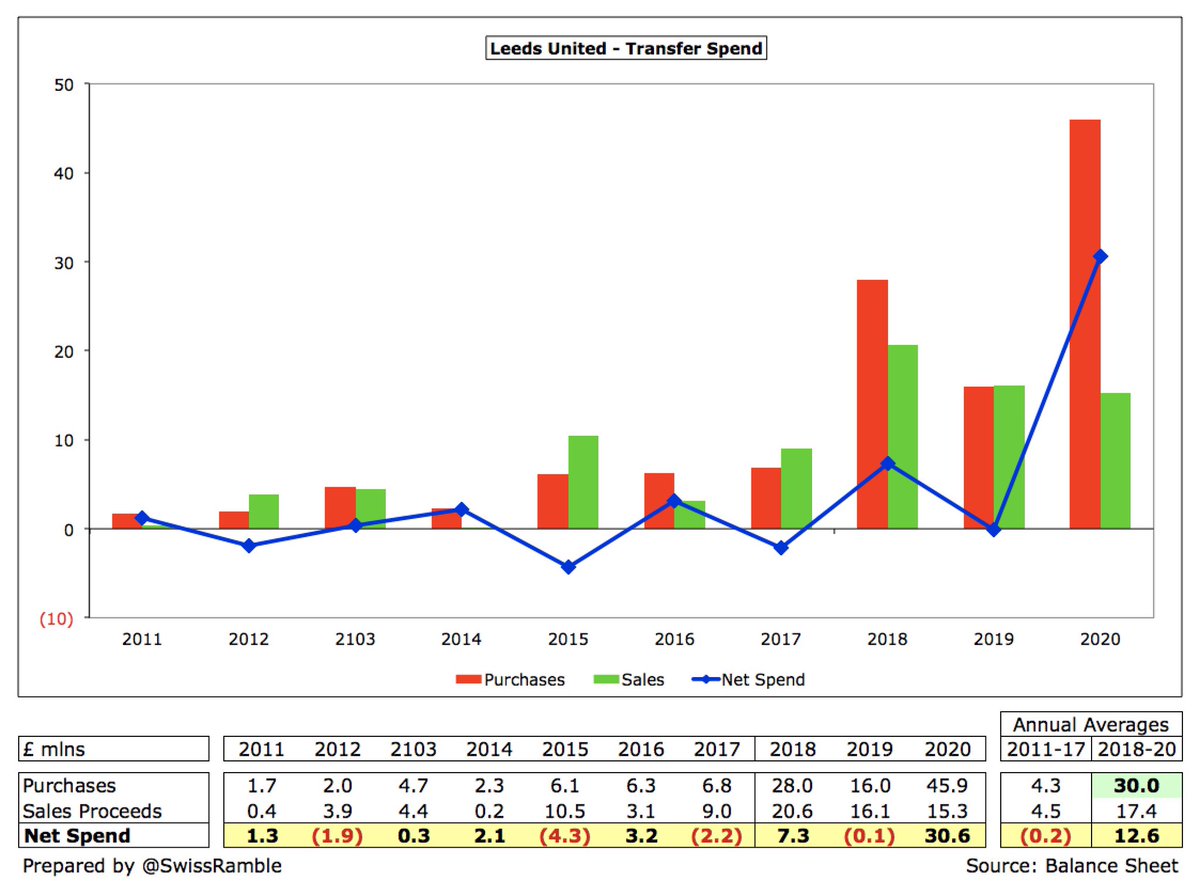

#LUFC loss would have been reduced if they had sold some of their talent. As it was, profit on player sales fell £6m to £10m, mainly Kemar Roofe to Anderlecht, Pontus Jansson to Brentford and Bailey Peacock-Farrell to Burnley. A fair way below Bristol City £26m & Brentford £25m.

#LUFC have only made money once in last 8 years (and that was just £1m in 2016/17). Losses have been increasing in the 3 years following Radrizzani’s arrival, due to investment in Bielsa, his coaching team and the squad, amounting to £88m.

#LUFC profit on player sales has been on the rise, averaging £15m over last 3 years. As Radrizzani explained, “Unfortunately to sustain a club in this league we need to sell one or two players each year.” However, this will fall this season, as mainly free transfers last summer.

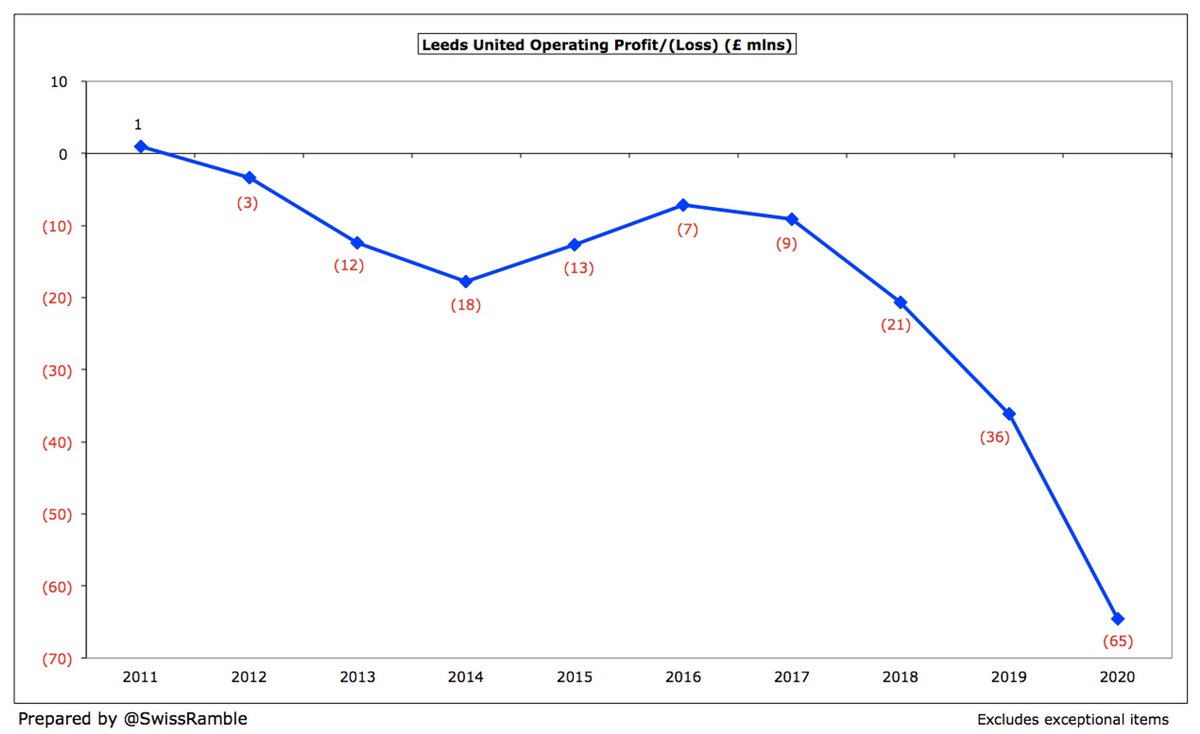

#LUFC operating loss (i.e. excluding player sales and interest) widened from £36m to £65m, the highest to date in 2019/20 Championship. This is obviously not great, but in fairness almost every club in this division posts substantial operating losses, i.e. over half above £30m.

#LUFC revenue has more than doubled in the last 5 years from £24m to £54m, mainly driven by commercial, which has tripled from £11m to £34m, now contributing 63% of total revenue. The growth was partly due to bringing £4m catering back in-house.

