West Bromwich Albion’s 2019/20 accounts covered a season when they finished 2nd in the Championship, thus securing promotion to the Premier League after a 2-year absence. Manager Slaven Bilic was subsequently replaced by Sam Allardyce in December 2020. Some thoughts follow #WBA

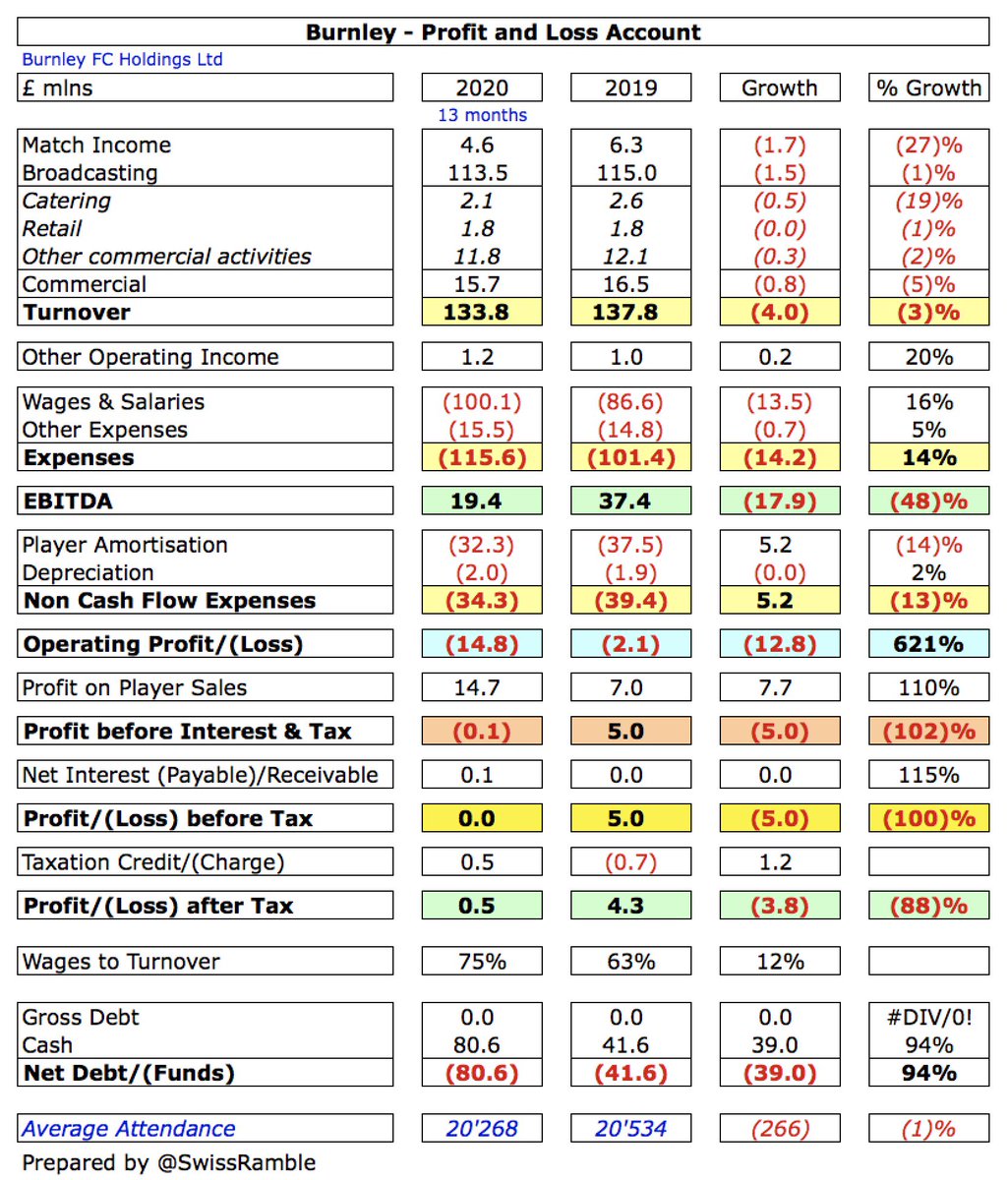

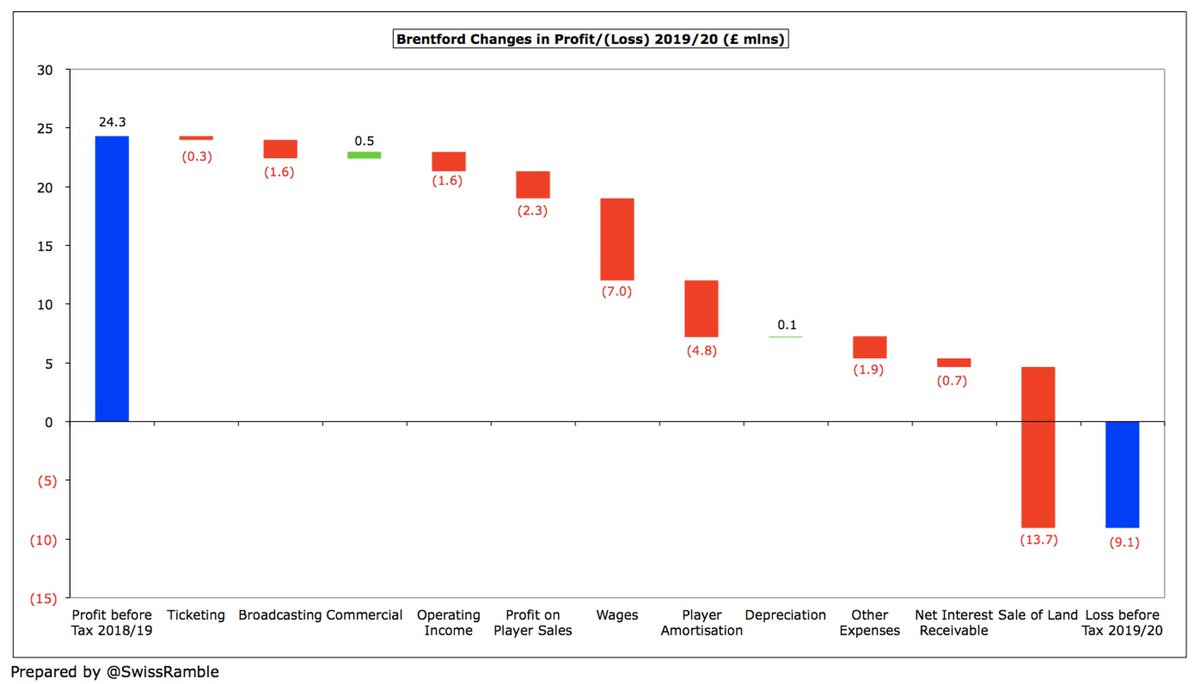

#WBA pre-tax loss widened from £7m to £23m, mainly due to promotion bonuses and COVID. Revenue fell £17m (24%) from £71m to £54m, while operating expenses increased £19m (22%), partly offset by profit on player sales rising £19m to £29m. Loss after tax up from £6m to £21m.

