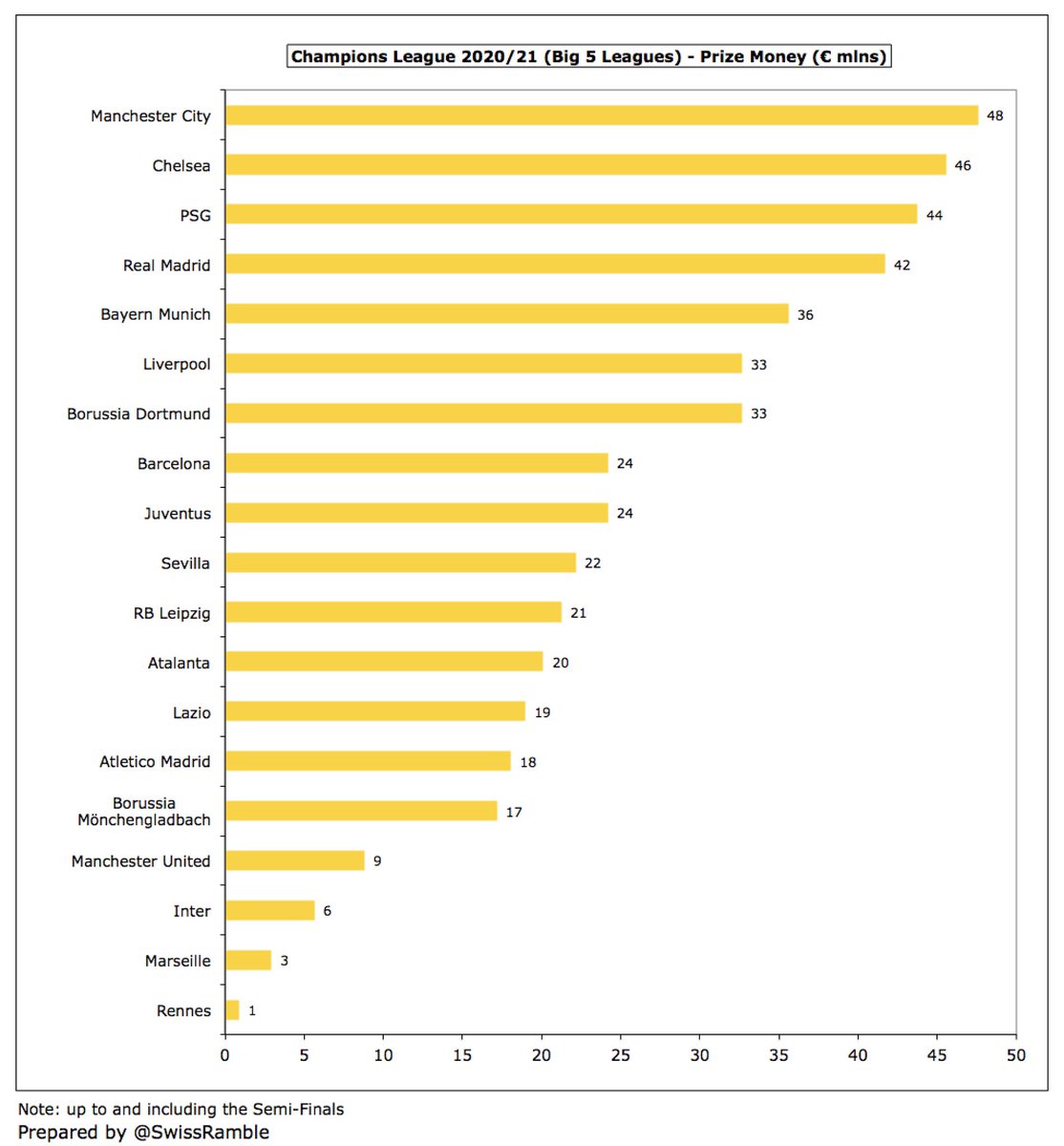

After news of the European Super League broke, the estimated earnings of clubs from the Big Five leagues in the 2020/21 Champions League might seem a little bit “after the Lord Mayor’s show”, but here’s an analysis up to the semi-finals in any case.