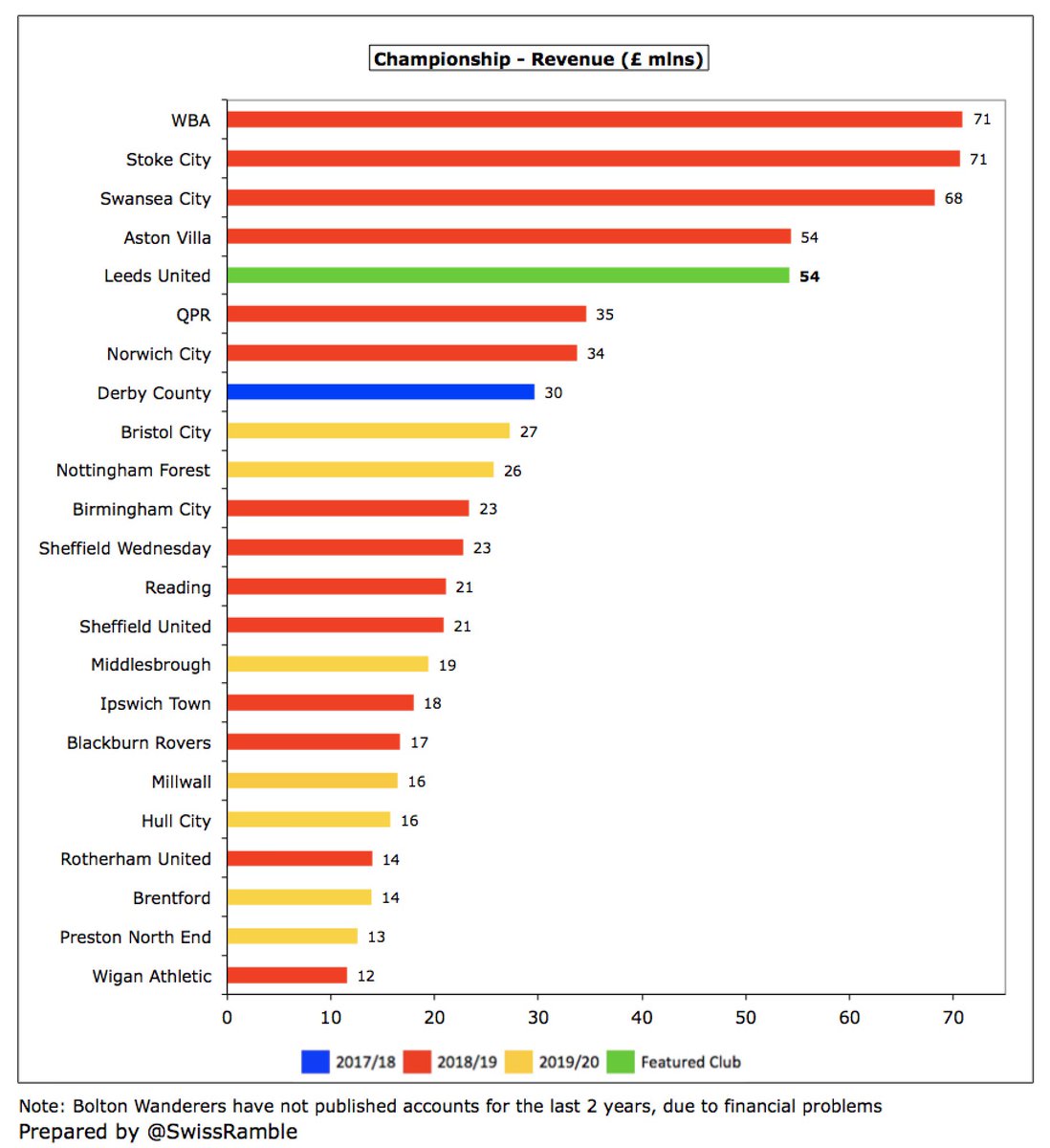

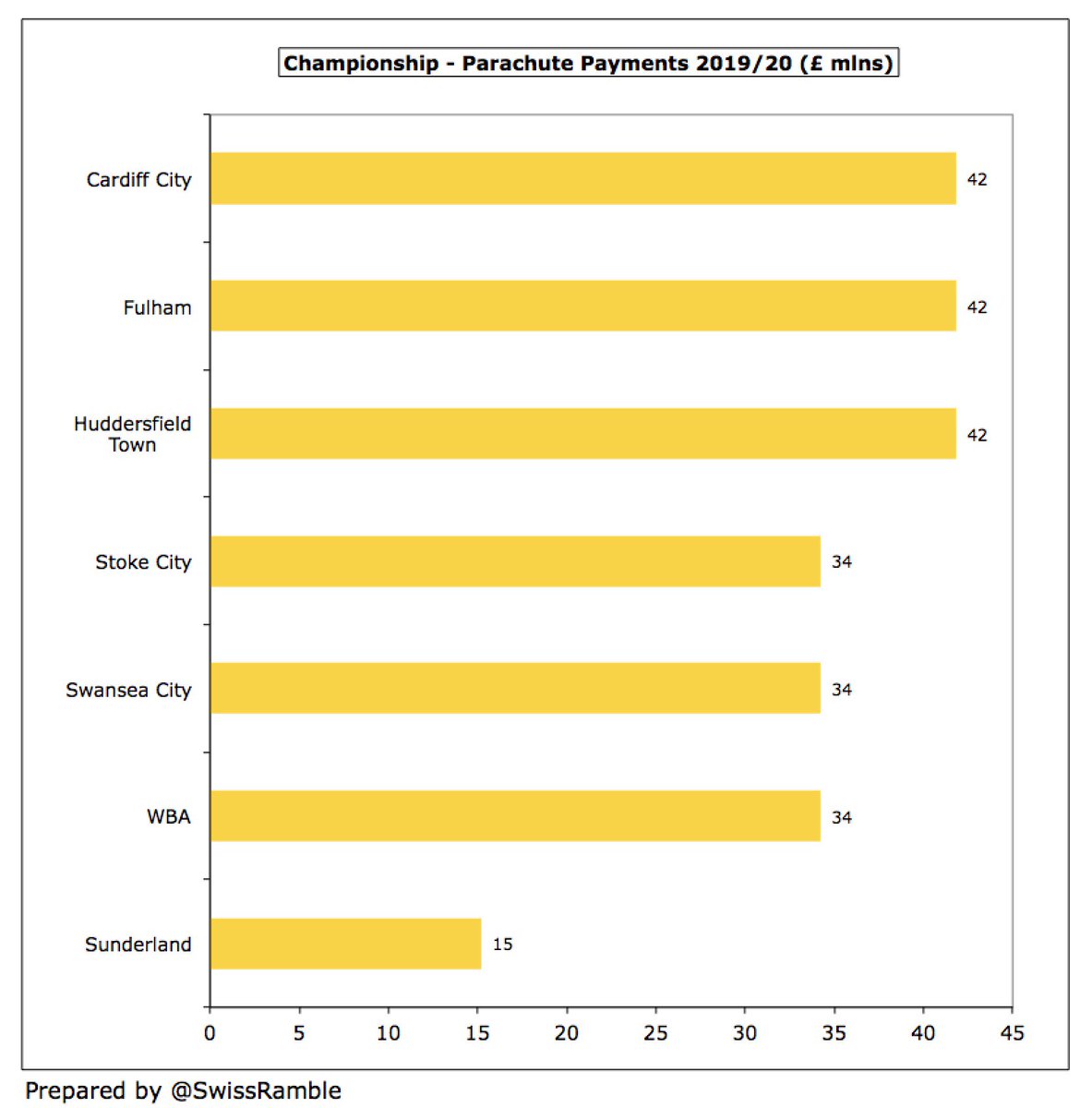

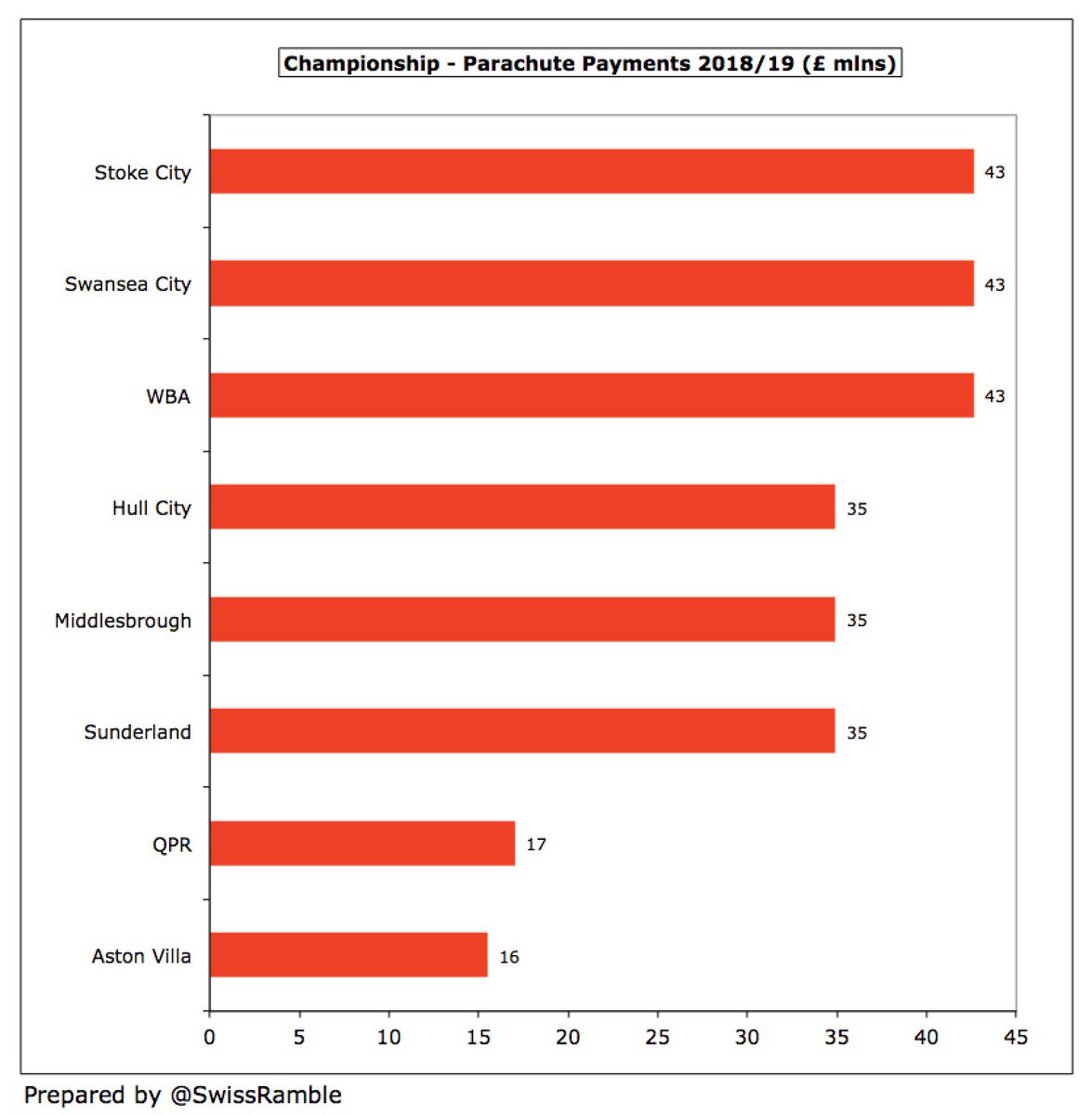

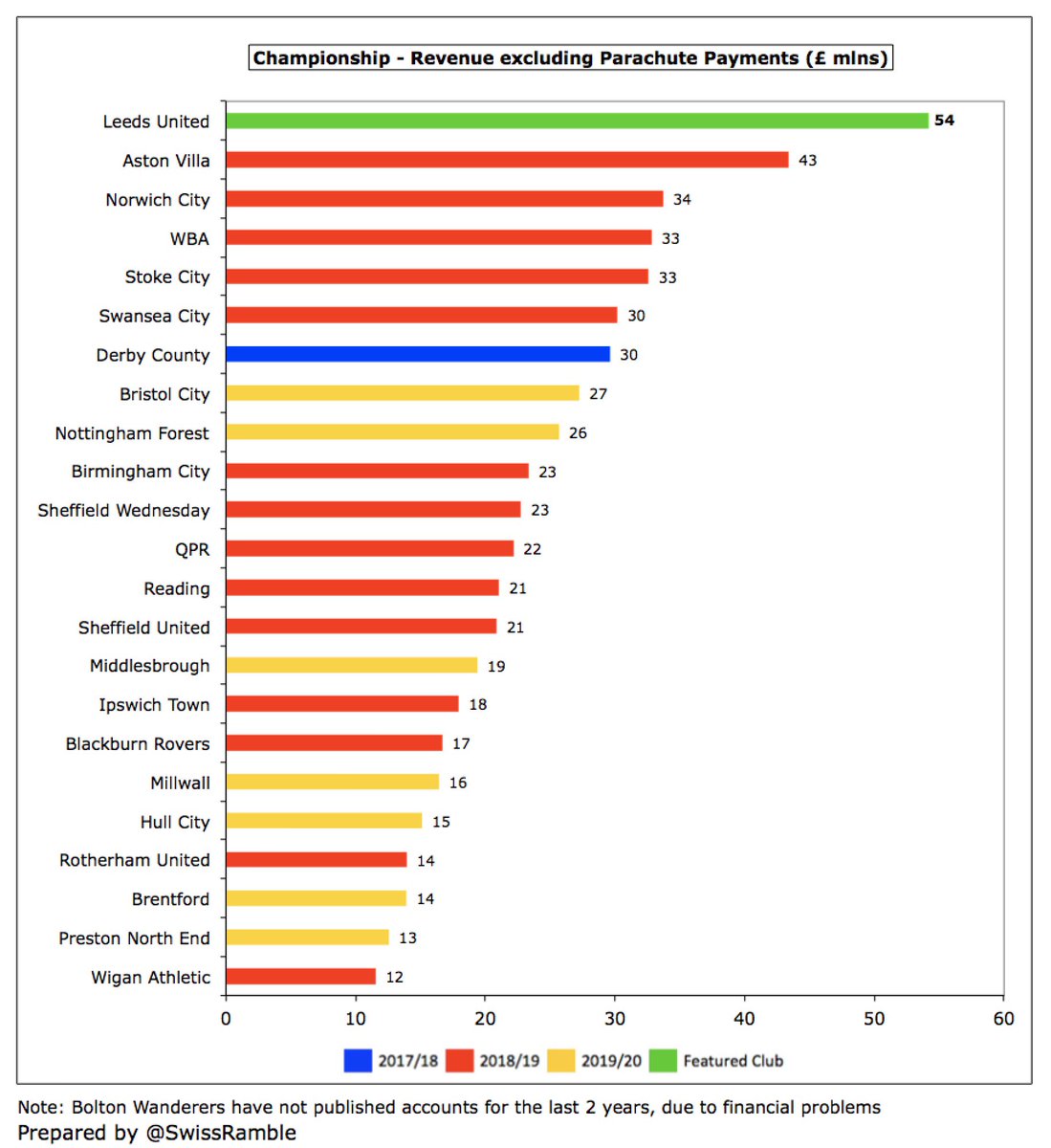

Following the growth, #LUFC £54m revenue is the 5th highest in the Championship, only behind 4 clubs receiving parachute payments. Seven clubs benefited in 2019/20, led by Cardiff City, #FFC £42m and #HTAFC (£42m), followed by Stoke City, Swansea City and WBA (£34m).

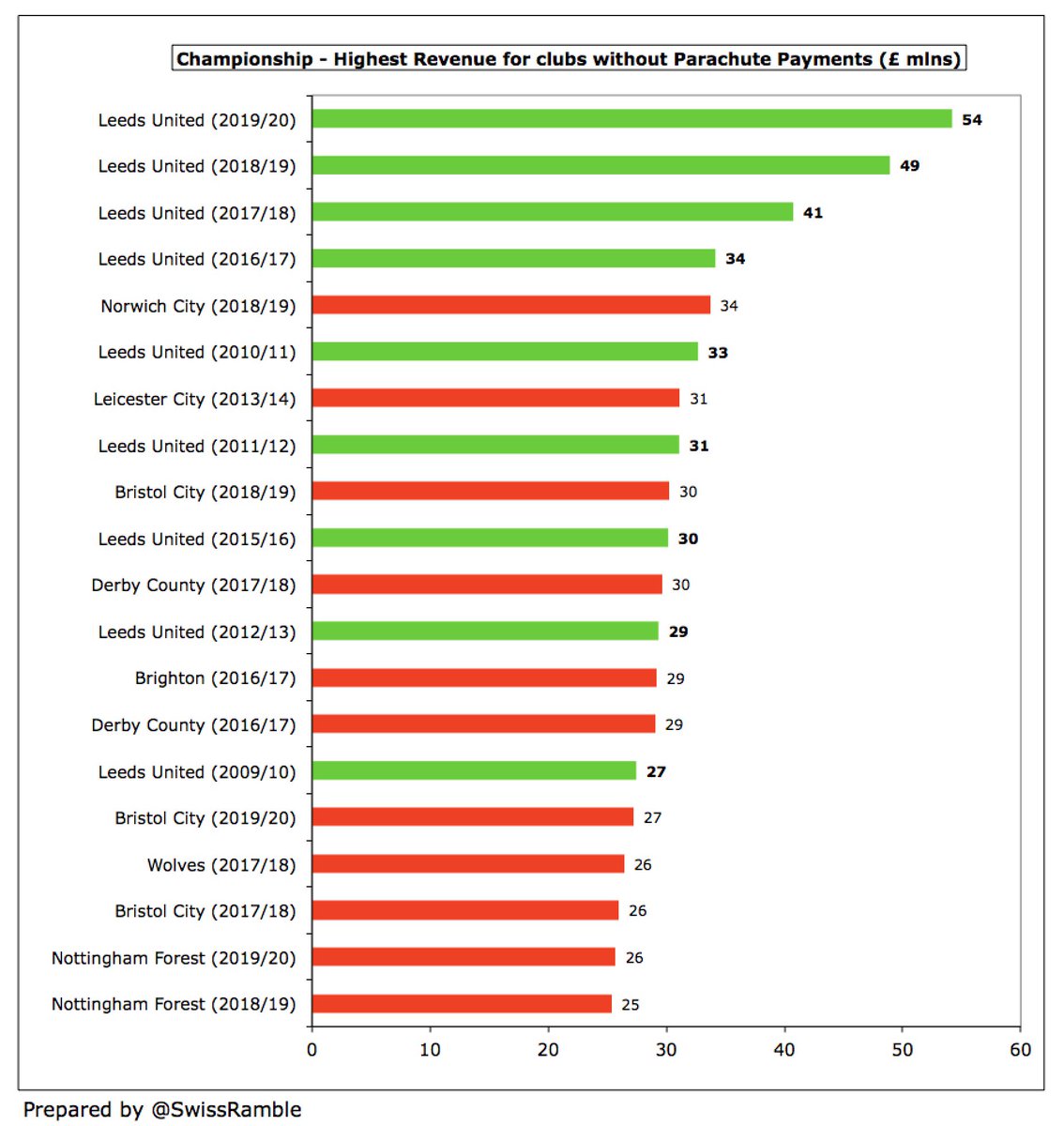

Excluding parachute payments, #LUFC £54m revenue would have been comfortably the highest in the Championship. In fact, this is the highest ever revenue for a Championship club not in receipt of parachutes (Leeds have the four largest on record, all from last 4 seasons).

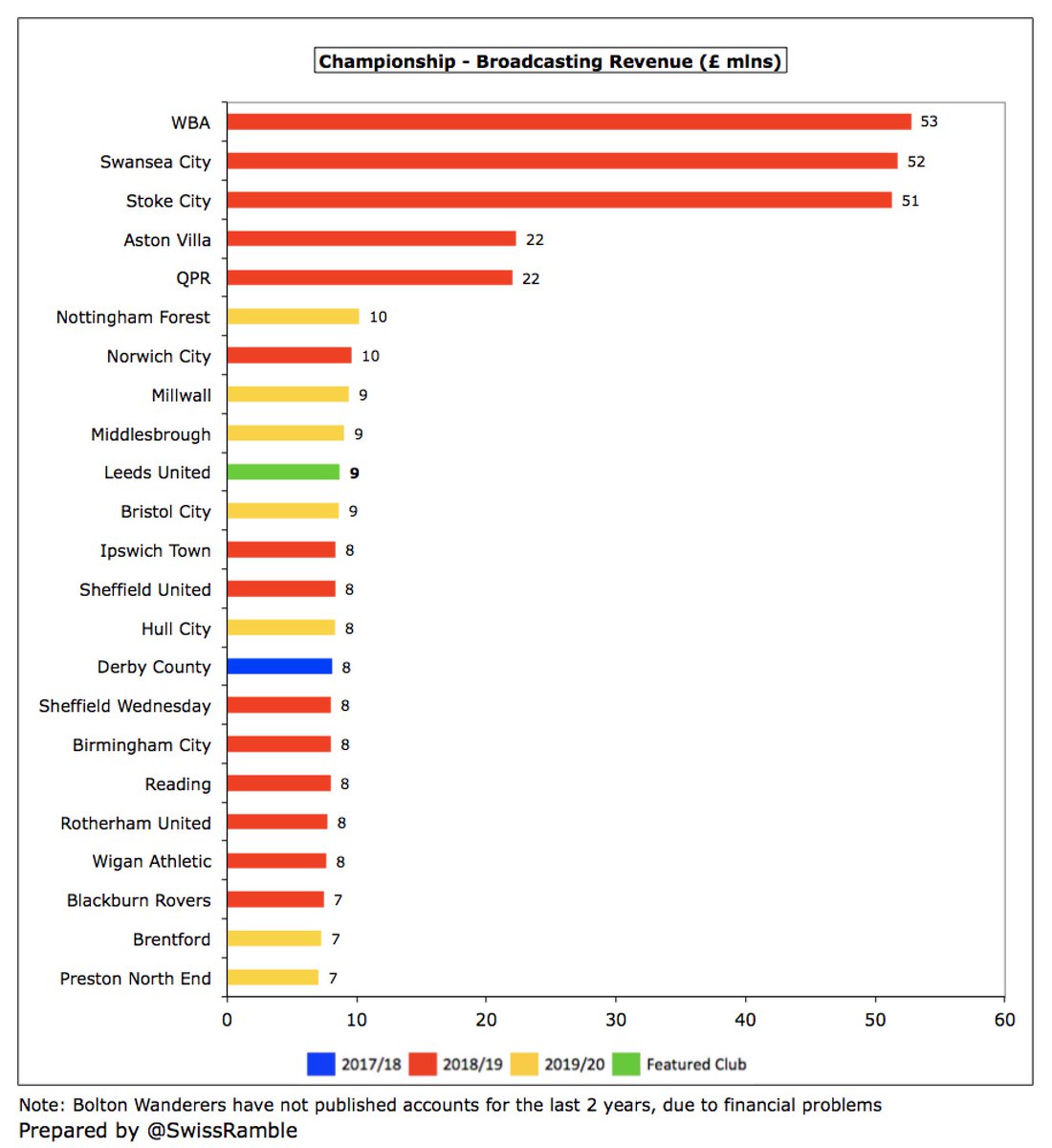

#LUFC broadcasting income fell £0.5m (5%) to £8.7m. In addition, as a promoted club, Leeds had to pay Premier League £7m rebate. Most Championship clubs earn £7-10m, but there is a significant gap to those with parachute payments (e.g. WBA, Swansea and Stoke received over £50m).