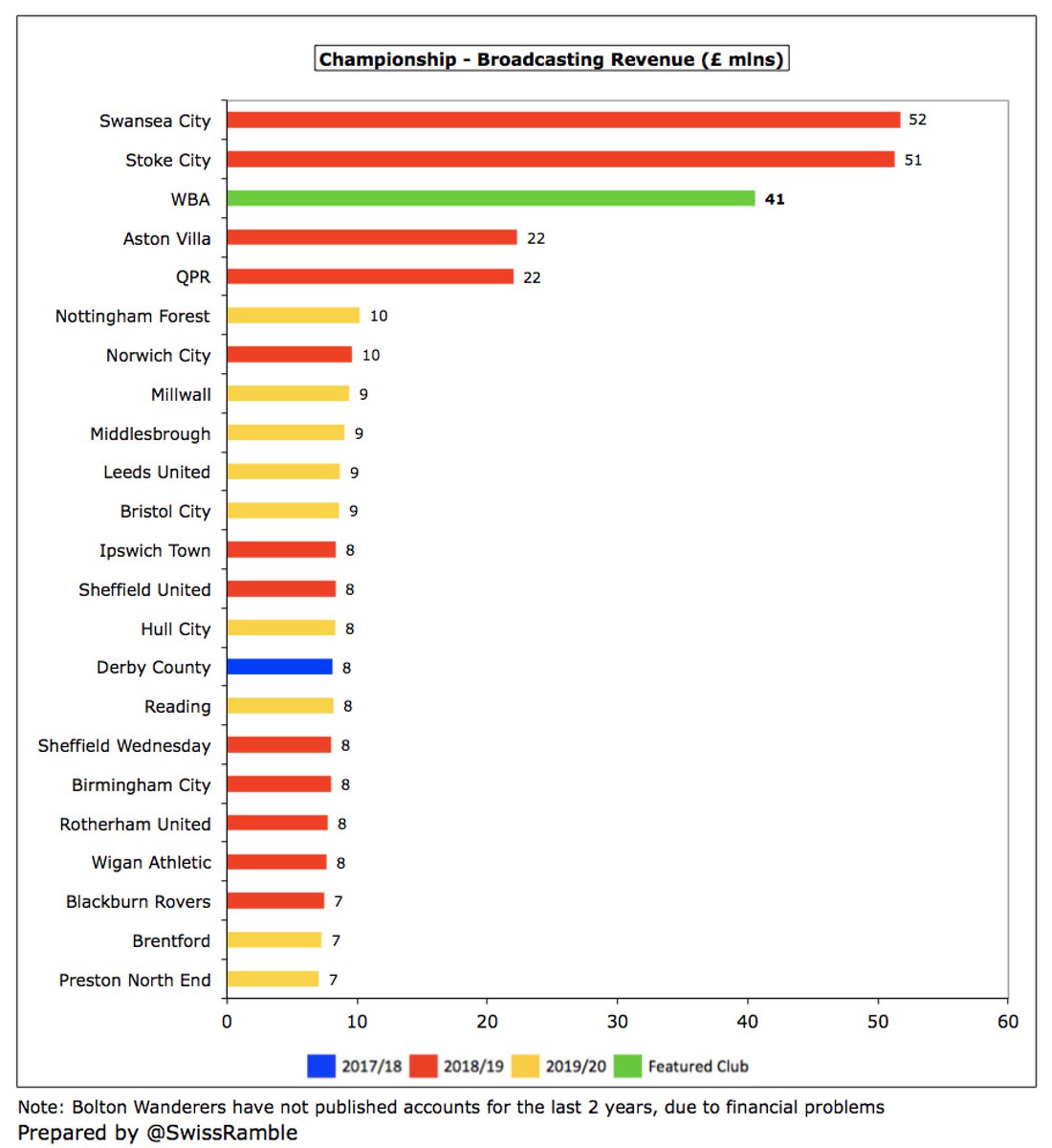

The main reason for #WBA £17m revenue reduction was broadcasting, which dropped £12m (23%) from £53m to £41m, mainly due to lower parachute payment, though gate receipts also decreased £2.5m (34%) to £4.8m, while commercial was down £2.4m (22%) to £8.4m.

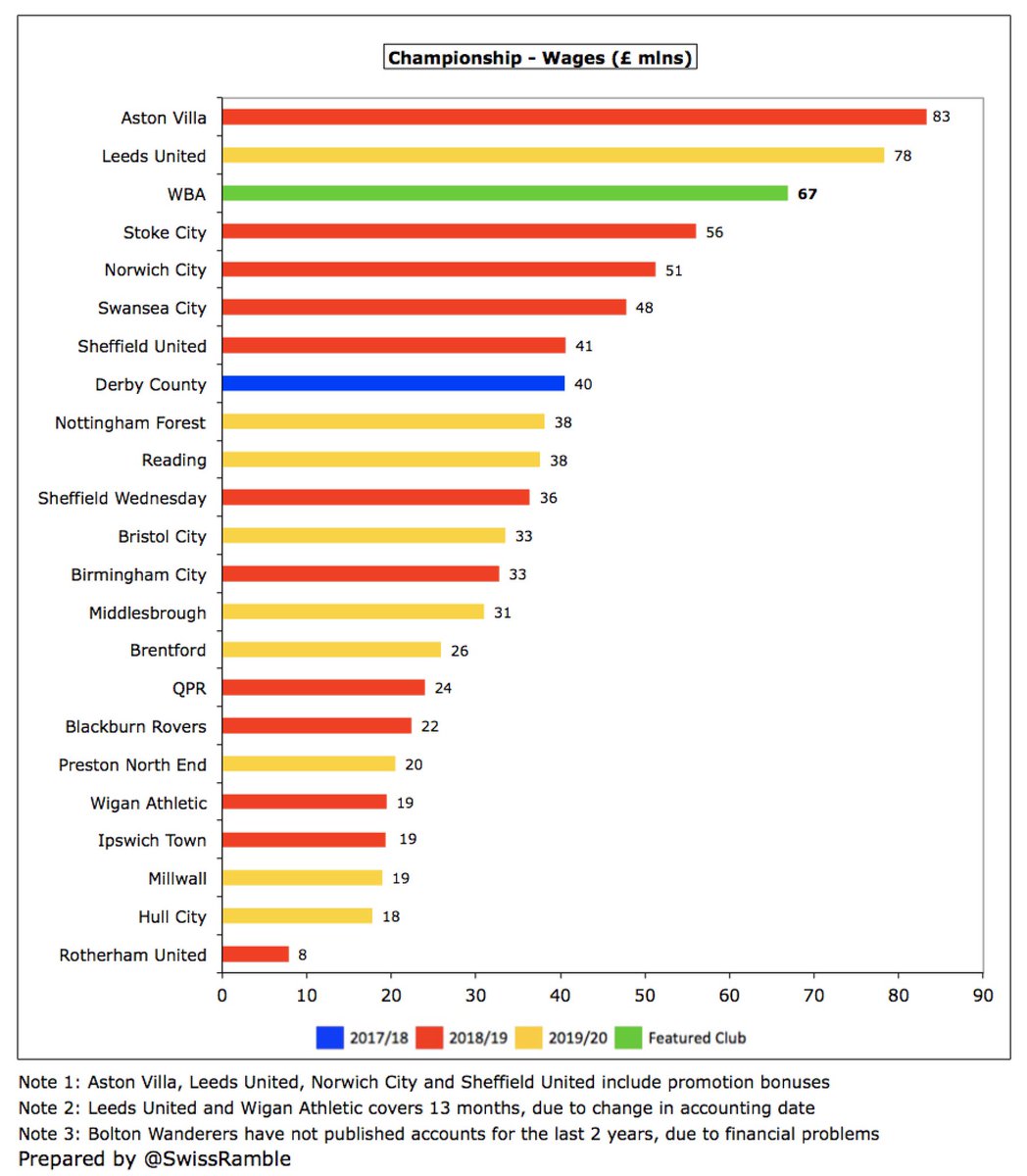

However, #WBA also had cost growth, as wages rose £20m (43%) from £47m to £67m (including estimated £17m promotion bonus), while player impairment increased £5m to £6m. In contrast, player amortisation fell £3m (11%) to £20m and other expenses were cut £4m (24%) to £13m.

