Paris Saint-Germain’s signing of Lionel #Messi from #FCBarcelona has come as a major surprise to the footballing world. This thread will look at the financial implications and explain how #PSG are likely to still be able to meet UEFA’s Financial Fair Play (FFP) targets.

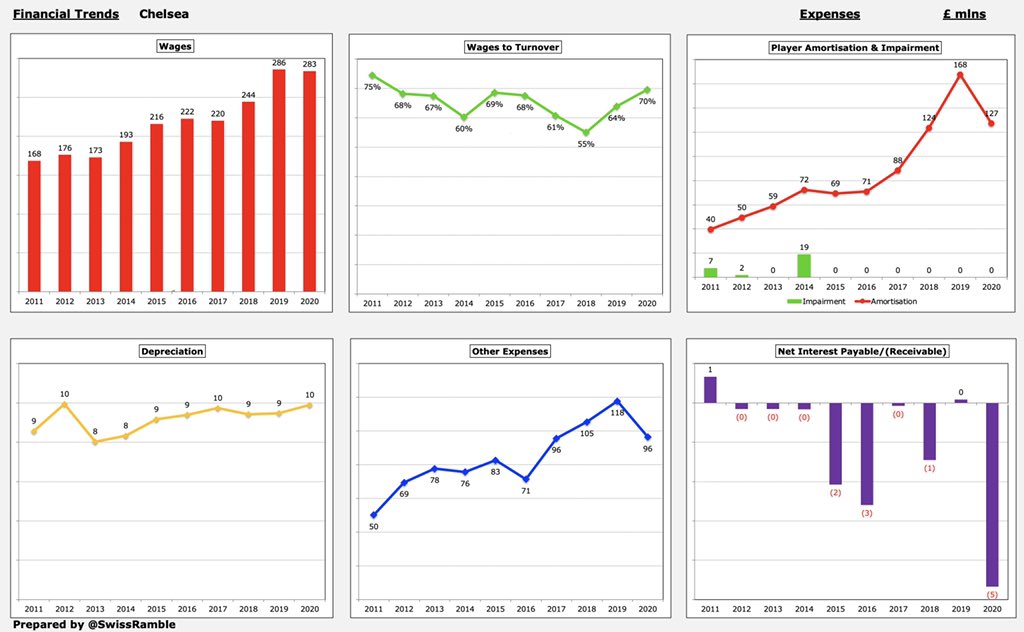

Despite a €99m (15%) fall in revenue in 2020, partly due to the COVID pandemic, #PSG wage bill still rose €43m (12%) to €414m, the club’s highest ever. This was more than 3 times as much as the closest challenger in France, Lyon with €132m, representing 29% of Ligue 1 wages.

#PSG €414m wage bill is the second highest in Europe, only surpassed by #FCBarcelona €443m (before their La Liga salary cap challenges), but more than clubs like #MCFC €401m, #RealMadrid €378m, #LFC €371m, #FCBayern €340m, #MUFC €324m and #CFC €323m.

#PSG wages to turnover ratio increased from 56% to 74% in 2020, though this is actually one of the lowest (best) in France. That said, it’s one of the highest of elite European clubs (just ahead of #MCFC 73%). Ligue 1 70% restriction postponed until 2023/24 due to the pandemic.

