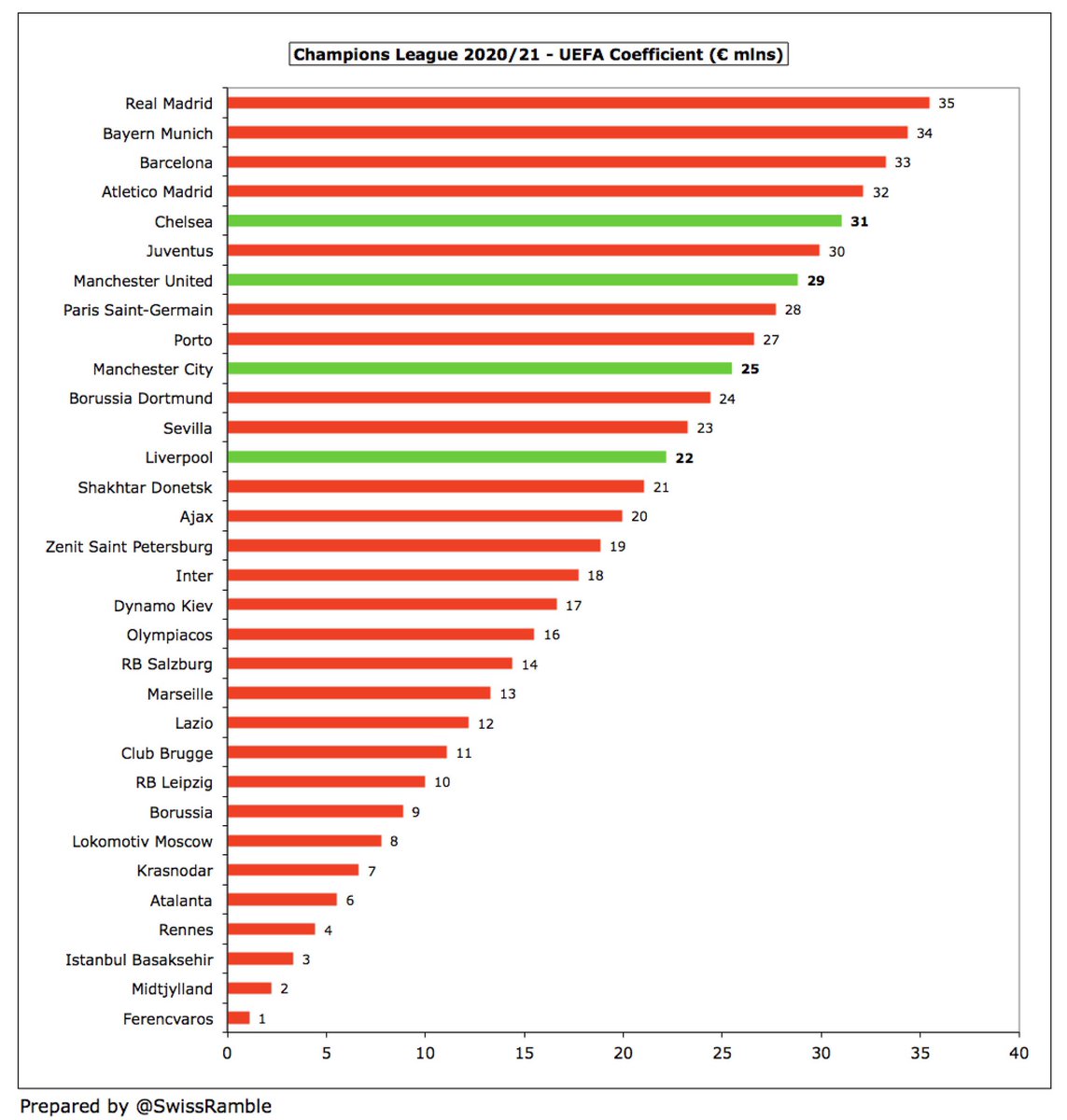

Quick look at the UEFA Champions League and Europa League 2020/21 revenue distributions for English clubs as at the quarter-final stage. Analysis of the amounts earned to date in the following thread #MCFC #LFC #CFC #MUFC #AFC #THFC #LCFC

I should emphasise that these figures are only indicative. They are based on UEFA’s revenue distribution guidelines, but also include some assumptions for the TV pool and rebates to broadcasters following losses caused by the COVID-19 pandemic.