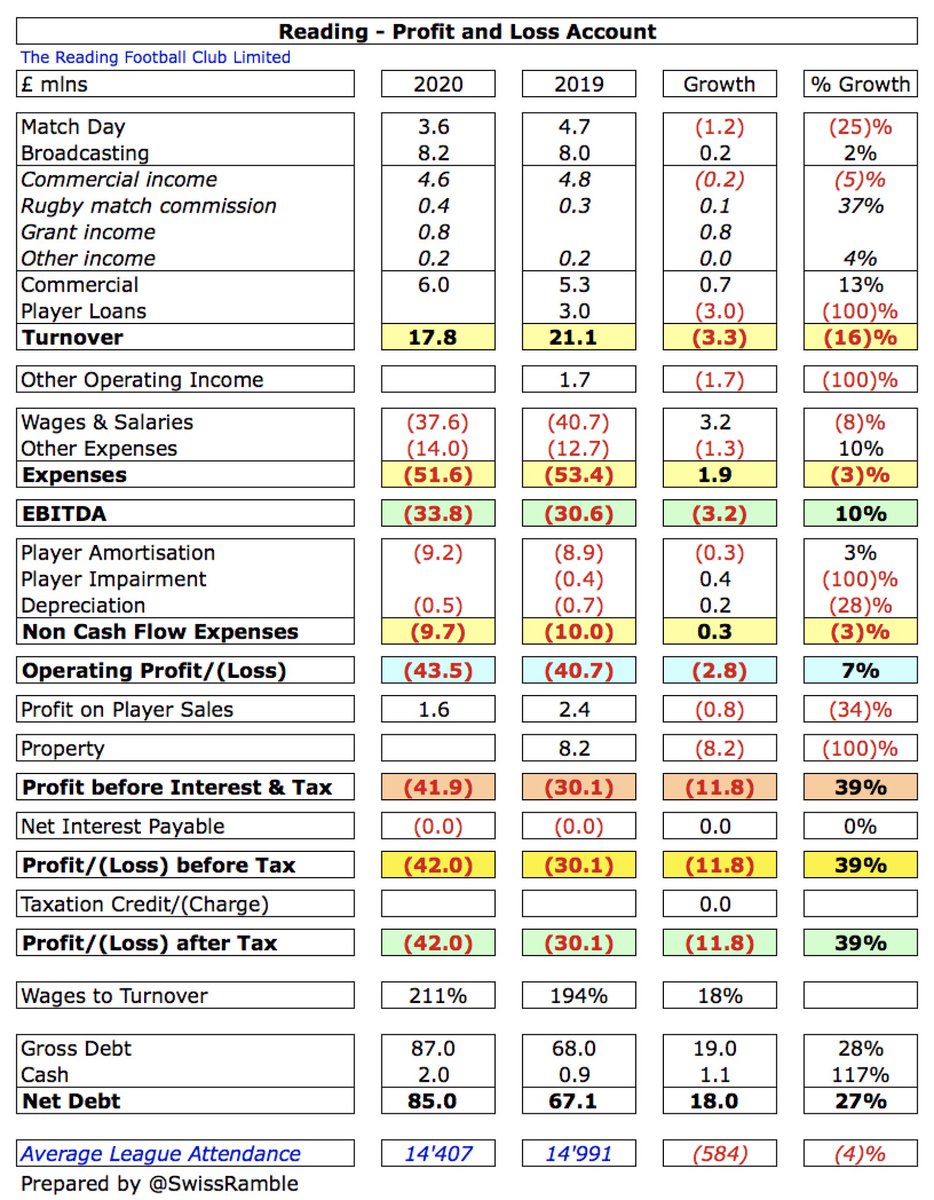

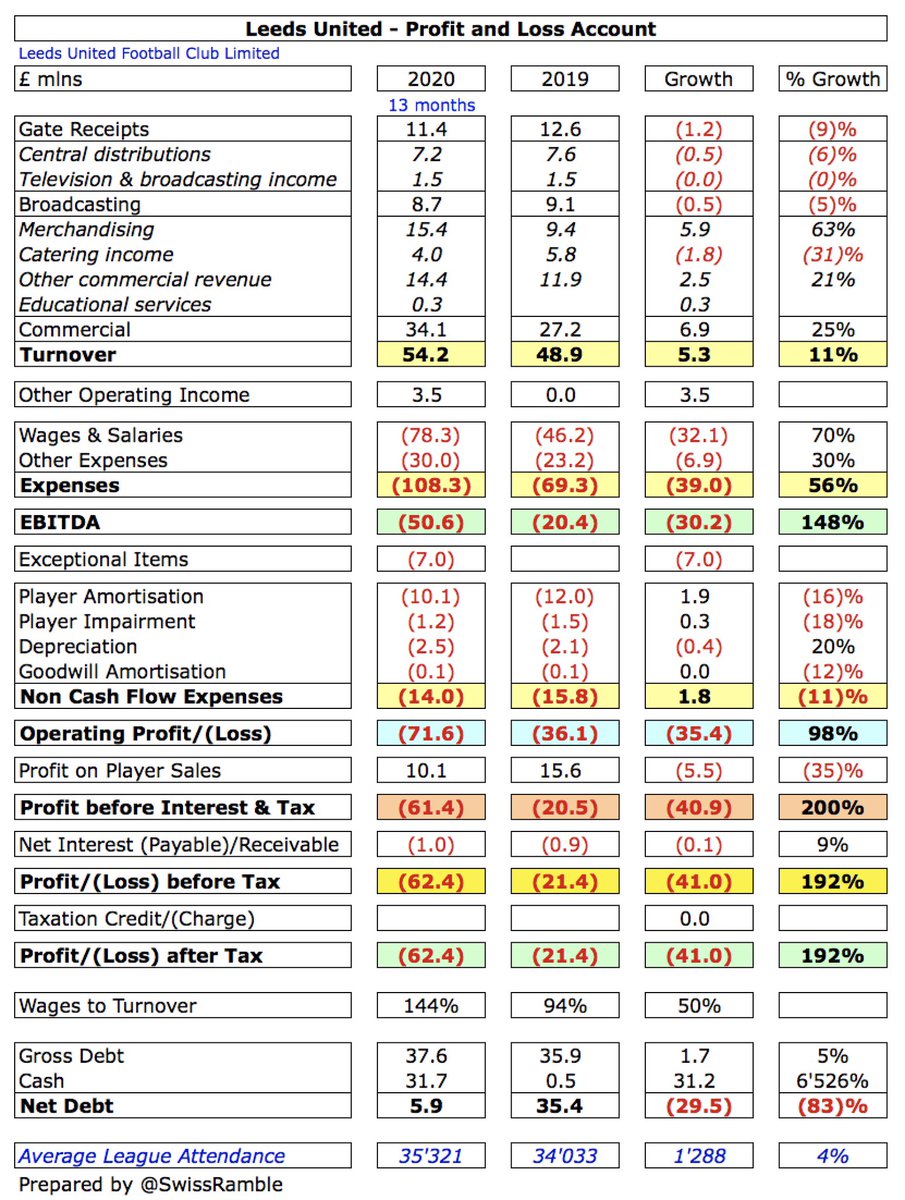

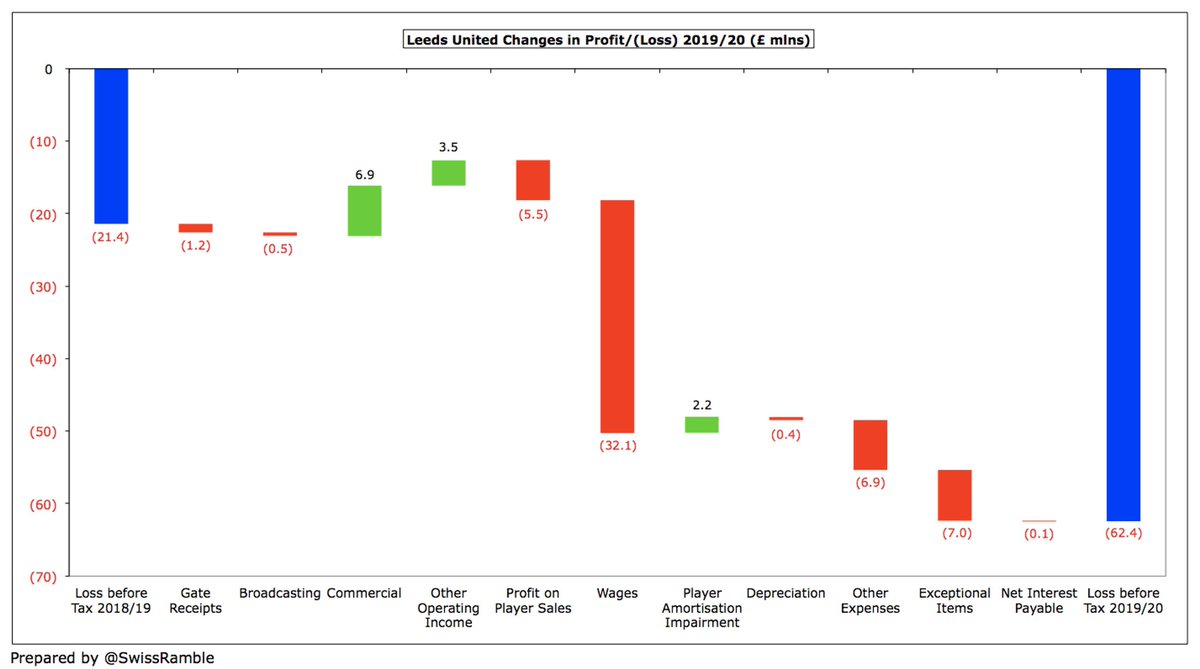

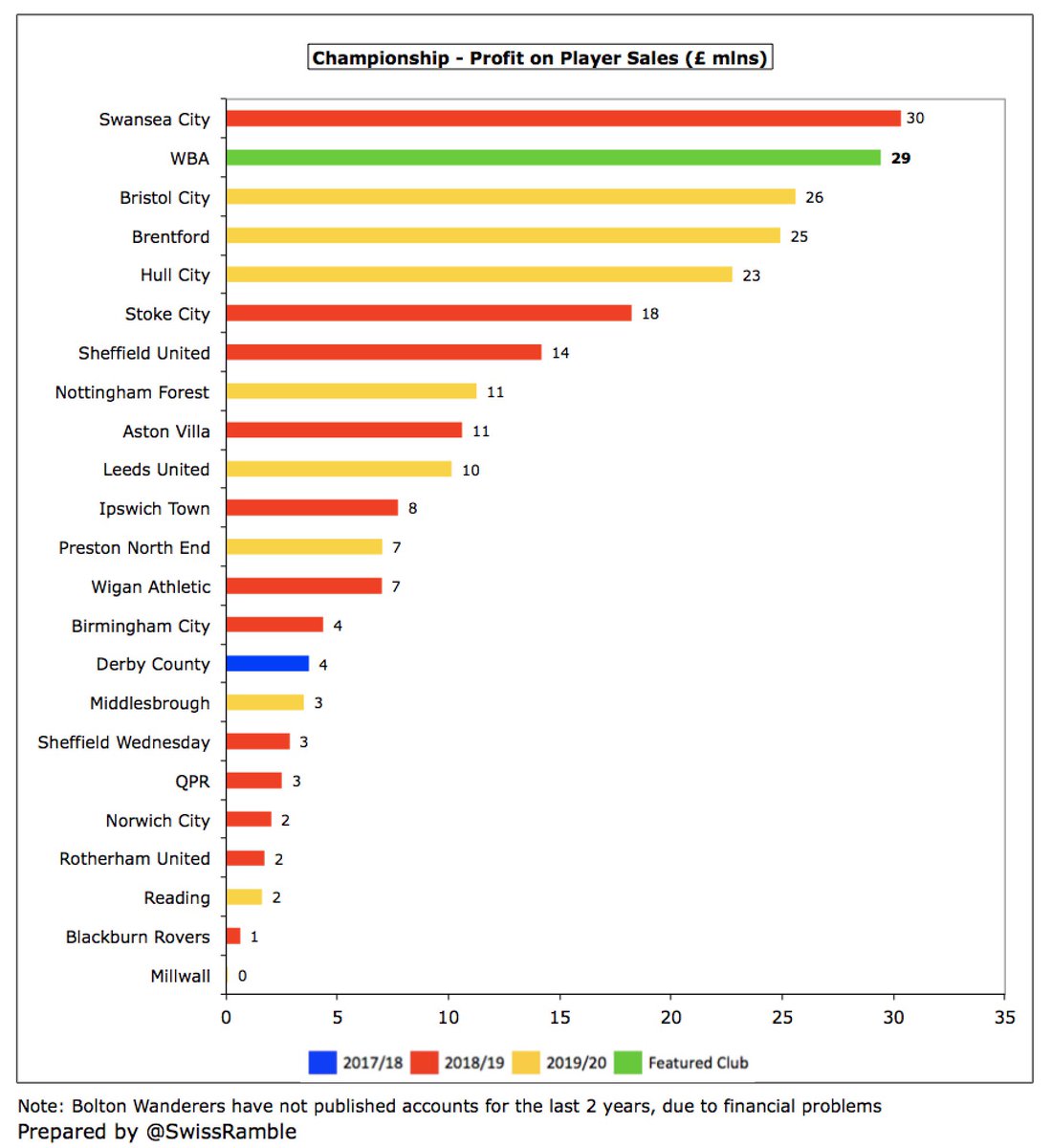

Although #WBA £23m loss is not great, it’s far from unusual in the Championship, even before the pandemic. Three clubs to date have reported larger losses in 2019/20, namely another promoted club #LUFC, whose £62m loss was significantly higher, Reading £42m and #Boro £36m.

It is also worth noting that some clubs’ most recent figures have been boosted by the sale of stadiums, training grounds and land, especially #DCFC £40m, #SWFC £38m and #AVFC £36m, so their underlying profitability was even worse than reported.

Excluding such property sales, only two Championship clubs are actually profitable – just one (#HCAFC £3m) in 2019/20. The harsh reality is that almost all clubs in this division lose a lot of money, as they strive to remain competitive in pursuit of promotion to the top flight.

As a technical aside, #WBA extended their financial reporting close to 31st July 2020, a period of 13 months. Although this enabled them to include revenue for games played in July, this also means that 2019/20 accounts covered an additional month of expenses.

#WBA lost £3.3m revenue due to COVID, including £2.1m rebate to broadcasters and £1.2m for games played behind closed doors, while they also incurred estimated £5m additional costs for the 13th month. Their loss was therefore higher by £8m, though it would still have been £15m.