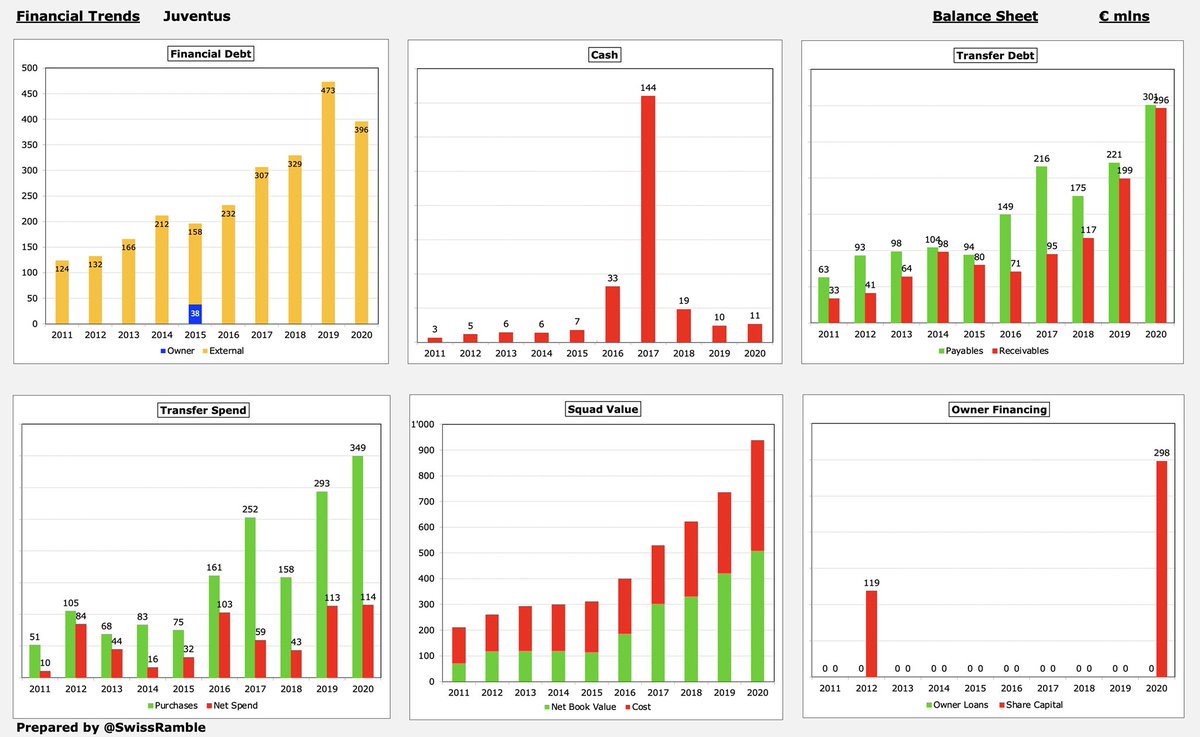

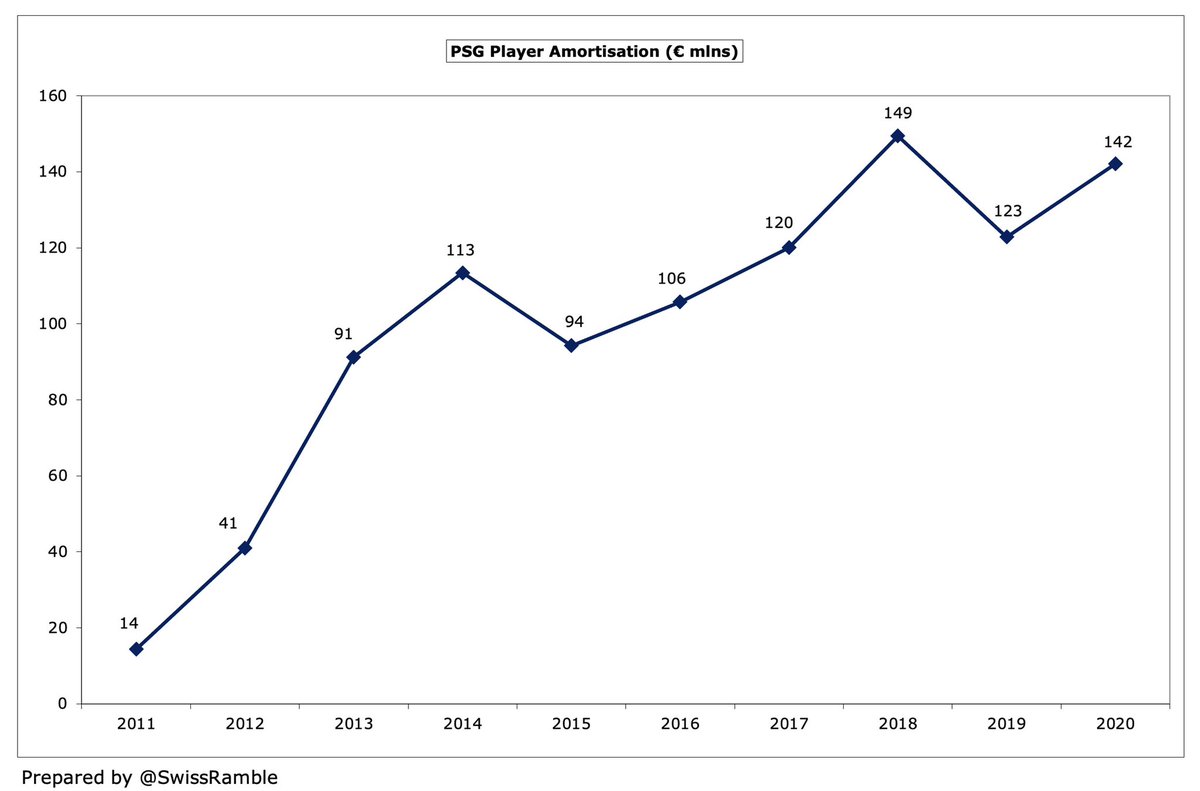

#PSG player amortisation, the annual cost of writing-off transfer fees, increased by €19m (16%) from €123m to €142m, reflecting “the pursuit of the ambitious recruitment policy of Paris Saint-Germain”. This expense has shot up from just €14m in 2011.

#PSG €142m player amortisation is by far the highest in France, well ahead of Monaco €88m, followed by Lyon €76m and Marseille €43m. However, this is not the case in Europe, as they are far below #FCBarcelona €174m, #Juventus €167m and #MCFC €166m.

#PSG have ramped up their transfer spend with a gross outlay of €560m in the 3 years up to 2019/20 season, almost twice as much as the preceding 3-year period. This included the significant acquisitions of Neymar from #FCBarcelona €222m and Kylian Mbappé from Monaco €145m.