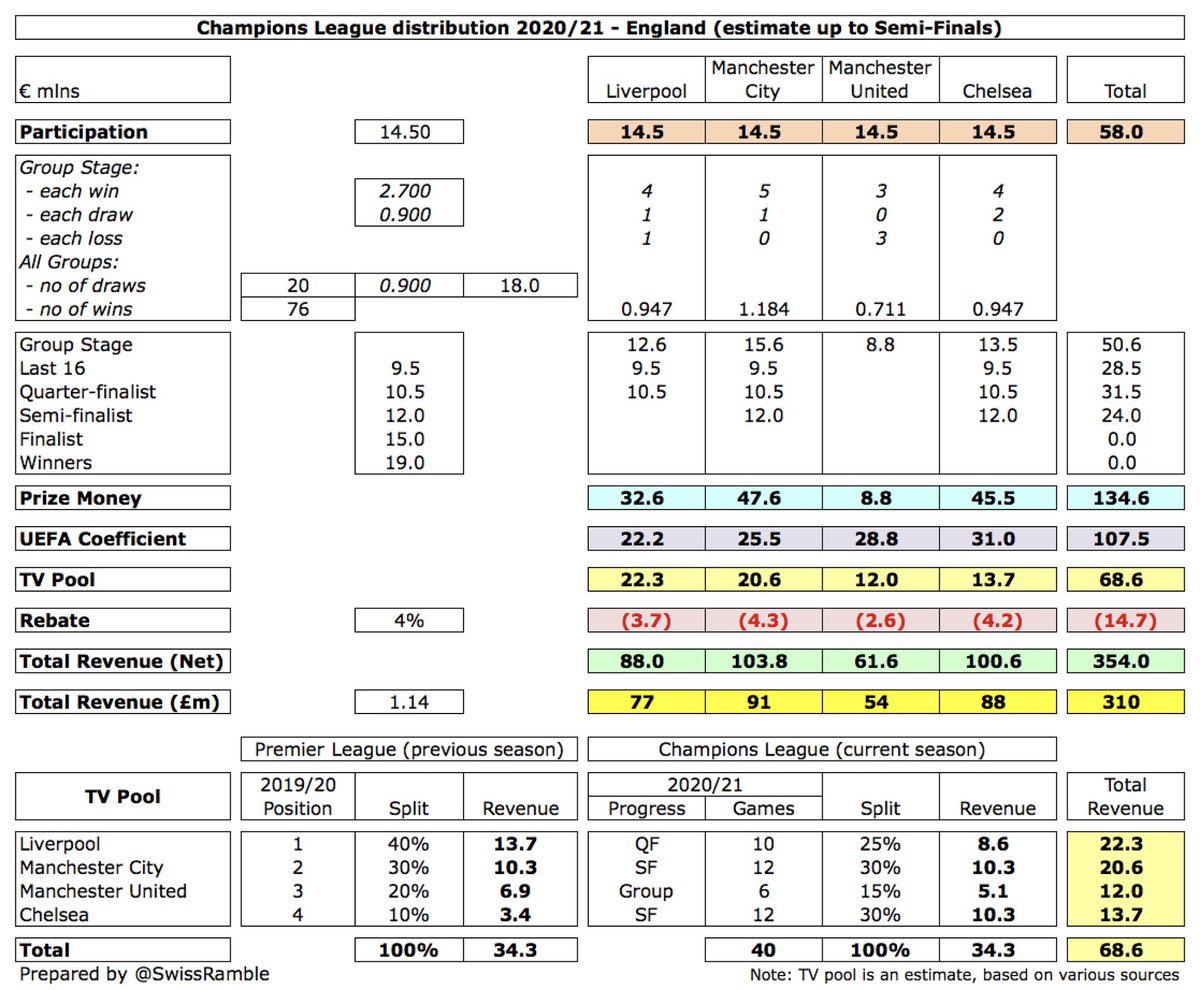

I should emphasise that these figures can only be considered as indicative. They are based on UEFA’s revenue distribution guidelines, but also include estimates for the TV pool and rebates to broadcasters following losses caused by the COVID-19 pandemic.