In fairness, nearly all promoted clubs have had to splash the cash to finance the investment required to get out of the Championship, leading to hefty losses (including promotion bonuses). In fact, #WBA £23m loss is one of the smallest of clubs going up in the last 3 seasons.

#WBA benefited from profit on player sales rising from £10m to £29m, including Salomon Rondon to Dalian Yifang, Jay Rodriguez to Burnley and Craig Dawson to Watford. This is the highest to date in the 2019/20 Championship, ahead of Bristol City £26m and Brentford £25m.

Up until 2017, #WBA had not made a loss since 2009, but they have now lost money in the last 3 seasons, amounting to £37m. The club had accumulated £83m of profits in the preceding 7 years, but around half of this (£40m) came in 2017 alone, under Tony Pulis in the PL.

Like many other clubs, #WBA have become increasingly reliant on player sales with the average annual profit rising to £15m in the last 4 years. However, 2020/21 to date only really includes the sales of Oliver Burke to #SUFC and Jonathan Leko to Birmingham City.

#WBA operating loss (i.e. excluding player sales and interest) widened from £17m to £53m, the 2nd worst to date in 2019/20 Championship. This is obviously not great, but in fairness almost every club in this division posts substantial operating losses, i.e. over half above £30m.

#WBA revenue is down £84m (61%) from the recent high of £138m in 2017 to £54m in 2020, almost entirely due to less TV money in the Championship. The decrease last season was mainly driven by the lower parachute payment.