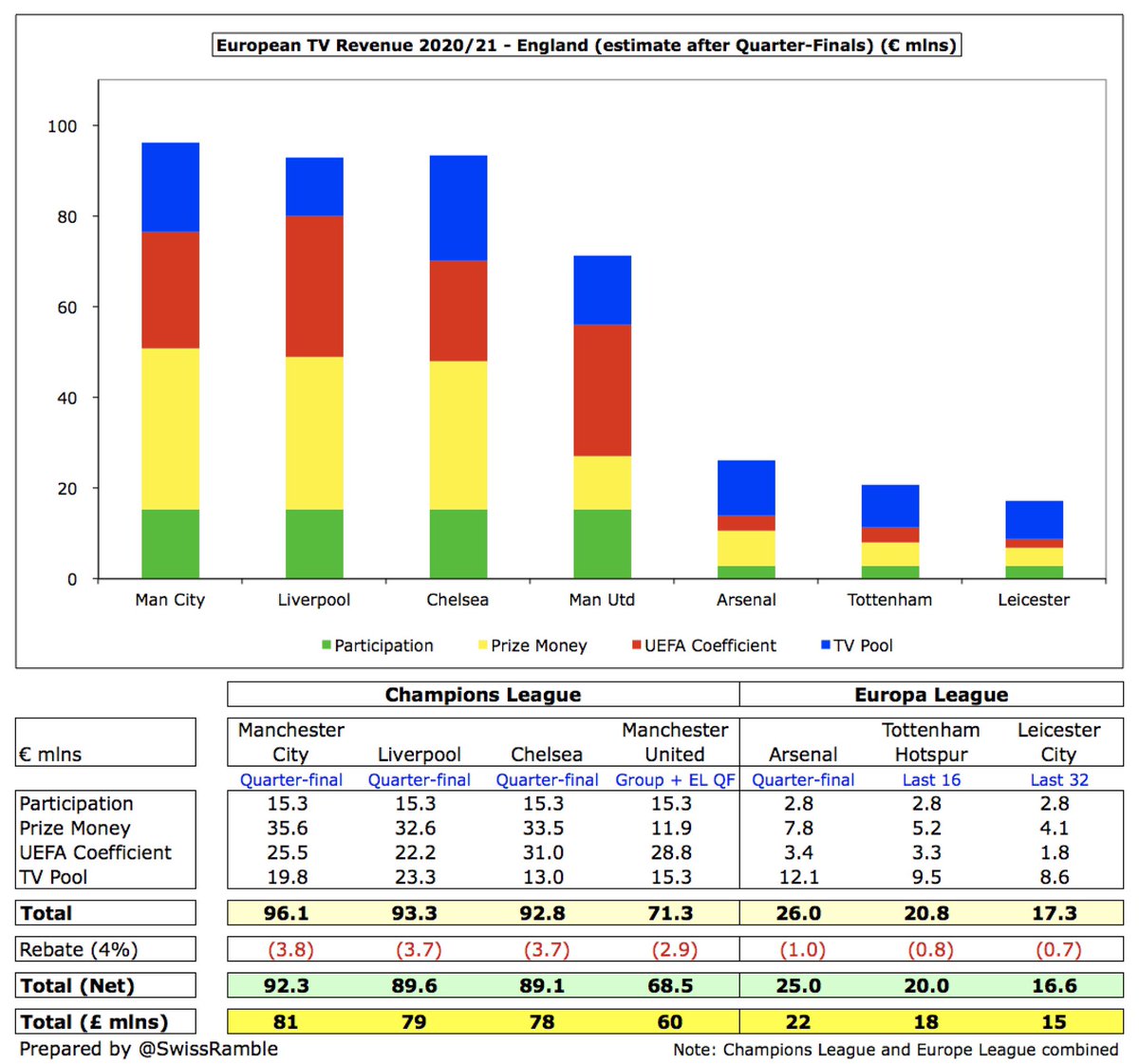

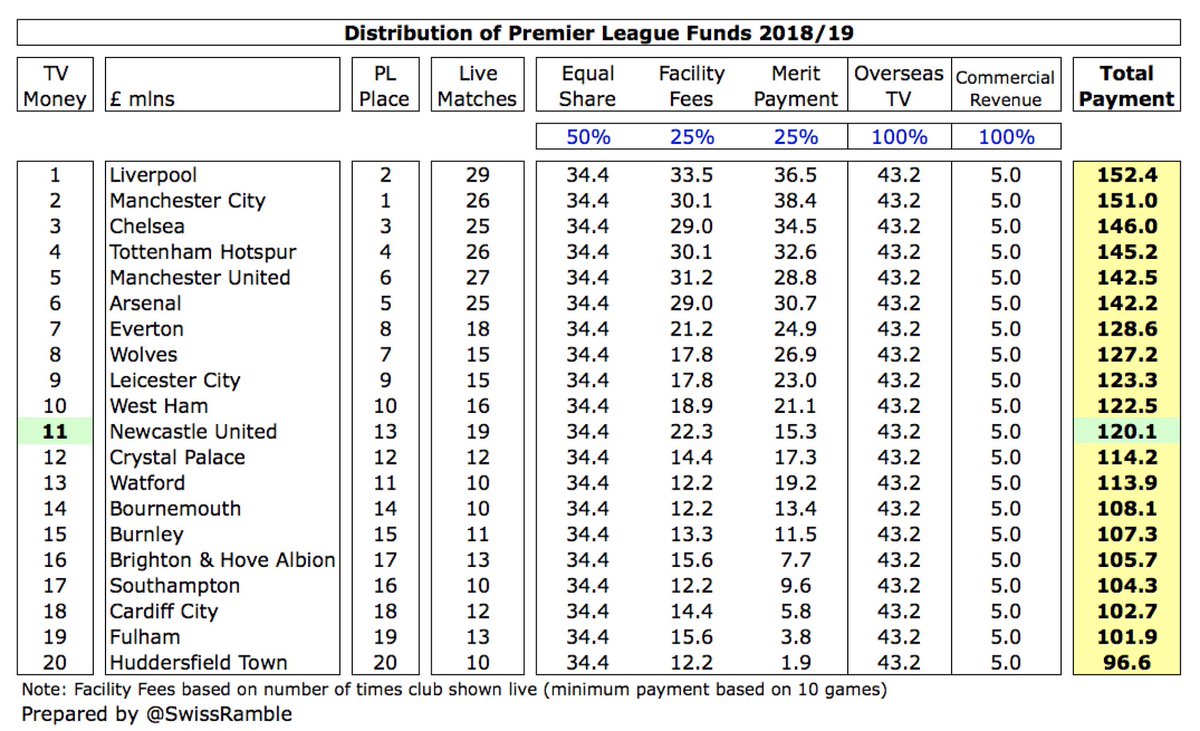

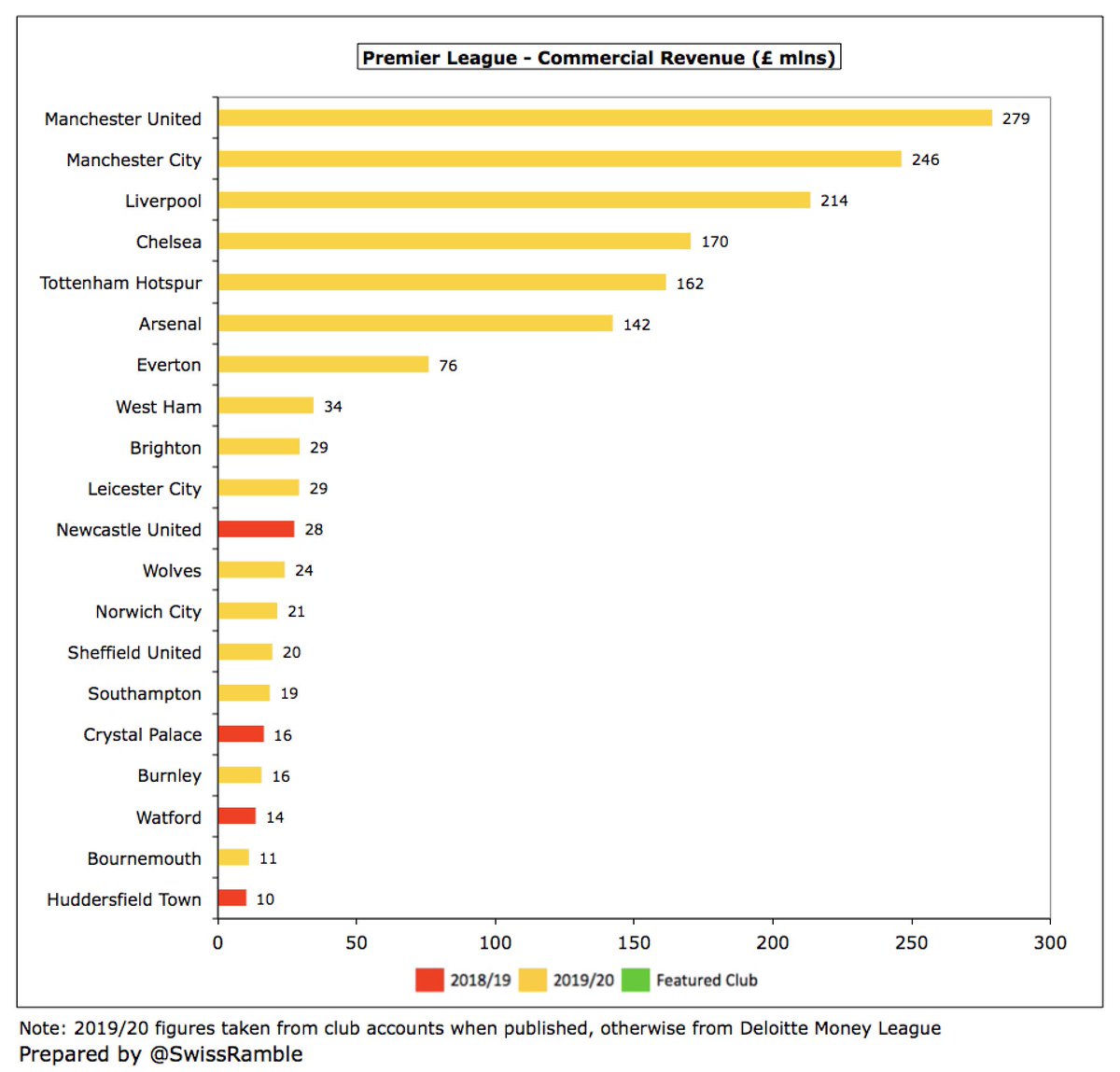

#LUFC will earn much more TV revenue in the Premier League, e.g. current 11th place gives around £120m based on 2018/19 distribution. Figures for 2019/20 have not been published, but should be higher (before any COVID rebate) with each league place worth around £3m.

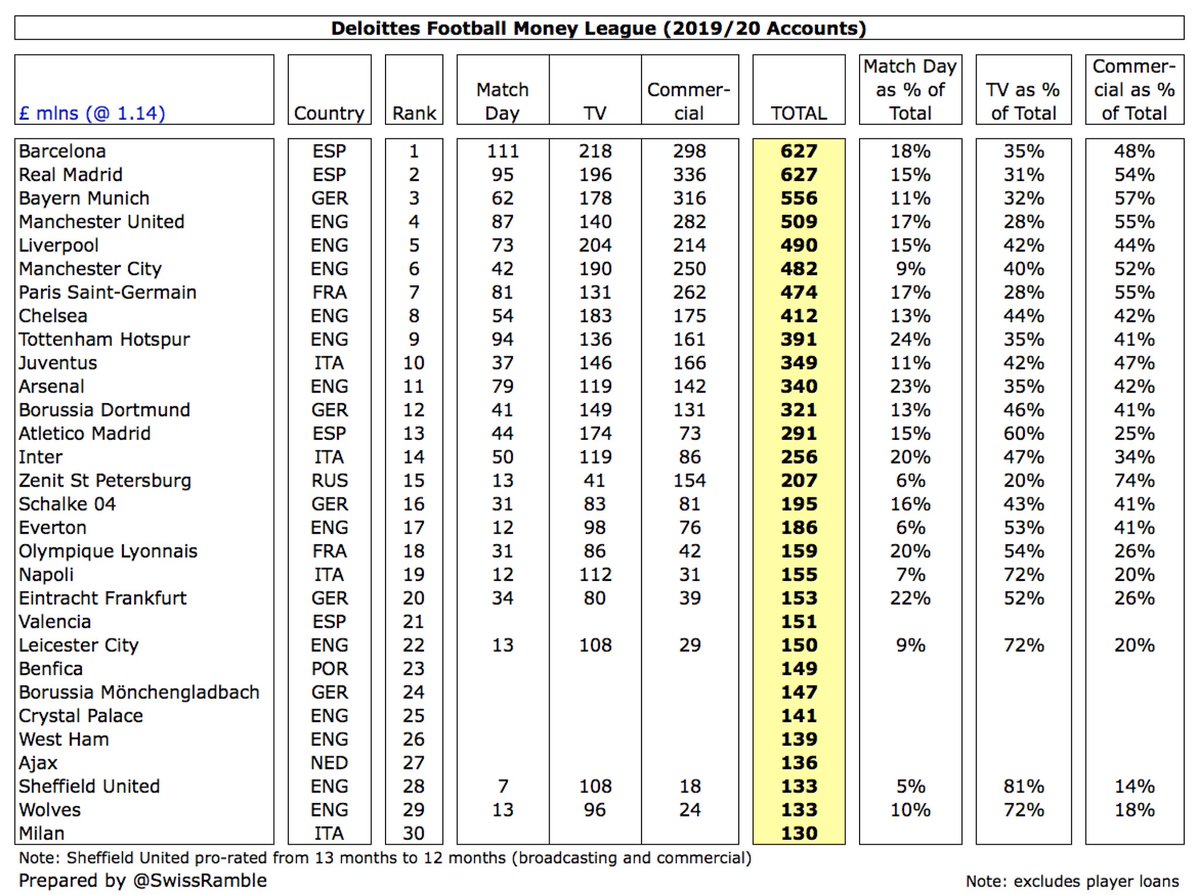

As a result, #LUFC revenue this season could increase from £54m to around £160m. Would have been even higher without COVID, which Radrizzani estimates has cost £30-40m with no fans at games and loss of corporate/commercial business. This would place Leeds among the revenue elite.

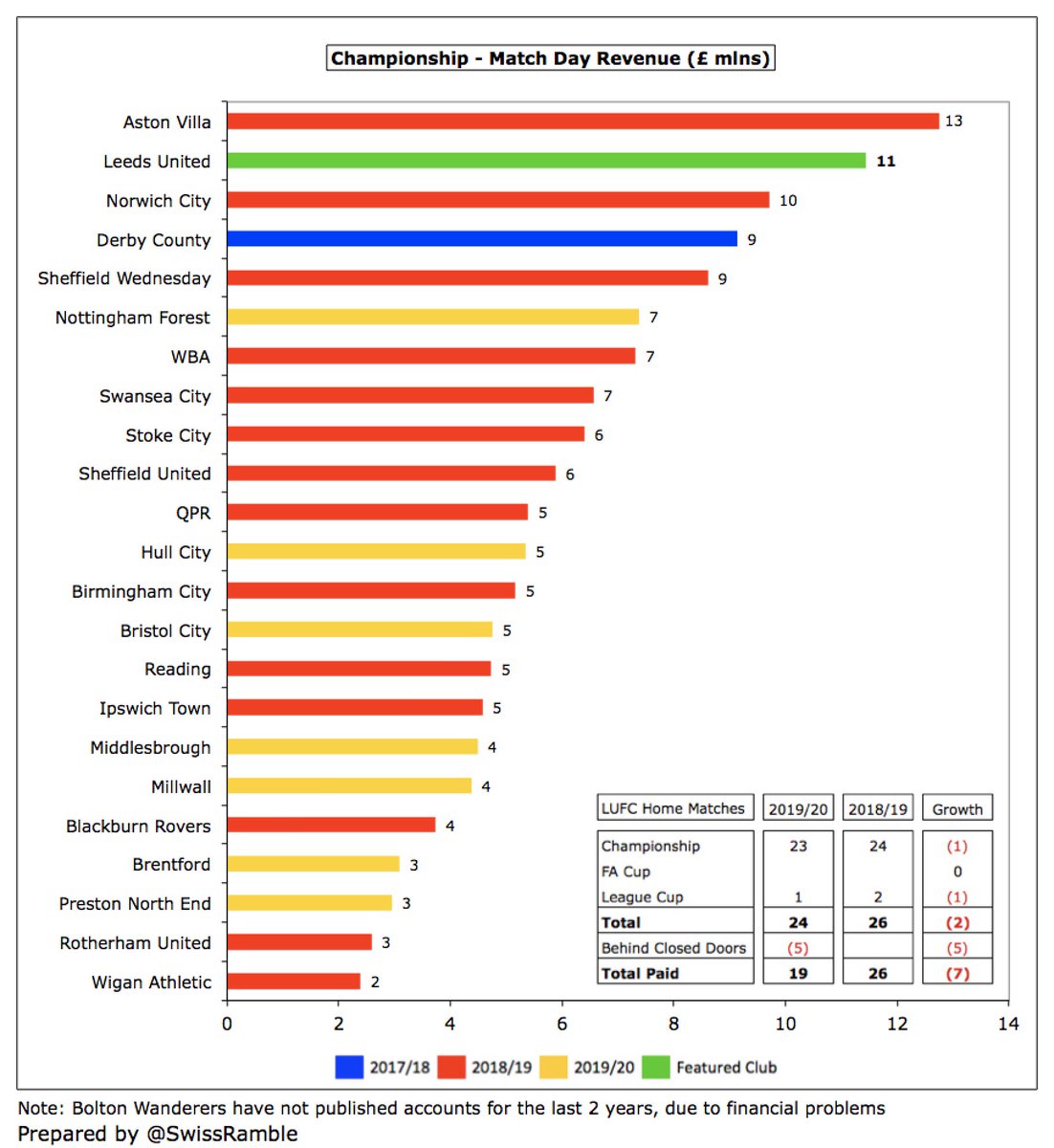

#LUFC gate receipts fell £1.2m (9%) from £12.6m to £11.4m, as 5 home games were played behind closed doors due to the pandemic, but this was still the highest match day income in the Championship in 2019/20. Season ticket prices have been frozen for nine years.

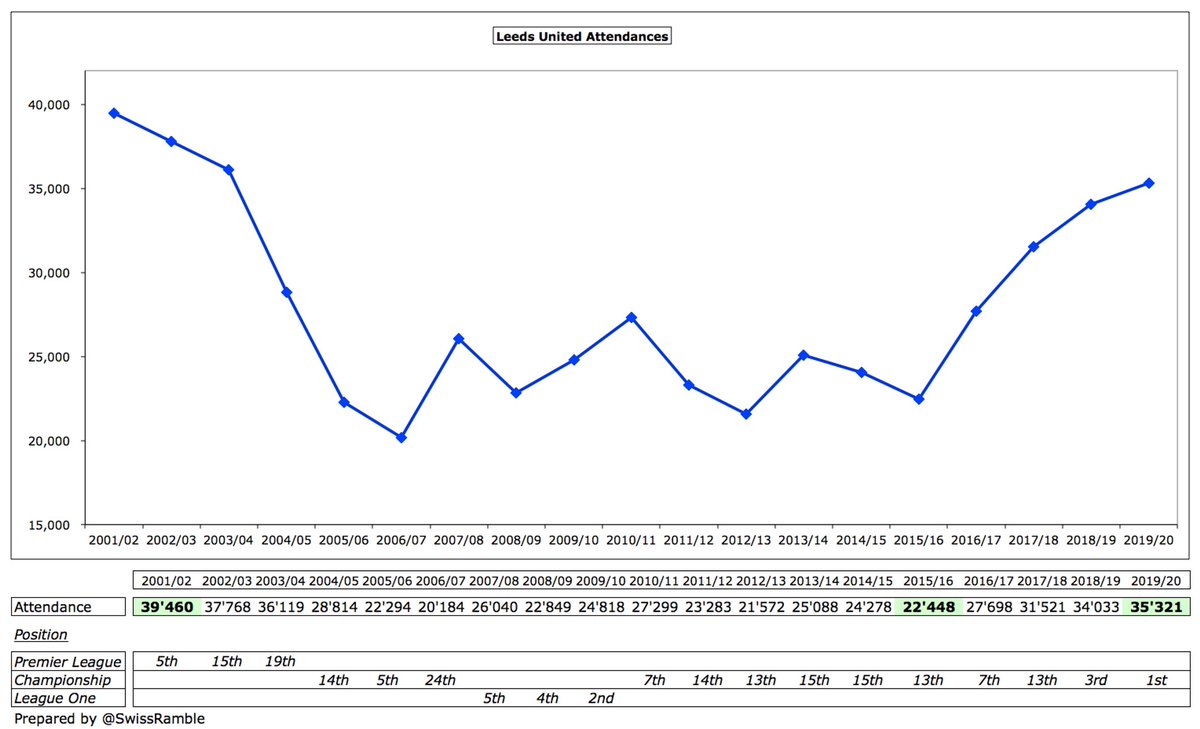

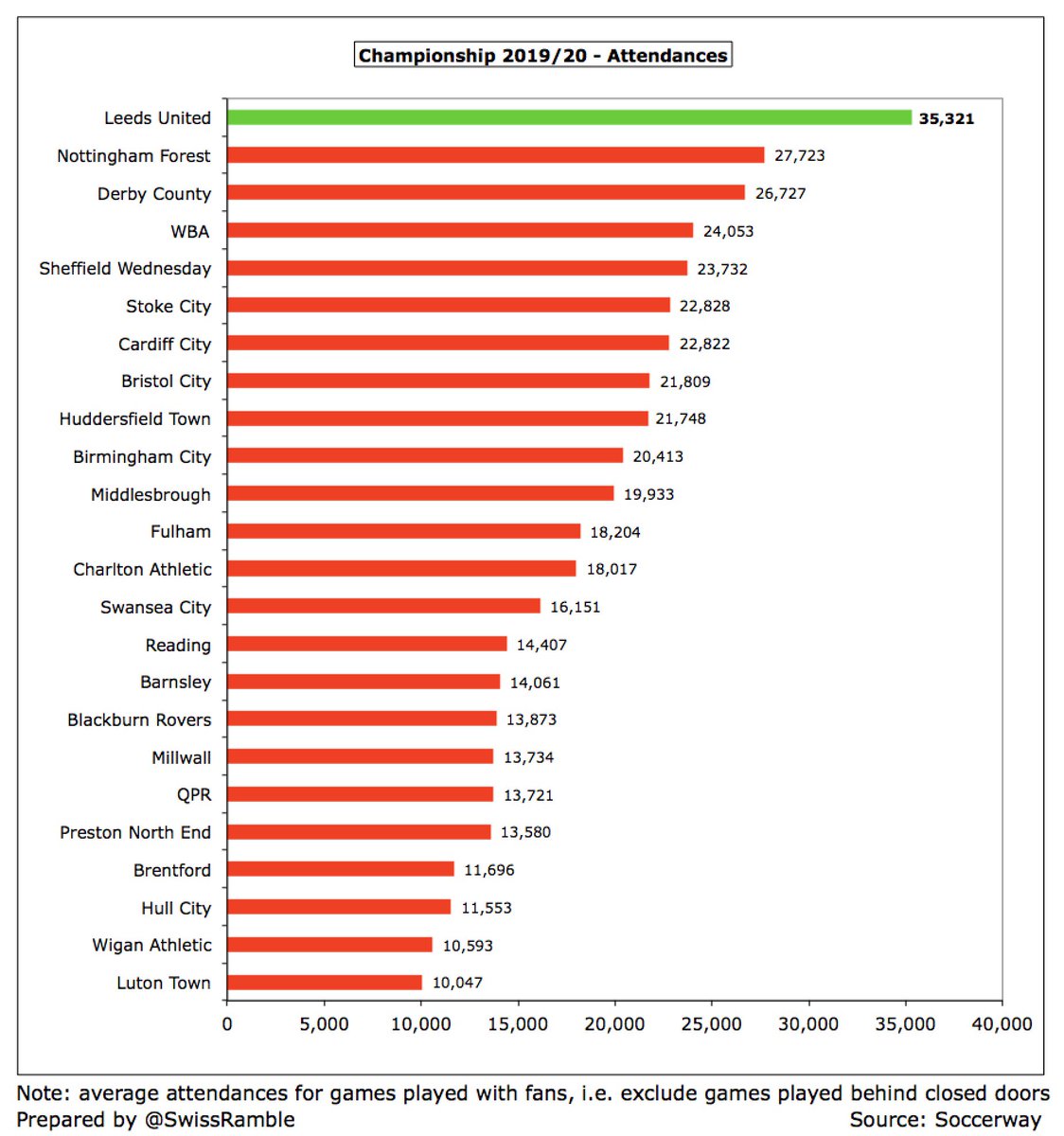

#LUFC average attendance increased from 34,033 to 35,321 (for games played with fans), which was by far the highest in the Championship, way ahead of #NFFC 27,723 and #DCFC 26,727. In fact, this is more than half of the clubs in the 2019/20 Premier League.

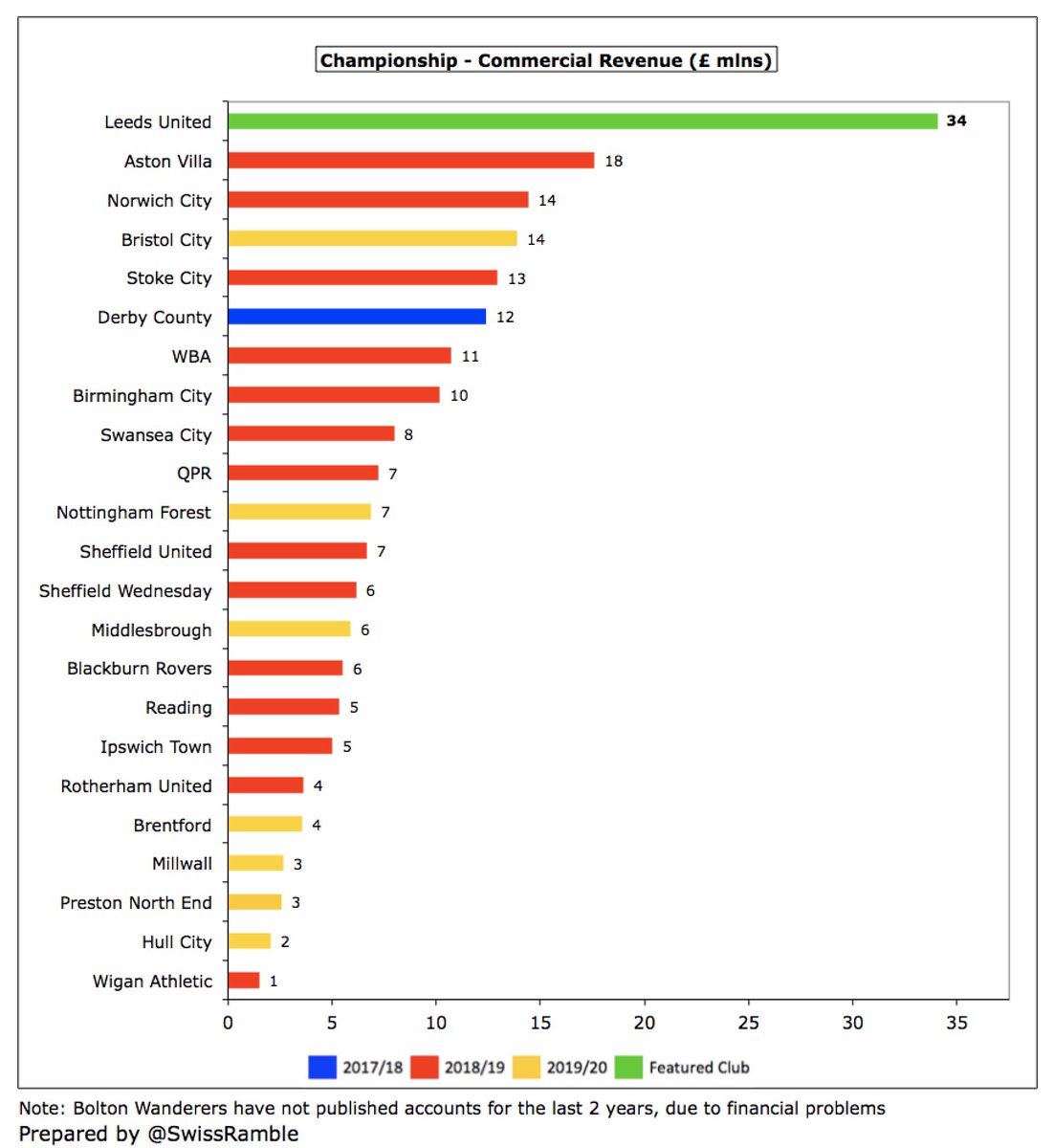

Where #LUFC have really shone is commercial income, which rose £7m (25%) from £27m to £34m, mainly driven by merchandising sales, up from £9m to £15m. This is by far the highest in the Championship and more than all but 8 clubs in the Premier League.

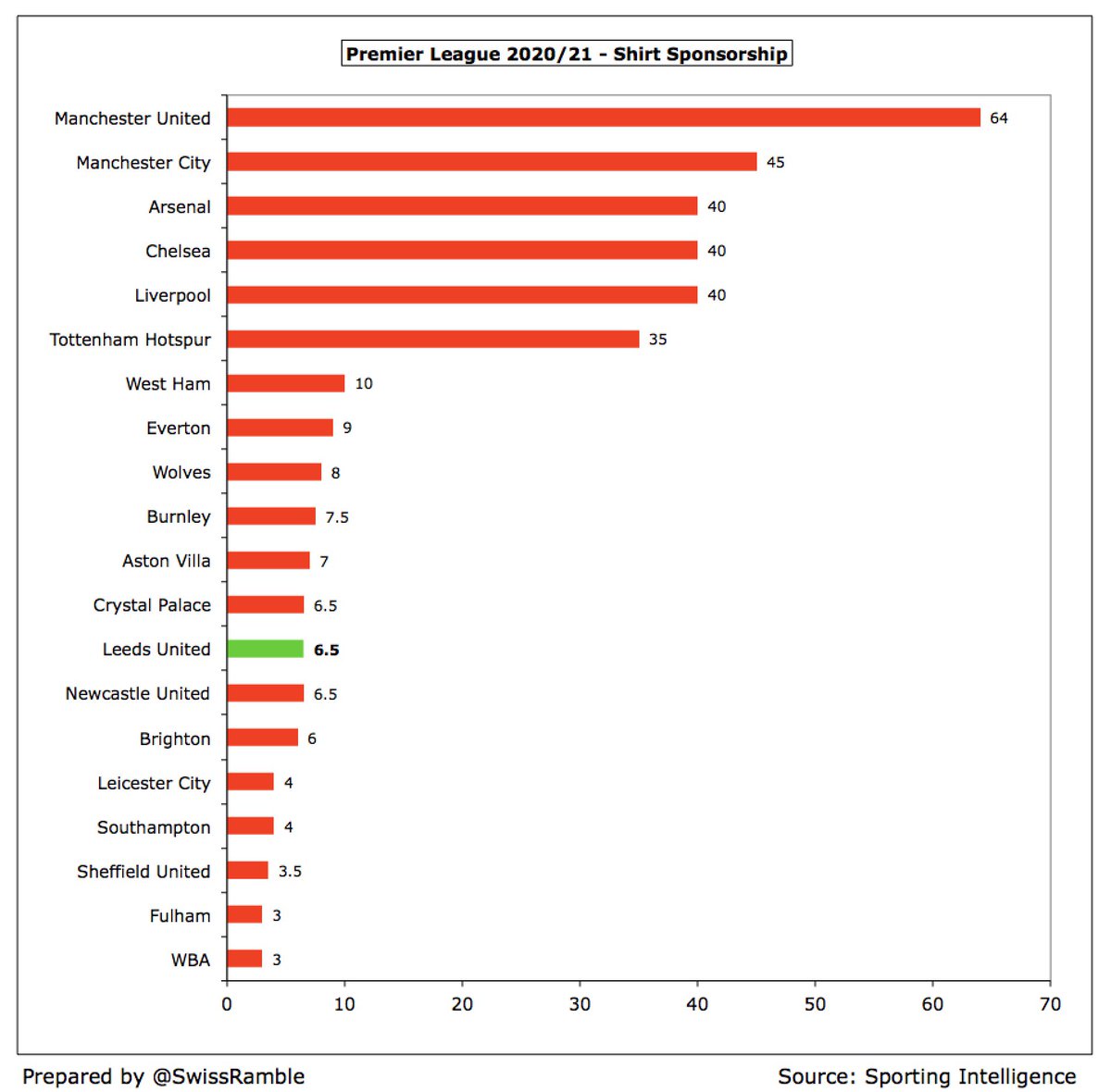

#LUFC commercial income will further rise, as lucrative new deals have been signed in 2020. SBOBET shirt sponsorship reportedly worth £6.5m a year, compared to 32Red £750k, while Adidas replaced Kappa in 5-year kit supplier deal and new training kit partnership with Clipper.

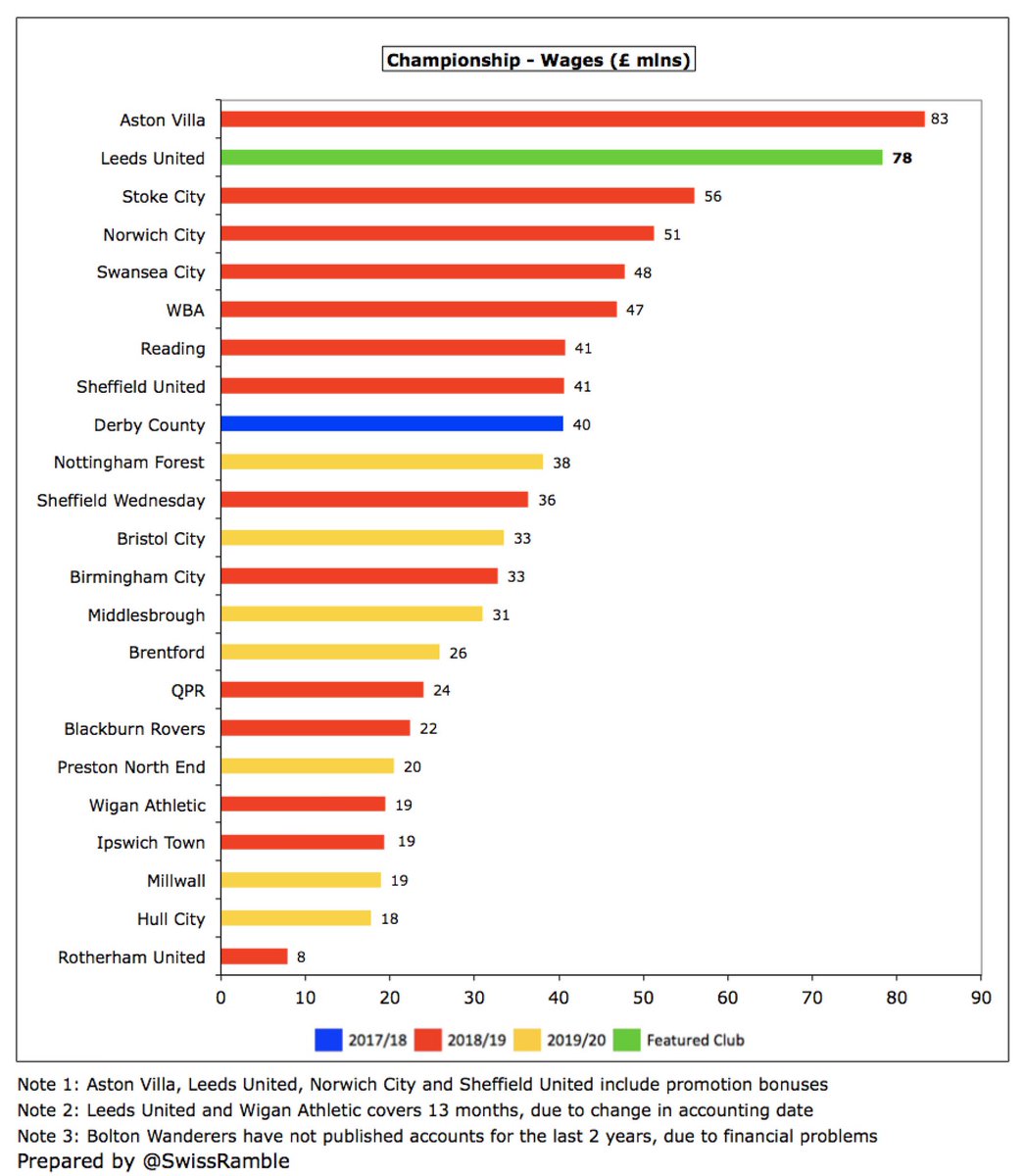

#LUFC wage bill rose significantly by £32m (70%) from £46m to £78m, including a £20m promotion bonus, which means that wages have almost quadrupled in the last 3 years, rising from £21m. Even excluding the promotion bonus, wages were pretty high at £58m.

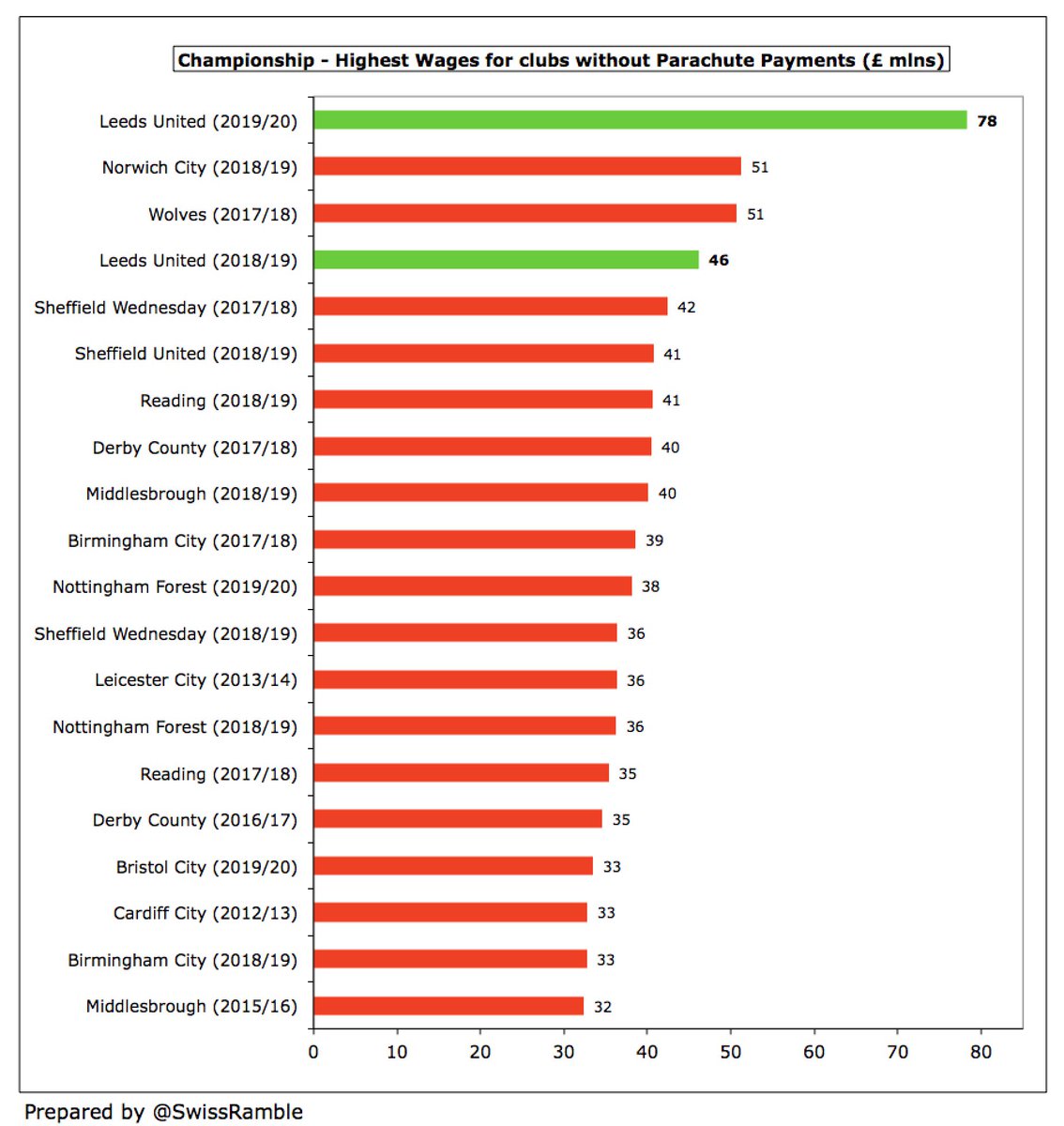

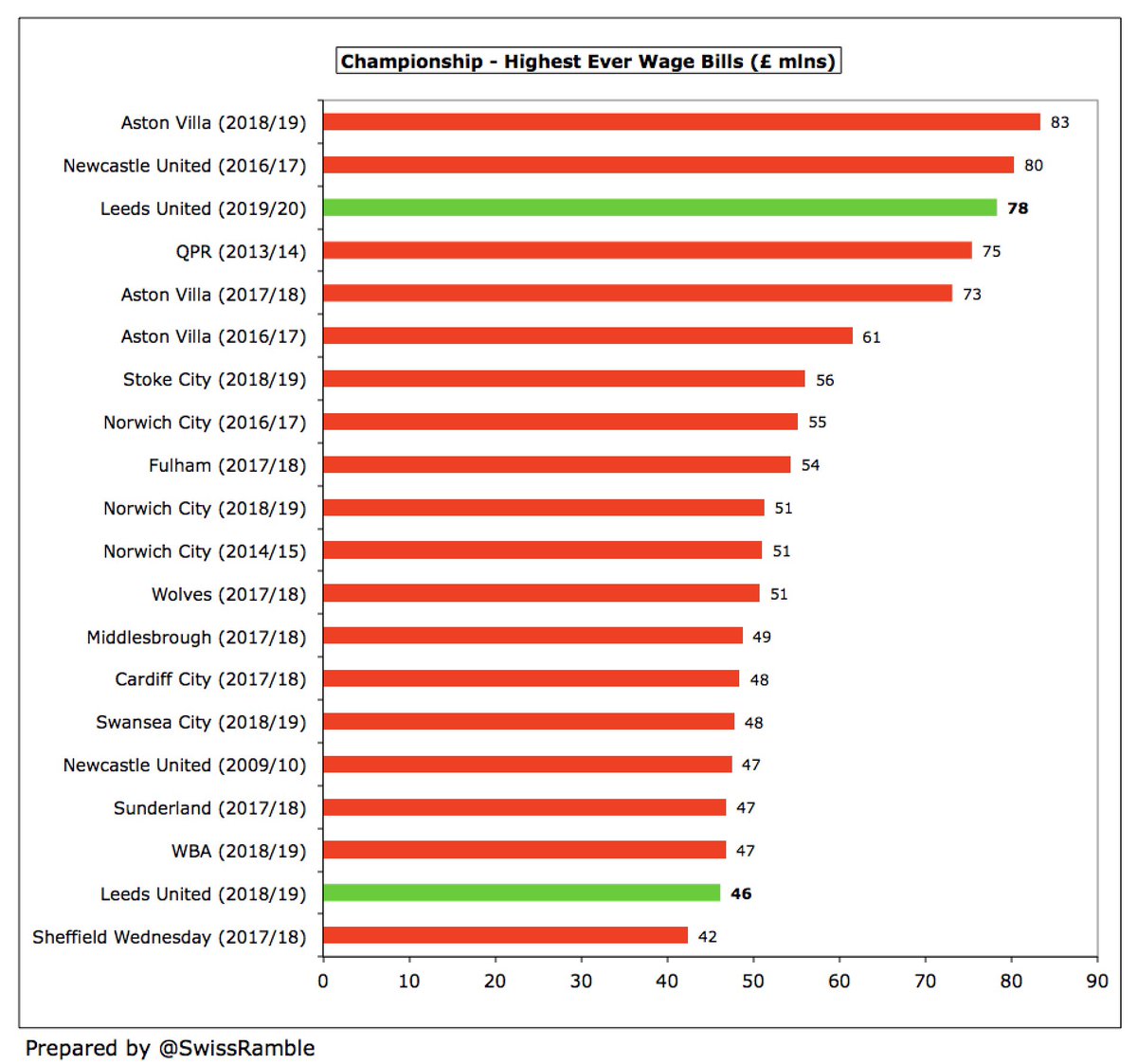

Following the increase, #LUFC £78m wage bill is by far the highest in 2019/20 Championship to date, though clubs with parachute payments have yet to publish accounts. Highest ever wages for Championship clubs without parachutes. In fact, 3rd highest ever of any Championship club.

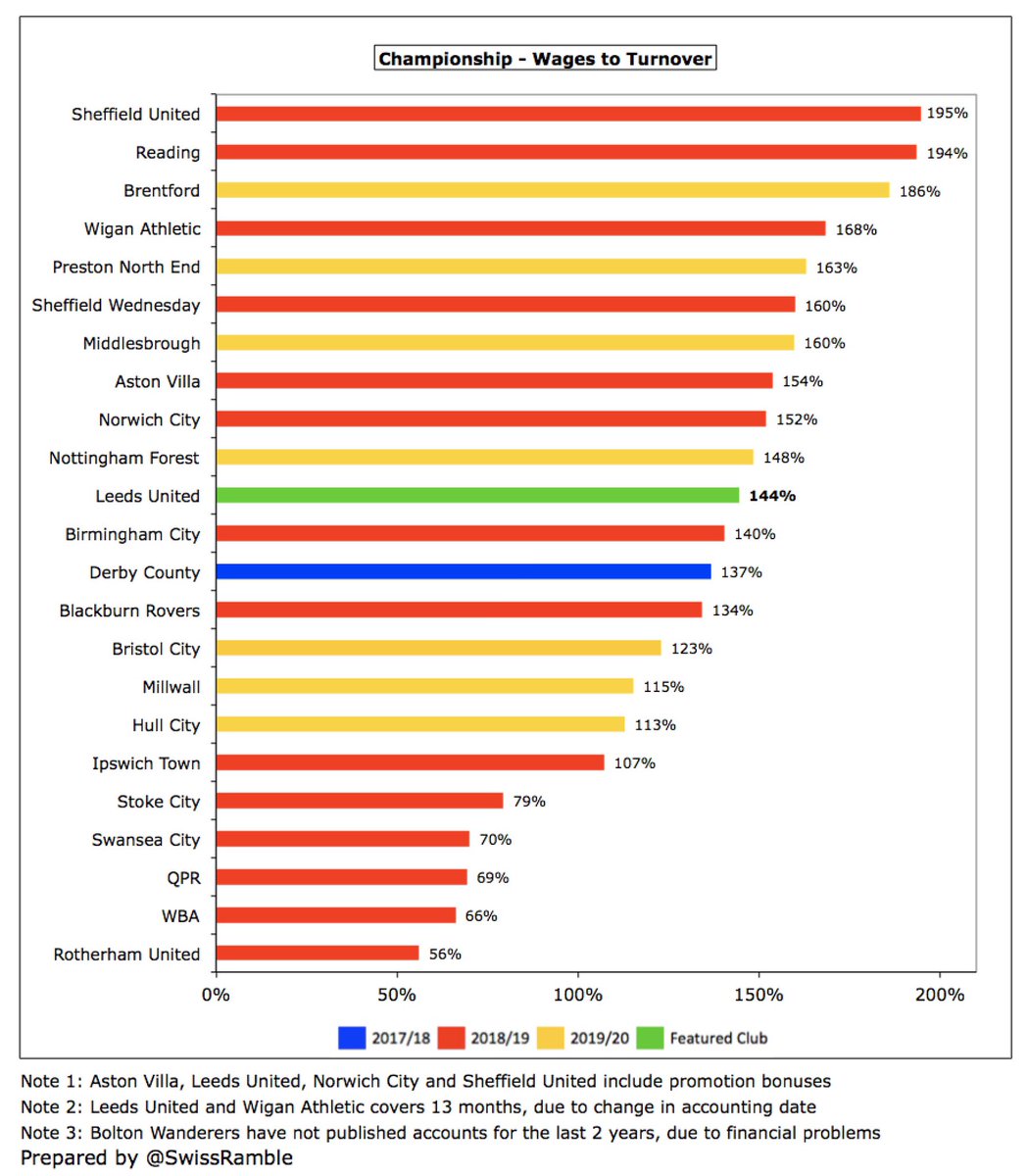

#LUFC wages to turnover ratio worsened from 94% to 144%, though this would be reduced to 108% if promotion bonus excluded. Either way, this is not desirable, but par for the course in this division, where 19 of the 24 clubs are over 100%, well above UEFA’s 70% upper limit.

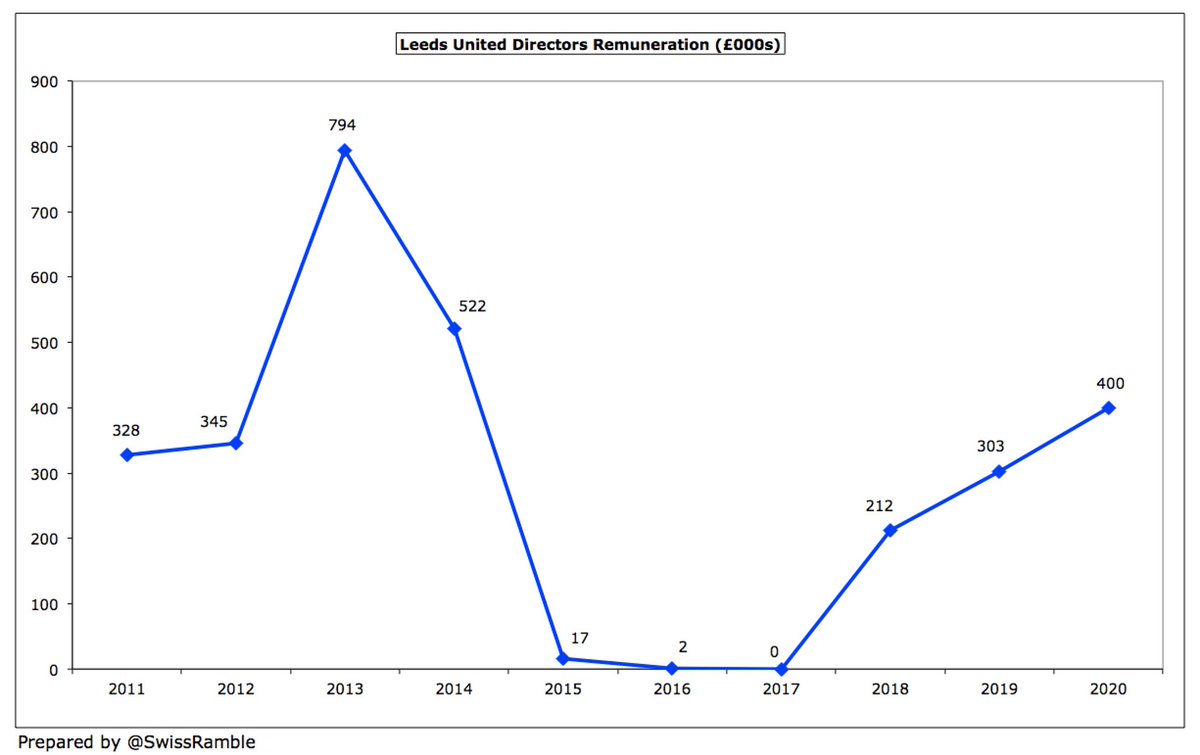

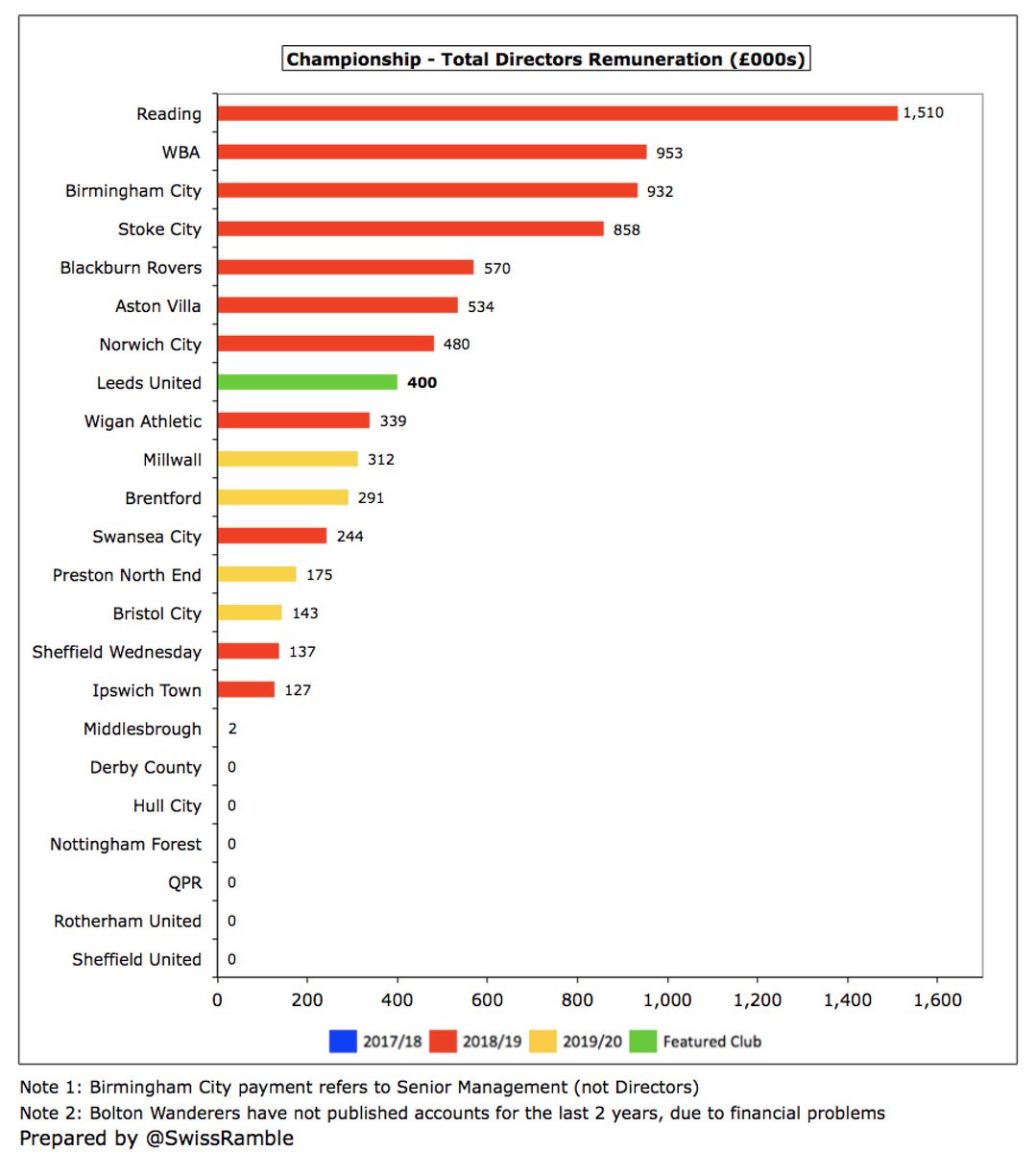

#LUFC directors’ remuneration rose from £303k to £400k, though still below the peak of £794k in 2013 during the Ken Bates/David Haigh era. Also a lot less than the likes of Reading £1.5m, WBA £953k, Birmingham City £932k and Stoke City £858k.

