#Fed v/s Markets:

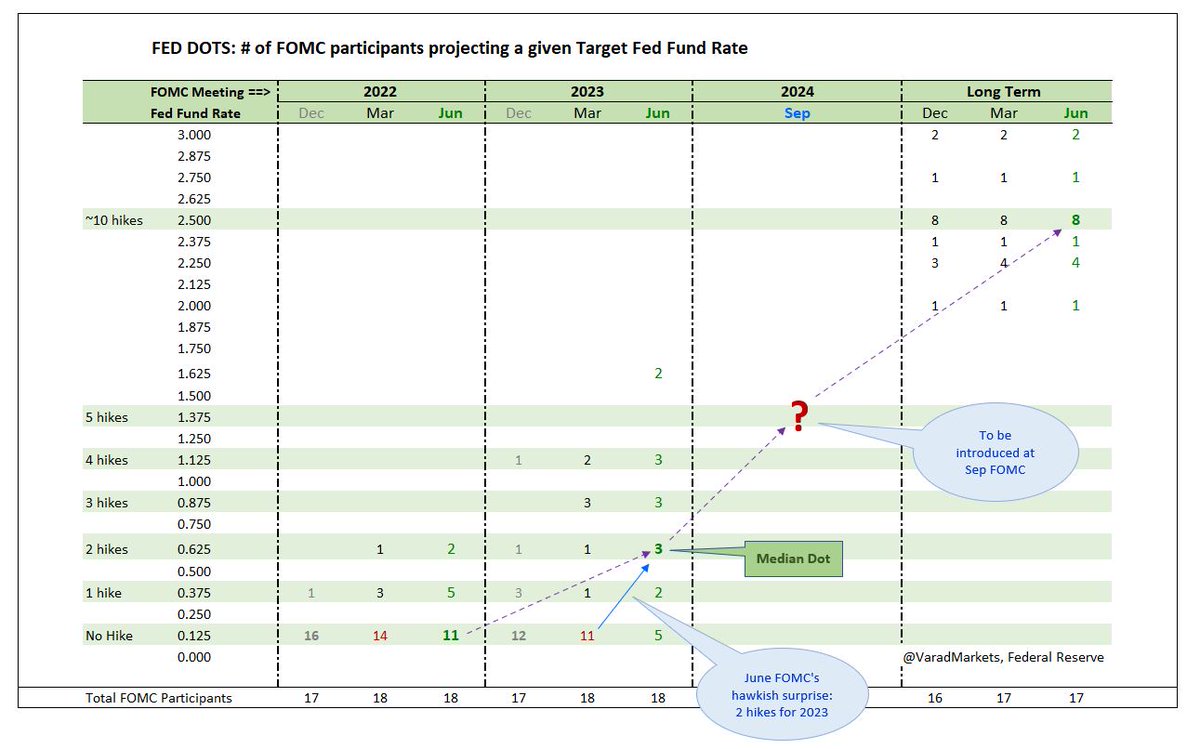

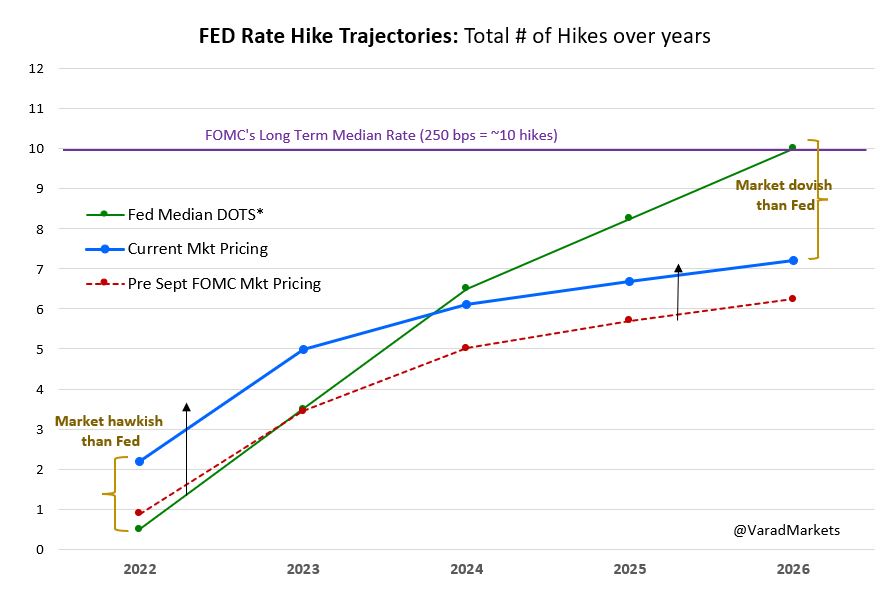

▪️ Mkt now pricing >2 hikes in 2022 vs Fed Dots @ 0.5 hike

▪️ Mkt @ 4 over 23/24 vs Fed 6 hikes

▪️ Mkt @ 18bp 0.7 hike by Jun'22 vs Fed to end taper only by mid-22 implies:

1⃣ Fed to hike with QE-buy (read #Powell 👇) OR

2⃣ Fed to accelerate taper by Mar'22

1/7

▪️ Mkt now pricing >2 hikes in 2022 vs Fed Dots @ 0.5 hike

▪️ Mkt @ 4 over 23/24 vs Fed 6 hikes

▪️ Mkt @ 18bp 0.7 hike by Jun'22 vs Fed to end taper only by mid-22 implies:

1⃣ Fed to hike with QE-buy (read #Powell 👇) OR

2⃣ Fed to accelerate taper by Mar'22

1/7

#Powell @ Jul-FOMC: "wouldn’t be still buying assets & raising rates...you’re adding accommod by buying & removing by raising.,,wouldn’t be ideal"

Sep-FOMC: "buying assets=adding acco..wouldn’t make any sense to then lift off...would be wiser..to go ahead & speed up taper"

2/7

Sep-FOMC: "buying assets=adding acco..wouldn’t make any sense to then lift off...would be wiser..to go ahead & speed up taper"