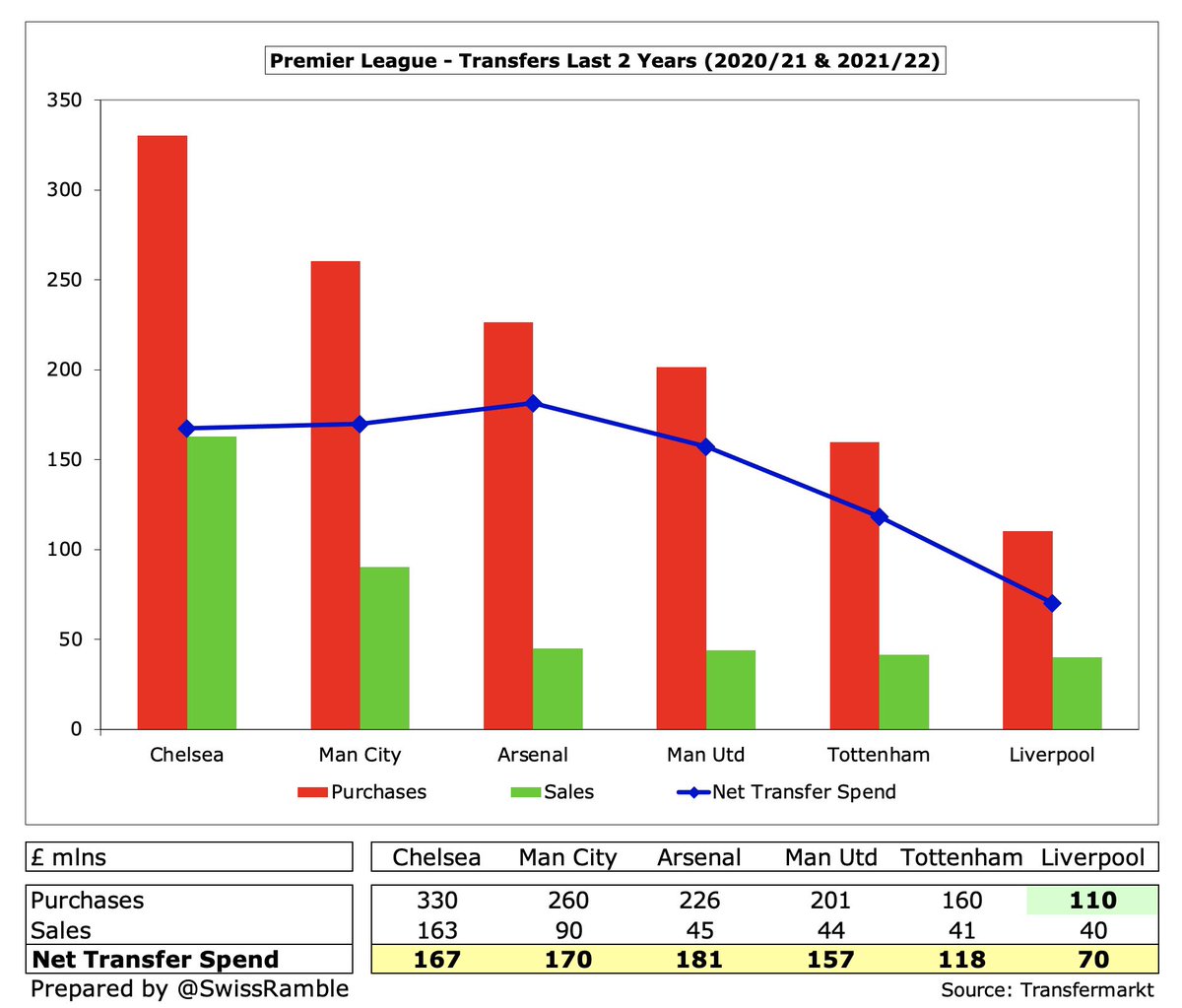

However, #PSG have not spent as much in the transfer market as European rivals. Their €560m gross spend in last 3 years is comfortably outpaced by #FCBarcelona €960m, #Juventus €801m and #CFC €758m. On a net basis, their €242m is around half #MCFC €460m and #MUFC €432m.

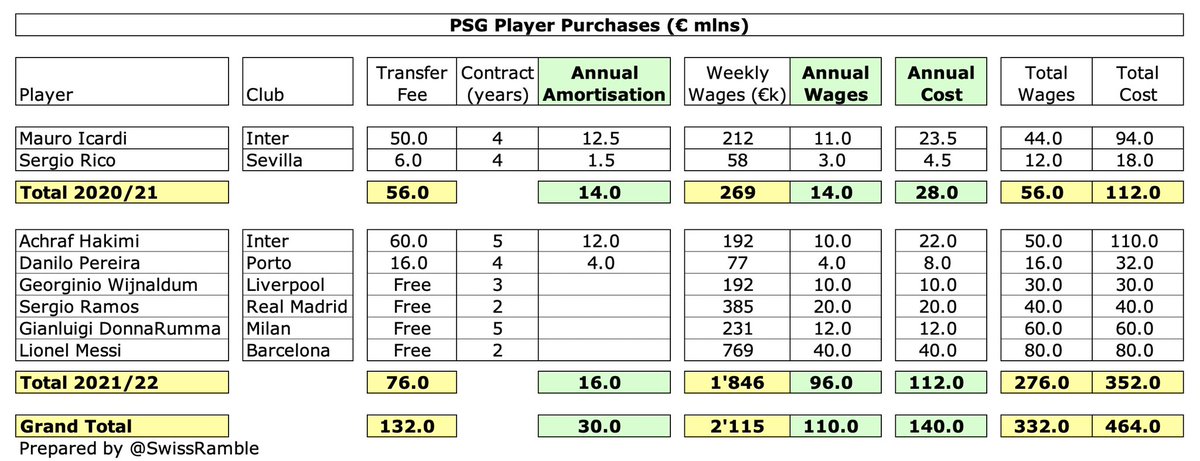

Before we look at #PSG player purchases, we should note that the amounts used for transfer fees and wages are not made public, so the numbers used in this analysis might not be 100% correct, but they should be sufficiently accurate to illustrate the financial impact.

Messi was acquired on a free transfer, as were Sergio Ramos, Gianluigi Donnarumma and Georginio Wijnaldum, but #PSG paid €60m for Achraf Hakimi and €16m for Danilo Pereira. Prior season saw the purchases of Mauro Icardi for €50m and Sergio Rico for €6m.

The impact on #PSG profit and loss account will be driven by 2 factors: (a) wages of the new purchases, which I have estimated at €110m for the last 2 years; (b) player amortisation, the annual cost of writing-off transfer fees, which is €30m. This adds up to €140m increase.

Against that, #PSG have sold players for €14m over last two years, including Bakker to Leverkusen this summer, booking an estimated profit from those sales of €12m. The profit is fairly low, as most departing players left on free transfers, including Cavani, Silva and Meunier.

However, #PSG benefit from reducing their wage bill and player amortisation for those exits, even when no transfer fee is received. My estimates (for the last 2 years combined) are annual savings of €53m wages and €5m player amortisation, so €58m off the cost base in total.

In addition, #PSG will benefit from player amortisation of some current players coming to an end, e.g. Mbappé €36m stops after season 2022/23. Neymar’s annual charge reduces from €44m to €11m in 2021/22, saving €33m a year, as his contract was extended by 4 years in June 2021

So net result of #PSG transfer activity for last 2 years in the accounts is a cost increase of “only” €49m, with player purchases growing cost base by €140m, partly offset by €58m reduction from sales and €33m fall in amortisation. Mitigated by €12m profit from player sales.