Based on my assumptions, the top 10 TV earnings from the Champions League up to the semi-finals are: #PSG €109m, #RealMadrid €109m, #MCFC €104m, #CFC €101m, #FCBayern €92m, #LFC €88m, #FCBarcelona €84m, #Juventus €82m, #BVB €78m and #Atleti €74m.

Looking at Champions League revenue distribution, the influence of the UEFA coefficient is evident with TV pool much less important than it was before. This change in the current cycle rewards historically successful clubs rather than those with larger national TV rights deals.

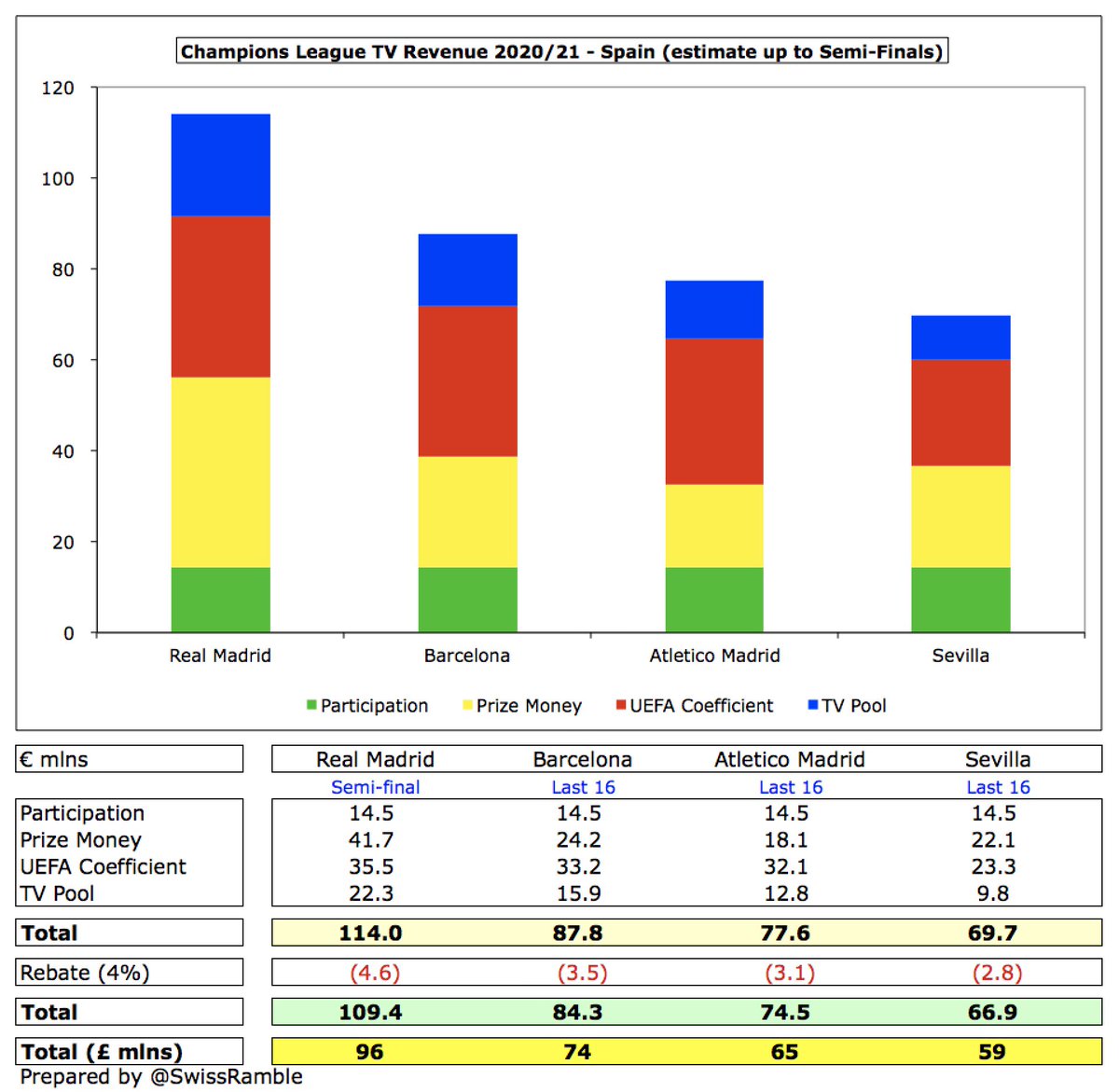

Right off the bat, each of the 32 clubs that qualify for the Champions League group stage receives a sizeable participation fee of €14.5m, much higher than the Europa League (€2.75m).