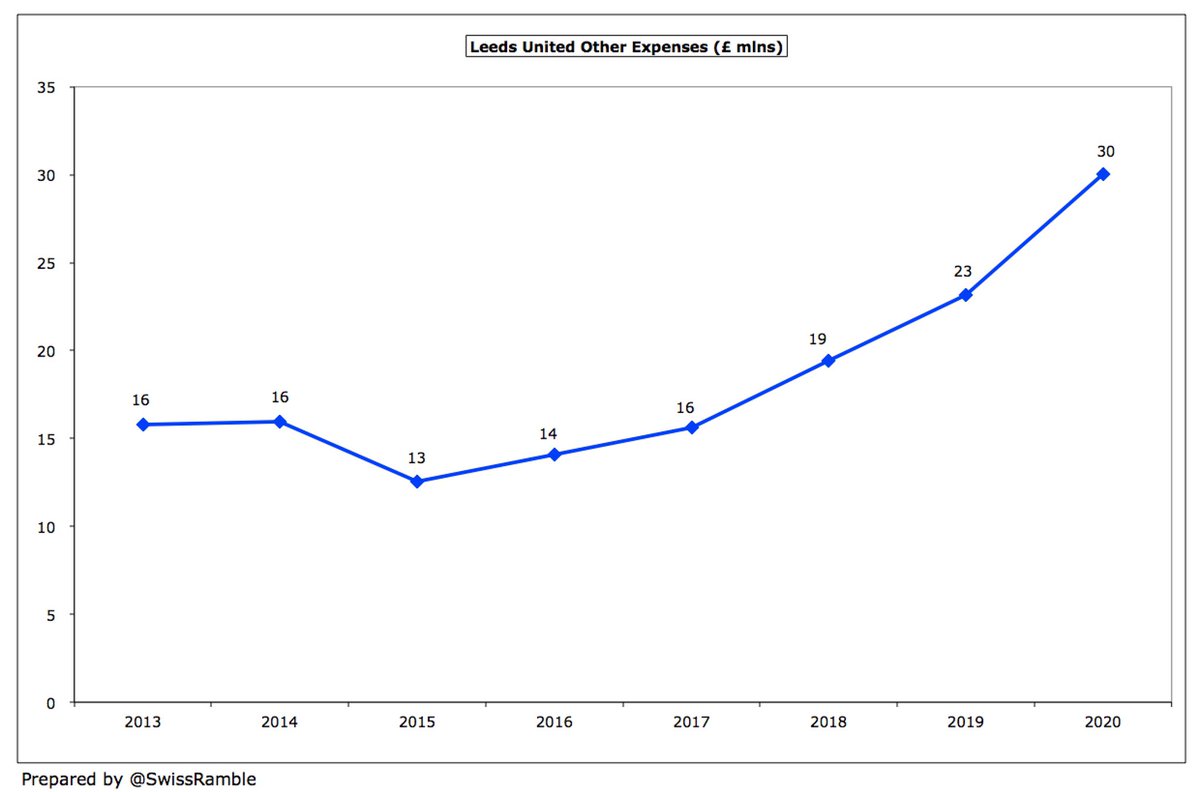

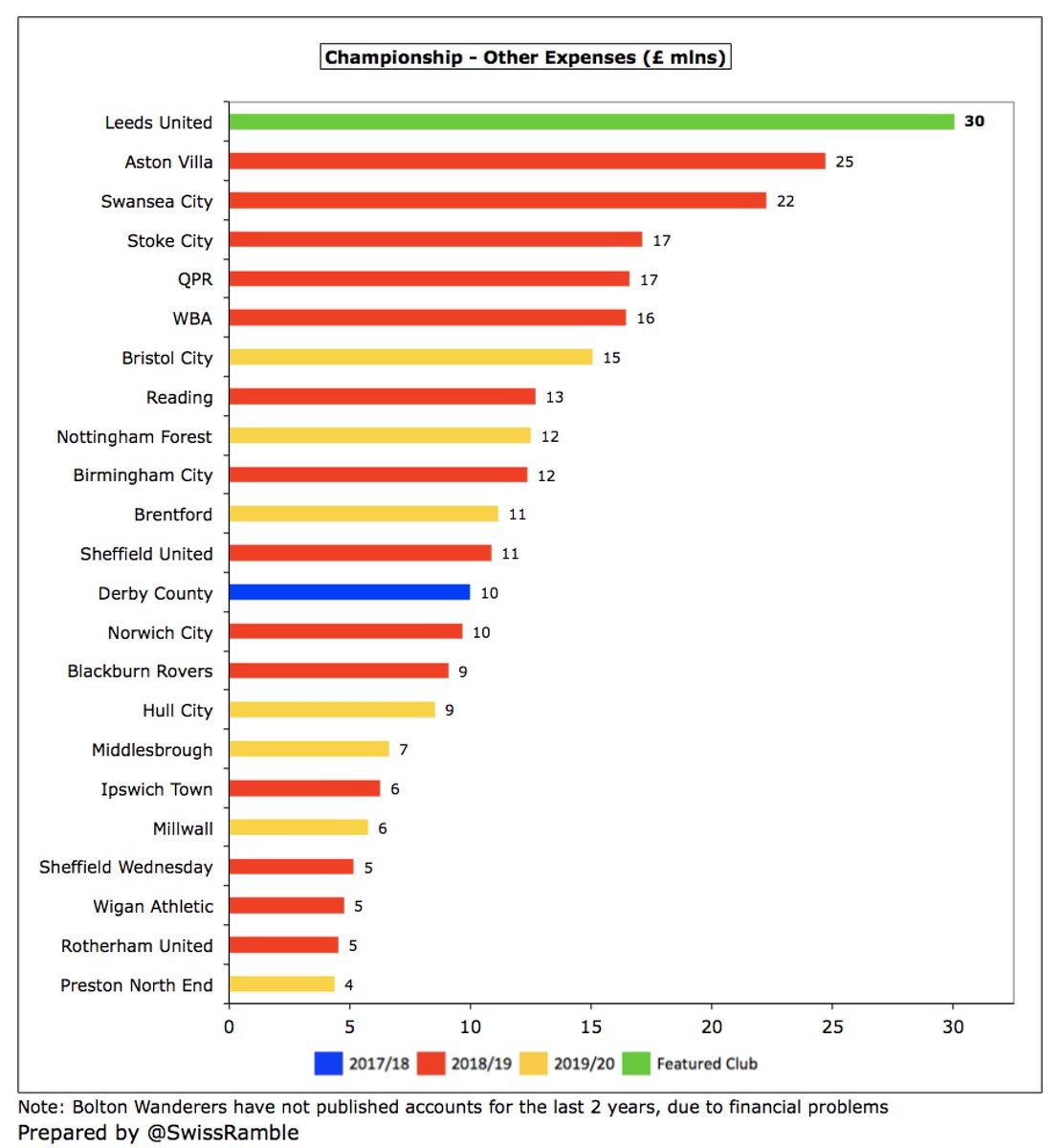

#LUFC other expenses rose £7m (30%) to £30m, which was the highest in the Championship, including £2.2m debtor write-off. In June 2017 Radrizzani bought back Elland Road stadium, leased from another group company until 2032 with annual rent of around £1.5m.

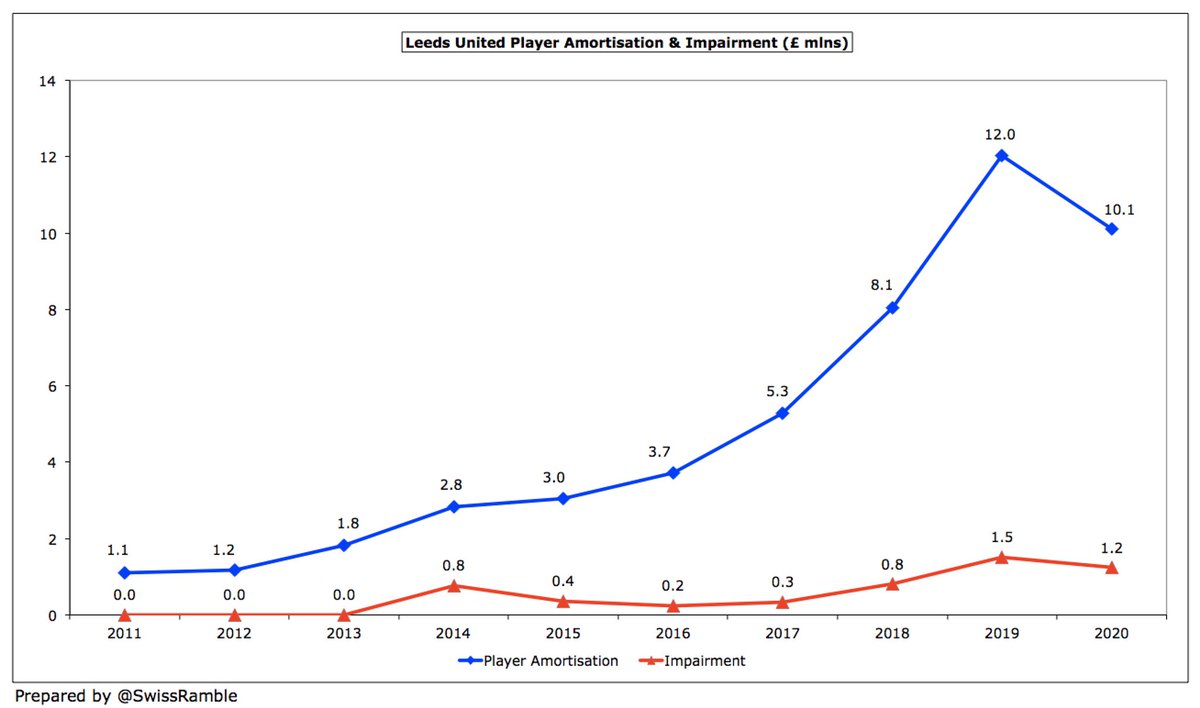

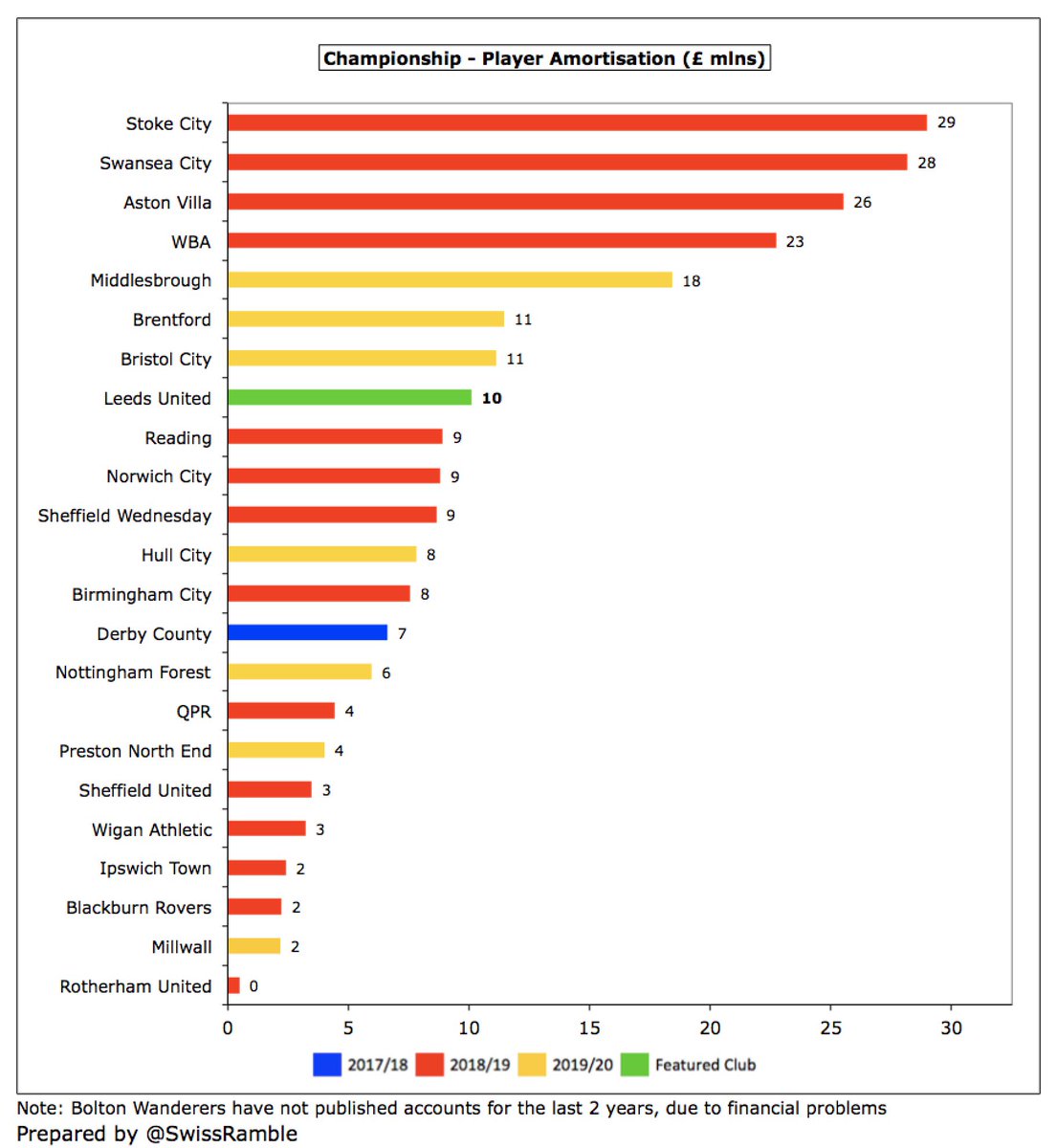

#LUFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, fell £1.9m (16%) from £12.0m to £10.1m, though still towards the upper end of the Championship. Also booked £1.2m of impairment (write-down of player values).