Clearly, there are likely to be signing-on fees for some of the free transfers, though the latest media reports, including Le Parisien and RMC Sport, suggest that, contrary to initial reports of an estimated €25m, Messi will not receive a signing-on fee after his move to #PSG.

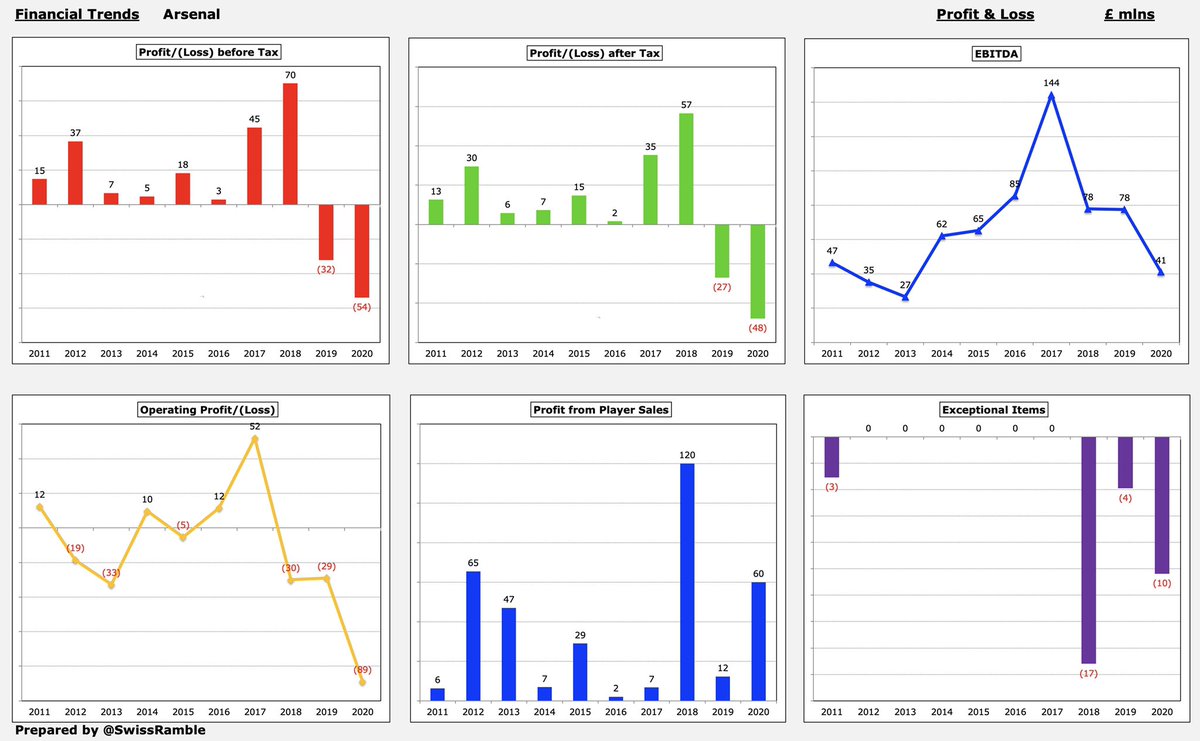

Before the COVID-impacted 2020 accounts, #PSG had actually reported pre-tax profits in 4 of the last 5 years, amounting to €75m between 2015 and 2019. In the 4 years preceding that period (2011-14), they posted small annual losses (none higher than €5m).

However, #PSG posted a huge €125m loss in 2020. Everyone was adversely impacted by the pandemic, but this was at the upper end of losses among leading clubs, only surpassed by #Milan €192m, #MCFC €143m and #FCBarcelona €128m. That said, over past 3 years loss was only €53m.

At an operating level (i.e. excluding player sales & interest), #PSG loss widened from €46m to €178m in 2020, one of the worst results among the European elite, only better than #Juventus €234m, #Milan €202m & #MCFC €182m, partly due to early cancellation of Ligue 1 season.

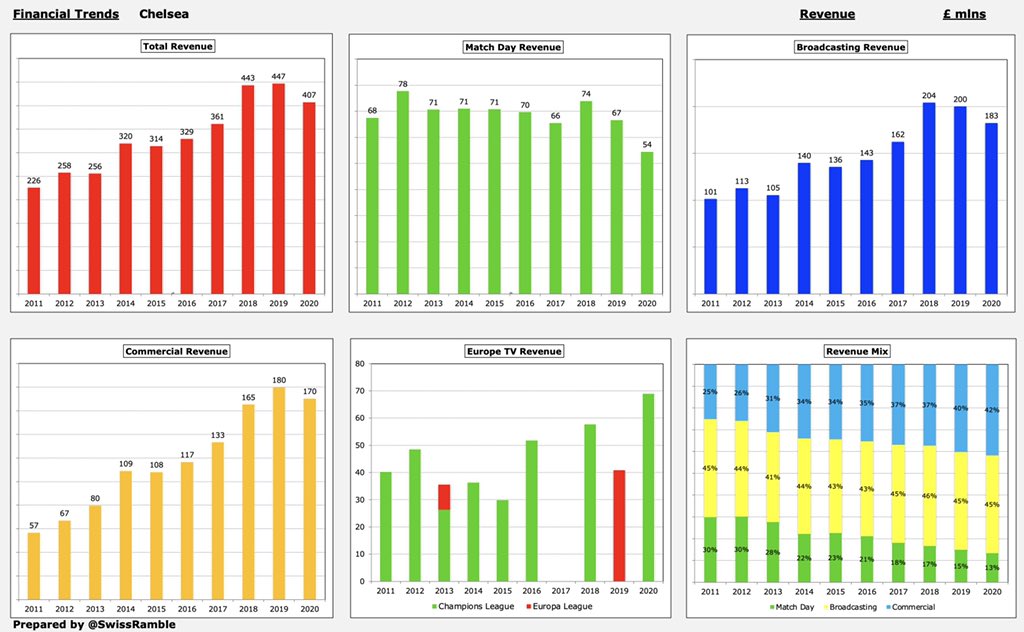

#PSG revenue dropped €99m (15%) from €659m to €560m in 2020, partly because of the pandemic, but mainly due to the expiry of the lucrative publicity deal with the Qatar Tourist Authority. The decrease was higher than €62m (14%) average at European Super League clubs.

Even so, #PSG generated over a third of total revenue in Ligue 1 – more than the 15 clubs with the lowest revenue combined. More tellingly, their €560m was also more than Lyon, €181m, Marseille €119m, Lille €95m, Saint-Etienne €69m and Monaco €62m put together.

#PSG dropped 2 places from 5th to 7th in the Deloitte Money League, which ranks clubs globally by revenue, with their €541m sandwiched between last season’s Champions League finalists, #MCFC €549m and #CFC €470m, and €174m below #FCBarcelona and #RealMadrid, both €715m.

As a technical aside, the Deloitte Money League revenue for #PSG of €541m is different to the €560m used by the DNCG (the organisation responsible for monitoring accounts of football clubs in France), presumably due to the latter’s approach of aggregating different companies.

#PSG commercial revenue (Money League definition) fell €64m (18%) from €363m to €299m in 2020, which is a fair bit lower than the likes of #RealMadrid €383m, #FCBayern €361m and #FCBarcelona €340m, so there is scope for growth after the arrival of Messi.

#PSG have by far the highest sponsorship & advertising revenue in Ligue 1 of €287m (up from €195m in 2019), which is a cool quarter of a billion more than Marseille €36m and Lyon €27m. In fact, #PSG are over €100m more the other 19 clubs combined (€186m).

In theory, there is little scope to increase #PSG main sponsorship deals, as Nike €80m runs to 2032, while Accor €60m runs to 2022, but with a 3-year option. That said, it would not be a massive surprise if the deals were re-negotiated after signing the best player in the world

One precedent is when #Juventus signed Cristiano Ronaldo in 2018, resulting in their sponsorship & advertising increasing by nearly 50% (€43m) from €87m to €130m, thanks to CR7’s “worldwide profile” per Andrea Agnelli. A 25% increase at #PSG would be worth an additional €70m.

There will also be a boost to shirt sales, though this is unlikely to be as much as many might think. If we optimistically assume an additional 1m sales at €100 per shirt, a 10% share for #PSG would mean only €10m revenue. This would obviously help, but not pay for the transfer

#PSG other income fell €153m (62%) to €104m in 2020, due to the expiry of the Qatar Tourist Authority deal (as high as €200m at one stage) after FFP pressure from UEFA. However, with the arrival of Messi, the club may well now be able to justify a hefty “publicity” deal.

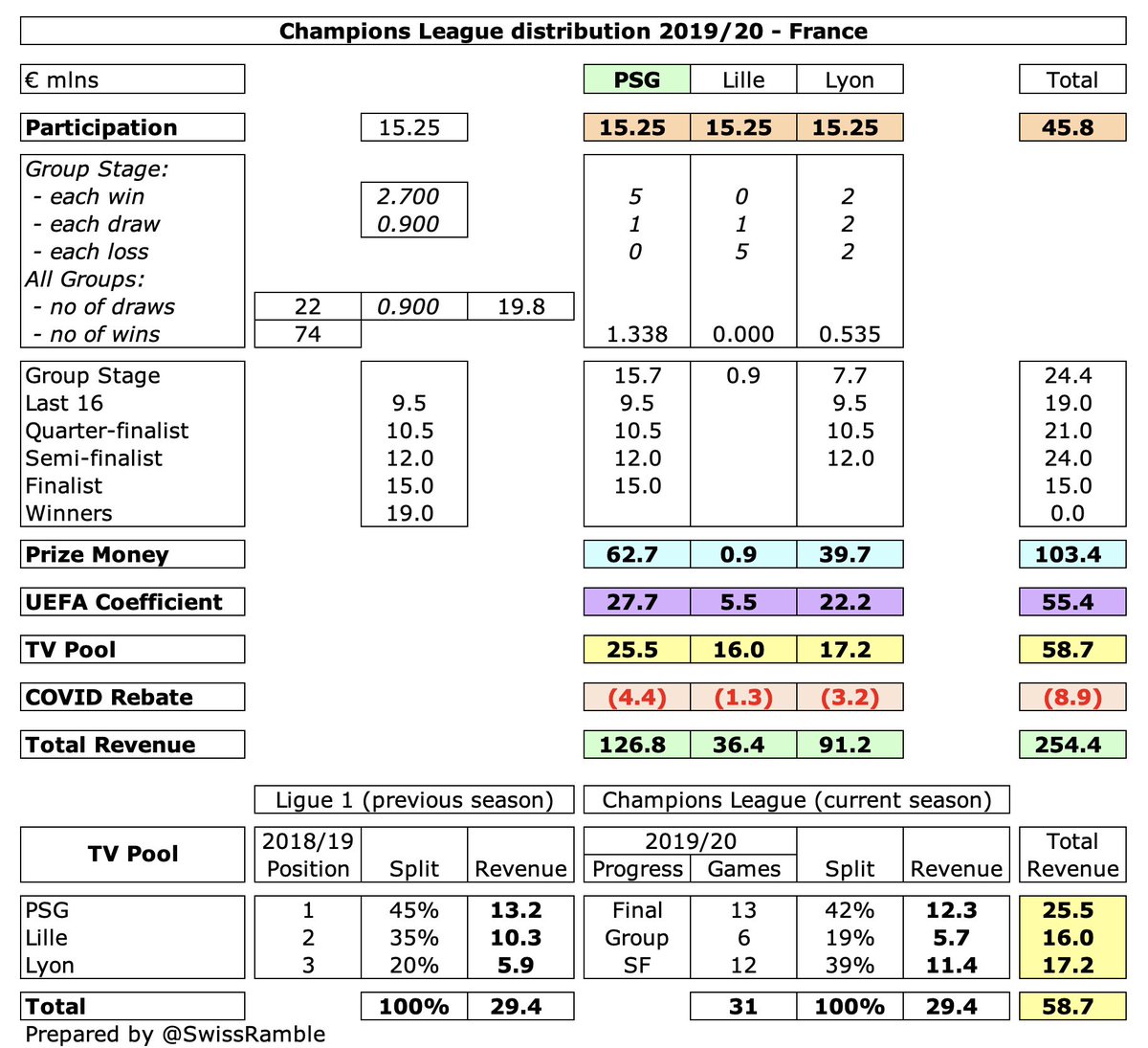

#PSG broadcasting income held up in 2020 at €150m. They have the highest from this revenue stream in Ligue 1, but relatively low in Europe, due to the poor TV rights deal in France. This was almost €100m less than clubs like #FCBarcelona €249m and #LFC €233m.

French domestic TV rights should have increased by 60% in 2020/21 from €760m to €1.2 bln, but Mediapro could not meet their payments, so new deal was cancelled. Canal+ picked up those rights, leading to revised total of €650m to 2024, i.e. less than the previous deal.

This is a major issue for #PSG when comparing TV rights in other major leagues. The revised €725m for #Ligue1 (including international rights) is the only one less than €1 bln, miles below the Premier League €3.6 bln, La Liga #2.0 bln, Bundesliga €1.4 bln & Serie A €1.3 bln.