#MCFC have earned most prize money with €47.6m, as they won 5 games (and drew 1) in the group for €14.4m (€2.7m for a win, €0.9m for a draw), plus €1.2m for share of pool for draws, then €9.5m for reaching the last 16, €10.5m for quarter-final and €12m for semi-final.

UEFA coefficient is based on performances over 10 years, including bonus points for winning UEFA tournaments. On this basis, highest ranked club, #RealMadrid, received €35m, followed by #FCBayern €34m, #FCBarcelona €33m, #Atleti €31m, then highest English club, #CFC €31m.

The UEFA coefficient payments are much lower in the Europa League, where #AFC are the highest ranked club, but only receive €3.4m, just ahead of Benfica €3.4m and #THFC €3.3m. The other English club #LCFC is back in 24th place with #1.8m.

TV pool assumes total payments by country are the same as 2018/19. On this basis, #PSG have received the most with €28m (French pool only shared between 3 clubs), followed by #RealMadrid €22m, #LFC €22m and #MCFC €21m. #FCBayern only get €12m, due to small German pool.

The calculation for the TV pool is split into two: (a) half based on position in previous season’s domestic league (known); (b) half based on progress in Europe this season (so this will change if a team goes further in the Champions League).

To date #LFC have earned most from the English TV pool with €22.3m, due to finishing first in prior season’s Premier League (40% of first half of pool, i.e. €13.7m) and reaching this season’s Champions League quarter-finals (worth €8.6m).

A rebate has been agreed with broadcasting companies for 2019/20, as matches were delayed and only one leg played in quarter-finals and semi-finals. This means 4% rebate over next five seasons, giving reductions of €4.6m in 2020/21 to date for #PSG and #RealMadrid.

#MCFC and #CFC have both earned over €100m after reaching the Champions League semi-finals with €104m and €101m respectively, followed by #LFC €88m. #MUFC €70m includes €8m from Europa League, while #AFC have €28m after also reaching the EL semi-final.

#RealMadrid have earned by far the most in Spain with €109m for reaching the semi-final. The other three representatives were all eliminated in the last 16 with revenue as follows: #FCBarcelona €84m, #Atleti €74m and Sevilla €67m.

After going out in the quarter-finals, #FCBayern received “only” €92m, but still a fair bit more than the other German clubs (#BVB €78m, RB Leipzig €51m and Borussia Mönchengladbach €44m), mainly due to their higher UEFA coefficient.

Although three Italian clubs went out at the last 16 stage, #Juventus €82m still earned much more than Lazio €53m and Atalanta €50m, driven by better UEFA coefficient and higher TV pool. #Inter received €49m even though they were eliminated in the group.

After reaching the semi-final, #PSG have the highest Champions League 2020/21 revenue in France (and Europe) with €109m, which is more than twice as much as Marseille €47m and Rennes €32m, who both failed to get out of the group.

Of course, a club could earn more if it progresses in the competition, i.e. another €15m if it reaches the final, plus a further €4m if it actually wins the trophy. The possible earnings for the semi-finalists are: #PSG €128m, #RealMadrid €128m, #MCFC €123m and #CFC €120m.

All of these calculations assume that UEFA does not throw any of the Super League clubs out of the Champions League this season. This might seem unlikely, given the slowness at which legal cases normally move, but there has been some talk of such action this week.

Despite the Super League news, the Champions League remains highly lucrative, reinforcing the financial strength of the leading clubs. This is more important than ever at a time when games continue to be played without fans, adversely impacting revenue.

• • •

Missing some Tweet in this thread? You can try to

force a refresh