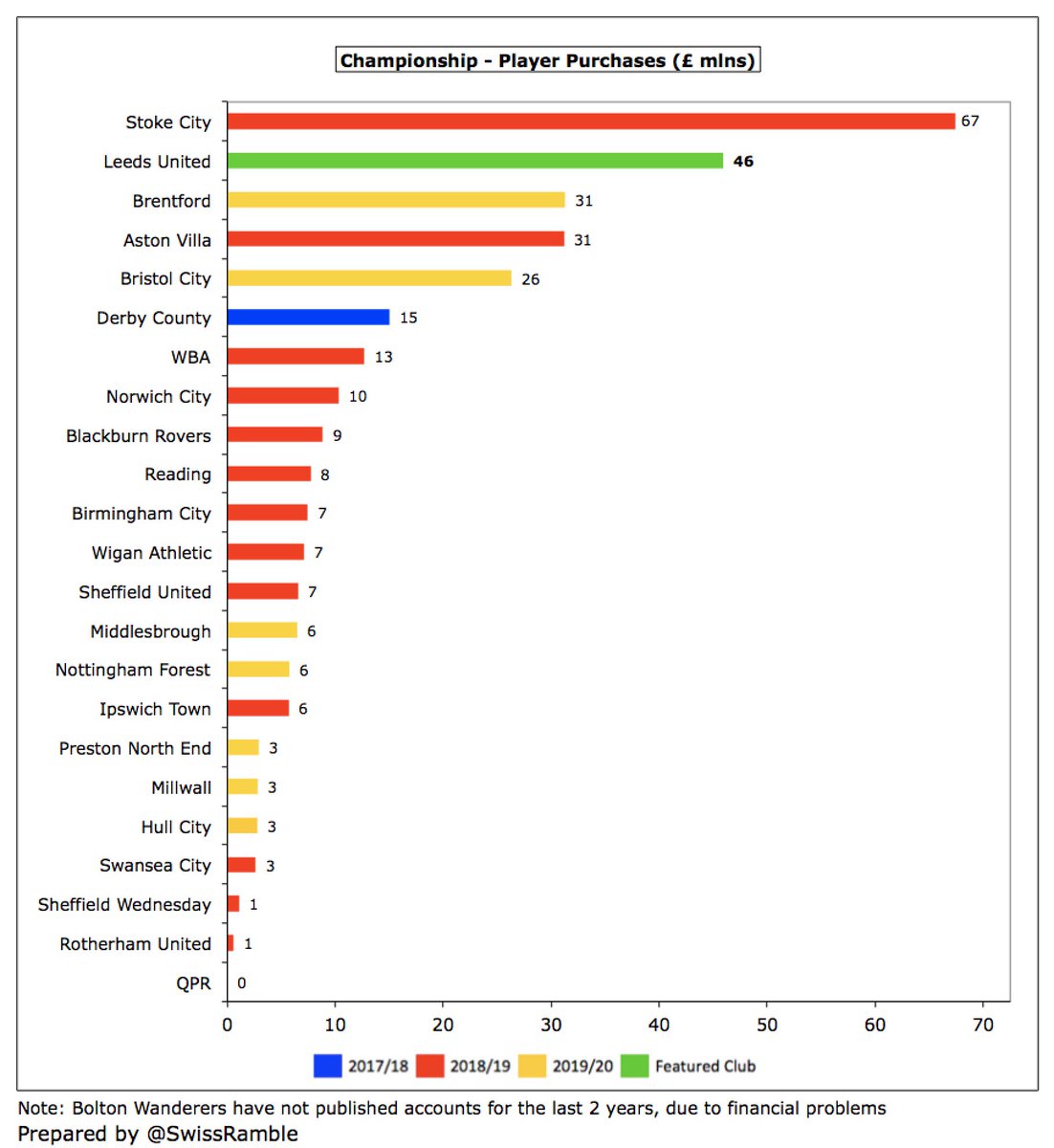

#LUFC spent £46m on player purchases per the accounts, which seems quite high, given the large number of loanees, though potentially includes making permanent the signings of Helder Costa from #WWFC and Illon Meslier from Lorient. Highest to date in 2019/20 Championship.

Radrizzani has loosened the purse strings at #LUFC since his arrival, averaging £30m gross spend in the last 3 years. Many loans in 2019/20, including Costa, Meslier, White, Harrison and Nketiah. Spent big since promotion to bring in Rodrigo, Llorente, Rapinha and Koch.

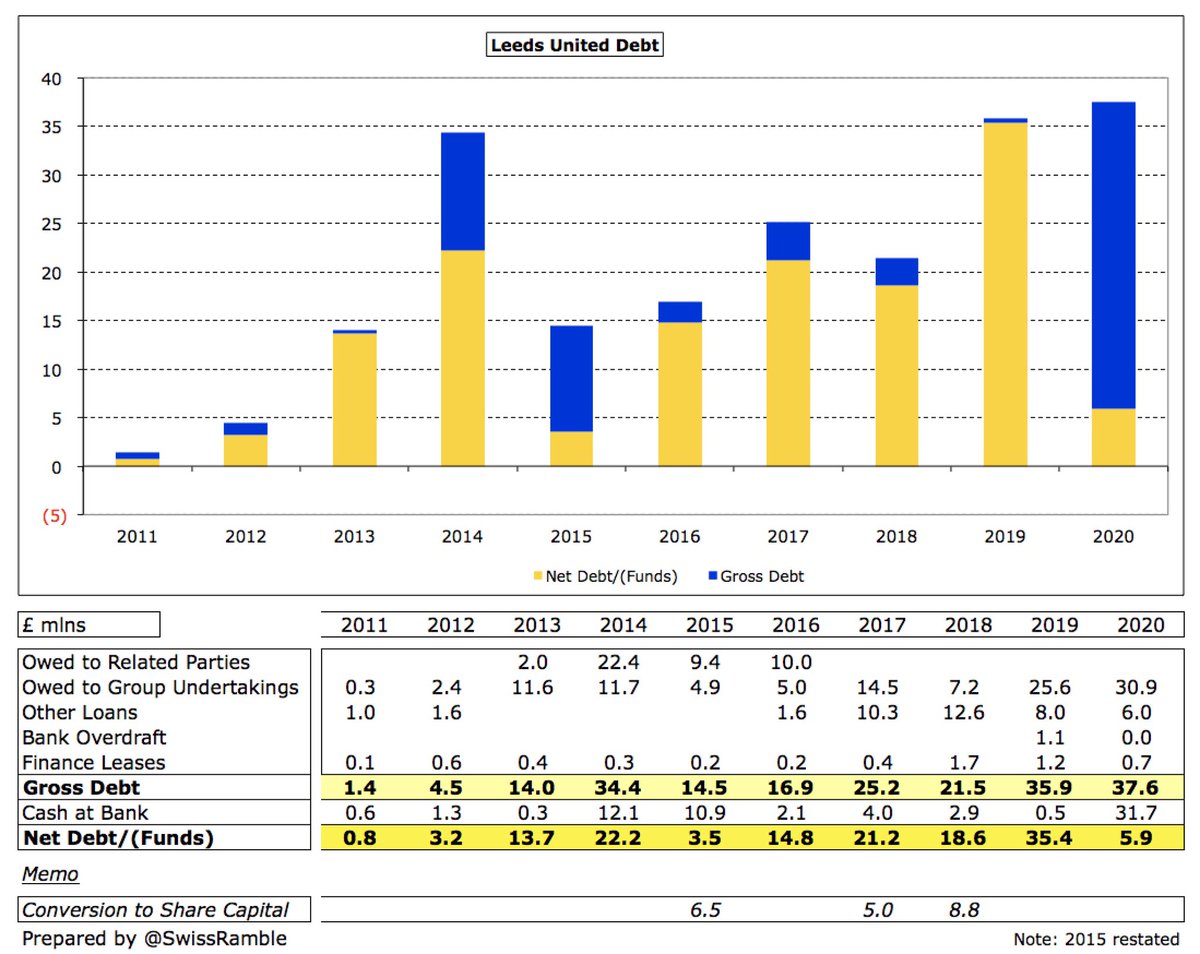

#LUFC gross debt rose £2m from £36m to £38m, including £31m from Radrizzani, £6m other loans (presumably former owner GFH) and £1m finance leases. This would have been higher without the owners converting £20m of debt to capital in the last six years.

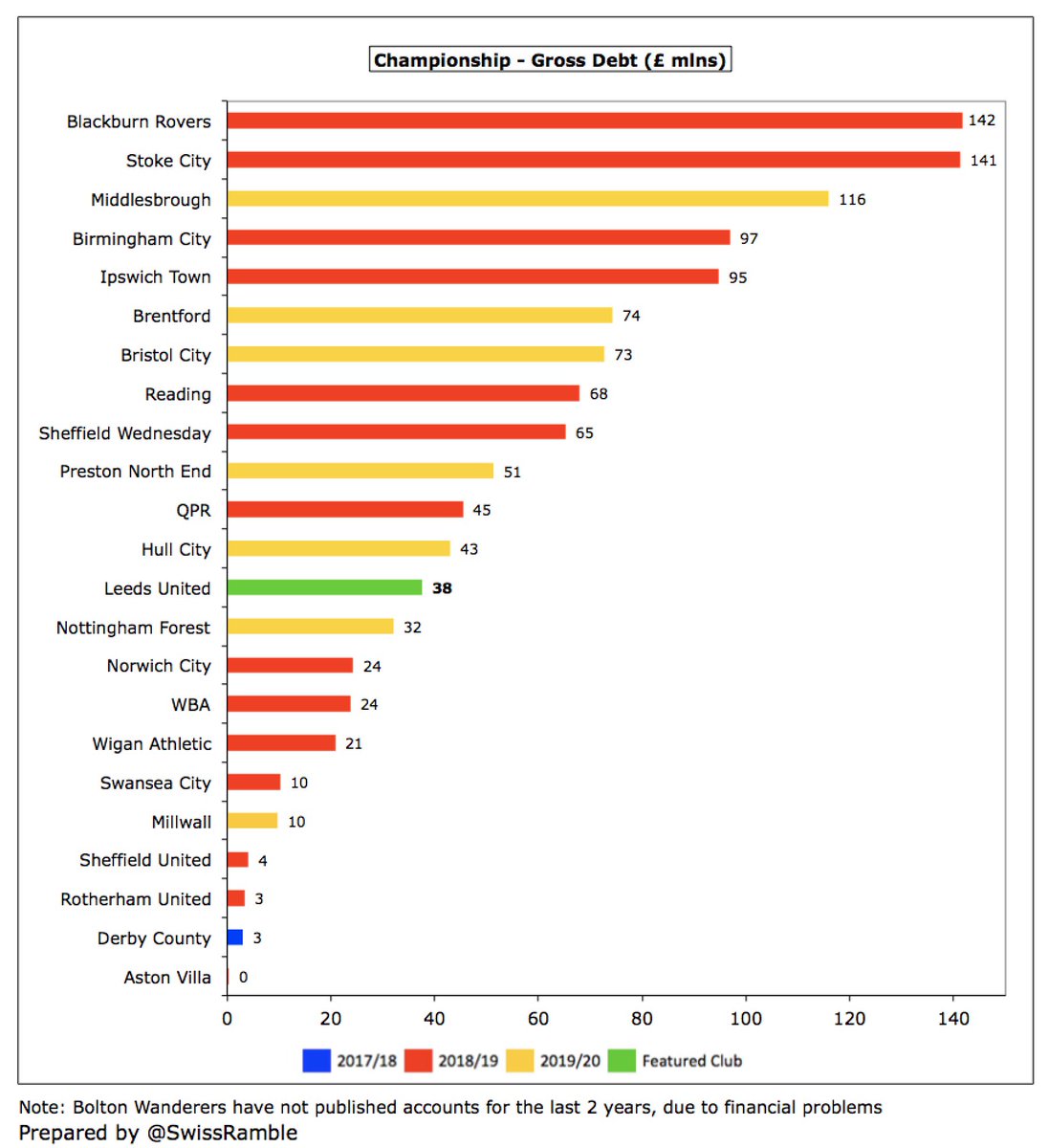

#LUFC £38m debt is pretty low for the Championship, far below the likes of #BRFC £142m, Stoke City £141m and #Boro £116m. . However, almost all debt in this division has been provided interest-free by the clubs’ owners, so is of the “soft” variety.

After these accounts were closed, Radrizzani converted £3m and $5m of debt into share capital, while an old £4m loan from a former owner was repaid. In addition, #LUFC took out a £43m loan, secured on future TV money, to fund the summer spend in the transfer market.

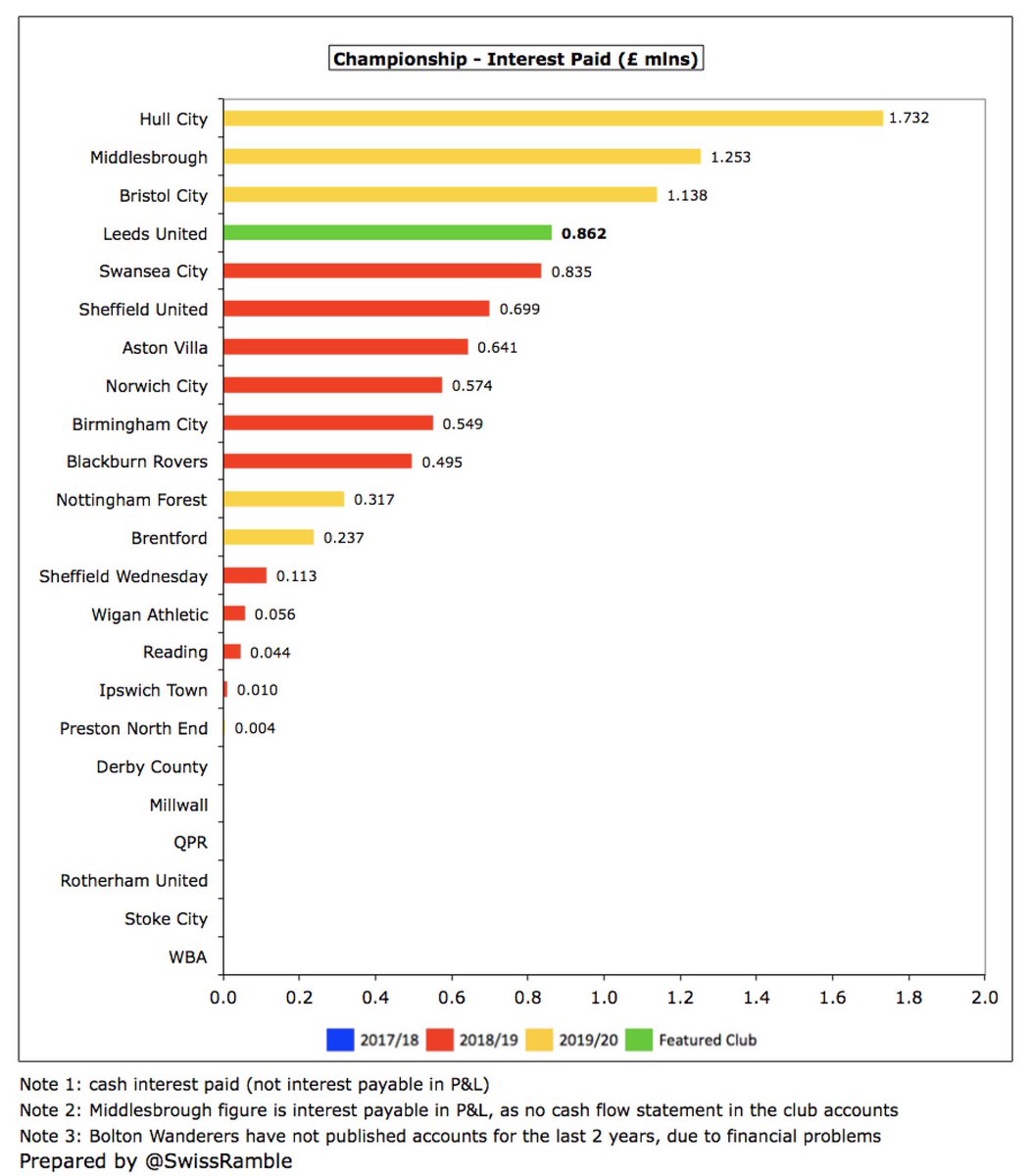

#LUFC interest payment fell from £908k to £862k, though this was 4th highest in the Championship. Although many Championship clubs have a lot of debt, very little interest is actually paid, e.g. only 3 clubs over £1m: Hull City £1.7m, Middlesbrough £1.3m and Bristol City £1.1m.

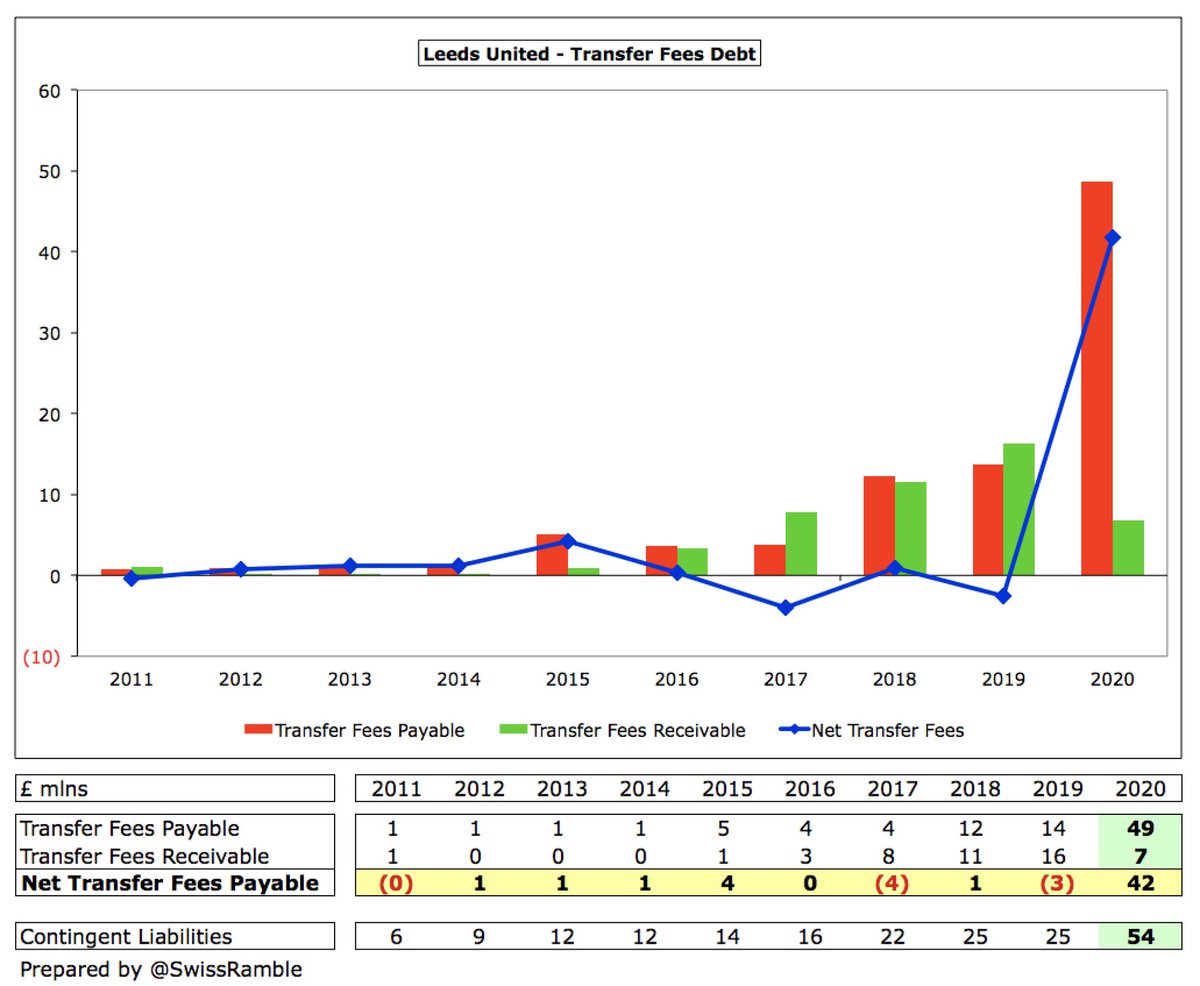

#LUFC transfer debt (for remaining stage payments on transfer fees) increased from £14m to £49m. Owed £7m by other clubs, so £42m net payable. Retention of Premier League status could cost an amazing £54m (£35m bonuses plus £18m additional transfer fees).