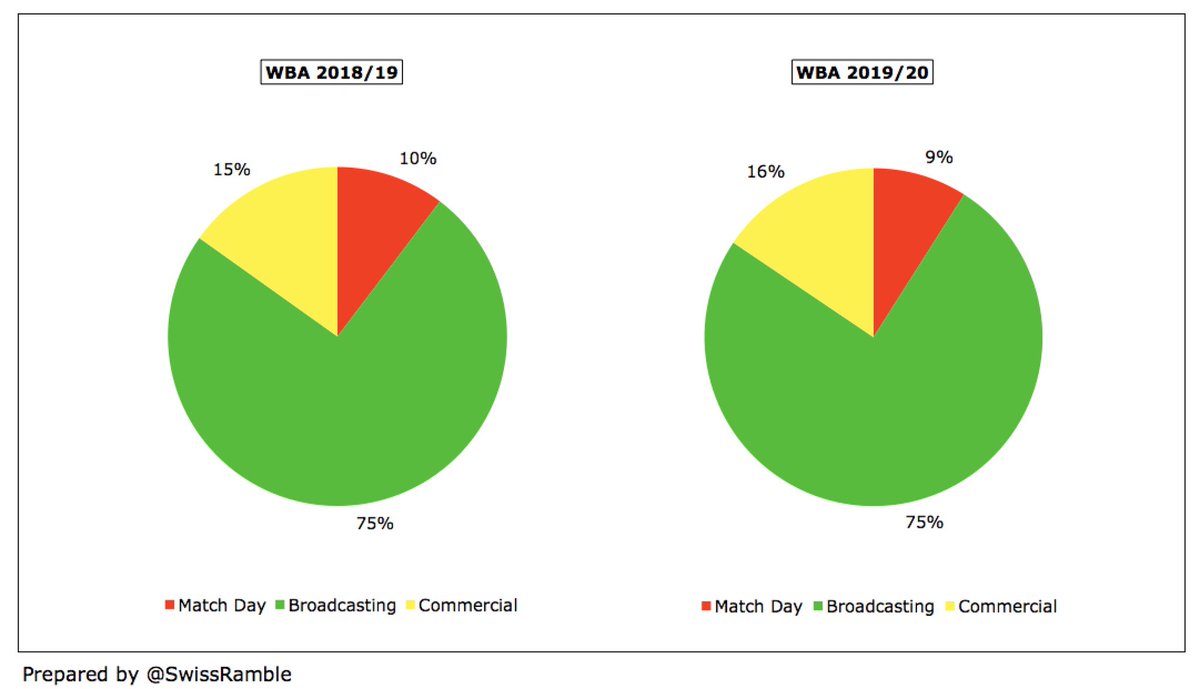

Despite the fall in broadcasting, this remained the most important revenue stream for #WBA, accounting for 75% of their total revenue. This is followed by commercial 16%, then just 9% from match day.

Even after this significant decrease, #WBA £54m was still one of the highest in the Championship, through they were overtaken by #LUFC (massive commercial income). West Brom will also be behind the three clubs most recently relegated from the Premier League.

Obviously, #WBA benefited from £34m parachute payments, though down from £43m the previous season. Six other clubs received parachutes in 2019/20, led by Cardiff City, #FFC and #HTAFC (£42m), followed by Stoke City and Swansea City (£34m)

If parachute payments were excluded, #WBA revenue would fall to £24m (£34m parachute replaced by £4.5m solidarity payment). This would have still been in the top half of the Championship, though the gap to the top club (#LUFC £54m) would increase to £30m.

#WBA broadcasting income fell £12m (23%) from £53m to £41m, due to lower parachute (including £2.1m rebate). Most Championship clubs earn £7-10m, but there is a significant gap to those with parachute payments (e.g. Swansea and Stoke received over £50m in 2018/19).

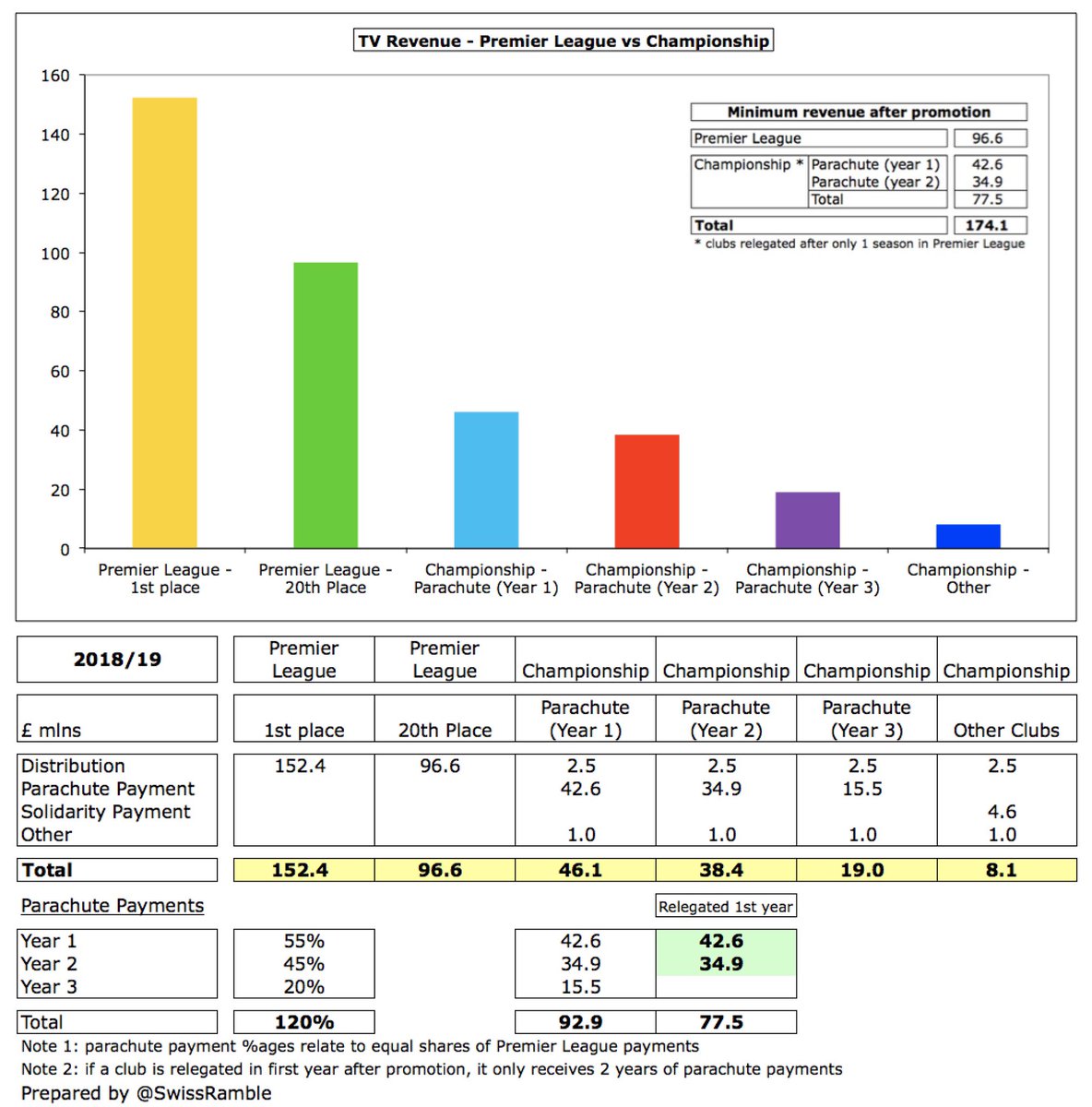

#WBA will receive much more TV money in the Premier League, e.g. current 19th place would be £102m based on 2018/19 distribution, though they will have to pay £7m rebate as a promoted club in 2020/21. Note: #LUFC already booked this rebate in their 2019/20 accounts.

Looking further ahead, if #WBA are relegated from the Premier League this season, they would receive two years of parachute payments in the Championship. Clubs only receive the full three years if they manage to survive more than one season in the top flight.

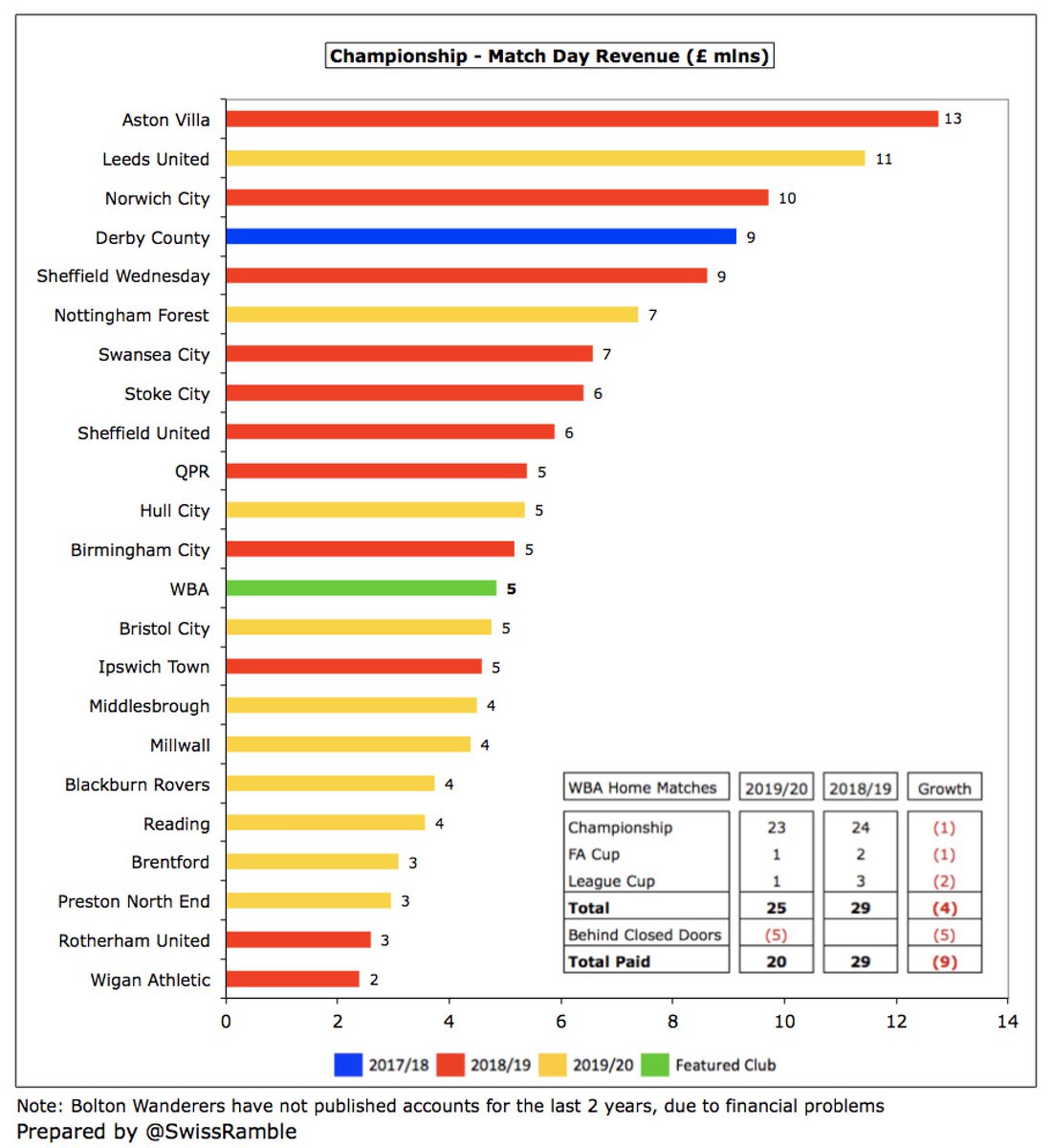

#WBA gate receipts fell £2.5m (34%) from £7.3m to £4.8m, as they played 5 home games behind closed doors (due to the pandemic). In addition, 3 fewer cup games and no repeat of prior season’s play-off semi-final. Mid-table in the Championship, less than half of #LUFC £11m.

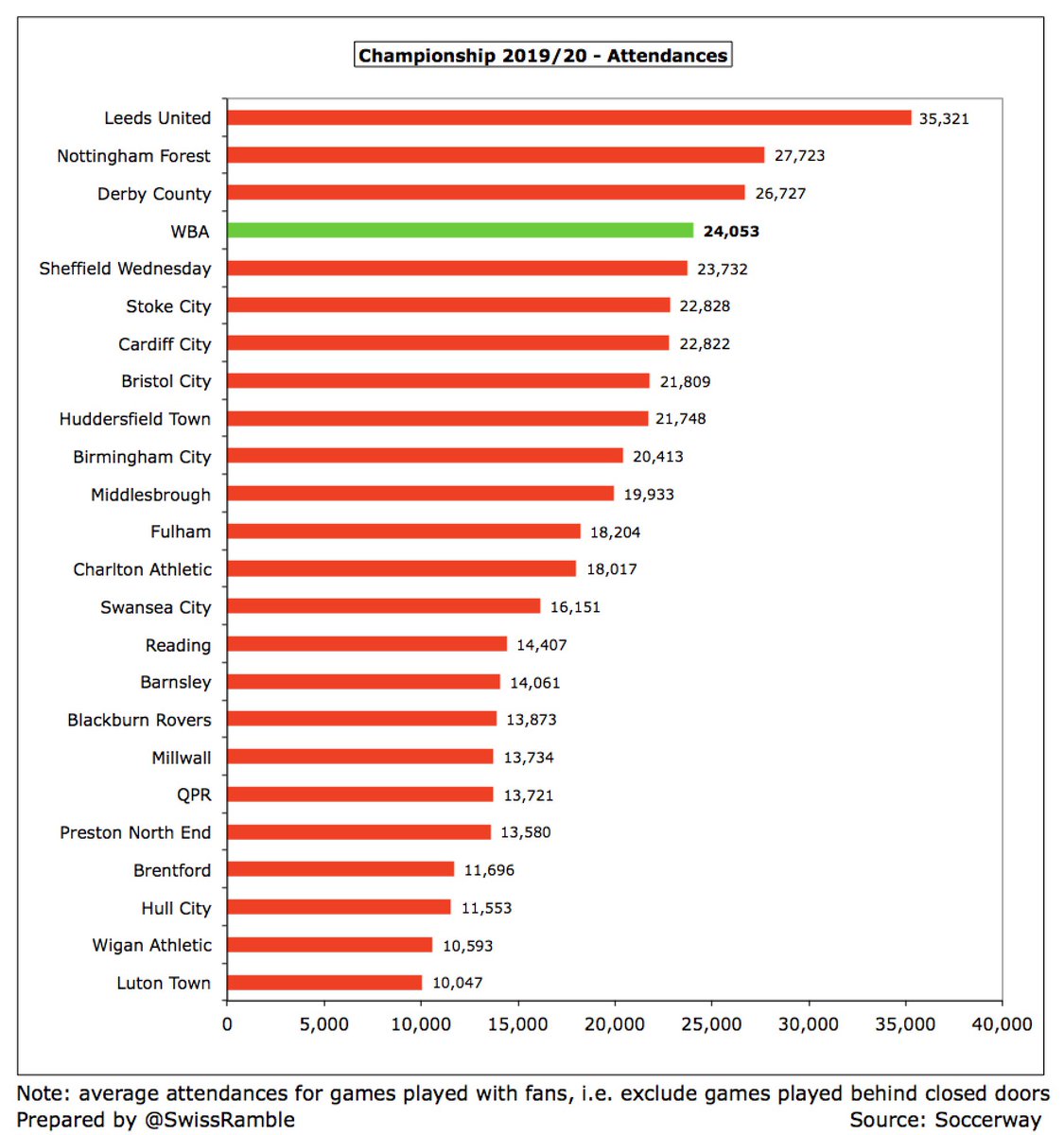

#WBA average attendance was relatively flat at 24,053 (for games played with fans), which was 4th highest in the Championship, only behind #LUFC, #NFFC and #DCFC. Crowds held up pretty well after relegation from the Premier League. Slight increase in 2019/20 season ticket prices.

#WBA commercial revenue fell £2.4m (22%) to £8.4m, as “the commercial realities of not being in the Premier League continued to take hold”, though only slight fall in merchandising to £2.8m. 8th highest in the Championship, but a long way behind #LUFC £34m and Bristol City £14m.

#WBA shirt sponsor Ideal Boilers has extended its deal by 3 years to 2024, though reportedly the lowest in the Premier League in 2020/21 at £3m. Puma have a multi-year deal as kit supplier. Training ground has been renamed the Monster HydroSport Training Ground.

#WBA wage bill rose significantly by £20m (43%) from £47m to £67m, including estimated £17m promotion bonus, an extra month’s wages and loan costs associated with the extended season. Wages down £12m (15%) in 3 years, while revenue down £84m (61%) in the same period.

Following the increase, #WBA £67m wage bill is the second highest in 2019/20 Championship to date, though other clubs with parachute payments are yet to publish accounts. In fact, it’s actually the 6th highest ever wage bill in the Championship.

#WBA wages to turnover ratio nearly doubled from 66% to 124%, though I calculate this would be reduced to 86% if promotion bonus and 13th month excluded. Either way, this is not desirable, but par for the course in this division, where 19 of the 24 clubs are over 100%.

#WBA total directors’ remuneration fell 44% from £953k to £536k, though still one of the highest in the Championship, only surpassed by Reading to date in 2019/20. Remuneration for highest paid director (Mark Jenkins) down from £457k to £223k, as he took 100% cut during lockdown.