2/7

▪️ Fed starts in Nov21 at $15bn/m; end in 8m in Jun’22

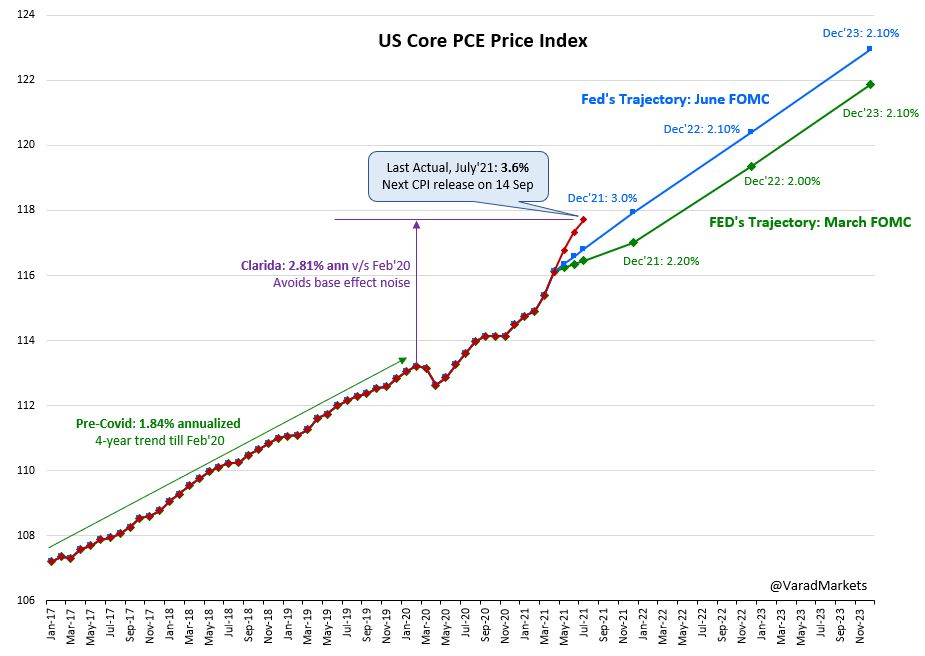

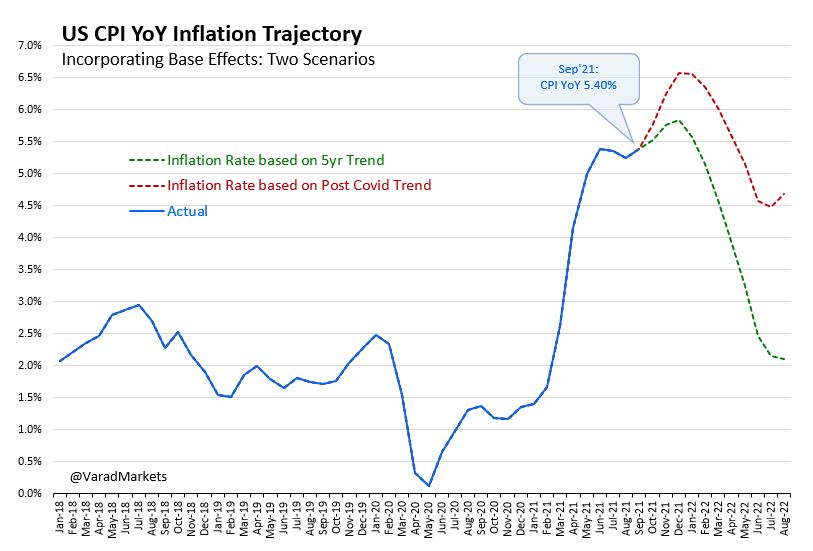

▪️ But even at 5y-avg ~2.0% pa, CPI doesn't fall below 5.0% until Mar22

▪️ Hawkish possibility=>Fed gives up on transitory in Feb22; accelerates taper to $30/m to end in Apr22; first hike by Jun22; that's current mkt pricing

▪️ But even at 5y-avg ~2.0% pa, CPI doesn't fall below 5.0% until Mar22

▪️ Hawkish possibility=>Fed gives up on transitory in Feb22; accelerates taper to $30/m to end in Apr22; first hike by Jun22; that's current mkt pricing

▪️ Dovish possibility #1:

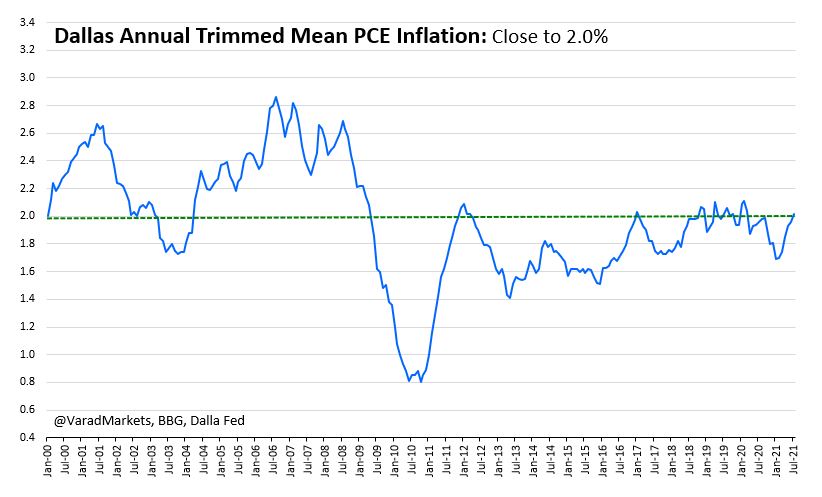

Oil/commod prx ease off + resolution of supply chain bottlenecks => CPI mom starts running below even 2% in 2022 (v/s post-Covid ~4.5% pa) = allows Fed to be patient till H2'22