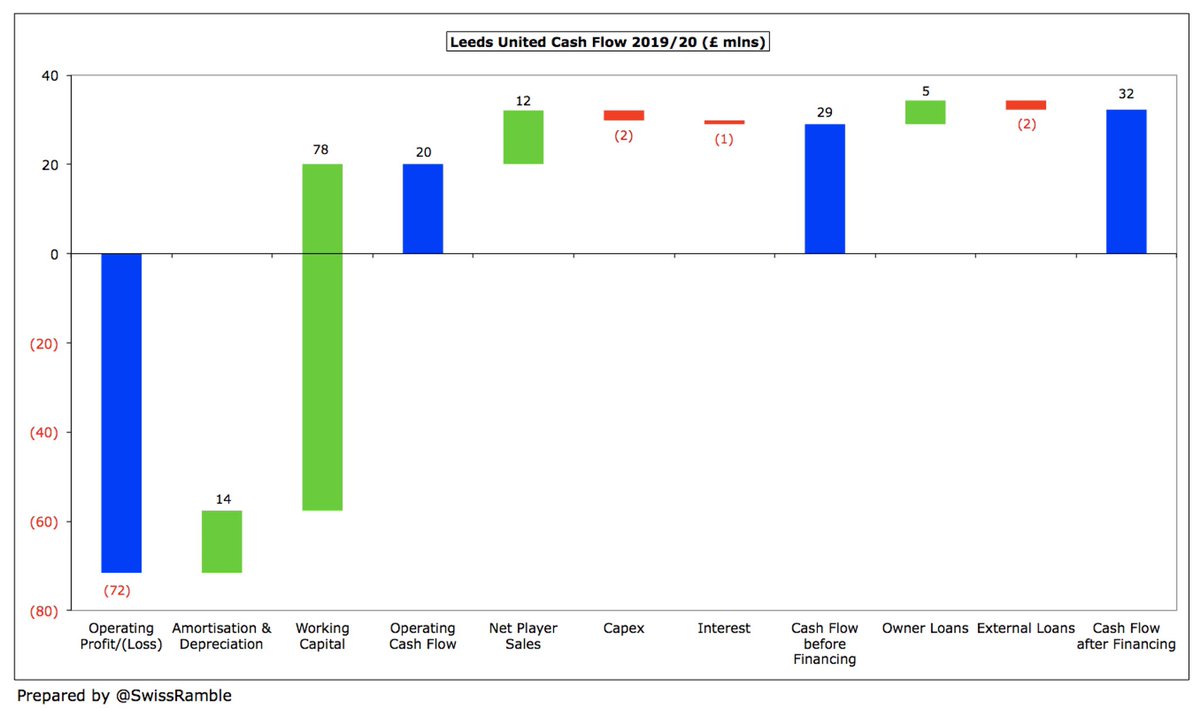

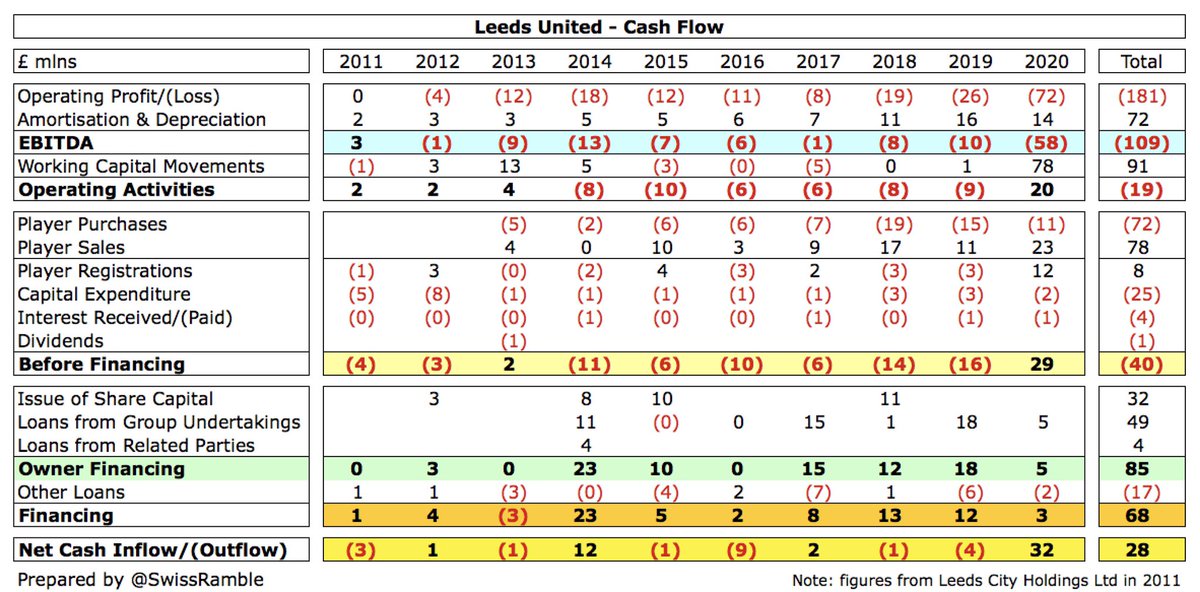

#LUFC £72m operating loss improved to £20m cash flow by adding back £14m amortisation/depreciation and £78m working capital movements. Boosted by £12m net player sales (sales £23m, purchases £11m) and £5m owner loan. Spent £2m on capex, £1m interest and repaid £2m external loans.

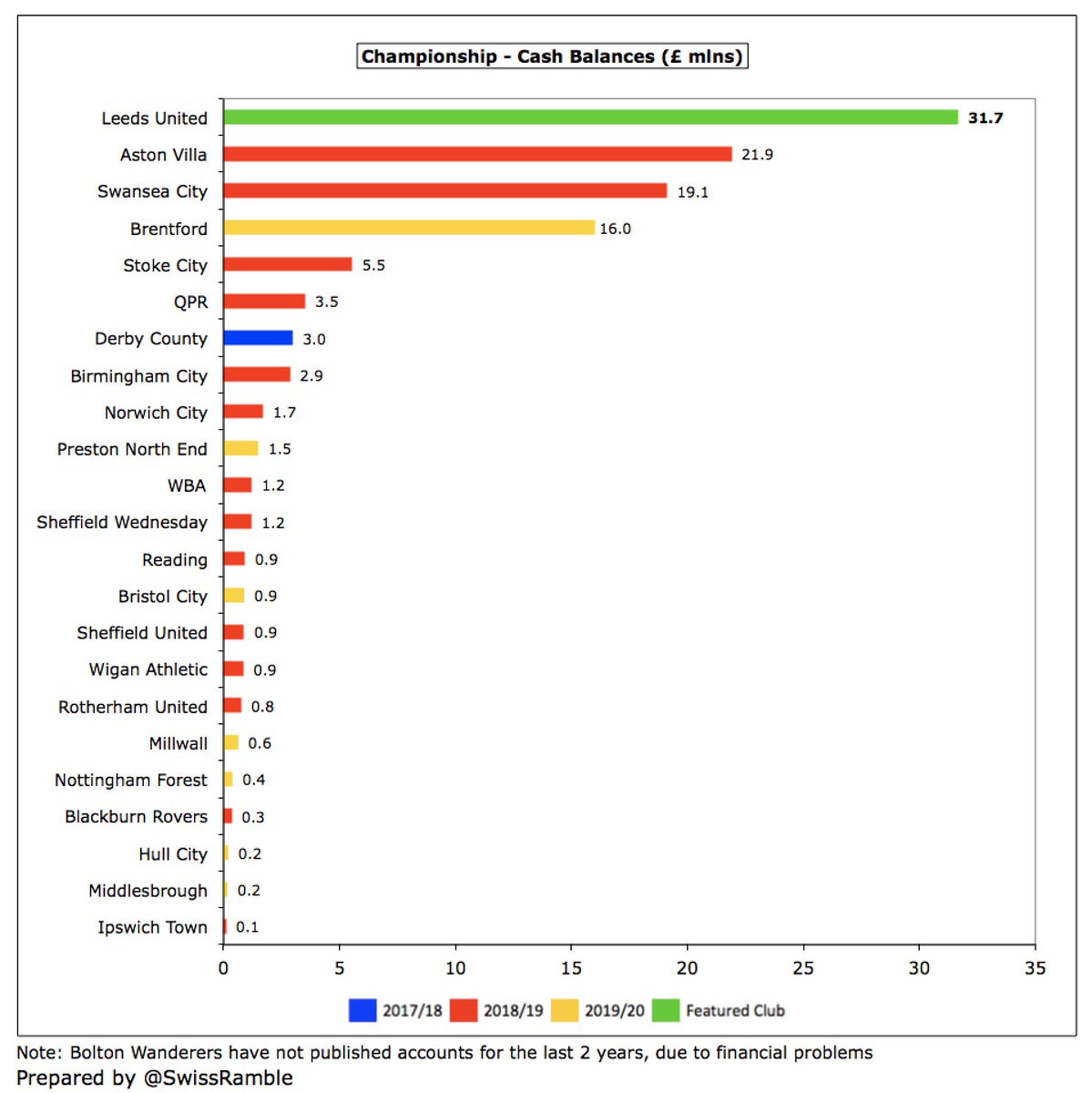

As a result, #LUFC cash balance increased to £32m, the highest in the Championship, twice as much as the next highest, Brentford. This is partly due to receiving the first tranche of Premier League TV money in advance.

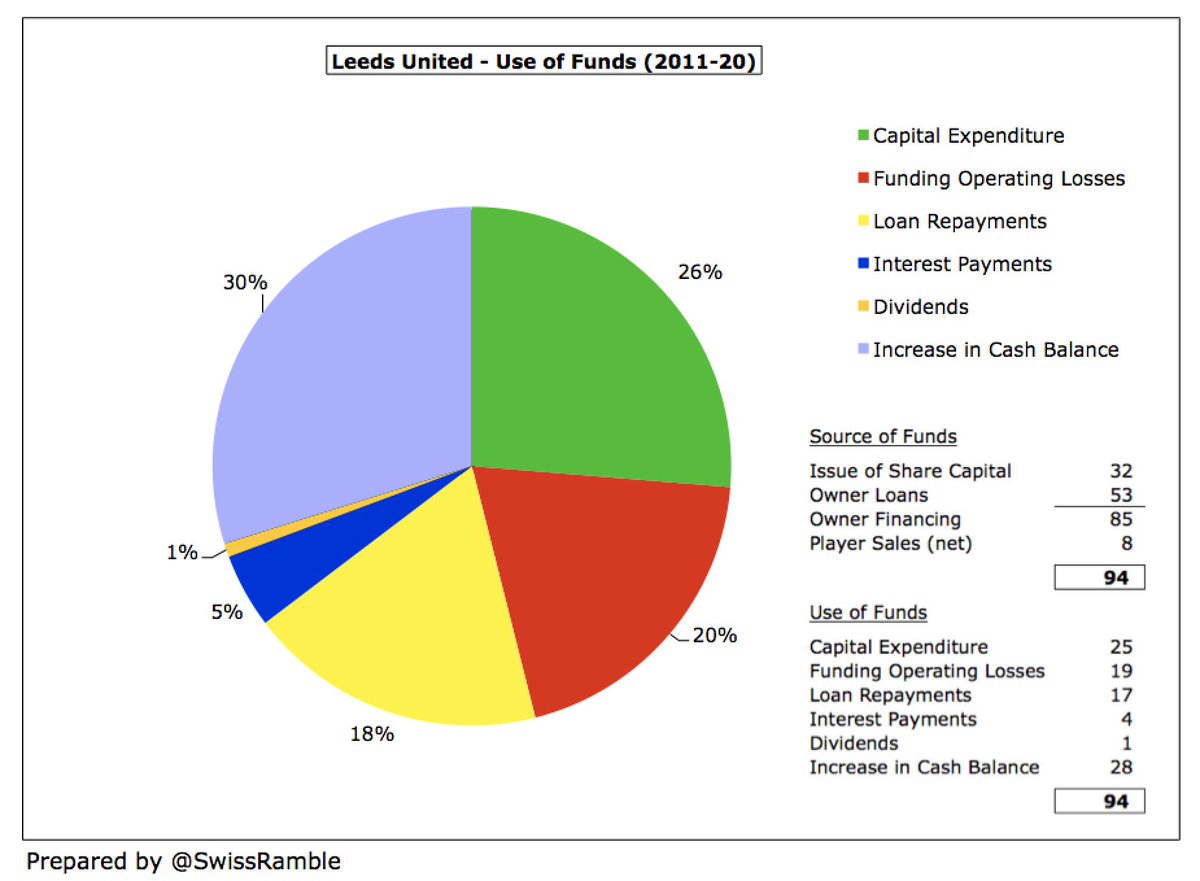

In the last decade #LUFC received £85m funding from owners (£32m share capital and £53m loans). This has mainly been spent on capital expenditure £25m, funding operating losses £19m, loan repayments, interest and dividends £22m.

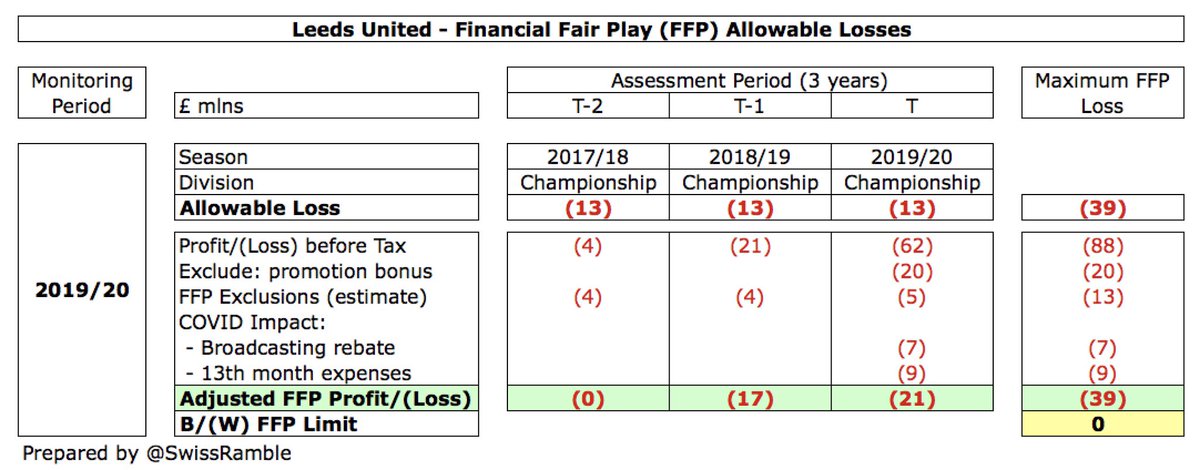

By my calculations, #LUFC just about within the FFP £39m loss over the 3-year monitoring period, as they can deduct the £20m promotion bonus, £13m allowable expenses for academy, community & infrastructure and £16m COVID impact (13th month additional expenses £9m, TV rebate £7m).

In December 20200 the San Francisco 49ers increased their stake in #LUFC from 18% to 37% after subscribing to £23m of new shares, thus boosting funds. Paraag Marathe became vice-chairman and will be “more involved in the decision-making process and day-to-day operations.”

Significant investment in the squad contributed towards the large financial loss, but #LUFC will believe that the end justifies the means, as this resulted in promotion to the Premier League. The impressive commercial growth and large fan base underlines Leeds’ future prospects.

• • •

Missing some Tweet in this thread? You can try to

force a refresh