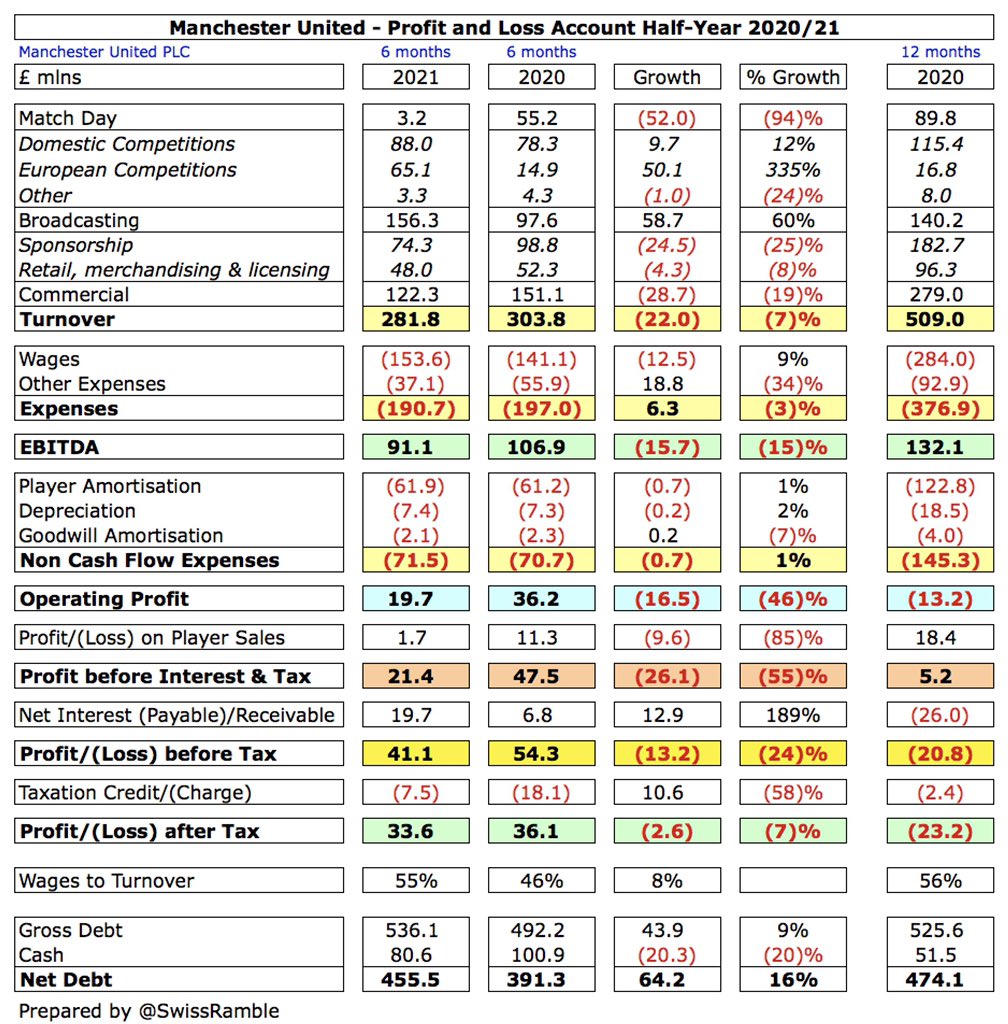

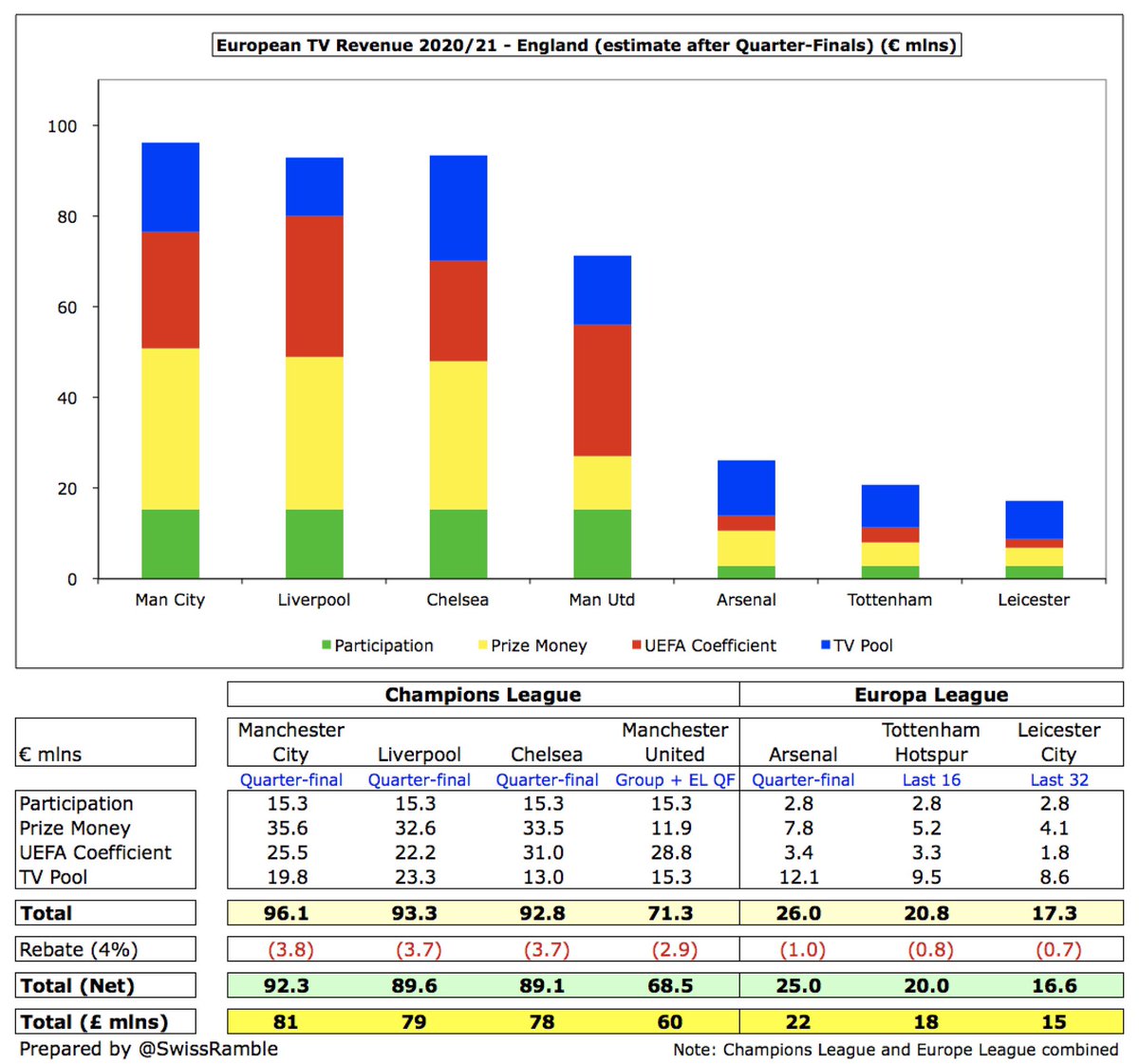

As it stands (at quarter-final stage), English clubs have earned the following amounts from Europe: #MCFC €92m, #LFC €90m, #CFC €89m, #MUFC €68m, #AFC €25m, #THFC €20m and #LCFC €17m. In the case of Manchester United, their figure is Champions and Europa League combined.

#MCFC have earned the most in the Champions League with €92.3m, comprising: participation fee €15.25m, prize money €35.6m, UEFA coefficient €25.5m and TV pool €19.8m less €3.8m rebate. #MUFC €62.8m earnings are much less than the others, as they exited at the group stage.

#AFC have earned the most in the Europa League with €25.0m, comprising: participation fee €2.75m, prize money €7.8m, UEFA coefficient €3.4m and TV pool €12.1m less €1.0m rebate. #MUFC have earned €5.9m after dropping down from the Champions League.

Each club receives a participation fee after qualifying for the group stage, though it’s much higher in the Champions League (€15.25m) compared to the Europa League (€2.75m).

#MCFC has earned most prize money of €35.6m, as they won 5 games (and drew 1) in the group for €14.4m (€2.7m for a win, €0.9m for a draw), plus €1.2m for share of draws pool, €9.5m for reaching last 16 and €10.5m for quarter-finals. #AFC earned €7.8m in Europa League.

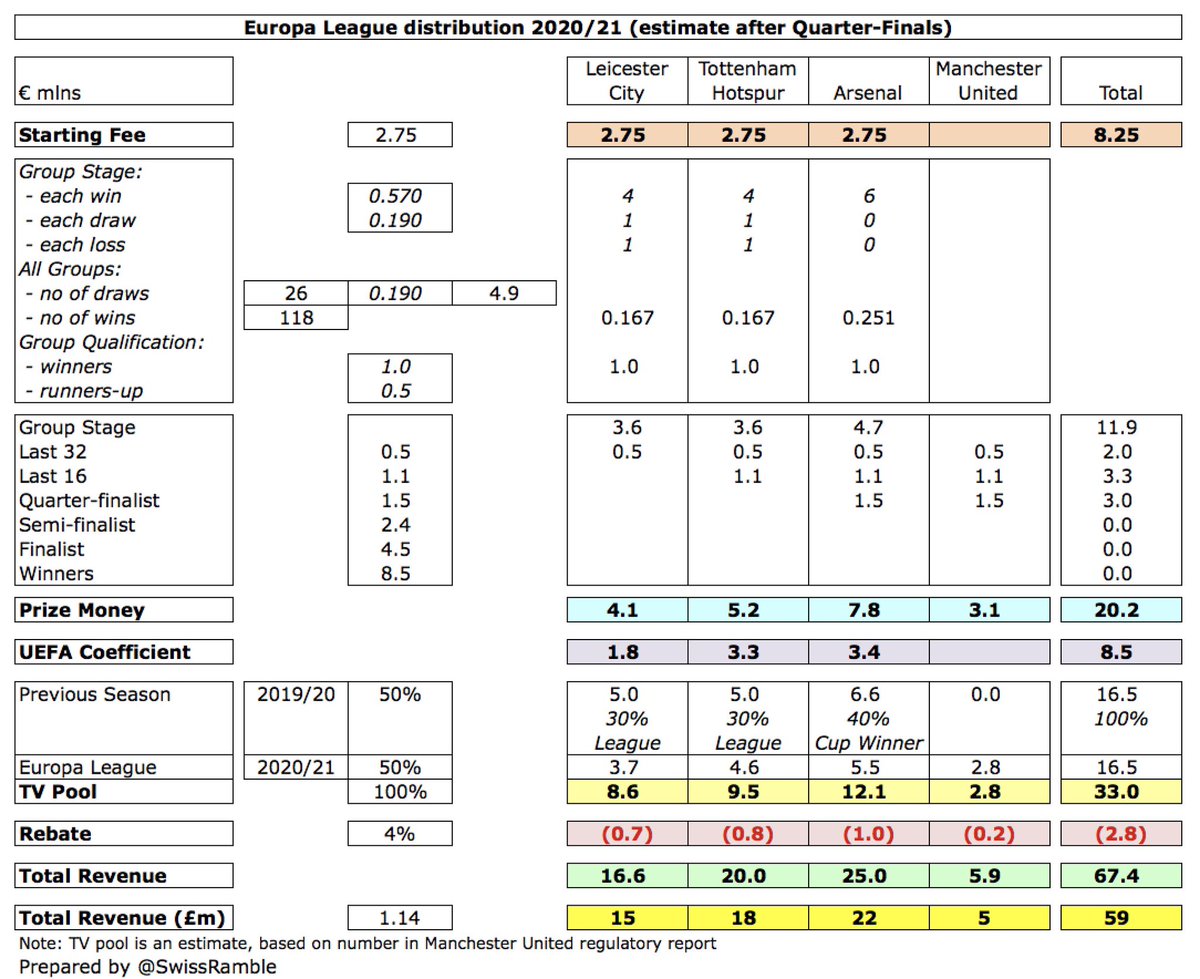

The UEFA coefficient payment is based on performances in Europe over the past 10 years, including bonus points for winning UEFA tournaments. On this basis, #CFC received #31m, followed by #MUFC €29m, #MCFC €25m and #LFC €22m.

The Champions League UEFA coefficient pot is divided into shares with each worth €1.1m, so the highest ranked club in 2020/21 (i.e. Real Madrid) gets €35m, but Ferencvaros only €1m. Highest English club is #CFC in 5th place with €31m; #LFC lowest in 13th place with €22m.

UEFA coefficient payments are much lower in the Europa League, where #AFC are the highest ranked club, but only receive €3.4m, just ahead of Benfica €3.4m and #THFC €3.3m. The other English club #LCFC is in 24th place with #1.8m.

The differences between the Champions League and the Europa League are much smaller for the TV pool, where #LFC CL €23m is “only” €11m more than #AFC EL €12m. Note: these figures are estimates, based on various sources and assumptions, so should be treated with some caution.

The calculation for the TV pool is split into two: (a) half based on position in previous season’s Premier League (known); (b) half based on progress in Europe this season (so this will change if a team goes further in the Champions League or Europa League).

To date #LFC have earned most from the TV pool with €23.3m, due to finishing first in prior season’s Premier League (40% of first half of pool, i.e. €13.7m) and reaching this season’s Champions League quarter-finals (same number of games as two other clubs, worth €9.5m).

Europa League TV pool is similar, though the FA Cup winner of the prior season receives 40% of first half, compared to 30% for teams qualifying via Premier League position. Other half essentially depends on progress in this season’s Europa League. As a result, #AFC earned €12m.

A rebate was agreed with broadcasting companies for 2019/20, as matches were delayed and only one leg played in quarter-finals and semi-finals. This means 4% rebate over next five seasons, giving reductions of just under €4m in 2020/21 to date for #MCFC, #LFC and #CFC.

Of course, a club could earn significantly more from Europe if it makes further progress, e.g. if it managed to win the Champions League, it would earn an additional €31m prize money (€12m for reaching the semi-final plus €19m for winning the tournament).

Once again, it should be noted that these are only estimates, particularly assumptions for the TV pool, while final revenue will clearly depend on progress in this season’s competition, but hopefully the analysis gives a good idea of the money that will be earned in Europe.

What is clear is that the Champions League remains highly lucrative, reinforcing the financial strength of the leading clubs. The revenue is more important than ever during this challenging period, as games continue to be played without fans, adversely impacting match day income.

• • •

Missing some Tweet in this thread? You can try to

force a refresh