Today in #Chainlink 🔗

"@PundiXLabs is using and supporting newly launched @chainlink Price Feeds for $PUNDIX/USD (live today) to accurately distribute platform rewards denominated in the native PUNDIX token"

Incentivized blockchain governance

medium.com/pundix/pundi-x…

"@PundiXLabs is using and supporting newly launched @chainlink Price Feeds for $PUNDIX/USD (live today) to accurately distribute platform rewards denominated in the native PUNDIX token"

Incentivized blockchain governance

medium.com/pundix/pundi-x…

"The @wise_token lending and borrowing smart contract will utilize #Chainlink Price Feeds to determine the real-time value of assets, enabling it to issue fair market loans and secure its liquidation mechanism"

Native price feeds #BSC + #Polkadot

devinmarty.medium.com/wise-token-wil…

Native price feeds #BSC + #Polkadot

devinmarty.medium.com/wise-token-wil…

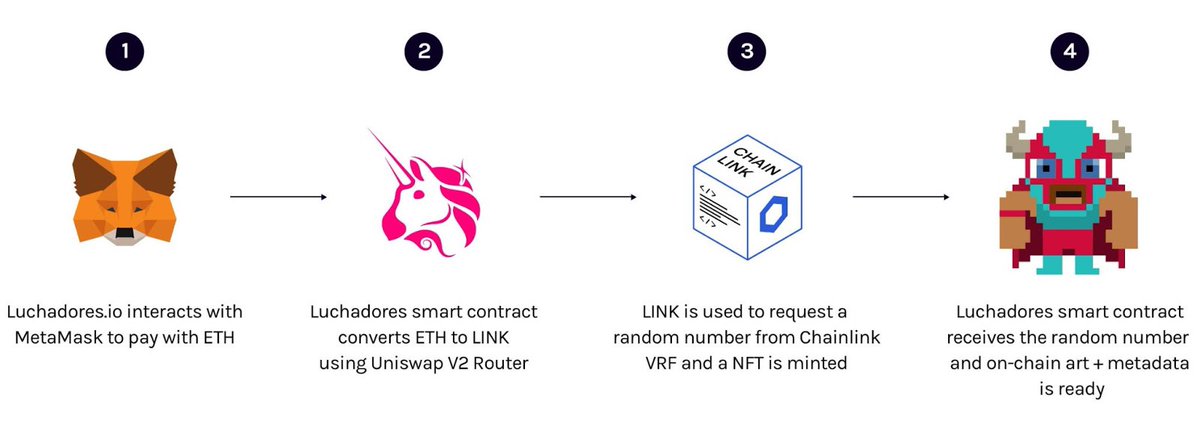

"Today, we are super excited to launch @LuchadoresNFT alongside the use of #Chainlink VRF to create #NFT collectables that are truly randomly generated at the time of purchase, with 100% of the art and metadata stored on the #Ethereum blockchain"

medium.com/@LuchadoresNFT…

medium.com/@LuchadoresNFT…

"When a Luchador NFT is purchased with $ETH using MetaMask, our smart contract uses the @Uniswap V2 Router to convert the user’s $ETH to the required fee to consume VRF in $LINK"

#Chainlink adoption -> demand for $LINK from users to pay for oracle services

#Chainlink adoption -> demand for $LINK from users to pay for oracle services

"Here’s how @ChainLinkGod; a #Chainlink community ambassador and in our opinion expert summed up the cryptocurrency in one sentence for us"

investrly.substack.com/p/twenty

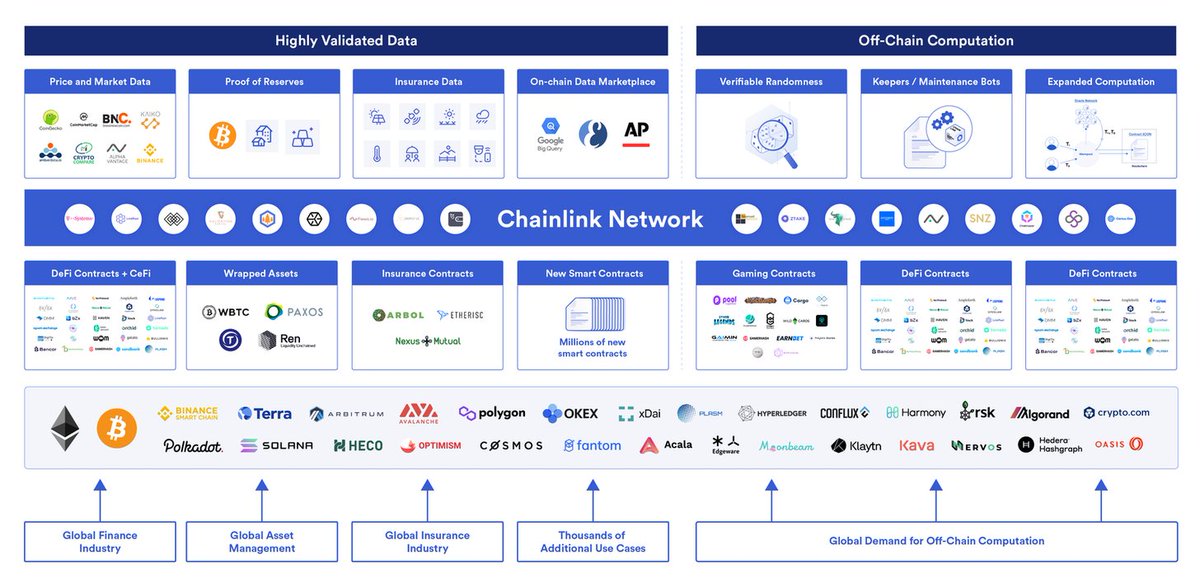

Chainlink extends the capabilities of smart contracts on every blockchain network in existence, based

investrly.substack.com/p/twenty

Chainlink extends the capabilities of smart contracts on every blockchain network in existence, based

@BinanceChain AMA with #Chainlink happening tomorrow at 11am UTC+0

Over $10B of TVL on #BSC is secured by Chainlink oracles 👀

@VenusProtocol was just the beginning, Chainlink is a truly blockchain agnostic solution

Over $10B of TVL on #BSC is secured by Chainlink oracles 👀

@VenusProtocol was just the beginning, Chainlink is a truly blockchain agnostic solution

https://twitter.com/BinanceChain/status/1394219998168502273?s=20

"@platinumqdao is delighted to announce its planned integration of #Chainlink Price Feeds to support the development and operations of a new Margin Tool for x5 leverage trading on @Uniswap and @pancakeswapp_"

You Just Buidl

news.platinum.fund/en/post/defi-p…

You Just Buidl

news.platinum.fund/en/post/defi-p…

"A week into building @VulcanExchange at the #Chainlink hackathon, Thalen heard @mcuban talk about blockchain-based weather insurance on a podcast. Before the hackathon was over, Cuban had jumped on board Vulcan as a strategic advisor"

Based and HDDpilled

chainlinktoday.com/chainlink-hack…

Based and HDDpilled

chainlinktoday.com/chainlink-hack…

• • •

Missing some Tweet in this thread? You can try to

force a refresh