#WBA player amortisation, the annual charge to write-down transfer fees, fell £3m (11%) to £20m, down from £25m in the Premier League two years ago. Still highest to date in 2019/20 Championship, but could be overtaken by others with parachutes. Also booked £6m impairment charge.

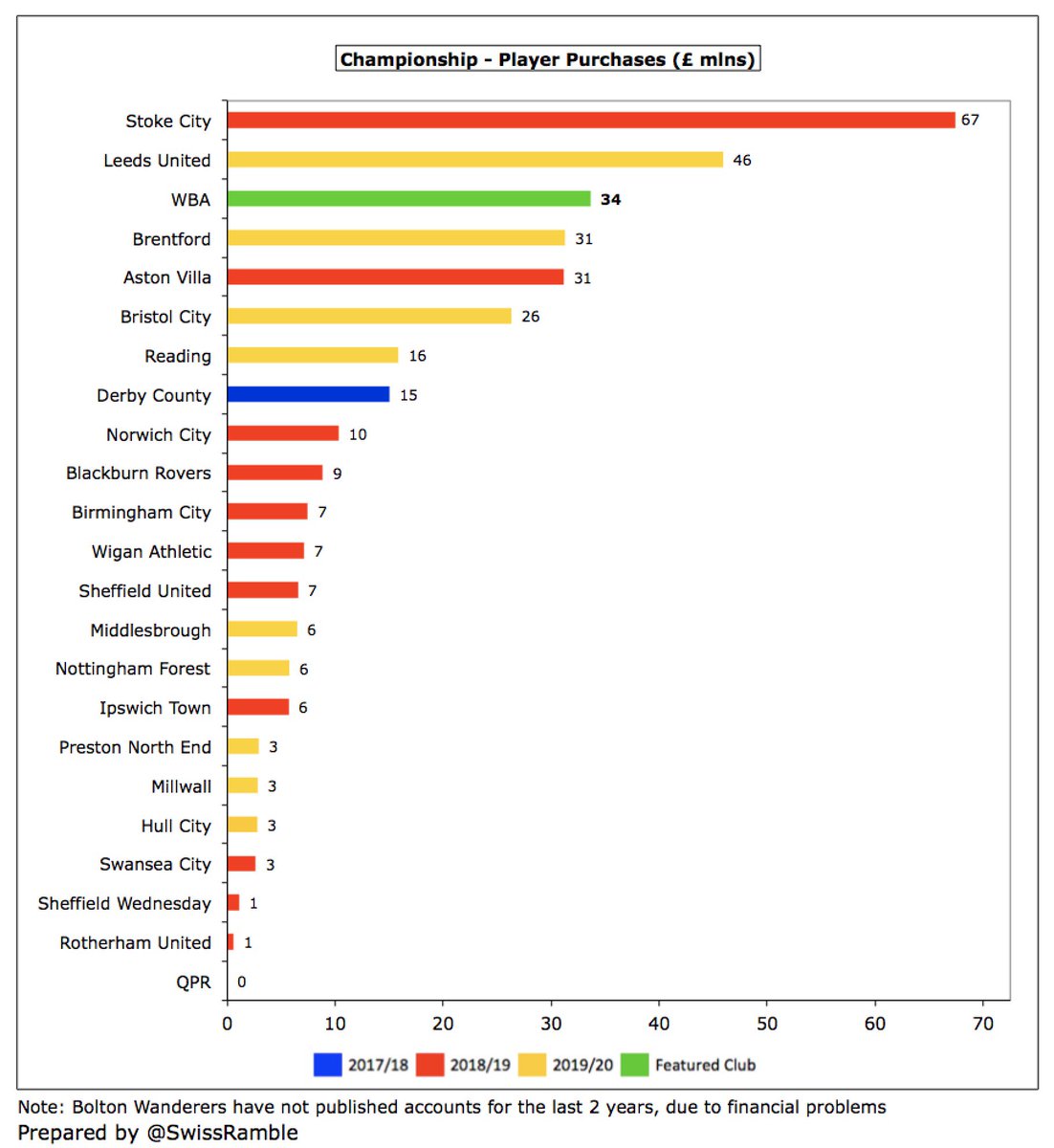

#WBA spent £34m on player purchases, mainly Kenneth Zohore, Matheus Pereira, Charlie Austin, Romaine Sawyers, Darnell Furlong and Semi Ajayi. Probably also includes payments contingent on promotion. Second highest to date in 2019/20 Championship, only below #LUFC £46m.

#WBA average gross transfer spend has grown to £31m in last 4 years, but sales also up to £22m, so net spend is relatively low at £9m. Spent £39m to bring in players following promotion, including Karlan Grant from #HTAFC, Grady Diangana from #WHUFC & Callum Robinson from #SUFC.

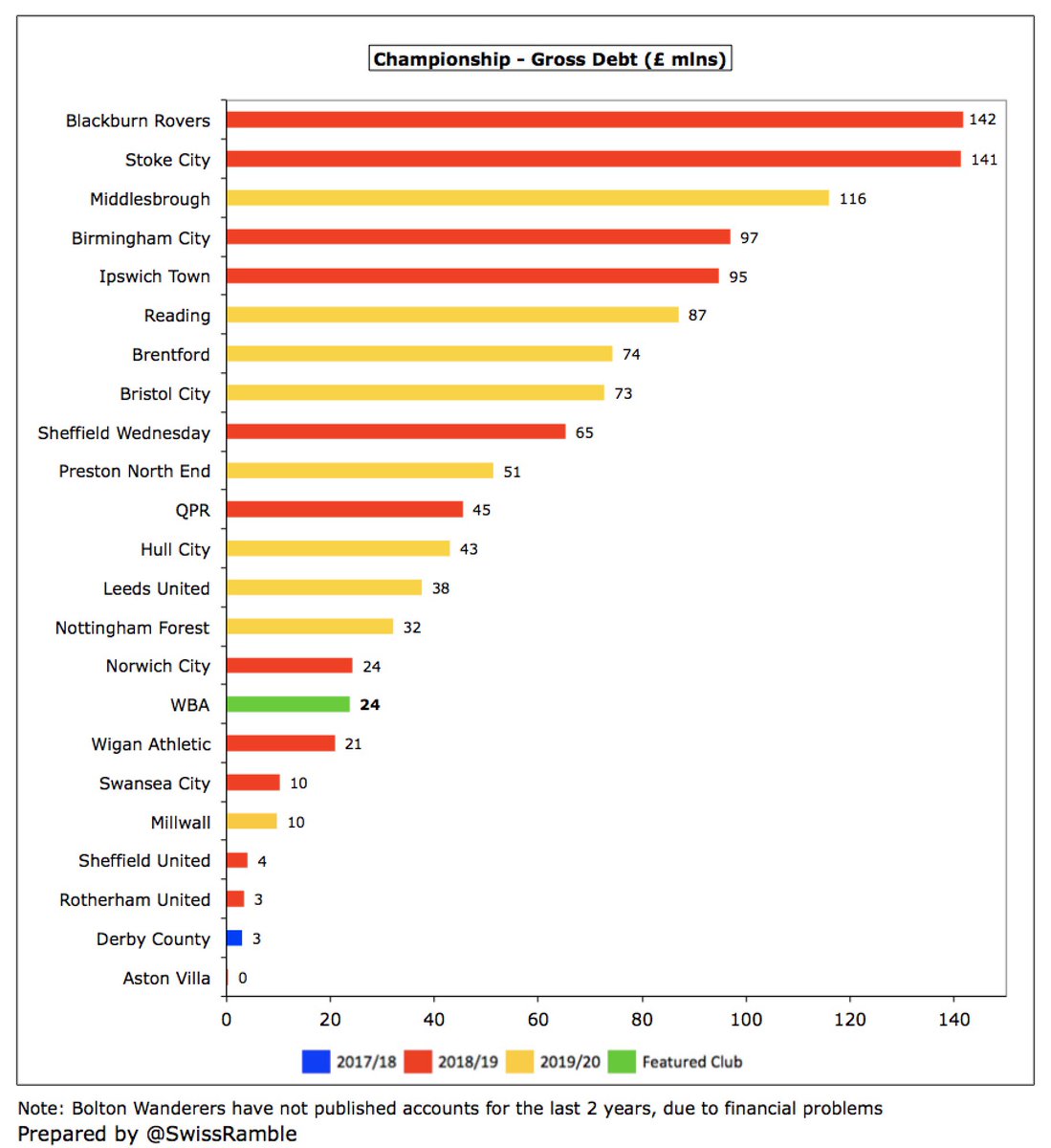

#WBA gross debt unchanged at £24m, all owed to the owners (unsecured, no fixed repayment date). Far below the likes of #BRFC £142m, Stoke City £141m and #Boro £116m. However, almost all debt in this division is provided interest-free by the clubs’ owners, so is “soft” in nature.