yes CPI collapse from 4.5 to <2% rate in early'22 seems low probability

4/7

Oil/commod prx ease off + resolution of supply chain bottlenecks => CPI mom starts running below even 2% in 2022 (v/s post-Covid ~4.5% pa) = allows Fed to be patient till H2'22

yes CPI collapse from 4.5 to <2% rate in early'22 seems low probability

4/7

▪️ Dovish possibility #2: If benign mom rate (~2% pa), Fed looks through Dec21-Jan22 CPI spike & remains patient knowing that CPI would fall off significantly by July-Aug’22 just on base effects

5/7

bloomberg.com/news/articles/…

5/7

bloomberg.com/news/articles/…

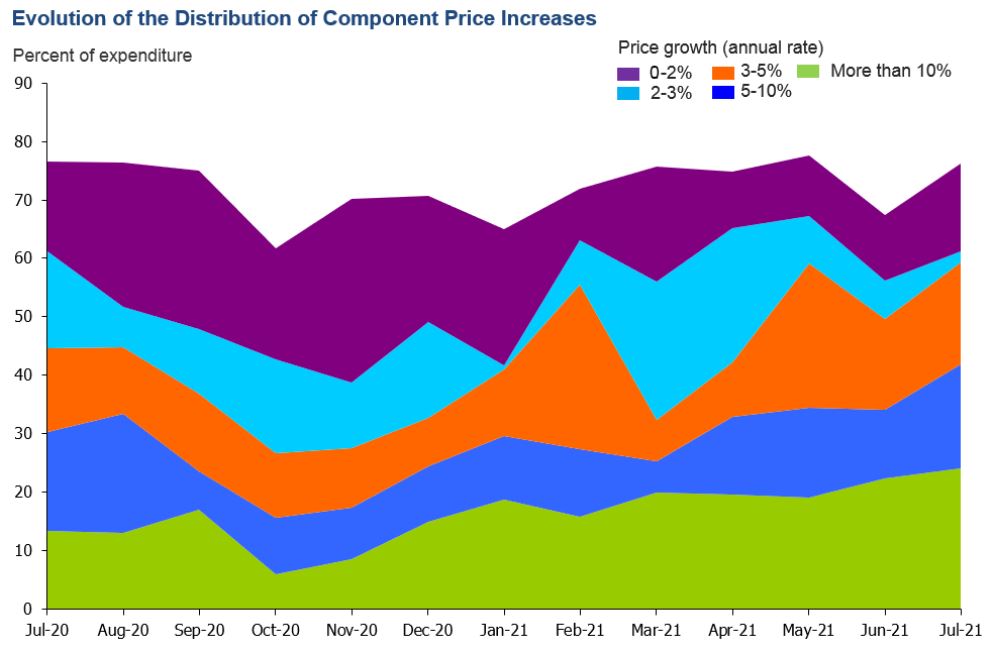

What base effects?

▪️ It so happens while CPI Index was increasing recently, base index from last yr (May-Sep20) was also increasing=>implying less worse YoY CPI

▪️ But base index for Oct-Dec’20 flattened=>YoY CPI for Oct-Dec’21 likely to spike, peaking in Dec’21 ceteris paribus

▪️ It so happens while CPI Index was increasing recently, base index from last yr (May-Sep20) was also increasing=>implying less worse YoY CPI

▪️ But base index for Oct-Dec’20 flattened=>YoY CPI for Oct-Dec’21 likely to spike, peaking in Dec’21 ceteris paribus

Thereafter, given high/increasing base CPI index over Feb-Jul'21, CPI YoY over Feb-Jul'22 can also be expected to ease off significantly towards Q3’22 purely on base effects

=>part reason for Yellen/Fed's confidence in inflation ease off in H2'22

7/7

=>part reason for Yellen/Fed's confidence in inflation ease off in H2'22

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh