Some new data & market commentary on who's buying land from our 3Q-2021 land broker survey. Build-for-rent operators snapping up 15% of raw land in #Florida & outbidding home builders on deals across many markets. Couple charts & market commentary to follow...

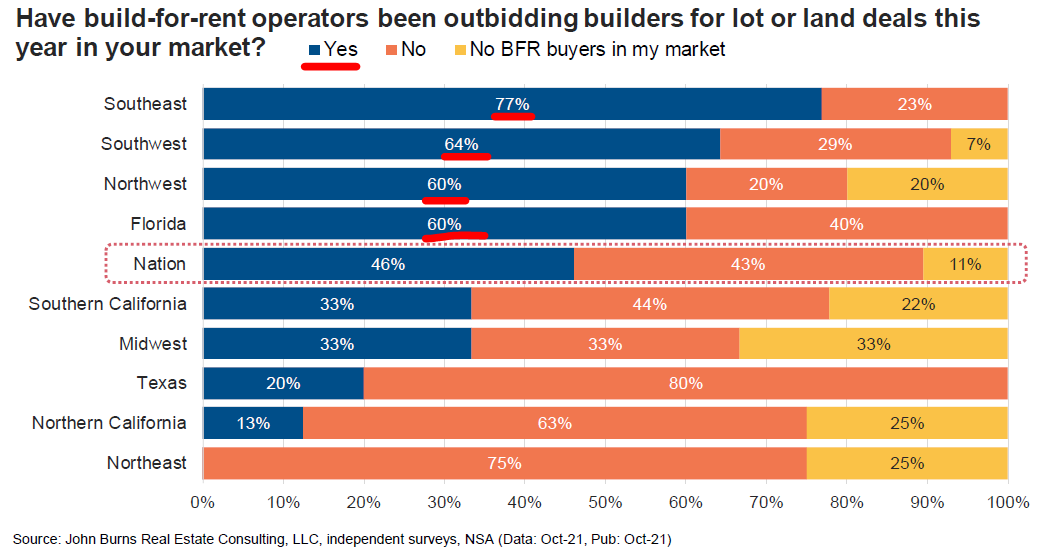

Here's the chart where we asked land brokers if they've observed build-for-rent operators outbidding home builders on land deals in their market. 46% said 'yes' when we rolled it up nationally, and as high as 77% in the Southeast.

#Phoenix land broker: “A lot of speculators in the build-for-rent space that are tying properties up & going through entitlement process, then flipping the property for an increased price. Equity requirements for the build-for-rent projects are getting larger.”

#SaltLakeCity land broker: “Build-for-rent groups are starting to flood the market but are not yet out-competing builders.”

#RaleighDurham land broker: “Possibly the most active land market in the country. One build-for-rent group has 4 deals under contract & many others are looking. We just had our first example of a build-for-rent buyer outbidding the builders.”

#Tampa land broker: “Just a parade of build-for-rent, but they sometimes compete on suburban sites against conventional 3–4 story apartment developers who are paying big bucks (2–3 times what they paid 2–3 years ago).”

#Atlanta land broker: “Noticed an increase in investment funds entering the Atlanta metropolitan area. They’re buying entire build-for-rent subdivisions at various stages of completion to rapidly expand their inventory of homes to rent.”

#Savannah land broker: “A number of institutional developers of ‘for rent’ townhome / cottage communities has driven up land prices.”

#Nashville land broker: “More & more build-for-rent buyers entering market.”

#Minneapolis land broker: “Apartment developers are competing with home builders for townhome land to build single-family rental or townhome rental product.”

#OrangeCounty land broker: “We are seeing build-for-rent outbidding builders occur in less expensive markets like the Inland Empire.”

#RiversideSanBernardino land broker: “Build-for-rent guys are looking at deals builders don't desire. Attached, No CFD (Community Facilities District) properties.” THE END

• • •

Missing some Tweet in this thread? You can try to

force a refresh