Loans provided by #WBA owners are interest-free, which gives them a slight competitive advantage. That said, although many Championship clubs have a lot of debt, very little interest is actually paid, e.g. only 3 clubs over £1m: Hull City £1.7m, #Boro £1.3m & Bristol City £1.1m.

#WBA transfer debt for outstanding stage payments fell slightly to £18m, but the amounts owed by other clubs dropped from £18m to £8m, so net payable up from £1m to £10m. In addition, £11m potential contingent liabilities, based on number of appearances and future events.

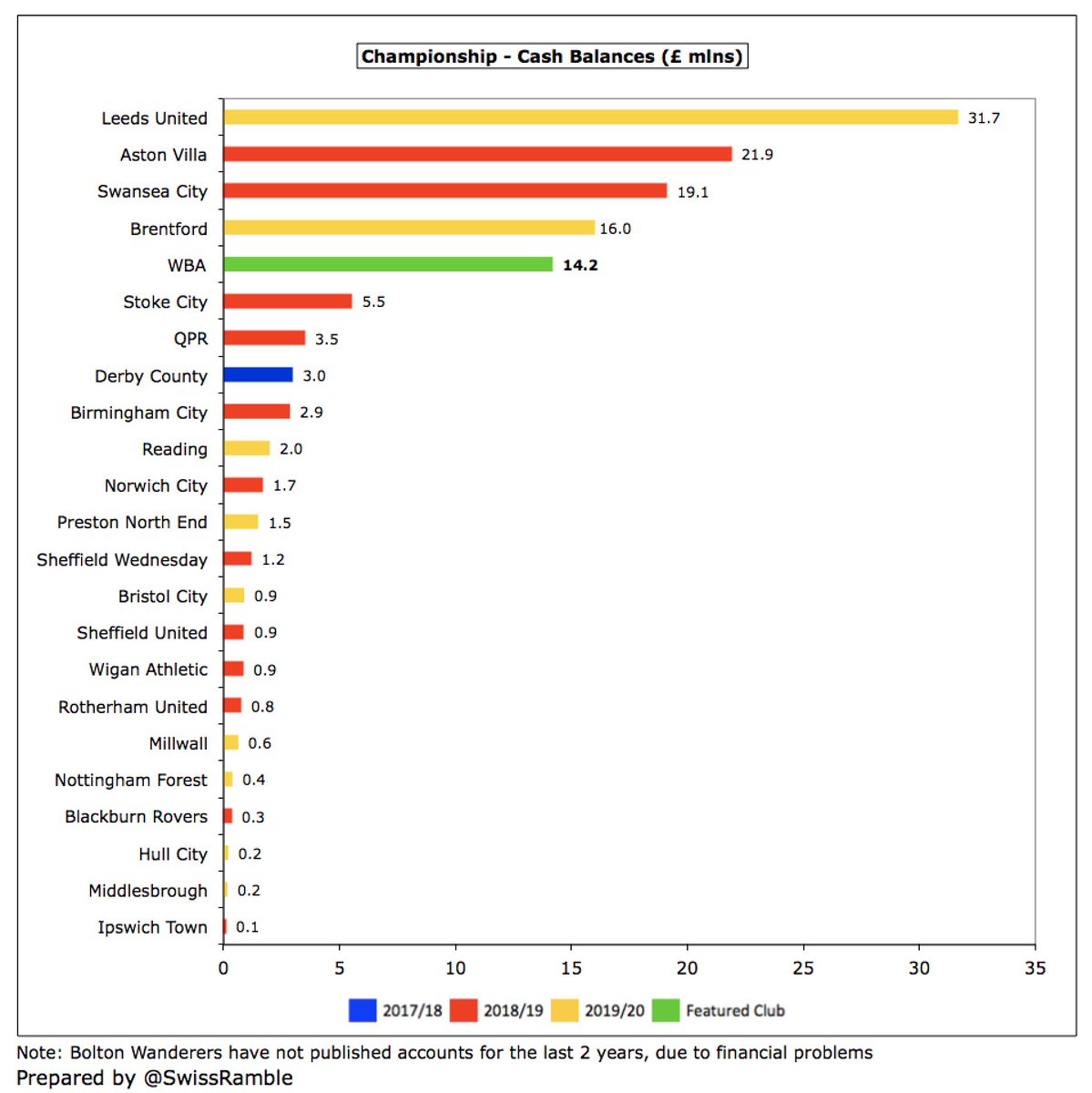

#WBA £53m operating loss improved to £2m cash flow by adding back £28m amortisation/depreciation and £27m working capital movements. Boosted by £12m net player sales (sales £46m, purchases £34m), before spending £1m on capex, resulting in £13m net cash inflow.

As a result, #WBA cash balance increased from £1m to £14m, one of the highest in the Championship. This is partly due to receiving the first tranche of Premier League TV money in July 2020.

In the last 8 years #WBA have been largely self-sustaining, generating an impressive £116m from operations, supplemented by £22m of owner loans. Of this, £79m was spent on players (net), £27m on a dividend in 2016, £11m tax and £8m capex.

Owner Guochuan Lai has not put any more money into #WBA since the £200m he paid to acquire 88% of the club in September 2016. That is relatively uncommon in the Championship, though not unusual at West Brom. To be fair, Chinese government regulations have also prevented funding.

There have been media reports that Guochan Lai is keen to sell the club with three parties apparently expressing interest, though nothing concrete as yet. It seems likely that the owner will have to take a hit on his investment, if he does end up selling.

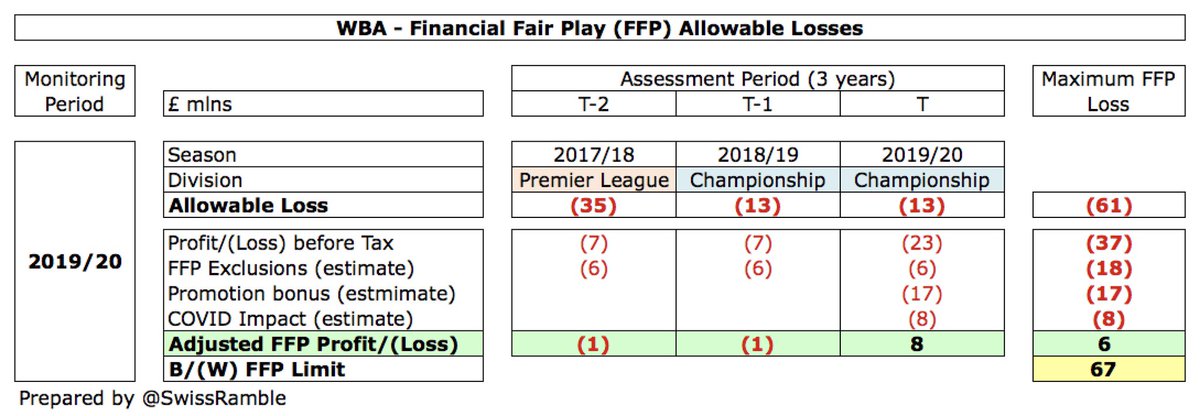

#WBA had no FFP issues, even before excluding academy, community & infrastructure, promotion bonus and COVID impact. The allowable loss for the three-year monitoring period was £61m (Premier League £35m plus two Championship seasons at £13m).

As a technical note, this analysis is based on West Bromwich Albion Football Club Ltd, while the ultimate parent company is West Bromwich Albion Holdings Ltd. There are no differences in revenue or wages, though there is no debt in the holding company.

#WBA managed the big decrease in revenue following relegation from the Premier League pretty well, though have obviously been hit by the pandemic. The club has “historically maintained a solid financial position” and expects to follow the same path in the future.

• • •

Missing some Tweet in this thread? You can try to

force a refresh