#PSG have compensated with progress in the Champions League, where TV money was up to €127m in 2020, when they were finalists. However, revenue for games played in August (after accounting close) was deferred to 2020/21 accounts, boosting that year by an estimated €47m.

#PSG match day income fell €24m (20%) from €116m to €92m in 2020, due to early cancellation of season. Towards the upper end in Europe, but still some scope for growth, e.g. after Ronaldo arrived #Juventus raised ticket prices by 30% (revenue increased €15m).

#PSG might not raise ticket prices, but they might do something with corporate hospitality. President Nasser Al-Khelaifi also spoke of stadium expansion, “I love the Parc des Princes, but we need it to be bigger. Every big club has a stadium with 80,000 spectators these days.”

Like many clubs, #PSG have become more reliant on player sales with profits in the last 3 years amounting to €272m, one of the highest in Europe. Club open to offers for up to 10 players, including Icardi, Herrera, Kurzawa, Rico, Sarabia, Diallo, Kehrer, Gueye and Rafinha,

#PSG have no external debt, but the shareholder loan from QSI increased by €50m to €197m in 2020. Net debt only €125m after taking into consideration €73m cash. This is one of the lowest of the ESL clubs, miles below #THFC €947m, #MUFC €599m and #FCBarcelona €480m.

Similarly, #PSG transfer debt increased from €120m to €144m in 2020, but again this was on the low side for leading European clubs, less than half of #FCBarcelona €323m, #Atleti €316m & #Juventus €301m. In fact, they have €6m net receivables, as other clubs owe them €150m.

Of course, #PSG have benefited from significant financial support from their owners, Qatar Sports Investments (QSI), as evidenced by their €316m capital injection in the 2017/18 season (following €24m the previous year).

There is the obvious concern that Messi’s signing will cause FFP issues, especially as the club has already been investigated by UEFA in the past in 2017, though they were ultimately cleared by CAS (Court of Arbitration for Sport). Al-Khelaifi is confident #PSG will be fine.

Al-Khelaifi: “We know the rules of FFP and will always follow the regulations. Before we do anything, we check with commercial, financial and legal people. We have the capacity. If we sign Leo, it’s because we can, otherwise we would not have done it.”

He added, “We respect FFP. If you look at it closely, we’ve signed four of the best players around on a free. We’ve had an amazing window and we’ve always respected the regulations. We’re only focused on our own project, which remains legal.”

FFP is monitored over a 3-year period with #PSG aggregate loss being €53m up to 2020. After adjusting for €57m estimated allowable deductions (youth development €24m, depreciation €18m, women’s football €9m and community €6m), they actually had an FFP profit of €4m.

Furthermore, UEFA have relaxed FFP regulations to “neutralise the adverse impact of the COVID-19 pandemic”, so the 2021 monitoring period will now only cover 2 years (2018 and 2019), while in the 2022 monitoring period 2020 and 2021 will be assessed as a single period.

In addition, any revenue shortfall caused by the pandemic (compared to the 2019 revenue base) will be excluded, while owners will be permitted to invest funds to cover losses. In other words, #PSG should be fine in terms of FFP for the foreseeable future.

This was explained by UEFA, “'COVID-19 has generated a revenue crisis and had a big impact on the liquidity of clubs. This is a crisis which is very different from anything we have had to tackle before. In such a situation clubs have difficulties in complying with obligations.”

In fact, UEFA are exploring new FFP rules with some talk of a salary cap, e.g. 70% of revenue, and luxury tax replacing the current break-even approach with a system similar to those used in America by the NBA and MLB, so this might be a moot point for #PSG.

It is also worth noting that #PSG president Al-Khelaifi is very much in UEFA’s good books at the moment following his club’s staunch opposition to the proposed European Super League. Indeed, he has replaced Andrea Agnelli as chairman of the European Club Association.

In any case, #PSG will look to pay for Messi by significantly boosting commercial income. As Al-Khelaifi said, “The club will increase in every part commercially. We will give you some numbers and you are going to be shocked.” They will also look to sell fringe players.

UEFA have adjusted their FFP regulations with the best of intentions, but one consequence seems to be that clubs with wealthy benefactors can now spend big in a buyer’s market. However, #PSG will consider this money well spent if it helps them to finally win the Champions League.

• • •

Missing some Tweet in this thread? You can try to

force a refresh